Summary:

- I think PayPal’s recent rally is just the beginning, as the stock remains undervalued given its growth prospects and strategic cost-saving measures.

- Q2 2024 results exceeded expectations with an 8% revenue increase, 28% adjusted net income growth, and substantial EPS gains, showcasing effective cost control.

- PayPal’s expansion into cryptocurrency for U.S. business customers and innovative payment solutions like “Buy Now Pay Later” drive future growth and user retention.

- It looks like Wall Street had written off the company’s growth potential, and management has started to prove the market wrong.

- Despite strong competition, PayPal’s turnaround strategy and potential EPS above-consensus growth suggest a 33.5% upside, reiterating my “Buy” rating.

Pixelimage

My Thesis Update

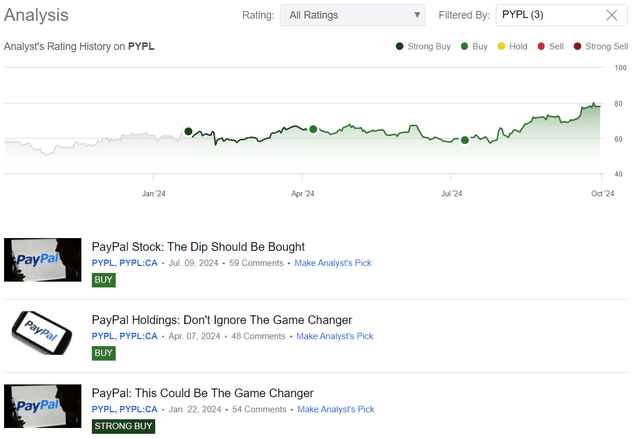

After I initiated coverage of PayPal Holdings (NASDAQ:PYPL) stock at the end of January 2024, the stock price initially went nowhere and remained in its usual price channel for several months, which began in the middle of last year. The S&P 500 index (SP500) (SPY) continued to update new all-time highs at the time. However, I kept updating my bullish thesis on PayPal’s expected business turnaround, and eventually, my calls paid off as the stock is now outperforming the market since my last thesis update:

Seeking Alpha, Oakoff’s coverage of PYPL

Fortunately for those who missed out on buying PayPal stock in recent weeks, I think the current rally is just the beginning, as the company is still cheap given the growth prospects I see ahead. The market is still skeptical about those prospects and still offers risk-takers a great opportunity to buy PayPal while it’s still cheap.

My Reasoning

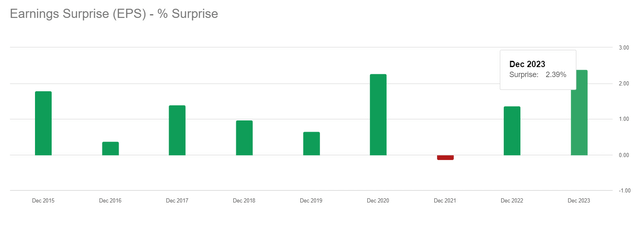

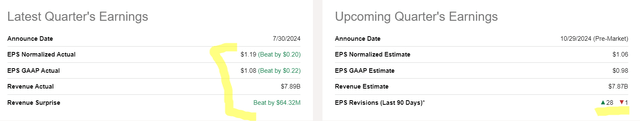

PayPal reported adjusted EPS of $1.19 for Q2 2024, compared with $1.16 during the same quarter last year (up from $0.99), as revenues increased 8% to $7.9 billion, or 9% after deferred foreign exchange rates. Adjusted net income increased 28% to $1.2 billion. The adjusted EPS increased even more at 36%, as the average number of shares issued fell by 6%, so in terms of shareholders’ returns, investors received substantial returns (even though the company doesn’t pay dividends). This strategic approach to rewarding investors also helped to reach a significant positive EPS surprise (the biggest for the past few years), exceeding market expectations. The impressive second quarter of 2024 demonstrated to analysts that they had underestimated their forecasts for Q3 and the company’s overall potential for full-year 2024. Consequently, we witnessed a widespread upward revision of estimates:

