Summary:

- PayPal is a strong e-commerce trend beneficiary with reasonable valuations & financials. Strategic options available set PayPal up as a potential growth-at-a-reasonable price.

- Management re-shift could be a positive catalyst as the existing board has destroyed value, shown by declining return on capital over the past few years.

- Risk factors include 1) declining market share and margins 2) no long-term moat and fragmented industry with little economic power 3) poor use of capital going forward.

- I view this as a compelling entry point for an income growth portfolio with opportunities to write covered calls.

Editor’s note: Seeking Alpha is proud to welcome The Contrarian Portfolio as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

bennymarty

Investment thesis

Valuations at PayPal (NASDAQ:PYPL) have finally become attractive, with strategic growth options being available in the future. Their balance sheet quality remains strong with a leading market share position that makes me believe that the company is classified as a growth at a reasonable price. The management turnover can be a positive, and we could see acquisition opportunities by the new management to bring back growth in users and transaction volumes. Despite being a huge beneficiary of the stay-at-home demand surge during the pandemic, where it arguably grew too fast for its own good, the company has a strong history of following the secular growth trend in e-commerce since the eBay (EBAY) spinoff, that is set to continue for the foreseeable future.

What’s going wrong at PayPal?

Falling margins and a series of underwhelming results

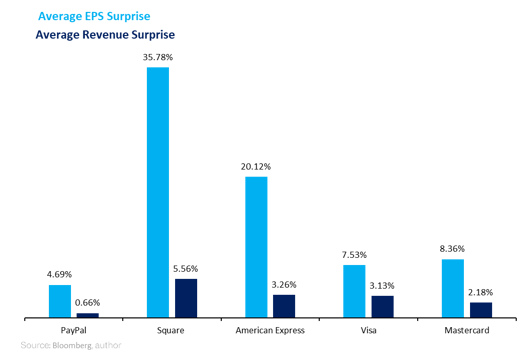

Operating margins have fallen from 16.8 to 13.94 from 2021 to 2022 respectively, despite volumes being up 9% to 1.36 trillion in the same time period. They have also had a declining return on invested capital since 2020 from 8.8% to 6.3%, whilst their WACC has increased from 8.9% to 11.3% in the same time, which is indicative of declining value and market share, according to Bloomberg estimates. Management have also made a series of overpromising earnings expectations since 2015. To put it into perspective, they have only had an average positive surprise on EPS of +4.69% and a revenue surprise of +0.66% in the past eight quarters, which indicates to me that they are not conservative in their guidance.

Bloomberg, Author

Management turnover

Management turnover is also high with the CEO, CFO and CPO departing, raising questions about the direction of the company. However, I believe that the new CEO transition is likely to be a positive catalyst, as Dan Schulman has proven to be a poor CEO that got the growth strategy wrong. Some of the failures were to focus on cryptocurrency trading and the inability to make strategic ventures to accelerate their growth. New changes at the board level might seem erratic at first, but it provides opportunities to rebuild and refocus the long-term growth strategy going forward. In addition, it’s been almost a year since activist Elliot Management came in and there hasn’t been any real drastic change, other than an even greater focus on treasury management, which has now resulted in a buyback yield for this year to be 5.8%. It feels like PayPal is managed like how an oil company is managed from a capital allocation perspective, which is a no-bueno for the growth type valuation.

The bull case

Resilient balance sheet and growth

Despite everything that is going wrong at PayPal, I believe that most of these issues can be fixed going forward, and that’s due to a good retention of their user base and solid financial health.

Fitch Ratings gave PayPal’s most recently issued Yen bonds an ‘A’ rating, citing a history of conservative balance sheet management and growth trends in e-commerce. Digging a little deeper into their balance sheet health, a key area that I look for is the ratio of intangible assets to total assets which can inherit some write-down risk especially if growth is flatlining. In PayPal’s case, this is low at 15.4%. Liquidity and solvency metrics are also healthy, along with a large cash balance of $10.6 billion. This indicates to me that they have levers to pull in terms of expanding their balance sheet to explore strategic initiatives, something I believe that the new management will undertake in future. The company botched the acquisition of Pinterest (PINS) in 2021 and although the deal seemed expensive at first glance, I believe the strategy was correct as they would have had access to a greater base of users and built a brand around integrating social media, which tends to create network effects. I do believe that management will explore acquisitions in the social media space, especially due to their balance sheet strength and the lower valuations in the market now compared to 2021.

