Summary:

- PayPal is a leading technology platform specializing in digital payments, with a dominant market share in the global payments service industry.

- The company has strong brand recognition and a large customer base, making it a trusted choice for online transactions.

- PayPal’s growth is driven by unbranded payment processing, strategic partnerships, and international expansion, with potential for improved profit margins.

Justin Sullivan

Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) is a leading technology platform specializing in digital payments and simplifying commerce for merchants and consumers worldwide.

PayPal offers a range of payment solutions that facilitate online and in-person transactions. Customers can use PayPal or Venmo accounts to make purchases, receive payments, and transfer or withdraw funds. Funding sources for these transactions include bank accounts, PayPal or Venmo account balances, PayPal and Venmo branded credit products, credit cards, debit cards, cryptocurrencies, gift cards, and eligible rewards.

The company primarily generates revenue by charging fees for completing payment transactions and other payment-related services based on the volume of activity processed on its payment platform. Additional revenue streams include foreign currency conversion fees, fees for instant transfers, fees related to the purchase and sale of cryptocurrencies, interest and fees from merchant and consumer credit products, referral fees, subscription fees, and gateway services.

As of December 31, 2022, PayPal operates a global, two-sided network with 433 million active accounts, which consist of 400 million consumer active accounts and 33 million merchant active accounts. This extensive network connects merchants and consumers across more than 200 markets.

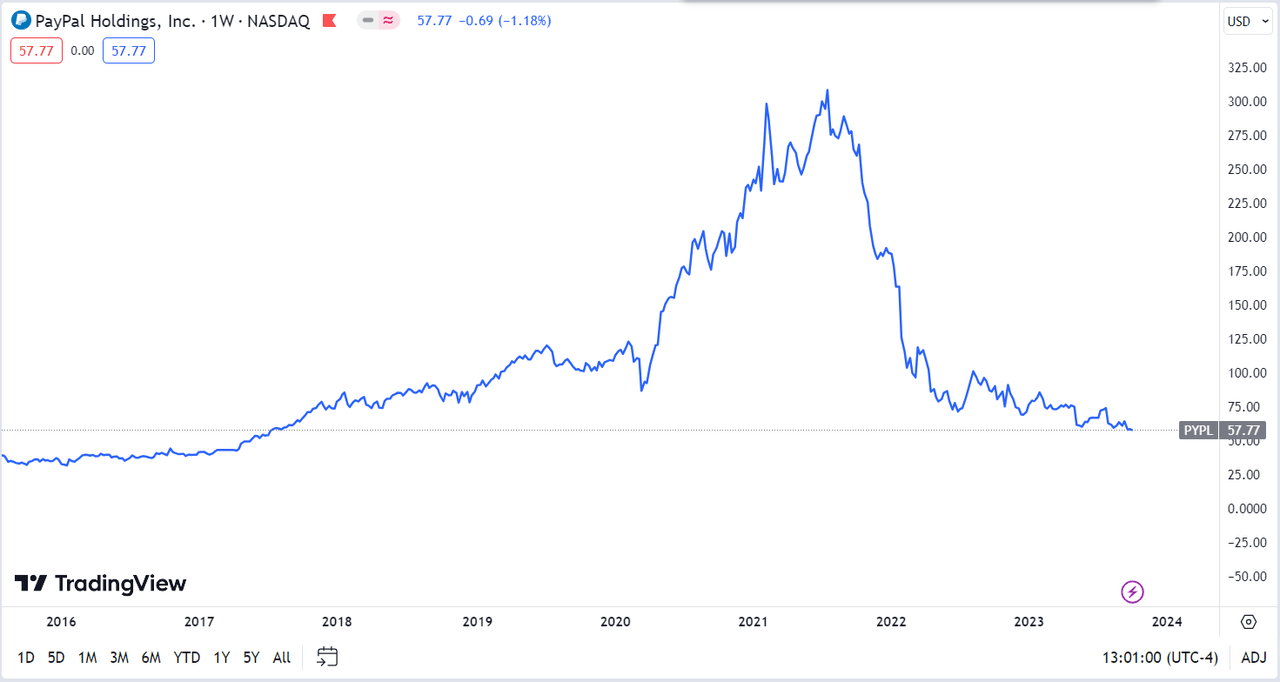

PayPal’s current stock price stands at $57.79, marking an 80% decline from its peak price of $309 in July 2021. The stock is presently valued at a level last seen in August 2017. Notably, the company’s revenues and cash flows have experienced substantial growth since that period. This significant drop in the stock price for a company of this magnitude raises the question of whether it represents a potential value trap or a compelling bargain. Let’s delve deeper to explore this further.

