Summary:

- PayPal stock basically went nowhere for the past few weeks, while the S&P 500 continued to see new ATH. I think this should change shortly.

- Despite a drop in the total number of users, transaction volume is also growing, which is positive and allows the company to generate a substantial amount of free cash flow.

- PayPal’s FCF should help surpass the pessimistic EPS consensus for 2024 if the company continues to repurchase shares at similar volumes and maintains its net income growth rate.

- I expect Wall Street to re-evaluate the current valuation discount, potentially leading to stock price growth and a shift in market sentiment.

- Therefore, I believe the current weakness in PayPal stock, its dip, should be bought.

chameleonseye

My Thesis Update

After I initiated coverage of PayPal Holdings (NASDAQ:PYPL) stock at the end of January 2024, the stock price continued to remain in its usual price channel that started in mid-last year. So the stock basically went nowhere for the past few weeks while the S&P 500 index (SP500) (SPY) continued to update new all-time highs. Unfortunately for me and my bullish thesis, PayPal didn’t react to the catalysts that I had assessed as extremely positive back in January and also in April.

Seeking Alpha, Oakoff’s coverage of PYPL stock

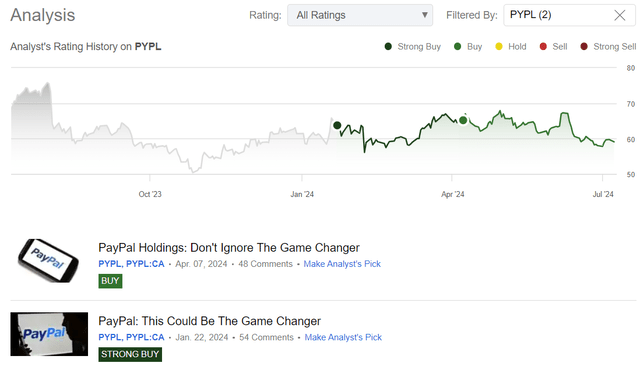

However, I see no reason to believe that the stock could fall significantly below its current price. It seems to me that the company is even more undervalued today than it was 3-6 months ago, while some of the catalysts I described earlier are still on the horizon and could improve the situation significantly in a positive direction. I believe the current dip should be bought – hence my today’s “Buy” rating update.

My Reasoning

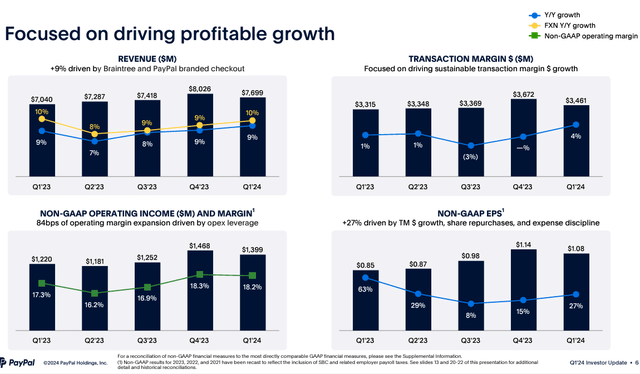

I don’t think we can call the Q1 2024 results bad for PayPal. The firm reported a 14% YoY increase in total payment volume (TPV) to $403.86 billion, with revenue growing by 9% YoY to $7.699 billion on a spot basis (+10% on a currency-neutral basis). I believe that for a company with a market share as large as PayPal’s, this is a substantial TPV growth. PayPal had 427 million active accounts as of March 31, down from 433 million the prior year, but again, the number of payment transactions rose 11% to 6.5 billion. What also caught my eye was that PYPL’s transaction margin rose by 4%, driven by factors such as “interest on customer balances, growth in PayPal branded checkouts, lower losses, and Venmo’s performance.” When analyzing the income statements, it’s also worth noting that the increase in S&M costs was reduced by 4% YoY, while G&A expenses were reduced by 9%. As a result, we saw continued expansion of operating profit: Non-GAAP EBIT reached $1.399 billion, resulting in an 18.2% operating margin (vs. 17.3% last year), and non-GAAP EPS increased by 27% to $1.08. In general, looking at the trends in various financial and operational indicators, I can conclude that the company’s business is continuing its turnaround, albeit not as actively as I (and many other analysts and investors) previously imagined.