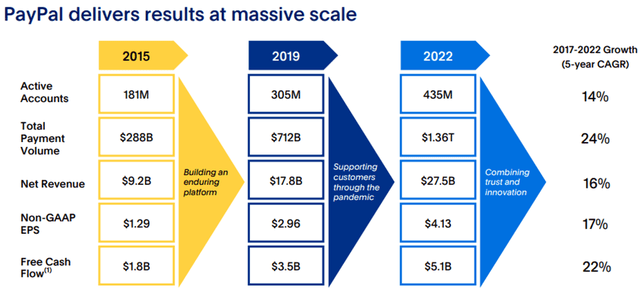

Total payment volumes grew at a CAGR of 24% since 2015, which highlights the secular shift in e-commerce, and whilst this growth cannot continue forever, the shift is likely in the middle innings globally where approximately 41% of PayPal’s revenue comes from. Net revenue per active accounts grew from $50.82 in 2015 to $63.22 in 2022 respectively, which highlights that they were able to grow revenues faster than they scaled their active accounts. On their most recent earnings release, management is also mentioning that they are focusing on the engagement on their current active accounts, currently at 433 million and is growing in the low single digits. The key metrics that I will be looking for in future is how much they are able to increase the transactions per active account, and the total amount earned by each active account.

Upside potential

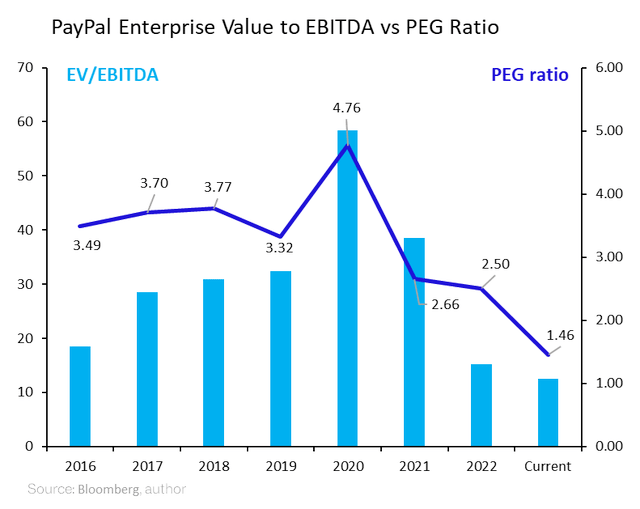

Current Bloomberg consensus estimates for the 2023 and 2024 forward P/E are 12.5x and 11.0x respectively, which is well below the S&P 500 multiple of roughly 19x. The peg ratio is also at an all-time low, and I consider that a reasonable growth rate relative to price would be the pre-pandemic average of 3.57 assuming that strategic ventures are explored, and they continue to benefit from the secular e-commerce trend internationally. Compared to peers, the enterprise value to EBITDA metric is also more attractively priced with the 5-year mean for the sector being at 15.5x EV/EBITDA, thus implying a price of approximately $105.4 from a conservative basis.

Technical indicators

Technically speaking, we could be forming a base at this $60-$65 mark however, there is a ton of overhead resistance ranging between the $70-$80 range where the 50, 100 and 200-day moving averages lie. If this is overcome, I could see a test of the $100 mark as a bullish case scenario in the next 12 months. Due to the blend of adequate fundamentals, challenging technicals and a “show me” story for growth, the strategy here would be to use options to maximise the income return by selling upside covered calls with the aim of not being too disappointed if the shares are called away. It is possible to extract 10-20% in income return by selling upside calls, depending on how aggressive you are at selling these options, while we wait for some clarity regarding management and their strategy.

Risk factors

One area of concern against this thesis is that the industry is heavily fragmented with competitors being Visa (V), Block (SQ), Stripe, American Express (AXP), Mastercard (MA), Google Pay (GOOG), Apple Pay (AAPL), etc. with a low barrier to entry and no sustainable moat long term that could lead to excess profits. The growth often comes with acquisitions or partnerships that can create brand loyalty from their customers, which PayPal is currently struggling at. If the new management team turns out to be like the incumbent and capital is wasted on poor acquisitions or initiatives, this also could lead the company into long-term decline and prove to be a value trap in the making.

Another long-term risk is that margins continue to contract whilst competitors stabilise or increase, therefore, leading to more operating margin compression. I believe the biggest threat comes from Apple and Google Pay taking further market share. If these profitability margins do not improve in the next twelve months in relation to peers, it would provide evidence that PayPal is entering the value trap category.

Conclusion

Overall, there are big challenges with PayPal, namely in the form of declining margins, market share, new management uncertainty and a fragmented industry. However, this presents an opportunity for the new management to take advantage of, namely by leveraging their strong balance sheet to grow their user base and taking strategic leaps in the M&A space to solidify their base in the secular e-commerce trend. I believe we are stuck in a waiting period for the new CEO to be named, which is why I favour an options overwriting strategy to generate income premium whilst we wait.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.