Summary:

- PayPal is sitting at a record-low valuation since separating from eBay and becoming a publicly-traded enterprise in 2015.

- A 6% free cash flow yield is quite extraordinary from this leading online money handler, able to benefit from inflation in the general economy and consumer demand for digital transactions.

- Lower interest rates may soon argue for a rerating of the stock by Wall Street, allowing valuation multiples to rise with the share quote.

franckreporter

PayPal Holdings, Inc. (NASDAQ:PYPL) stands out as the best and easiest way to invest in the mega-trend of paying bills and transferring money online. Steady operating returns over time, and record-high free cash flow generation on the current stock quote are the draws for me.

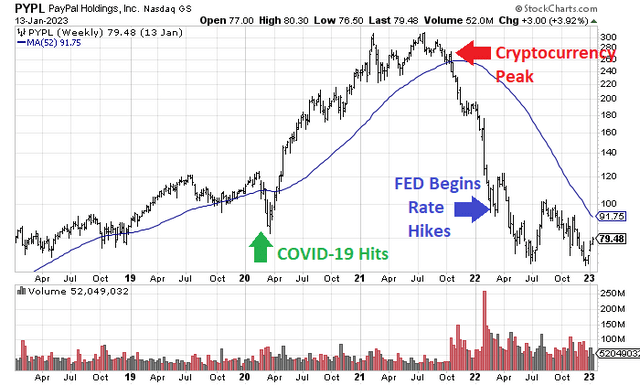

PayPal was an initial darling in the first years of the COVID-19 pandemic, as consumers and businesses stayed at home and bought things online, often using the company’s transaction services. Online money transfers and related cryptocurrency value holders eventually entered a boom mania for valuations during 2020-21. Then, pandemic demand for such ideas faded as people went back to work in the office, while the Federal Reserve began raising interest rates from zero to encourage money flows toward traditional banks and away from digital creations (not able to earn serious interest or provide an FDIC insurance guarantee on your capital). The digital money revolution fizzled (at least hit a detour), cryptos collapsed, and money changers like PayPal have seen underlying sales growth stagnate or reverse the previous pandemic spike in popularity.

StockCharts.com – PayPal, 5 Years of Weekly Price & Volume Changes, Author Reference Points with 1-Year MA

I warned readers of the coming bust in digital money in August 2021 here, explaining PayPal and cryptos were completely overvalued and would succumb to a large selloff at some point.

Seeking Alpha – Paul Franke, PayPal Article, August 16th, 2021

However, my cautious to bearish views on PayPal switched to a bullish stance in June 2022 here. I figured the selling in shares was overdone, and a compelling valuation story was developing for long-term investors around $72 per share. And, if anything, the buy proposition has improved since the summer months.

Seeking Alpha – Paul Franke, PayPal Article, June 14th, 2022

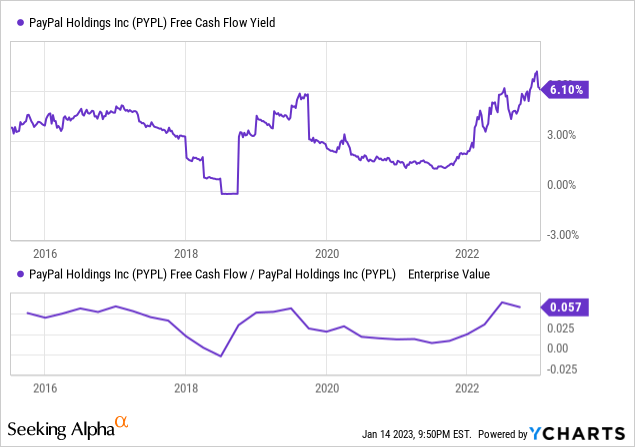

The valuation setup today is at the exact opposite end of the spectrum vs. early 2021. Below is a graph of what you could put in your pocket for after-tax yield each year, without affecting future operating growth, assuming you owned the entire company. The current 6.1% free cash flow yield on trailing results is quite extraordinary vs. the July 2021 number of 1.3%. In fact, this trailing yield is the highest since the company was spun off eBay (EBAY) as a standalone company in 2015. In addition, the free cash flow to enterprise value (including total equity and debt after subtracting cash held on the balance sheet) is equally good.