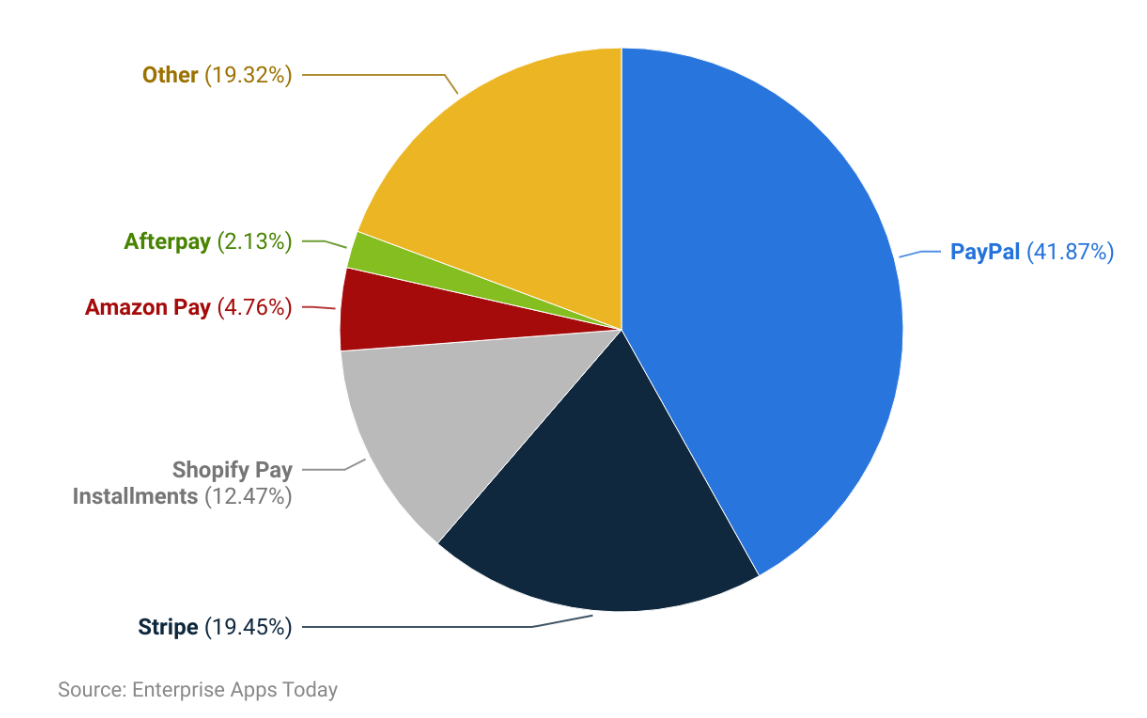

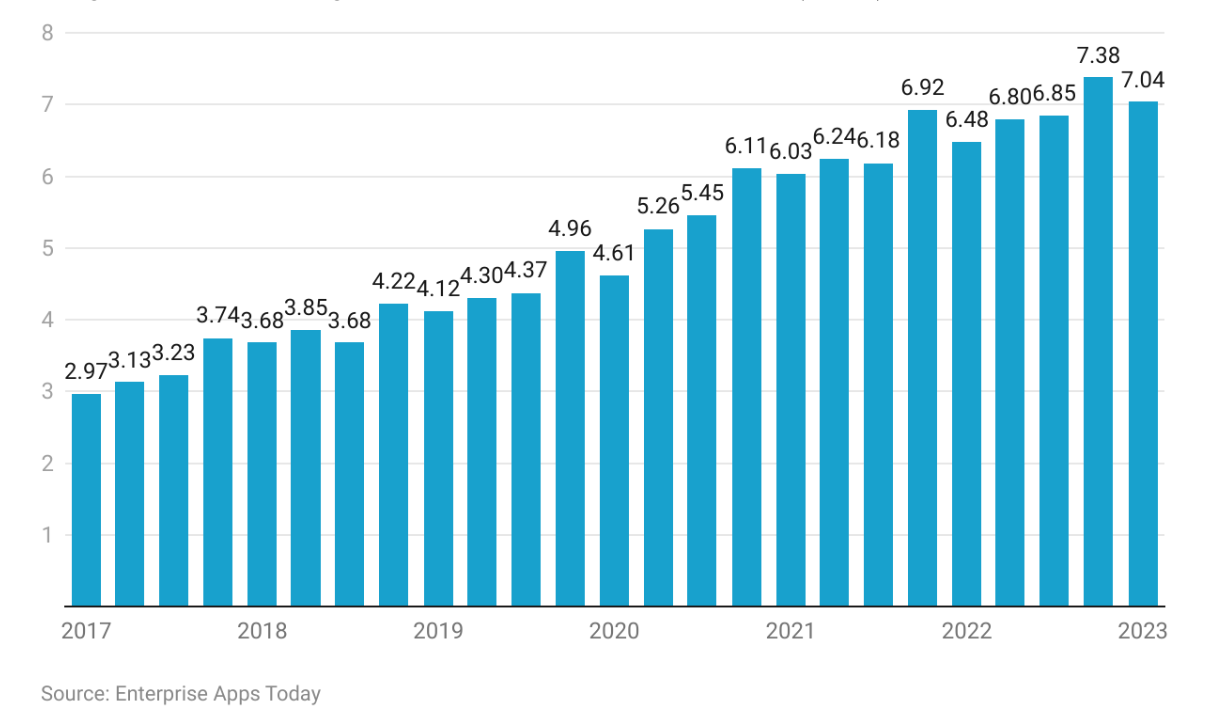

Highest Market share in the online payment industry

PayPal’s competitive advantage is unmistakably clear, as it commands a majority share of 42% in the global payments service industry. This remarkable market dominance underscores the trust and widespread acceptance that PayPal enjoys among consumers and businesses worldwide. With its user-friendly platform, commitment to innovation, strategic acquisitions, and global reach, PayPal has established itself as the foremost choice for digital transactions, ensuring its continued prominence in the dynamic landscape of online payments.

Enterprise Apps Today

Strong Brand Recognition and Customer Base

PayPal is one of the most well-known and trusted online payment platforms in the world, with over 430 million active accounts. This gives PayPal a significant advantage over its competitors, as customers are more likely to choose a payment platform that they are familiar with and trust. PayPal is available in over 200 markets and supports over 150 currencies. This makes it easy for merchants to accept payments from customers all over the world, and it also makes it easy for consumers to send and receive payments from friends and family members in other countries.

Unbranded Payment Processing Driving Growth

