Summary:

- PayPal has the potential to appreciate over 100% in 5 years with share buybacks and multiple expansions if execution is spot on.

- Positive factors include a strong brand, FCF growth, and aggressive share buybacks.

- Concerns include declining capital efficiency, competition catching up, and margin pressure.

JasonDoiy

The PayPal Investment Thesis

In my opinion, PayPal (NASDAQ:PYPL) is currently at an interesting long-term risk/reward point, as the downside is relatively well hedged and the upside has the potential to more than double the stock price in 5 years, if the share buybacks continue and the multiple returns to its former strength.

Because even with a conservative calculation and without the exorbitant multipliers of the past, it can still be a worthwhile bet.

What I like about PayPal

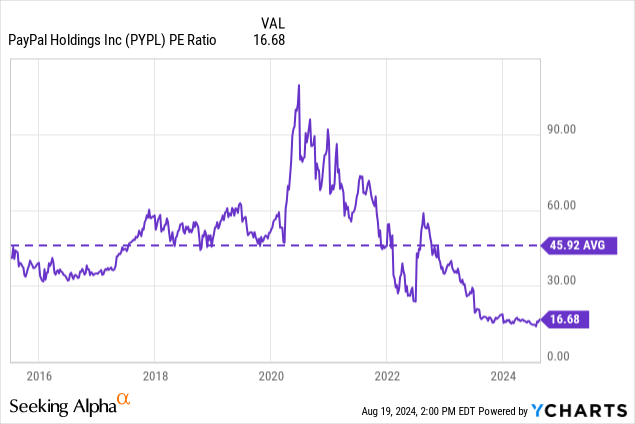

One of the main things I like about PayPal is that I think there is an opportunity for multiple expansion. If the turnaround works and sentiment changes, I think a 30x multiple is reasonable. This is primarily due to the strength of PayPal’s brand, the network effects of its large customer base, and its market share in the online payments market.

Most of the decline in the share price is due to the multiple contraction, as the EPS growth rate over the last 5 and 10 years has remained strong.

- EPS Growth Rate 5Y: 14.52%

- EPS Growth Rate 10Y: 17.28%

If the EPS growth rate remains close to 15% and the multiple rises, this would be a very rewarding long-term investment.

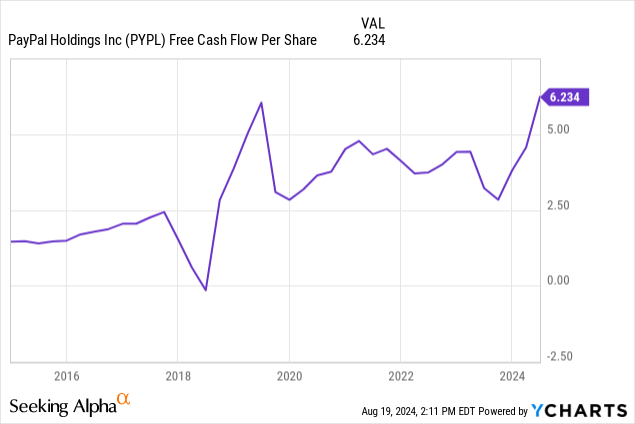

I am also very positive about the development of FCF per share and the capital allocation based on it. Even if we take into account the SBC, which in my opinion is a real cost, the development of FCF is very positive. In fact, FCF per share increased from $2.8 to $6.2 in 5 years, while SBC only increased from $1,021 million to $1,430 million. So the growth rate of FCF far exceeds that of SBC.

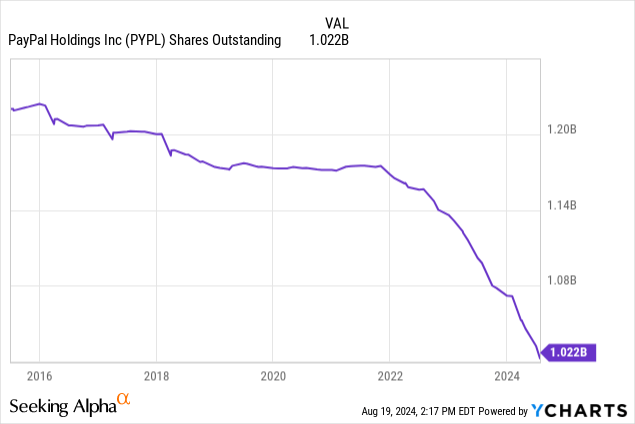

And by capital allocation in the last section, I mean that PayPal is using a portion of FCF to aggressively buy back shares, which, I think, is very positive given the current share price. These buybacks could be one of the most important drivers for PayPal’s long-term total return.

And I think the balance sheet is also healthy. The total debt of $12.9 billion, which is unfortunately up from $5.4 billion in 2019, is offset by $7.7 billion in cash and $5.9 billion in ST investments, for a total of $13.6 billion.

In addition, the EBIT/interest coverage ratio is 15x, which is higher than the S&P 500’s coverage ratio of ~10x. So PayPal’s balance sheet appears to be stronger than the average company in the world’s most important stock index.

The ratio of net income, LTM $4.4 billion, to total debt is also healthy at less than 4 times. But of course, market sentiment has affected PayPal’s share price for a reason, so we need to look at the things I don’t like as well. Before we get to the final step, the valuation.

What I currently do not like about PYPL

While the growth rates of sales, FCF and also EPS have been strong in the last 5 and 10 years, the capital efficiency has developed negatively in my opinion. In fact, since 2019, days sales outstanding have increased from 7.7 to 11.3, while days payable outstanding have decreased from 9.6 to 2.6. In other words, it’s taking longer and longer to collect sales, while PayPal’s customers want to get paid faster.