YCharts – PayPal, Free Cash Flow Yield vs. Price & EV, Since 2015

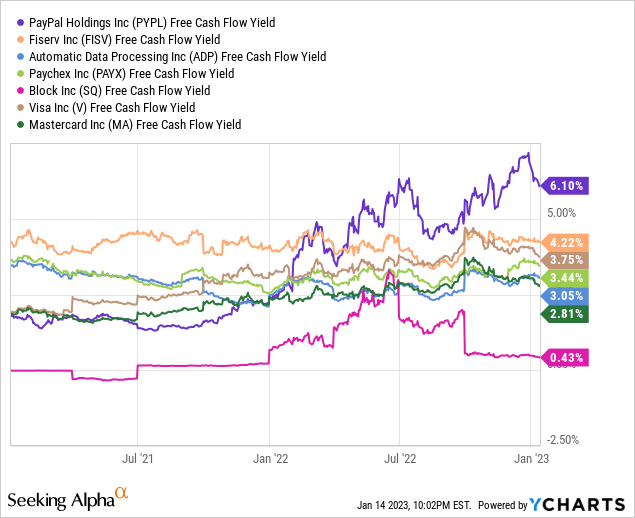

More bullish news, the free cash flow yield is now about DOUBLE the median average of 3.4% experienced by its closest competitors in digital money transfers. This sort group includes Fiserv (FISV), Automatic Data Processing (ADP), Paychex (PAYX), Block (SQ), Visa (V) and Mastercard (MA).

YCharts – Online Data Processing & Transaction Majors, Trailing Free Cash Flow Yield, Since 2021

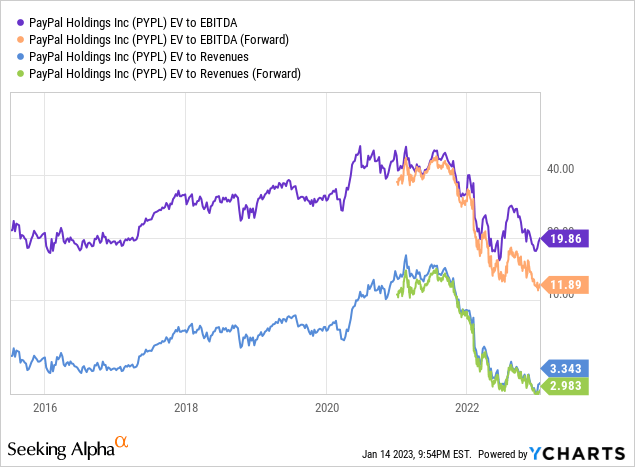

Corroborating the bargain valuation for PayPal today, enterprise value stats point to a solid buy entry for serious investors. EV to EBITDA and sales are reaching for all-time lows for shareholders. On forward estimates, the EV to EBITDA multiple of 12x is quite a distance under the 2020 high number of 50x. EV to forward revenue estimates under 3x is equally a bargain vs. the 2021 high of 16x.