PayPal’s growth is driven by unbranded payment processing, where it offers software and services to merchants, facilitating various payment methods, including cards and competitors’ checkout options. The Braintree division, in particular, is witnessing substantial growth, competing with other rapidly expanding payment processors, making client acquisitions a potential catalyst for further expansion. Additionally, rising interest rates are boosting PayPal’s revenue by increasing earnings from user account balances held in PayPal and Venmo accounts. Furthermore, the company’s international expansion in the unbranded sector holds promise for improved future profit margins.

PayPal’s Strategic Integration into the Apple Ecosystem

On October 3, 2023, PayPal announced that customers can now add their eligible PayPal and Venmo credit or debit cards to Apple Wallet. This means that customers can use Apple Pay to make payments with their PayPal or Venmo cards in stores, online, and in apps. This partnership is a way for PayPal to expand its reach and make it easier for customers to use its payment services. Apple Pay is one of the world’s most popular mobile payment platforms, with over 600 million active users. While there were previous speculations about potential competition between Apple and PayPal in this sector, this partnership announcement underscores their collaborative approach and mutual growth goals, dispelling notions of direct competition.

Financials

PayPal has consistently shown revenue growth in every quarter since its initial public offering. Nevertheless, as we delve deeper into the figures, several important aspects warrant further examination. Before we analyze PayPal’s performance over the years, let’s first take a close look at its most recent quarter.

