Summary:

- I had a ‘Neutral/Hold’ view on PayPal stock, but was able to capture +2.57% of alpha from a tactical bullish play since my update. Now, I am downgrading my stance.

- PayPal’s quality of growth continues to be weak as it fails to grow active accounts. Consumer surveys suggest loss of user share.

- Q1 FY24 gross margins saw a 100bps decline, but I expect future quarters to be worse in the absence of certain tailwinds.

- There have been a couple of notable insiders, each selling ~25% of their stake in PayPal.

- PayPal needs to grow 4x faster to match the attractiveness of NVIDIA, considering a combination of valuation and growth expectations.

chameleonseye

Performance Assessment

In my last article on PayPal (NASDAQ:PYPL), I had initially issued a ‘Neutral/Hold’ rating to reflect my expectation of performance in-line with the S&P 500 (SPY) (SPX). However, for a brief period, I changed my stance to a ‘Buy’ when the technicals showed signs of a potential V-reversal. But once the follow-through started to weaken far sooner than expected, I reverted my stance to a ‘Neutral/Hold’ again. As usual, these updates were communicated in a pinned comment in my last article. During this tactical bullish play, PayPal gained +4.33% vs the S&P 500’s +1.76%, leading to a capture of +2.57% alpha.

Thesis

I am downgrading my stance on PayPal to a ‘Sell’ as I note the following:

- Quality of growth metrics are weak

- Gross margin pressures continue and are expected to worsen

- Insider sales are ramping up

- The valuation case is not compelling vs better opportunities

- A breakdown in the relative technicals of PYPL vs. S&P 500 is likely

Quality of growth metrics is weak

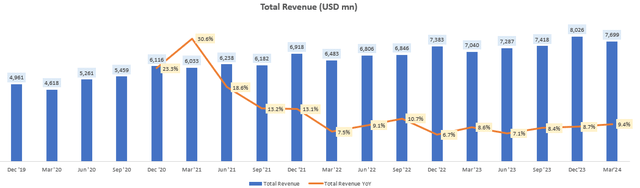

Overall revenues are growing at around 9% YoY, which I think is ok, but not too impressive given faster growing companies (more on this in the valuation section).

Total Revenue (USD mn) (Company Filings, Author’s Analysis)

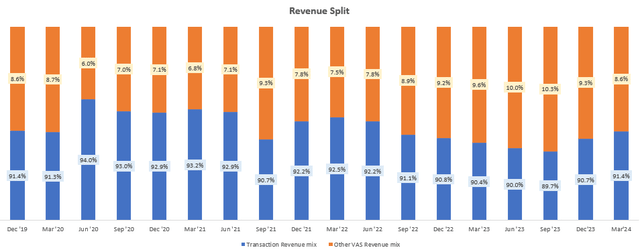

91.4% of the revenues are driven by transactions with the remaining driven by value added services such as fraud detection, tools to help merchants reduce customer churn and package tracking solutions to name a few. Over the past couple of quarters, the value added services mix has decreased slightly:

Revenue Split (Company Filings, Author’s Analysis)

It is not a big deal in light of bigger issues, but ideally, I would like to see the value-added-services mix increasing as I think that would be a good sign of PayPal’s growing ecosystem strength, leading to a better quality of revenues than the transaction and take rates combination.

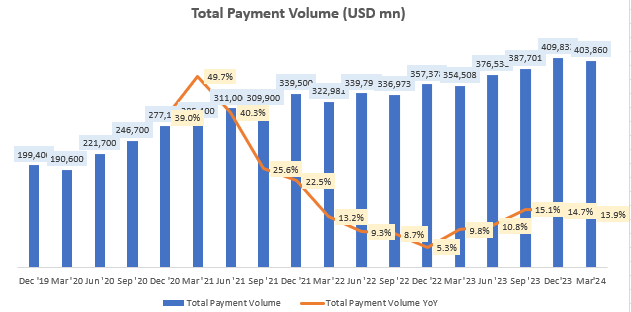

On transaction take rates, these have been broadly stable in the 1.7-1.8% ranges. Hence, the key growth driver is total payment (transaction) volume:

Total Payment Volume (USD mn) (Company Filings, Author’s Analysis)

This metric has been growing in the low-mid teens. However, digging deeper, I continue to have concerns about the quality of growth:

Total Payment Volume = Active Accounts * Average Payment Value * Number of Payment Transactions per Active Account. Let’s dig into each driver:

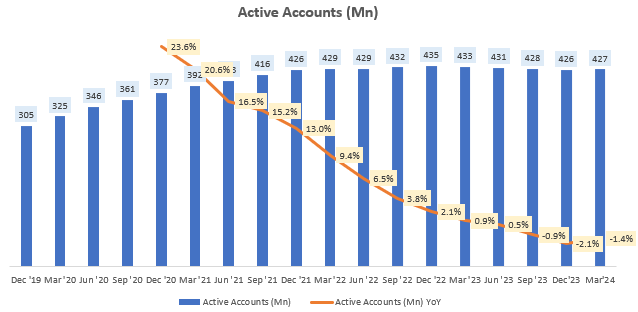

Active Accounts (Mn) (Company Filings, Author’s Analysis)

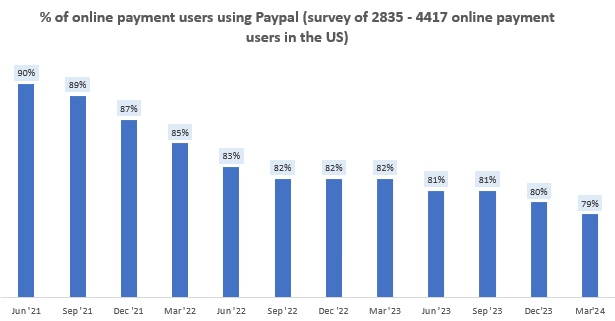

Active accounts continue to stagnate and decline. This is unfortunate because active accounts are arguably the most important growth driver not just for transaction revenues but value-added services revenues as well. A Statista Consumer Insights survey highlights PayPal’s declining user share, which may explain a slow degrowth in active accounts:

PayPal User Share (Statista Consumer Insights, Author’s Analysis)

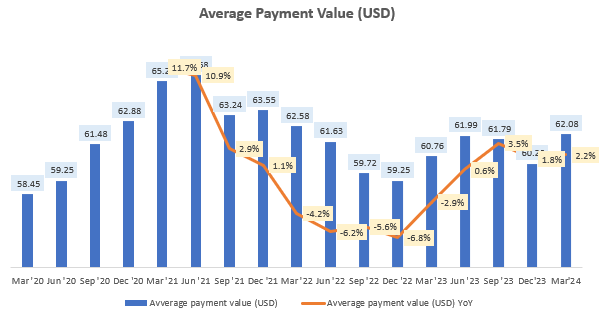

Average payment values are growing at around 2-3% YoY in USD terms, which is below US inflation levels of 3.27%:

Average Payment Value (USD) (Company Filings, Author’s Analysis)

This is another sign of stagnant growth, which would be especially pronounced in the US market that makes up 58% of overall revenues.

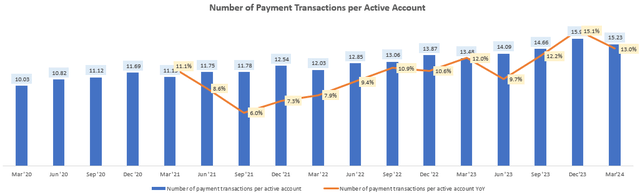

Therefore, most of the low-mid teens growth is being driven by an increasing frequency of transactions from existing active accounts:

Number of Payment Transactions per Active Account (Company Filings, Author’s Analysis)

This is a weak growth driver as the upper limit to transaction frequency per user is more easily reached than the upper limit to active accounts, for example.

Hence, I continue to believe that PayPal’s quality of growth is subpar.

Gross margin pressures continue and are expected to worsen

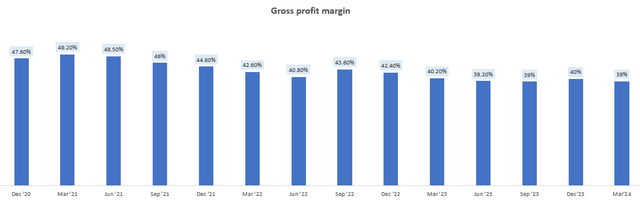

Gross profit margins have been on a steady decline in recent quarters and now sit around 39%:

Gross Profit Margin (Company Filings, Author’s Analysis)

CFO Jamie Miller commented on some of the gross margin pressures leading to a 100bps fall from Q4 FY23 levels:

Transaction take rate declined 5 basis points to 1.74% driven primarily by lower foreign exchange fees and lower gains from foreign currency hedges. In addition, mix shift to large merchants continued to impact our branded checkout take rate…

Unfortunately, there are signs that some of the tailwinds holding up gross margins such as interest on customer balances and loan loss performance are unlikely to persist for the rest of FY24:

Higher interest on customer balances, branded checkout, better transaction loss performance and lower credit losses were the largest contributors to growth… we expect that a few of these tailwinds are likely to be less meaningful as we move through the year. Specifically, we expect to see lower year-over-year benefit from interest on customer balances and lower year-over-year improvement on transaction and loan loss performance.