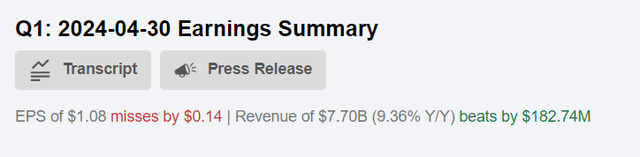

The bottom line growth surpassed guidance expectations – largely due to effective expense control and a new non-GAAP methodology that includes SBC expenses – but it wasn’t enough to beat the consensus expectations even amid sales surprising in a positive way:

As I see it, PayPal is taking active steps to revive its former growth, developing in several directions simultaneously. First, it’s targeting large enterprises, trying to improve the checkout experience and make Fast Lane widely available in the US. For small and medium-sized businesses, the company is expanding its PPCP platform and offering no-code and low-code tools to increase merchant adoption. PYPL is also reviving a consumer rewards program and introducing new products such as the PayPal debit card. Management continues to focus on advancing Venmo at the same pace as in recent quarters. All of these initiatives appear to be bearing fruit, otherwise, we wouldn’t have seen management’s increased guidance: FY2024 EPS is now expected to grow in the mid to high single digits, while Q2 revenue is expected to increase by 6.5% on a spot basis and 7% on a currency-neutral basis.

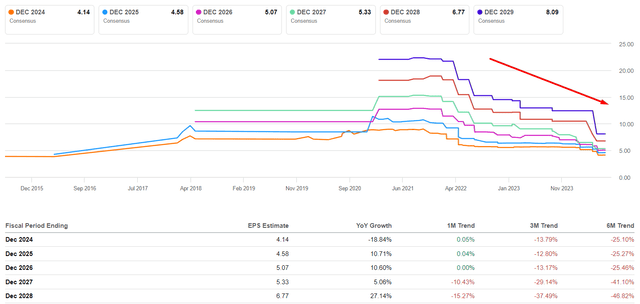

Despite the heightened guidance, Wall Street analysts’ reactions have been mixed: According to Seeking Alpha Premium data, over the last three months, the sales estimates have indeed increased in 79% of cases, but analysts have also become more conservative regarding EPS forwarding growth, lowering their forecasts 95% of the time, or 36 times over the past three months alone.

I forgot to mention that in Q1 2024 PYPL’s growth of free cash flow was 76% YoY (86% on an adjusted basis), amounting to $1.763 billion – that includes the negative $100 million impact by the “timing between originating European BNPL receivables as HFS and the subsequent sale of these receivables”, so I think without these one-off events, the FCF would have been even larger. According to the new guidance, PYPL is going to generate around $5 billion of FCF for 2024 with at least $5 billion settled for buybacks – this is a massive prospective support for the bottom line going forward. I should add to this the ongoing strengthening of margins through the reduction of certain operating expenses as well as the acceleration and potentially higher growth rates of revenues in the coming years (as indicated by consensus forecasts as well as recent corporate events and management core focus). Therefore, I don’t see why EPS forecasts should have fallen as much as they have in recent months.

Seeking Alpha, PYPL, Oakoff’s notes added

Based on current consensus forecasts, I see that the market expects PayPal to grow its revenue and EPS at CAGRs of ~7% and ~11.8%, respectively, over the next 6 years. This indicates that the market is still expecting some improvements in terms of margin stabilization, but the implied recovery seems relatively slow to me. In my opinion, the company is capable of achieving more, especially with the amount of FCF it plans to spend on buybacks: By repurchasing its shares, PYPL can significantly reduce the number of shares in circulation, thereby decreasing the denominator in the EPS calculation and increasing the EPS itself. I don’t recall seeing a similar trend from another company, but over the last 5 quarters alone, the number of PYPL’s diluted shares outstanding has decreased by almost 5.5% – this is a very rapid decline.

Assuming that by the end of 2024, the number of shares will decrease by another 4%, which is quite possible given the current depressed share price and the company’s continued generation of free cash flow, and also assuming that net income will increase by 3% YoY in 2024, which is quite realistic to me, we’d see EPS amounting to ~$4.34. This is almost 5% higher than the current consensus is pricing in. Based on these calculations, which I find relatively realistic and achievable, I conclude that Wall Street may be underestimating PayPal’s EPS expansion prospects in the medium term. If my forecast proves accurate, this should provide an excellent catalyst and incentive for the recovery of the stock and a shift in market sentiment once/if PYPL beats the current estimates.