YCharts – PayPal, EV to EBITDA & Revenue Stats, Since 2015

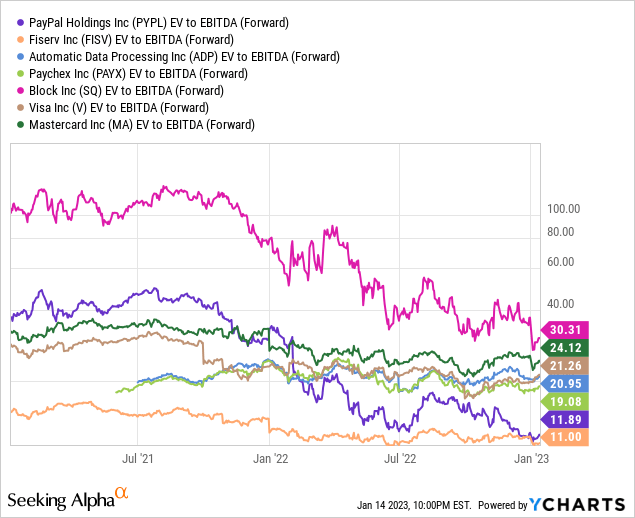

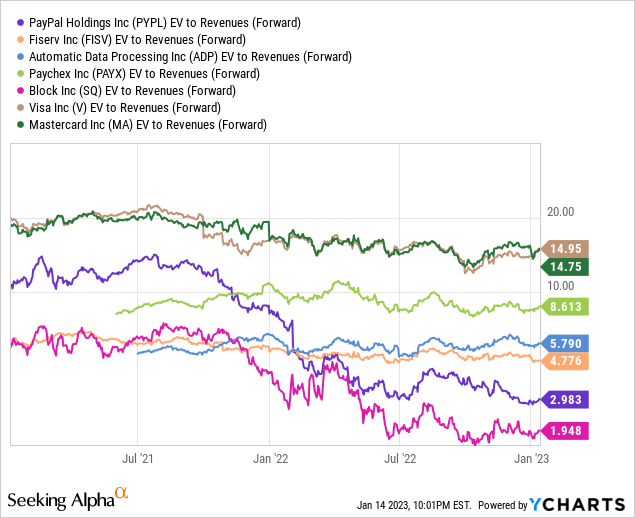

Compared to peers, PayPal has fallen from one of the most expensive choices in 2021 to one of the least expensive, using EV calculations. The overall valuation on EV is now a 30% to 40% discount to peer averages.

YCharts – Online Data Processing & Transaction Majors, EV to Forward EBITDA Estimates, Since 2021

YCharts – Online Data Processing & Transaction Majors, EV to Forward Revenue Estimates, Since 2021

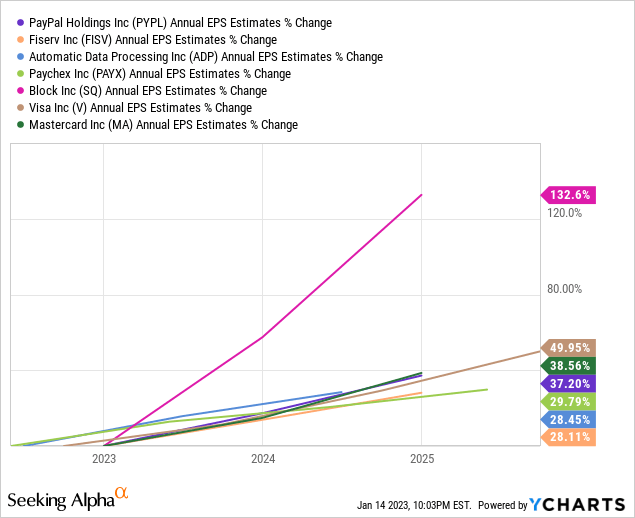

The price and valuation are so cheap, you would think sales and earnings growth would be projected to grow at a subpar rate vs. the industry in 2023-25. Nope. For example, PayPal’s EPS growth estimates are in the middle of the pack vs. peers and competitors, drawn below.

YCharts – Online Data Processing & Transaction Majors, EPS Estimated Growth for 2023-25, January 14th, 2023

Business Financials

All told, PayPal has been offering better rates of business growth than the vast majority of U.S. stocks or the macroeconomy at large for many years. You can get an idea of the expansion taking place, when reviewing the slides taken from the company’s Q3 2022 Investor Update.