Seeking Alpha, PYPL, notes added

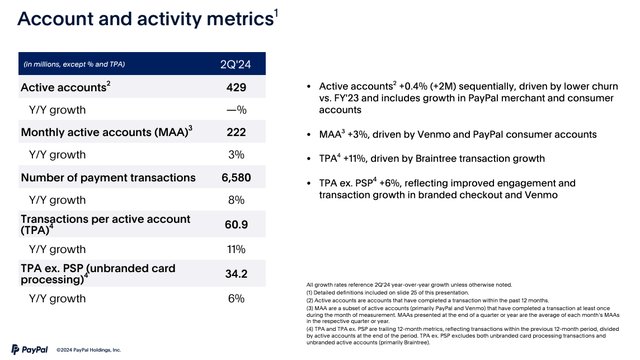

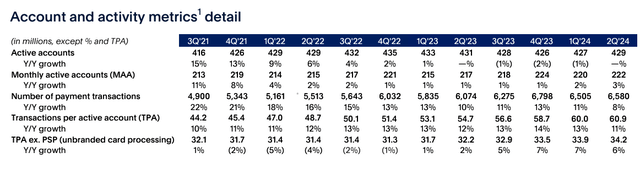

Let’s talk more about the revenue figure. Again, total revenue increased by 8% to $7.9 billion, or 9% adjusted for FX, with a majority driven by an 11% increase in overall payment volume to $416.8 billion. This increase was driven by increases in payment transactions that grew by 8% to 6.58 billion (even though active accounts fell slightly to 429 million from 431 million last year).

[Source]

In my previous articles, I emphasized the importance of company unit economic metrics, and the data from Q2 2024 supports my previous optimistic outlook as these metrics remained in an upward trend. We observed an 8% increase in the number of transactions, and transactions per active account grew by 11% YoY. Although this growth is slightly lower than last year’s, it is still above 10%, which is encouraging to see. Additionally, the growth in transactions per active account, excluding unbranded card processing (TPA ex. PSP), is also on the rise, and this growth is gradually accelerating:

I think this performance reflects PayPal’s well-planned marketing move towards using accounts more efficiently, instead of adding new ones. The expansion of the “Buy Now Pay Later” program and the use of crypto payments have also been part of this growth as they work to innovate in the online retail sector.

Adding to that, PYPL cost cuts, which included a 9% workforce cut, increased operating margins – these efficiency gains resulted in an increase in adjusted net income of 28% to $1.2 billion as I already noted above. It looks like their strategic focus on cost control and extensive network has enabled the company to be well-positioned to tap into the evolving market for digital payments.

Coming back to crypto stuff, just a few days ago the Seeking Alpha News team reported that PayPal has enabled U.S. business customers to buy, hold, and sell cryptocurrencies right from their accounts, which was previously only available to retail customers. The change takes care of entrepreneurs’ growing demand for cryptocurrency functionality, said PayPal’s senior VP of Blockchain and Digital Currencies, Jose Fernandez da Ponte. One can also send crypto to third-party wallets that are allowed by the merchants.

The estimated number of Bitcoin-accepting U.S. businesses, including Bitcoin ATMs, as of late 2022 was 2.352, per Deloitte estimates. Cryptocurrencies are now used by an increasing number of businesses worldwide for investment, operational, and transaction purposes. According to a survey of 2,000 top executives at US consumer businesses, merchants are using digital currencies to remain competitive, and they expect digital currency use to continue to grow. Also, some major retailers have adopted Bitcoin as a means of payment, from groceries to flight tickets. So even despite some estimates that say that cryptocurrency use has decreased over the past few years, I think this option addition is a great thing for PayPal’s expansion and user retention prospects – it’s always good when users who are used to the convenience of an app have more options.

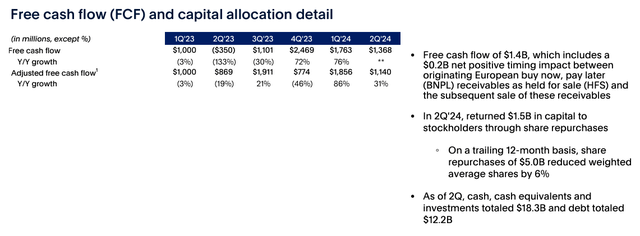

On the balance sheet, I believe PayPal is still very well-funded with $18.3 billion in cash and short-term assets to $12.2 billion in long-term debt (as of 30 June 2024) – enabling it to invest in the business, explore acquisitions, and continue its share buyback program that already has repurchased 24 million shares for $1.5 billion in the second quarter alone. The absence of an ongoing cash dividend points to growth and capital optimization, so it’s more of a feature of the firm rather than a disadvantage.

They also have sound cash flows, and free cash flow is reinvested back into the business for innovation and growth. Q2 FCF amounted to $1.4 billion, which includes a $0.2 billion net positive timing impact from originating European BNPL receivables as “held for sale and their subsequent sale”.