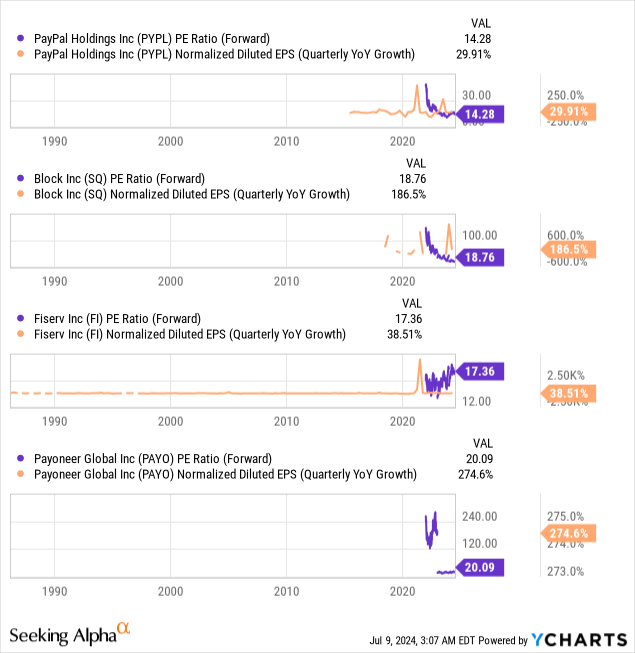

Also from a valuation perspective, the potential for a recovery in growth seems very favorable to me: despite Seeking Alpha Quant’s “D+” rating, PYPL is trading at only a 14.4x forward non-GAAP P/E ratio, which is, of course, higher than the Financials sector median of 10.4 times, PYPL is a fintech firm first of all, so this multiple should be at least 30-40% higher when looking at other peers (although PYPL’s growth rates still lag).

Without looking too far ahead, just looking to the end of 2024, I think PYPL’s P/E ratio should expand to at least 16x if the company reports Q2, Q3, and Q4 (and hopefully beats current estimates). Using the non-GAAP diluted EPS of ~$4.34 I calculated above, I arrive at a price target of about $69, which is 17.5% above the current stock price. Again, this price target is also based on very realistic forecasts (in my view). If PayPal manages to exceed them, the growth potential should be much higher.

From all this, I conclude that PYPL is still a worthy candidate for a medium-term recovery. So I confirm my “Buy” rating today.

Risks To Consider

First off, it’s crucial to keep in mind that PayPal faces stiff competition from established brands such as ApplePay by Apple (AAPL), Visa’s Checkout (V), MasterPass by MasterCard (MA), American Express (AXP) Later Pay and other digital products by Meta Platforms (META) and Google (GOOGL) (GOOG). In addition to PayPal, customers usually have several choices for making payments at the time of sale, so the company must compete on ease of use and transaction costs – that’s very, very hard in today’s reality.

You may also have noticed in one of my charts above that I show the FWD P/E multiple for the next year and compare it to the EPS growth rate for the most recent quarter. PayPal doesn’t appear in the most favorable light, as its EPS growth rate still lags that of its closest peers. Yes, there is a 30-40% discount, as I mentioned earlier, but that can be attributed to its weaker growth rates. Therefore, my thoughts on the company’s undervaluation may be a bit too optimistic.

Also one of the main risks to my bullish thesis today is the uncertainty surrounding the turnaround strategy pursued by the current management. This uncertainty has led some banks and research agencies to remain cautious and not recommend PayPal to their clients. For example, here’s what Argus Research analysts write about PayPal in their latest analysis (proprietary source, dated May 2, 2024):

The company, which itself has dubbed 2024 a transition year, has announced several innovation efforts, but we expect them to take time to meaningfully add to EPS. We expect weaker overall growth in payment volumes for PayPal in 2024 amid higher interest rates and rising competition.

Your Takeaway

Despite some significant risks surrounding PayPal stock, I remain bullish.

In my analysis today, I didn’t find any value trap characteristics in PayPal shares – I think the company simply needs more time to achieve its goals for profitable growth. From the latest financials, I see that revenue continues to grow and cost management remains in place: OPEX is declining, albeit not as rapidly as expected. Despite a drop in the total number of users, transaction volume is also growing, which is positive and allows the company to generate a substantial amount of free cash flow. This FCF is almost entirely used for buybacks. If the company continues to repurchase shares at similar volumes as it has previously, and if its net income grows at the same rate as we have seen over the past few quarters, I believe PayPal has a good chance of exceeding the current quite pessimistic EPS consensus for 2024. This should allow Wall Street to re-evaluate the current discount, potentially leading to stock price growth and a shift in market sentiment. At least, this is what I hope for. So based on all that, I believe the current weakness in PayPal stock, its dip, should be bought.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.