Summary:

- PayPal’s Q2 results show revenue growth, margin improvement, and strong net income, supporting my bullish thesis.

- It looks like PYPL now focuses less on new users and more on greater utilization by existing users.

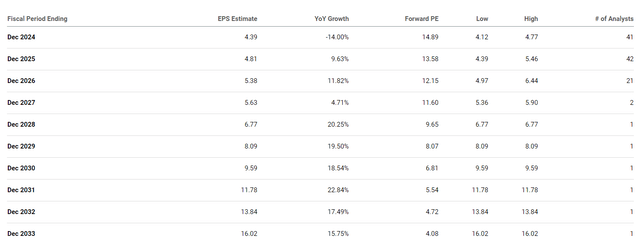

- The company’s EPS should grow at a CAGR of 10.7% over the next 6 years, while the stock is priced at 14x FY2024 earnings.

- PayPal’s medium-term recovery should keep going thanks to its current cheap valuation, potential growth drivers in emerging markets, and management’s generous shareholders’ return policy.

Stockernumber2

Thesis Update

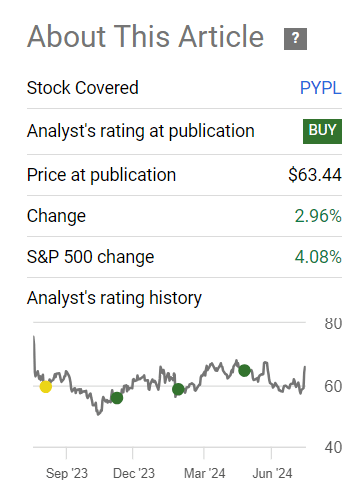

I initiated coverage of PayPal Holdings, Inc. (NASDAQ:PYPL) stock in May 2023 and have since authored 5 articles. The first 2 articles were published with a “Hold” rating but already in November 2023, I upgraded my rating to “Buy” after analyzing the company’s financials (as well as turnaround plans) at the time and observing an increase in its fair value. In my most recent bullish article on PYPL stock, I argued that the new management at PayPal was effectively executing its strategies, and the turnaround seemed to be in its early stages as the company’s financials were showing widening margins and a return to growth. I also believed that PayPal’s consistent stock buybacks would eventually lead to a supply shortage, especially as PYPL’s growth rates keep returning to more stable levels. Since that last bullish call, the stock has kept moving in its range and as a result, we saw a slight underperformance relative to the S&P 500 index (SPY) (SP500):

Seeking Alpha, my article on PYPL

Looking at the company’s latest financial data, which came out just a couple of days ago, I can conclude that my previous bullish thesis remains intact. I still believe that PayPal has a fairly good chance of recovery in the medium term due to its current cheap valuation, the potential unlocking of new growth drivers, and the shareholders’ return policy that management adheres to.

Why Do I Think So?

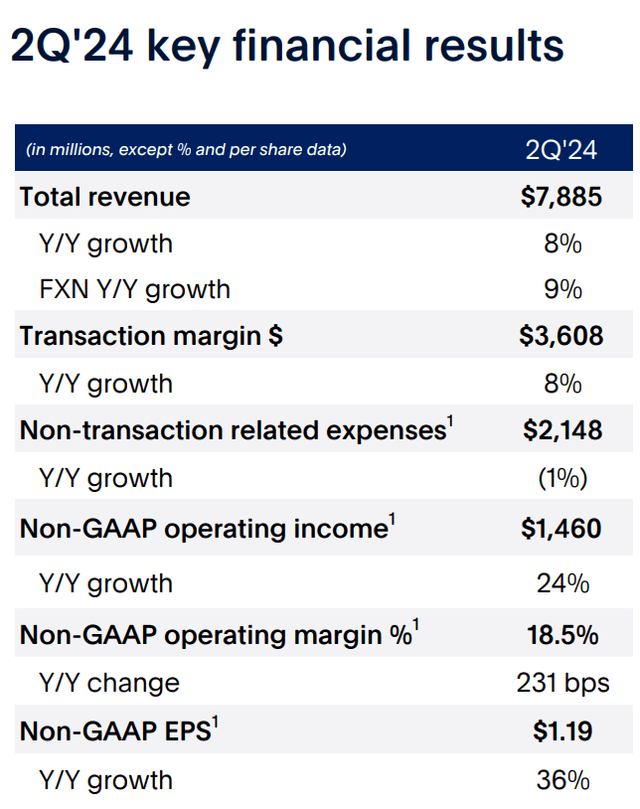

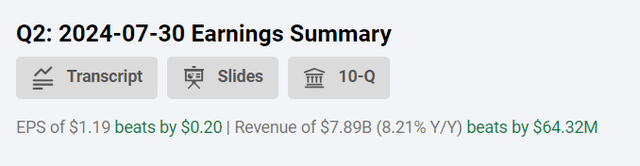

On July 30, PayPal announced its Q2 2024 financials, revealing revenue at $7.9 billion (+8.2% YoY, or about +9% adjusted for FX). Since the operating costs increased by only 6.6% YoY, the company managed to show a better EBIT margin (16.8% vs. 15.55% last year). Adjusted net income saw a significant rise of 28% to $1.2 billion, so aided by a 6% reduction in average shares outstanding, the adjusted EPS amounted to $1.19 (+36% YoY), heavily beating the consensus estimate of $0.99.