During the second quarter, the company reported total revenue of $7.29 billion, slightly exceeding the consensus estimate by $14.2 million. PayPal’s non-GAAP earnings per share (EPS) reached $1.16, surpassing expectations by $0.01. Notably, the total active accounts (TAS) hit a milestone of 456 million, marking a substantial year-over-year increase of 7.3%. Additionally, PayPal processed a significant payment volume (PV) of $340 billion, indicating robust year-over-year growth of 10.8%.

Regarding segment performance, the Payments segment achieved revenue of $5.83 billion, demonstrating strong growth at 9.6% year-over-year. The Platform segment generated $1.32 billion in revenue, exhibiting solid performance with a 4.0% year-over-year increase. Meanwhile, the other segment posted revenue of $142 million, reflecting notable growth at 12.4% year-over-year.

On the downside, the company’s adjusted operating margin for the quarter was 21.4%, slightly below the expected 22%. Operating cash flow experienced a significant decline compared to the previous year, hovering at -$0.2 billion, while free cash flow also decreased to -$0.4 billion. These declines were primarily attributed to a $1.2 billion negative impact resulting from European BNPL (Buy Now, Pay Later) operations, which PayPal anticipates selling in the latter half of the year.

To summarize, PayPal’s performance in the last quarter showed modest growth, but not by a significant margin.

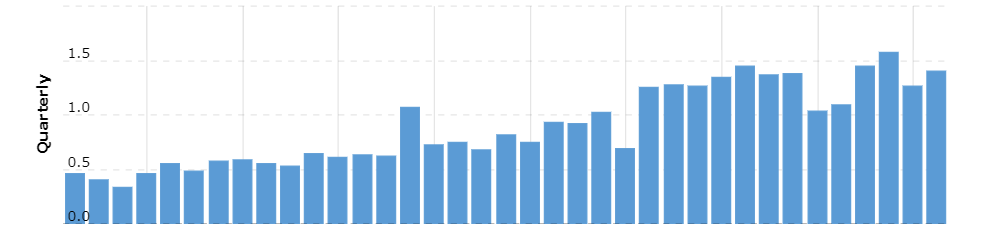

Let’s explore this company by examining its historical fundamentals. To start, we’ll take a closer look at PayPal’s quarterly revenue.

Enterprise Apps Today

Here’s a chart depicting PayPal’s quarterly revenue dating back to 2017. The company has maintained consistent performance, with revenue showing a steady upward trend. However, there appears to be a recent deceleration in revenue growth over the past few quarters.

Next, let’s delve into PayPal’s profitability. There are various metrics to evaluate this aspect, and we’ll begin with EBITDA. The data reveals a consistent increase in EBITDA; although the growth rate has slowed down in recent quarters, it still demonstrates steady performance.

Macrotrends

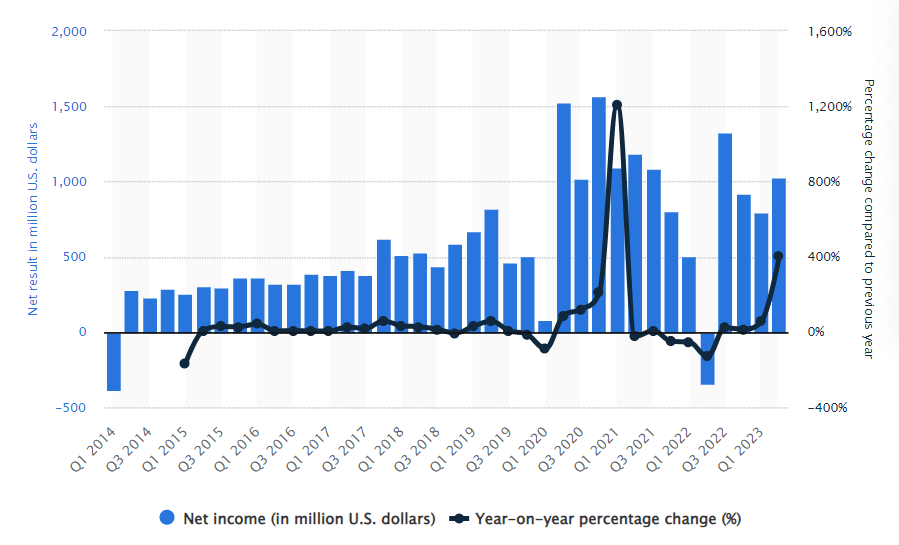

Turning our attention to the company’s net income, we observe past periods of healthy growth, but in recent years, it has plateaued with limited growth. Nevertheless, it remains relatively stable.