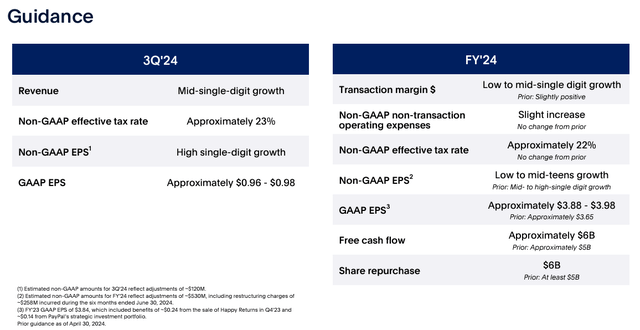

Management’s Q3 guidance calls for mid-single-digit revenue increases and high single-digit non-GAAP EPS growth, with adjusted EPS for the full-year increasing by low- to mid-teens.

I believe PayPal will continue to benefit from aggressive cost savings and strategic actions that should help it continue to grow and increase shareholder value even amidst fierce competition within the online checkout space.

On the other hand, the company’s valuation remains discounted.

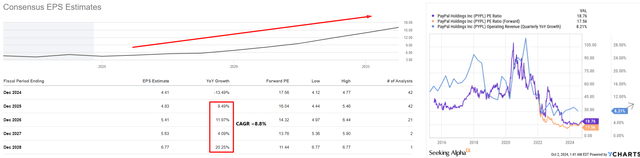

For months, PYPL’s valuation multiples have been falling amid falling business growth metrics. According to the current consensus forecasts, recovery rates suggest that EPS should increase in the foreseeable future and stabilize at ~8.8% by the end of 2028. If this scenario unfolds, I expect PYPL’s price-to-earnings ratio to remain at least at its current level of 17-18x. However, the implied P/E ratios indicate that the market anticipates a further correction of the P/E multiple to 11-13x by FY2028, which seems illogical given the expected stabilization in EPS growth.

YCharts, Seeking Alpha, Oakoff’s notes

I also believe that the current EPS growth rate for 2025 may be understated given the strength with which PayPal has started to beat quarterly forecasts – there is a possibility that PayPal’s actual EPS growth will be 1.5-2.5% higher than analysts currently expect (which is roughly in line with the level at which the company has outperformed consensus in recent years).

Adding the 2% premium to the forecast EPS growth rate for 2025 and assuming a P/E ratio of 17-18x, the fair price of PYPL in 12 months is around $86.2/sh. That is 11.3% more than the current stock price.

Above is my pessimistic forecast, as the valuation multiple will most likely widen into the 20-22x range if PayPal’s EPS growth accelerates, based on historical norms. So this is my base case scenario, according to which PYPL is currently trading at a 33.5% discount to its “fair value”.

Risks To My Thesis

What was pressuring the company’s growth in the recent past – fierce competition in the fintech space – is still there to date. PayPal’s payments industry is under serious pressure from established companies such as Apple’s (AAPL) Apple Pay, Visa’s (V) Checkout, Mastercard’s (MA) Masterpass, American Express’s (AXP) Later Pay, and Meta’s (META) and Google’s (GOOG) other digital services. So customers now typically pay with several options apart from PayPal in-store, and the business has to compete on ease and price of purchase. It also needs to be agile in adjusting to the shifting customer requirements, such as the growing need for mobile payments.

One of the main risks to my bullish view on PayPal is the uncertainty about the current management’s turnaround strategy. This uncertainty has caused some banks and research agencies to be cautious and not recommend PayPal to their clients. Of course, the overall market sentiment around PayPal has improved recently, but unless the company continues to delight investors with above-consensus EPS growth rates, we’re likely to see lower valuation multiples than described in my base case scenario. This means that the upside potential could be limited from here.

Your Takeaway

Despite the obvious risks to my thesis, I think the company’s management has begun to prove in practice that PayPal’s turnaround has legs. We are seeing the efficiency of the existing customer base increase and the result is higher EPS growth than the market expected. It looks like Wall Street had written off the company’s growth potential, and management has started to prove the market wrong. So far, PayPal has been able to do so, and judging by the new products (especially crypto offerings), as well as FCF stability, I think the potential for a turnaround has yet to be realized. At the same time, the stock is still reasonably valued – I see a growth potential of 33.5% by the end of 2025, which is why I have decided to reiterate my “Buy” rating today. The rally we have seen in recent weeks could be just the beginning.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.