– CFO Jamie Miller in the Q1 FY24 earnings call

Thus, I expect gross margins to further deteriorate going ahead.

Insider sales are ramping up

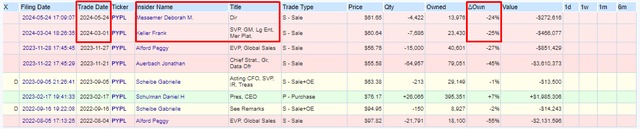

In March and April 2024, OpenInsider data shows 2 insiders; Board of Director member Deborah Messemer and Executive Vice President and General Manager of PayPal’s Large Enterprise and Merchant Platform Group Keller Frank each exited around 25% of their shares in PayPal:

PayPal Insider Sales (OpenInsider, Author’s Highlights)

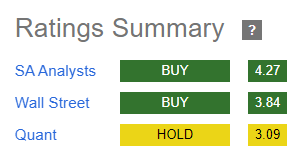

Given the large % of these exits, I perceive this to be a sign of caution, contradicting the bullish narratives of other Seeking Alpha analysts and Wall Street:

PayPal Ratings Summary (Seeking Alpha)

The valuation case is not compelling vs better opportunities

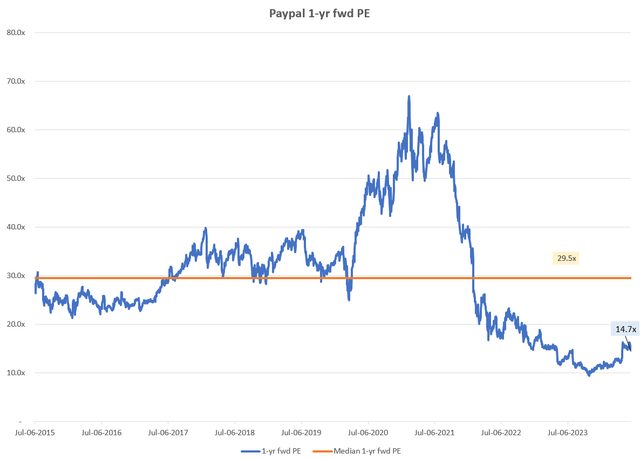

PayPal is trading at a 1-yr fwd PE of 14.7x. Clearly, this is lower than its historical median (29.5x since 2015). But I think the lower valuation is deserved due to the weak growth quality and margin pressures.

PayPal 1-yr fwd PE (Capital IQ, Author’s Analysis)

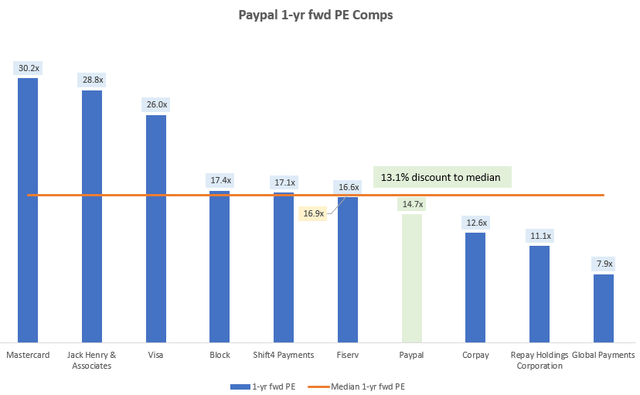

Relative to its comparables, PayPal’s 1-yr fwd PE is at a 13.1% discount to the median multiples:

PayPal 1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

Given the operational headwinds, this valuation discount is not compelling to me. However, I think in the current environment of low market breadth with stocks like NVIDIA (NVDA) contributing to a third of overall index movements, I believe it is important to consider investments from the perspective of opportunity cost and relative attractiveness across industries:

I believe investors would allocate to the opportunities with the best valuation and growth combinations regardless of industry, especially if the discrepancy is extremely wide. As Ram Ahluwalia from Lumida Wealth Management describes:

I believe we are at risk of an unusual type of correction ahead. Arguably, we are in it now. Put simply – investors are waking up to the fact that they hold stocks that are more expensive than Nvidia… but they are growing at a slower rate. So they dump that stock and buy $NVDA. That causes a narrowing of breadth.