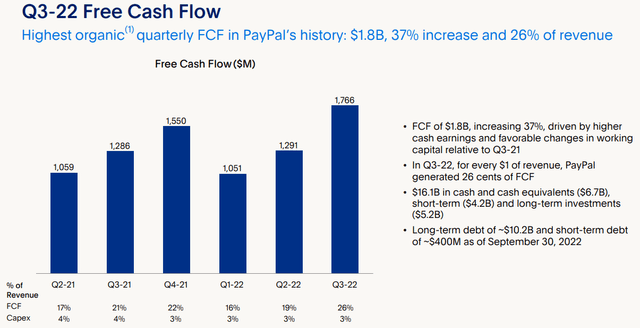

Below is a graph of rising free cash flow results, even with sales stagnating in 2022. In my experience, if you can find a company with expanding cash flow, even during a rough year for the business, buying/holding shares usually is a smart move into the future.

PayPal – Q3 2022 Investor Update

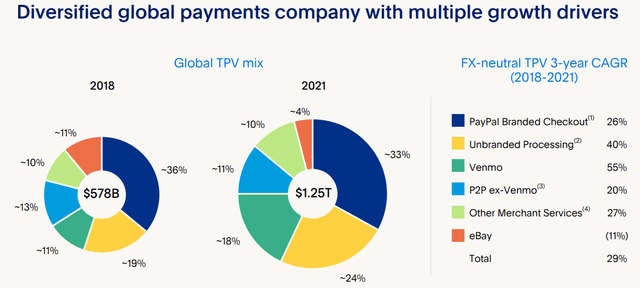

Measured from 2018, a few years before the pandemic, sales have more than doubled, which works out to an 18% annualized compounding rate.

PayPal – Q3 2022 Investor Update

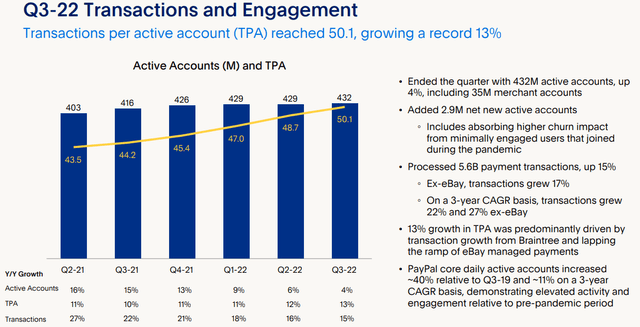

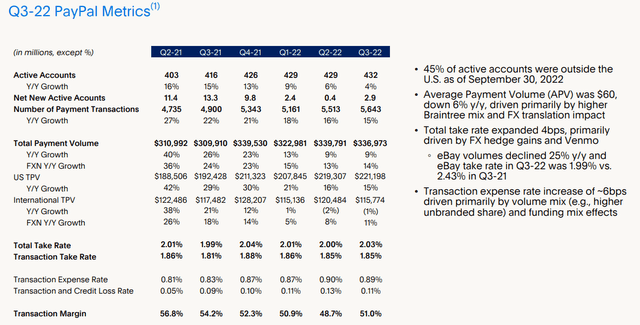

Despite slowing growth for digital money usage last year, numbers for transactions and engagement are still climbing at PayPal.

PayPal – Q3 2022 Investor Update

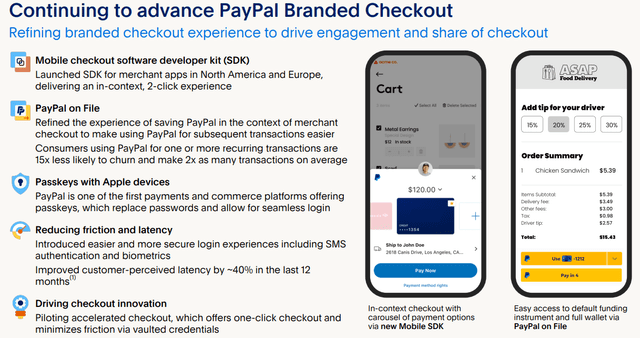

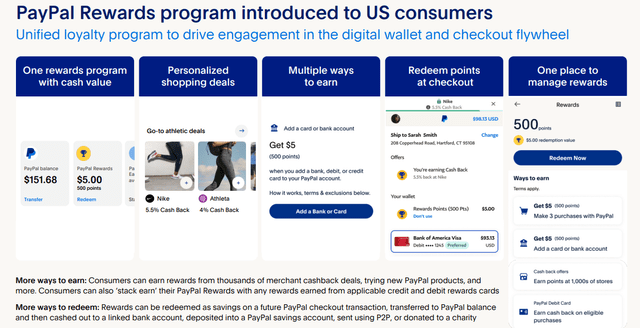

Plus, the company is always introducing new features to keep customers and attract new ones. Below are some examples, including a recently introduced rewards program for consumers using its online services.