In addition, the development of active accounts, which fell from 435 million in December 2022 to 429 million TTM, shows that the competition is catching up. However on a positive note, the number of payment transactions per active account increased from 51.4 to 60.9 over the same period.

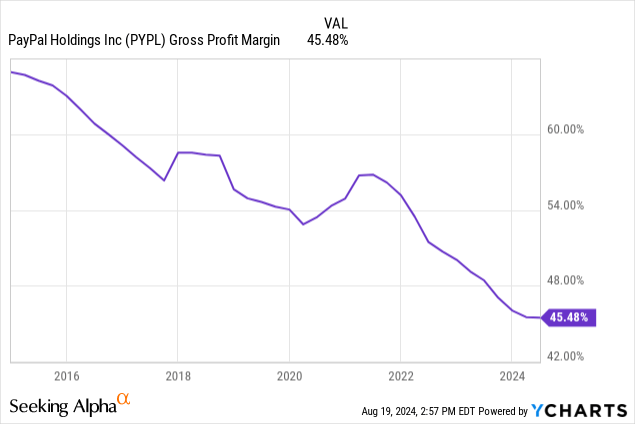

The declining take rate, partly due to the fact that the fast-growing unbranded segment with Braintree has lower margins than branded, is leading to margin pressure. Of course, this could change in the future. For example, Adyen (OTCPK:ADYEY) and Stipe, Braintree’s two main competitors, have their own payment processing, while Braintree relies on Fiserv (FI). This could be an area for improvement. And in the last earnings call, PayPal’s management already hinted that they would rather focus on higher-margin businesses than on payment volume growth.

A good Twitter / X account named Jevgenijs Kazanins also made a nice comparison between Adyen’s and Braintree’s payment volume growth, which shows that Adyen is ahead and doing very well in America. While in Q1/23 both had a growth rate of 30%, in Q2/24 Adyen is at 45% and Braintree only at 19%. I think this is an indication that Adyen is a competitor to be taken seriously.

All in all, Adyen is a very interesting company, as I pointed out a year ago when the share price had temporarily fallen sharply. This is also why I find the PayPal story interesting because sometimes the sentiment does not match the actual value of the company, which creates opportunities.

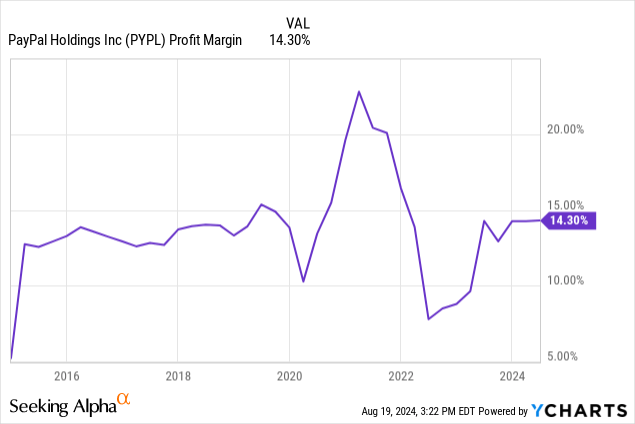

However, PayPal’s often-criticized margin and take rate development has less impact than many believe when we look at the profit margin. It has remained relatively stable over the last 10 years, suggesting that PayPal has been efficient with its costs despite a lower gross profit margin.

And in my opinion, the development of FCF and profit margin is much more important than the development of gross profit margin. At the end of the day, what matters is how much FCF is available and how it is being used, not what the gross profit margin is.

But one small criticism I would like to add is that I consider the insider ownership of only 0.21% to be low, as I would like to see the insiders own more shares and have their interests more aligned with those of the shareholders.

PayPal’s Valuation

I would like to show my bear case, a base case and a bull case that, I think, is realistic in 5 years to assess if this investment is attractive to me personally. Attractive to me means 100% upside, or in other words, close to 15% per year.

| Bear Case | Base Case | Bull Case | |

| Revenue Growth Rate | 5% | 7% | 10% |

| Revenue in 5 years | $39,6b | $43,5b | $49,9b |

| Net Income Margin | 12% | 14% | 16% |

| Net Income | $4,752b | $6,09b | $7,984 |

| Shares Outstanding | 900m | 900m | 900m |

| EPS | $5.28 | $6.77 | $8.87 |

| Multiple | 15x | 18x | 20x |

| Share Price in 5 years | $79.2 | $121.9 | $177.4 |

| Upside | 13% | 74% | 153% |

This is based on revenues of $31 billion, a current share price of $70 at the end of August 2024, and a reduction in shares outstanding to 900 million in 5 years.

And here it depends on how high the level of confidence is that PayPal will be able to get the market to see a higher multiple as appropriate again. I think it is quite likely that PayPal will reduce the number of shares outstanding and increase revenue in the next five years. But how fast is the big question. I tend to say that something between the base case and the bull case is most likely.

The secure balance sheet, which protects against the downside, as well as the growth opportunities with fast lane or in the branded and unbranded segment and the currently cheap valuation make PayPal attractive in my opinion, if one has high confidence that the market will change its mood because the multiple expansion will be the key in my opinion.

But also, higher than expected buybacks could have a positive impact on the investment. Therefore, I believe that the positive opportunities, especially due to the strong FCF, outweigh the downside and an upside of 100% or more is possible. Especially since I chose a relatively conservative reduction of the outstanding shares as well as the exit multiple in order to have an additional safety margin.

Conclusion

Due to the historically cheap valuation and the possibility of strong buybacks and multiple expansion, PayPal could generate a very strong total return over the next 5 years, ideally even exceeding my bull case. As a result, I think the current price is attractive based on a buy-and-hold approach with a holding period of 5+ years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.