PYPL’s IR materials Seeking Alpha

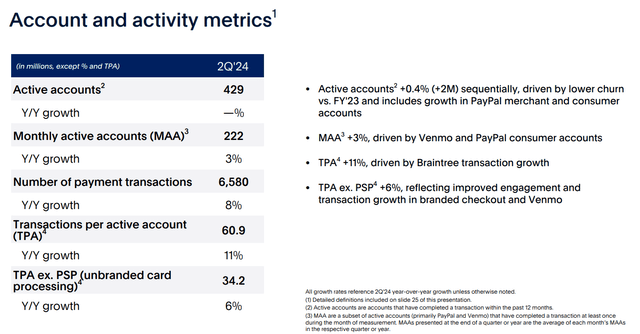

In Q2 we could see that while competition within the fintech industry has put more pressure on PayPal’s growth rates, the new management team has already done a lot to get PYPL’s active accounts back on track for growth. As of June 30, 2024, the number of active accounts amounts to 429 million, which basically looks like a flat result on a YoY basis, but anyway, PayPal gained 2 million new accounts YoY thanks to lower churn, which is good – it looks like PYPL now focuses less on new users and more on greater utilization by existing users. As is known in business practice, attracting new users is usually significantly more expensive than retaining existing ones. Given that the company has already acquired a huge audience in the past few years, I think this is the right step that should theoretically contribute to margin expansion in the medium and long term, even if the top-line growth rates are not outstanding.

In general, various unit economic metrics indicate that PayPal’s business is on the rise, with the number of transactions increased by 8%, and the number of active users has grown by 3%. Additionally, the quantity of transactions per active account (transactions per active account – “TPA”) has improved by an impressive 11%, primarily due to Braintree transactions:

Definitely, the COVID years, which forced many people to buy online more frequently and pay via PayPal, helped the company form a strong base that the new management is now actively trying to monetize. What’s good is that, as an analyst from Argus noted, PayPal has a significant advantage over other fintech companies, which are only now trying to expand their presence in various countries.

In our view, the company has several competitive advantages as it seeks to grow payment volumes. These include a strong international presence, with 100M non-U.S. users in more than 200 countries.

Going forward, I expect PayPal to keep benefiting over time from the ongoing trends that have driven growth for credit card processors, such as the increasing use of digital payments over checks and cash for convenience and security. Not all countries have been impacted by these actions en masse yet; there are still a number of developing markets in the world that are just starting to use PayPal on a more regular basis. So I anticipate further market share gains as the company leverages its platforms globally and capitalizes on its strong brand recognition and rapid growth in merchant acceptance.

Today, we operate in a massive $6 trillion plus global e-commerce market that benefits from the ongoing digitization of payments and commerce in new contexts. These tailwinds, combined with the initiatives we are now executing, such as building more omnichannel capabilities and offering more value-added services for consumers and merchants, will expand our addressable market and provide PayPal with significant opportunity for long-term growth.

Source: Q2 Earnings call, the CEO’s comments

Besides everything else, I like how the company’s financial position looks. The total amount of cash and short-term investments in current assets is approximately $18.3 billion, while long-term debt is at $12.2 billion (as of Q2 FY2024). At the same time, the company generates a substantial amount of free cash flow, which allows it to actively buy back its shares from the market. For example, based on Q2 FY2024 results, PayPal generated ~$1.37 billion in free cash flow and bought back ~24 million of its shares for $1.5 billion. This ultimately helped it show such impressive growth in net profit per share and other metrics that many analysts simply did not expect.