PayPal – Q3 2022 Investor Update

PayPal – Q3 2022 Investor Update

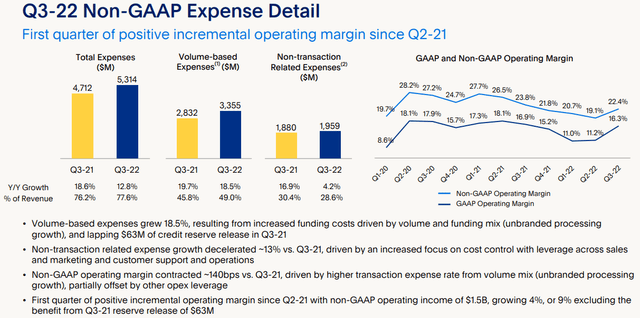

If there’s any bad news, it revolves around margin compression. The company is spending extra money on research & development (up to $3.2 billion annually vs. $2.1 billion in 2019). New growth initiatives and efforts to keep customers in a crowded and competitive space are the reasons.

PayPal – Q3 2022 Investor Update

PayPal – Q3 2022 Investor Update

My opinion of the business metrics overall is PayPal has been shifting toward a lower growth profile. Yet, changing long-term economic trends like inflation rates above zero (bringing greater transaction fees on rising “dollar” volume, absent any increase in transaction numbers) and the shift in consumer demand/preferences for online money should help total sales coming in the door, while a conservative balance sheet (without much interest expense, $170 million in trailing net interest cost vs. $5.5 billion in free cash flow) will support expanding margins by 2024.

Final Thoughts

I am looking to acquire shares on slight weakness over coming weeks if it appears. (Regular readers know I have a large cash weighting, as I patiently wait for one last Wall Street selloff in Q1.) A 6% free cash flow proposition is worthwhile, but with 6.5% CPI inflation and 4.5% from risk-free Treasuries available as an alternative, I would prefer a somewhat better cushion in yield for a margin of safety on my investment. That’s the difference between a Buy and a Strong Buy view.

Today, I place strong buy territory under $70 per share. Whether we get under this number is an open question. For retail investors not watching day-to-day price changes, buying a small starter position is an excellent idea under $80. You can always add PYPL shares if a big Wall Street swoon is approaching, as recession becomes reality?

For downside risk, I believe it rather unlikely PayPal can fall under $60 (equivalent to a forward 12-month free cash flow yield closer to 8%), even in a deep recession scenario. If the stock market plunges for whatever reason, pulling PYPL under $60, I doubt it would stay there for long. Of course, if new competition for digital money steals away market share, PayPal’s stock price may not recover much above $100 for years, maybe never. However, the company’s namesake money app and popular Venmo division are leading the pack for total online accounts. It will be hard for another competitor to knock the company from its perch.

I am offsetting a potential real-world decline to $65 a share in my work (just under its 52-week low), against theoretical upside to $120 by the end of 2023. In a best-case scenario, inflation/interest rates will continue to zigzag lower all year, and acceptable free cash flow returns of 4% from PayPal may become appropriate. And, if business results beat expectations for growth, investment upside beyond 50% is entirely possible over 18 months. Modeling a worst-case drop of -20% vs. best-case gain of +50% over the next 12 months, the risk/reward analysis odds of investment success purchasing shares under $80 seem to be quite positive. I remain confident PYPL will at least perform in line with the S&P 500 over calendar 2023, if not outperform by a wide margin. I rate shares a Buy.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.