Statista

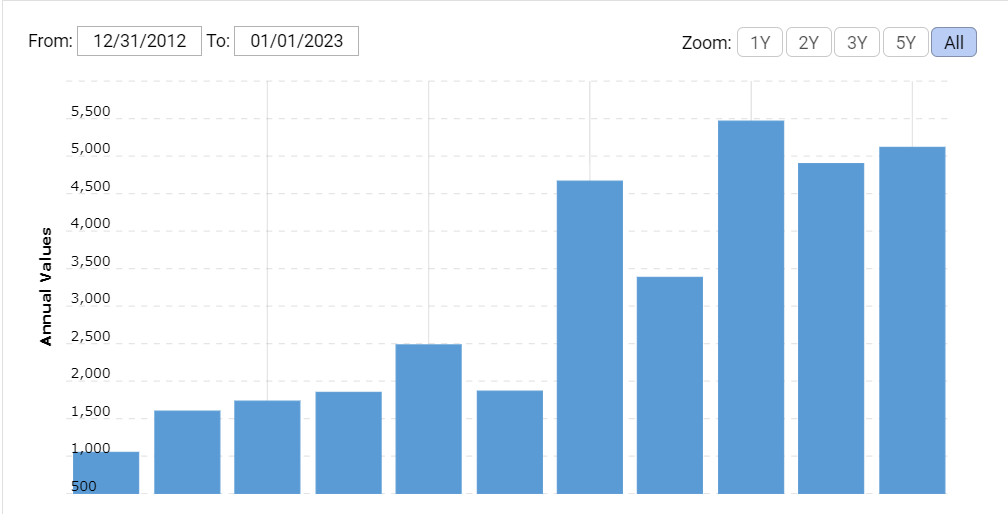

When examining the free cash flow of the firm, we notice a lack of growth over the past few years. Free cash flows have mostly remained flat. For a company expected to show growth, this stagnant trend in cash flows could be concerning.

Macrotrends

In summary, while PayPal demonstrates consistency in its performance, there appears to be a lack of significant economic growth in the company.

Now, let’s shift our focus to the company’s stock price. Currently, PayPal is trading at $57.77. With its stock price at this level and its cash flows showing stability albeit stagnation, the company has the opportunity to stimulate growth. This is precisely what PayPal is attempting to achieve. Recently, they announced a $5 billion share buyback plan, which could substantially boost the share price. By reducing the number of shares in circulation, the company aims to increase its earnings per share at a much faster rate.

Hence, PayPal’s most significant advantage at the moment is its attractively low stock price. This makes PayPal an appealing investment opportunity.