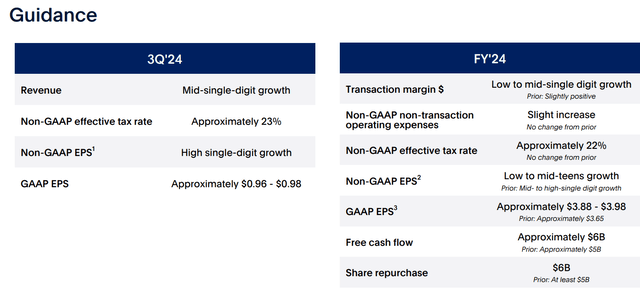

Leaning on quite strong Q2 results, PayPal’s management decided to increase the 2024 projections, indicating that adjusted EPS would rise in the low- to mid-teens (up from a prior mid- to high single-digit pace):

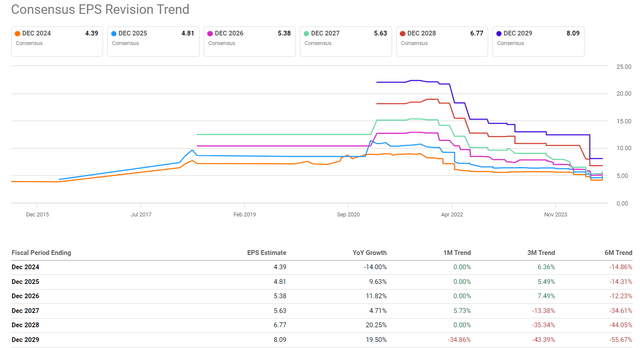

At the same time, for some reason, the market is in no hurry to adjust its EPS estimates regarding the long-term future. Yes, if we look at the projections for the next 3 years, we’ll see that over the past 3 months, they have indeed grown slightly by about 5-7.5%. But in the long term, Wall Street continues to revise its estimates downwards (FY2027-2029). On what basis the market makes these pessimistic forecasts, I don’t quite understand.

But it’s clear to me that, if we assume that the acceleration of growth and improvement in margins that we have seen in recent quarters will continue, then PayPal will most likely keep beating consensus estimates from quarter to quarter, which theoretically should give additional impetus to the growth of the stock.

After the company reported its second-quarter 2024 results, its stock began to actively recover from the lower support level of the medium-term channel (speaking “technical analysis language”). If nothing critical happens by the end of this week, then we could close with a very strong bullish candle right before one of the resistance critical levels; a breakthrough of that could easily mark the beginning of a new bullish trend, in my opinion.

TrendSpider, PYPL weekly, notes added

Now let’s talk about valuation. Even if we assume that the current consensus forecasts of EPS are correct, then according to Seeking Alpha Premium data, the company’s EPS should grow at a CAGR of 10.7% over the next 6 years. This means that the current 14.9x P/E ratio at which the stock is traded should eventually turn into 8x, assuming that after 2029, the growth rate of EPS will not decline. Actually more than that: According to the same consensus, from FY2029 through FY2033, EPS is expected to grow at a CAGR of 14.64%, which is even faster than the FY2024-2029 period. Yet, again, the stock would be traded at only 8x P/E, which seems absolutely illogical to me.

I don’t have a strict price target in mind for the next year or two, as it’s quite difficult to predict based on historical trends, which have been somewhat disrupted over the last couple of years. However, the illogicality in the current market forecasts that I highlighted above suggests that if the business trends observed in Q2 FY2024 continue in 2H FY2024 and possibly into FY2025, then, in theory, the PYPL stock could be much higher than current price levels.

Where Can I Be Wrong?

First off, I have to admit that I may have been wrong about the expected turnaround in the company’s business under the new management. Despite the insignificant tenure of the new leadership, the results in some areas may not be as remarkable as expected. Perhaps I’m wrong in granting them a longer period of time to win the market’s favor, so to speak.

In my opinion, the main risk of investing in PayPal lies in the strong competition the company faces in the payment market. Established brands such as Apple Pay, Visa’s Checkout, MasterCard’s MasterPass, and American Express’s Later Pay, as well as digital products from Meta (META) and Google (GOOG), represent major competition. Customers have several payment options available to them at the point of sale, and PayPal must compete on the basis of convenience and transaction pricing.

I also cite examples to support my argument, both from valuation and technical analysis, which are primarily subjective judgments anyway, not strict scientific rules. Therefore, I may be wrong in my conclusions on both valuation and future price action for PYPL.

The Bottom Line

Despite all the risks mentioned above, I’ve decided to give the stock a “Buy” rating again because I like the latest financial data. The company’s margins are gradually improving and the user base is not declining – in fact, it’s growing slightly. However, this is not the main driver of growth. The main driver is increasing utilization and the ability to monetize the existing huge user base, which should theoretically lead to even greater margin expansion in the medium term if management’s efforts continue. I have no data to doubt this.

I also like the valuation of the company as it trades at only 14x its 2024 earnings. The market expects the multiple to fall very sharply over the next few years. Therefore, the most important thing for PayPal now is to continue to increase net earnings per share, even if only slightly. This should be possible even if net income doesn’t increase, as the company can continue to buy back its shares with its free cash flow.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!