Summary:

- PayPal Holdings, Inc. stock has experienced a significant decline of 84% due to poor management decisions and other factors, but an epic recovery is possible.

- The appointment of a new CEO is seen as a positive change for PayPal, allowing the company to refocus on profitability and shareholder returns.

- PayPal’s revenue and earnings growth are expected to increase, making its stock undervalued and a strong buy.

chameleonseye

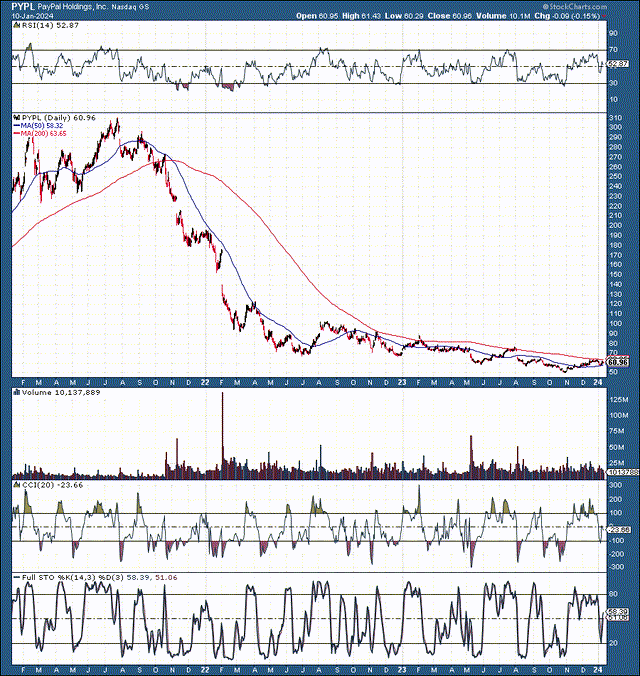

PayPal Holdings, Inc. (NASDAQ:PYPL) stock used to trade around $300, hitting a high of about $310 in 2021. However, poor management decisions, a slow economic environment, high interest rates, worsening sentiment, higher costs, and other factors caused PayPal’s stock to melt to a low of just $50 in recent months.

This monstrous decline illustrates an epic drop of 84%. PayPal probably bottomed, and we could see an epic recovery from here. Despite the transitory issues, PayPal remains the preeminent global online payment platform. Also, despite the economic slowdown, PayPal’s revenues continue expanding, and we should see healthy revenue growth ahead. Most notably, PayPal stock is dirt cheap, trading at only 11 times this year’s EPS estimates and below a 10 forward P/E.

This ultra-low valuation likely won’t last long, as PayPal deserves a higher multiple due to its leading market position, growth potential, and profitability prospects. Moreover, PayPal surpassed its most recent earnings announcement and could report better-than-expected earnings as we advance. The dynamic of an ultra-low multiple and better-than-anticipated top and bottom line growth should enable sentiment to improve, causing PayPal’s multiple to expand and its share price to rise much higher in future years.

Management Change – A Considerable Advantage

One of the most favorable factors concerning PayPal is the new CEO and a changing management team. Under the leadership of Dan Schulman, PayPal booted accounts that didn’t “align” with its beliefs. The company became too politicized, serving as a crusade tool for top management and their political agenda instead of focusing on growth and optimization processes. As a result, PayPal found itself in the center of a storm, alienating users, employees, and investors.

The primary objective of PayPal, and any business, is to make money for shareholders. Of course, the company must abide by ethical and moral guidelines and provide a product or a service that benefits society. However, when an organization steps away from its objectives, begins censoring speech, taking on responsibilities it shouldn’t, and so on, bad things can happen to its business.

Fortunately, PayPal’s issues appear transitory and can be corrected with the right approach. Dan Schulman wasn’t up for this job, and his departure from the company may be the best thing for shareholders. PayPal can return to focusing on growing revenues, increasing profits, and delivering returns for shareholders instead of taking on obligations unfavorable to its business in the long run.

PayPal’s Revenue Growth to Increase

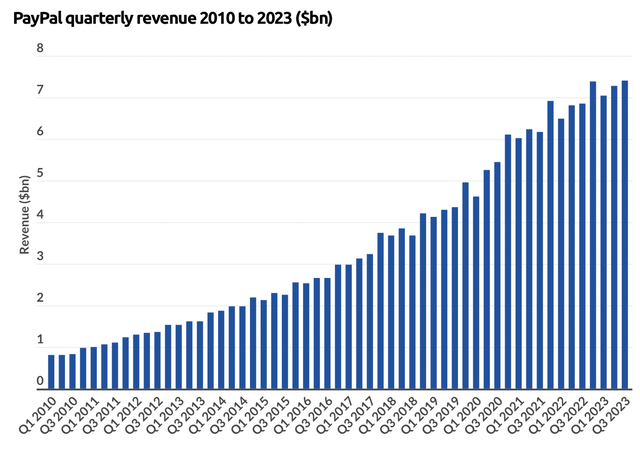

PayPal revenue trend (businessofapps.com)

First, I must point out PayPal’s excellent revenue growth trajectory. PayPal had less than $1B in quarterly revenue in 2010, and now it’s scheduled to report about $7.9B, a record for the company in Q4. And the stock is trading 84% below its ATH? What’s going on here?

Also, PayPal’s earnings revisions have been aggressive and could be overdone. Just as revenue and earnings growth projections were too optimistic around the height of the tech bull market, they may be too pessimistic now. This dynamic should enable PayPal to beat its upcoming earnings announcement (anticipated around February 1st), improving sentiment and resulting in a higher stock price as we advance.