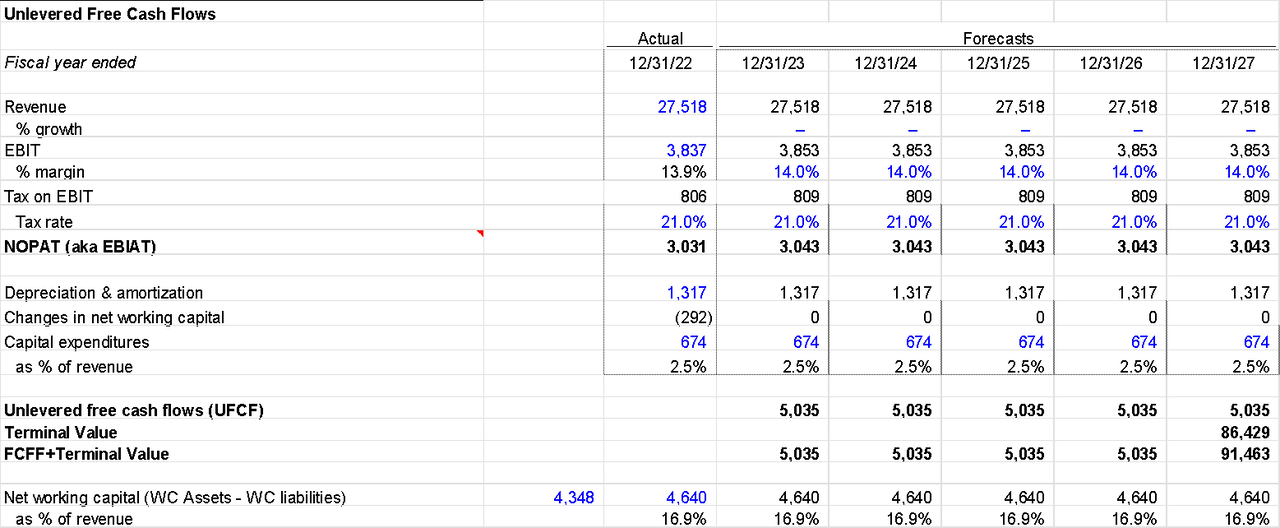

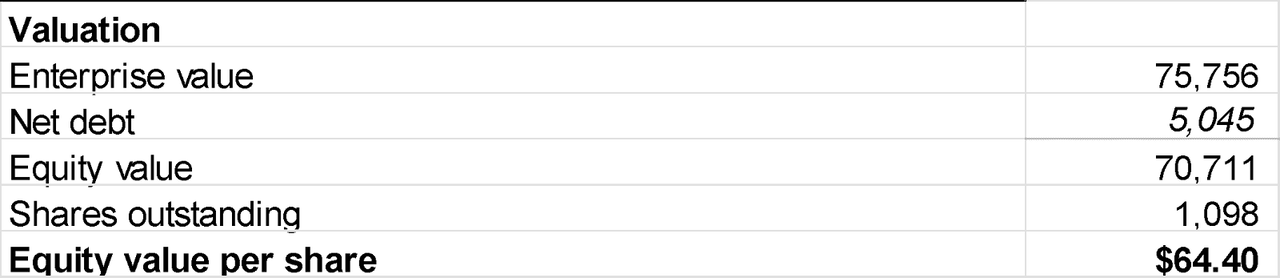

Valuation

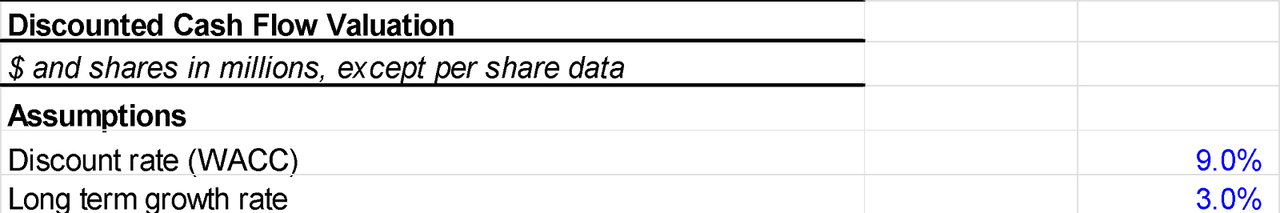

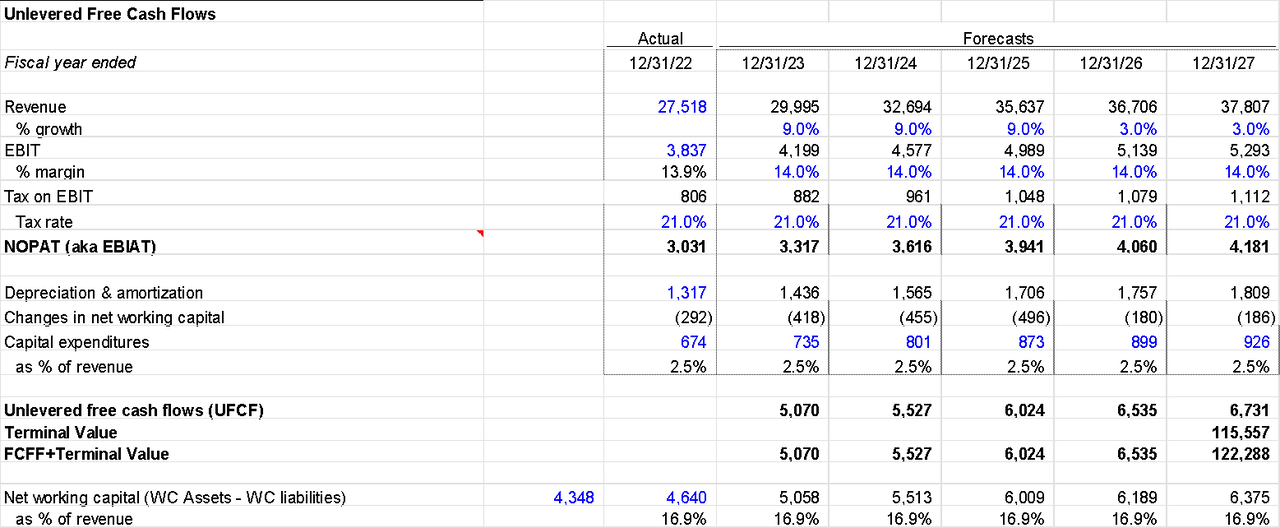

For the valuation, I have created three scenarios. In creating scenarios, I modified revenue growth while keeping other factors constant as last year. In all the scenarios, I have used a WACC of 9% and terminal growth of 3%.

Best Case

In the Best-case scenario, I have projected the revenue growth to be 9% for the first three years and then 3% growth for the rest period. I do believe that this growth rate is achievable based on the historical performance of the company and the potential untapped market in the future. Based on this case, PayPal’s intrinsic value comes out to be $84.71 per share.

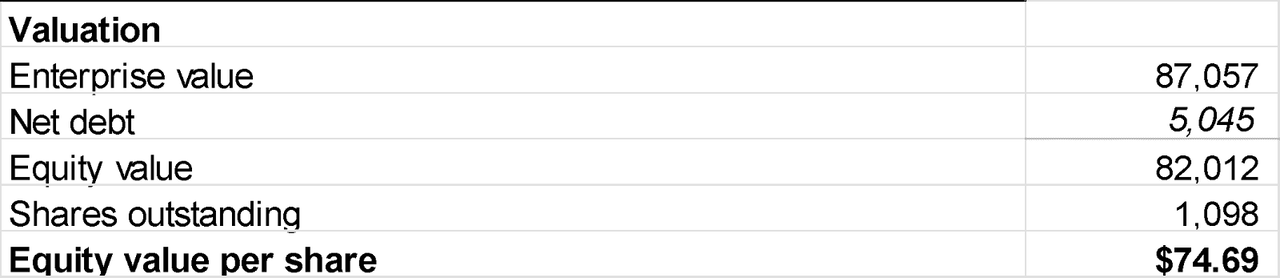

Base Case

In the second case scenario, I have assumed conservative numbers, halved the revenue growth, and kept it constant at 4% during the forecast period. This is possible if the company’s growth slows down, but still, it maintains its competitive advantage.

In this case, PayPal’s intrinsic value comes out to be $74.69 per share.

Worst case

In the last case scenario, I have kept the revenue stagnant without any growth. This case is also possible if competitors catch up and PayPal fails to gain additional market share, but it is highly unlikely in my opinion.

In this case, the stock should be valued at $64.40 per share.

Even in the most unfavorable scenario, it’s evident that PayPal’s share price surpasses the current valuation. This underscores the substantial undervaluation of the stock at this point, which, in my view, presents a compelling buying opportunity.

Risk

PayPal is a large and well-established company with a strong track record of growth. However, there are several risks associated with investing in PayPal stock, including:

Increased competition: PayPal faces increasing competition from several companies, including traditional banks, fintech startups, and other online payment platforms. This competition could squeeze PayPal’s margins and make it difficult for the company to maintain its growth trajectory.

Regulatory risks: PayPal is subject to a variety of regulations, both in the United States and internationally. Changes in these regulations could harm PayPal’s business.

Economic slowdown: A slowdown in the global economy could lead to a decrease in online spending, which would hurt PayPal’s revenue.

Conclusion

My analysis leads me to believe that PayPal is a fundamentally strong company. While it’s true that the company has experienced a slowdown in growth and relatively stagnant cash flows over the past few years, these challenges have already been reflected in the drop in its share price from its previous high of $300. However, the current trading price appears unduly low, given the company’s solid business foundation, consistent revenue growth, and steady cash flows. The recent change in management is a positive development, and the ongoing share buyback program initiated by the management is poised to bolster the share price. Taking all these factors into consideration, I would recommend a BUY rating for this company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.