Another way of putting it is that particularly within the technology sector, NVIDIA is the “pace-setter” in the market:

Does it make sense to over-pay up for an asset that is growing less than the pace setter? That means you should scrutinize investments that are (i) more expensive than $NVDA, and (ii) have lower growth

– Ram Ahluwahlia’s Post on X

I respect Ram Ahluwahlia’s market opinions as I believe he has demonstrated real prognostication skill. For example, he had anticipated the now-consensus risks to the SaaS sector way back in May 2023

Hopefully that explains why I believe comparing PayPal vs NVIDIA is relevant in today’s unusual context. So let’s look at the PE vs revenue growth ratios of PayPal vs NVIDIA, for which I recently wrote a bullish piece:

| Metric | PayPal | NVIDIA |

| 1-yr fwd PE | 14.7x | 54.3x |

|

Growth expectation |

51% 1-yr fwd | 31.15% over 2024 – 2025; I am handicapping NVIDIA here because the 1-yr fwd growth rate is 96.98% |

| PE/Revenue Growth | 1.96x | 1.74x |

This is a simpler variant of the PEG ratio. A PEG ratio analysis would be even more favorable for NVIDIA since PayPal’s consensus EPS implies degrowth over the next year and NVIDIA is expected to see earnings growth in excess of revenues due to margin expansion.

Thus, even when severely handicapping NVIDIA by taking a 2024-2025 YoY growth rate instead of the much higher 1-yr fwd growth rate, the PE/Revenue growth ratio of NVIDIA is 1.74; a 11% discount to PayPal.

I think this explains the relative unattractiveness of PayPal vs stocks such as NVIDIA which is seeing tremendous momentum to lead major market indices such as the S&P 500 and the Nasdaq. I anticipate this trend to continue:

A breakdown in the relative technicals of PYPL vs S&P 500 is likely

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

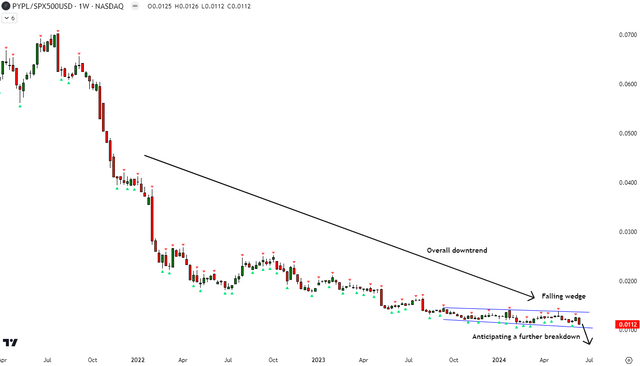

Relative Read of PYPL vs SPX500

PYPL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

PayPal vs S&P 500 has been on an overall downtrend. Since October 2023, I see a falling wedge in the ratio prices and anticipate a further breakdown below to occur soon. This would lead to continued alpha erosion of PayPal vs the S&P 500.

Key Monitorables

A rebound in the active accounts growth would improve the growth expectations of PayPal and that may lead to a better PEG comparison vs alternatives such as NVIDIA. However, I do note that this is a tough ask to match NVIDIA’s 0.56 PE/Revenue growth ratio without the handicap of taking 2024-2025’s growth rate, PayPal would need to have a 1-yr forward growth rate of 26.25%; almost quadruple its current levels.

Takeaway & Positioning

PayPal’s valuation and growth combination is very uncompetitive vs superior alternatives such as NVIDIA. To be competitive, PayPal would need to grow revenues 4x faster than what is implied by the current 1-yr fwd consensus numbers.

The quality of growth is poor as the company is unable to grow and barely maintain its number of active accounts, which correlates with surveys indicating user-share loss. Furthermore, management has indicated that gross margin pressures are likely to persist for the rest of FY24, without the benefit of tailwinds that helped curb gross margins decline in Q1 FY24.

~25% exits of stake of some insiders also do not inspire much confidence in the stock. Hence, I rate PayPal a ‘Sell’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.