PayPal’s Earnings To Increase

PayPal reported $7.42 billion last quarter, a solid increase of 8% over the same quarter one year ago. Also, we must consider that the healthy 8% revenue increase comes during an economic slowdown. Interest rates are the highest in decades, yet PayPal faces minimal adverse effects. As economic growth returns, costs, and inflation moderates, and interest rates move lower, PayPal’s growth should improve. Moreover, PayPal’s profitability should increase.

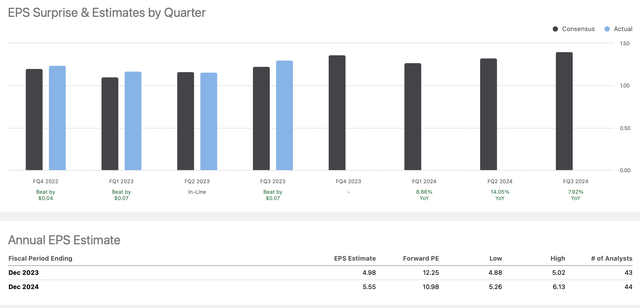

EPS Estimates (SeekingAlpha.com)

This year’s consensus EPS estimate is $5.55, illustrating PayPal’s dirt-cheap P/E ratio of 10.98 relative to this year’s lowballed consensus estimate. Also, I want to highlight that PayPal’s earnings revision grade is a B (SA Quant System). There’s a high probability PayPal can surpass the consensus figure, earning roughly $6 this year, placing its P/E multiple even lower (around 10). It’s remarkable how cheap PayPal is.

Additionally, the consensus EPS estimate is $6.16 next year, but PayPal could surpass this depressed, lowballed EPS expectation. Demonstrating modest 10-12% YoY EPS growth, PayPal could deliver $6.50 (or higher) in EPS next year, placing its forward P/E ratio at just 9.3. With this multiple, the market is not valuing PayPal correctly because it’s factoring in Armageddon, possible loan defaults, an earnings recession, and I don’t know what else. In short, the sentiment surrounding PayPal is ultra-low, and this is typically the ideal time to buy a stock.

PayPal Remains A Top Player In The Industry

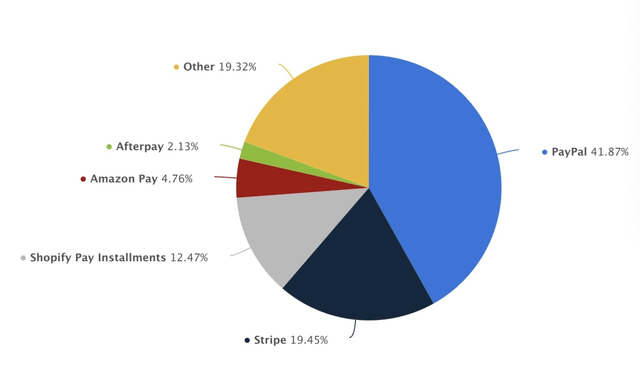

As of Q3 2023, PayPal had 428 million active user accounts. While this is a slight decline from the recent 435 million user record, growth will likely return. At about 42% market share, PayPal leads the global online payment services segment. Inside the U.S., PayPal owns nearly 60% of the payment services market.

PayPal’s 42% Global Share In Online Payment Processing

Market share payments segment (helpama.com)

In 2022, PayPal processed 22.8 billion global transactions. Despite the transitory decline in active users, PayPal processed a record 6.2 billion transactions last quarter, 11% more than the 5.6 billion processed in the same quarter a year ago. Therefore, PayPal’s growth continues despite a slow economic environment. As rates moderate and economic growth improves, PayPal could benefit from a compound effect of increased transaction volume and renewed user growth. Moreover, this phenomenon should lead to better-than-anticipated profitability, multiple expansions, and a significantly higher stock price.

Where PayPal’s stock could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $33 | $36 | $40 | $44.5 | $50 | $55 | $60 |

| Revenue growth | 10% | 9% | 11% | 11% | 12% | 10% | 9% |

| EPS | $6 | $7 | $8 | $9.20 | $10.50 | $12.20 | $14 |

| EPS growth | 20% | 15% | 15% | 14% | 15% | 15% | 14% |

| Forward P/E | 14 | 16 | 18 | 19 | 19 | 18 | 17 |

| Stock price | $98 | $128 | $166 | $200 | $232 | $252 | $280 |

Source: The Financial Prophet.

The last I checked, PayPal was still a fintech company capitalizing on transactions. It’s different from a traditional financial institution with heavy loan exposure and minimal growth. Despite the transitory economic slowdown and other short-term negative factors, PayPal’s sales growth should improve, and increased optimization and cost-cutting should expand profitability in future quarters. Therefore, PayPal deserves a higher multiple than its current sub-ten P/E ratio.

I used modest revenue and EPS growth to achieve price projections much higher than PayPal’s current stock price. Also, I used a relatively low P/E ratio of below 20 for PayPal in future years. In a bullish scenario, PayPal’s sales and earnings growth could be higher than my projections, and its P/E ratio could expand beyond the 20 range, leading to higher stock prices than my model projects. PayPal Holdings, Inc. stock is exceptionally undervalued and remains a strong buy here with an intermediate-term and more extended outlook for its shares.

Risks to PayPal

Despite my bullish projections, there are risks associated with investing in PayPal. Competition may be PayPal’s most significant concern. To keep leading in its segment, PayPal needs to remain on top of its game, as big companies like Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), and Alphabet Inc. (GOOG, GOOGL) all have alternative payment processing platforms. The primary risk factor is worsening user growth, which could transition to fewer active users, leading to declining transactions. Another concern is lower margins and a potential earnings contraction. There is also the risk of poor performance by new management. Macroeconomic factors and Fed policy could also adversely influence PayPal’s business. Investors should consider these and other risks before committing to a PayPal investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!