Summary:

- PayPal’s stock is trading near multi-year lows despite impressive margin expansion and growth in branded and unbranded checkout volumes.

- While MAUs continued to decline sequentially, that hasn’t stopped the acceleration in revenue growth.

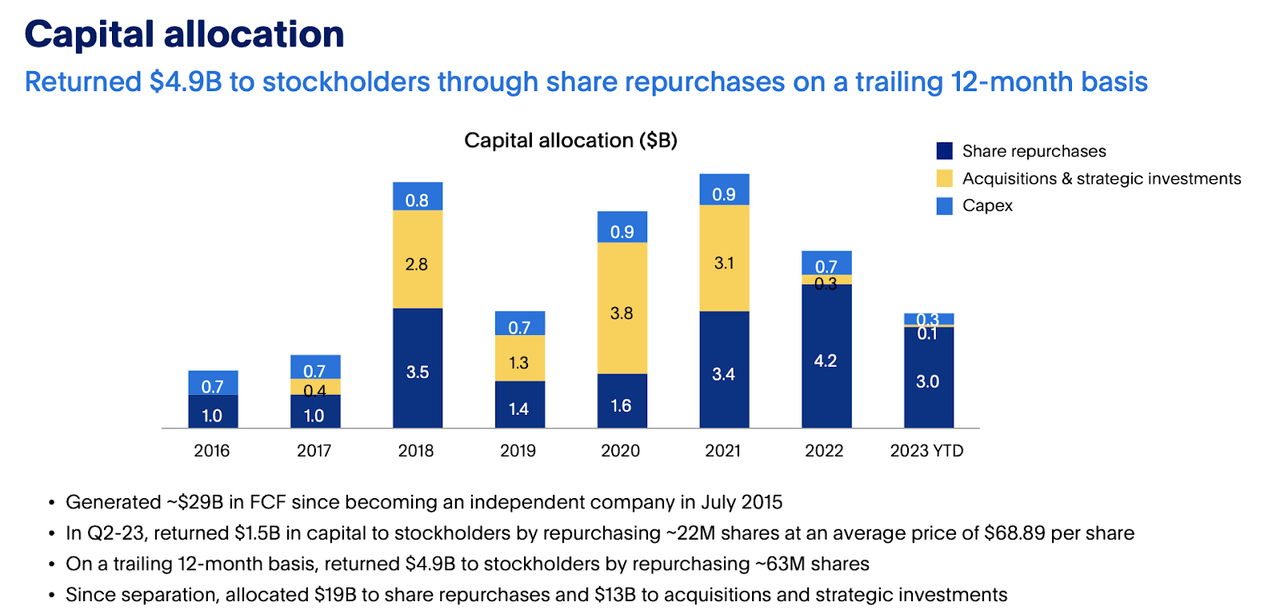

- The company has a net cash balance sheet and is aggressively repurchasing stock.

- I reiterate my strong buy rating but note the important risks.

MoMo Productions/DigitalVision via Getty Images

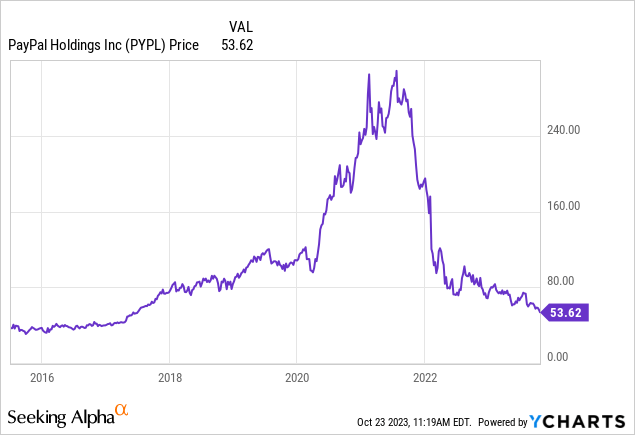

PayPal (NASDAQ:PYPL) is one of the more misunderstood stocks in the market today. As most tech stocks have recovered much of their losses, PYPL is still trading near multi-year lows. The company has seen active accounts continue to decline sequentially, apparently validating fears of rising competition. But such analysis ignores the impressive margin expansion taking place, as well as the incessant growth of its branded and unbranded checkout volumes. Management is guiding for a continued acceleration in top line growth, yet the stock is still trading at cheap valuations. The company has a net cash balance sheet and is repurchasing stock. I reiterate my strong buy rating for the stock – stay patient here.

PYPL Stock Price

PYPL is an example of why diversification is so important. PYPL looks and feels like a tech stock, but it has not traded like a tech stock over the past year.

I last covered PYPL in July where I evaluated the stock against fears of disruption from FedNow. The stock plunged after it subsequently reported earnings, but pessimism remains high here.

PYPL Stock Key Metrics

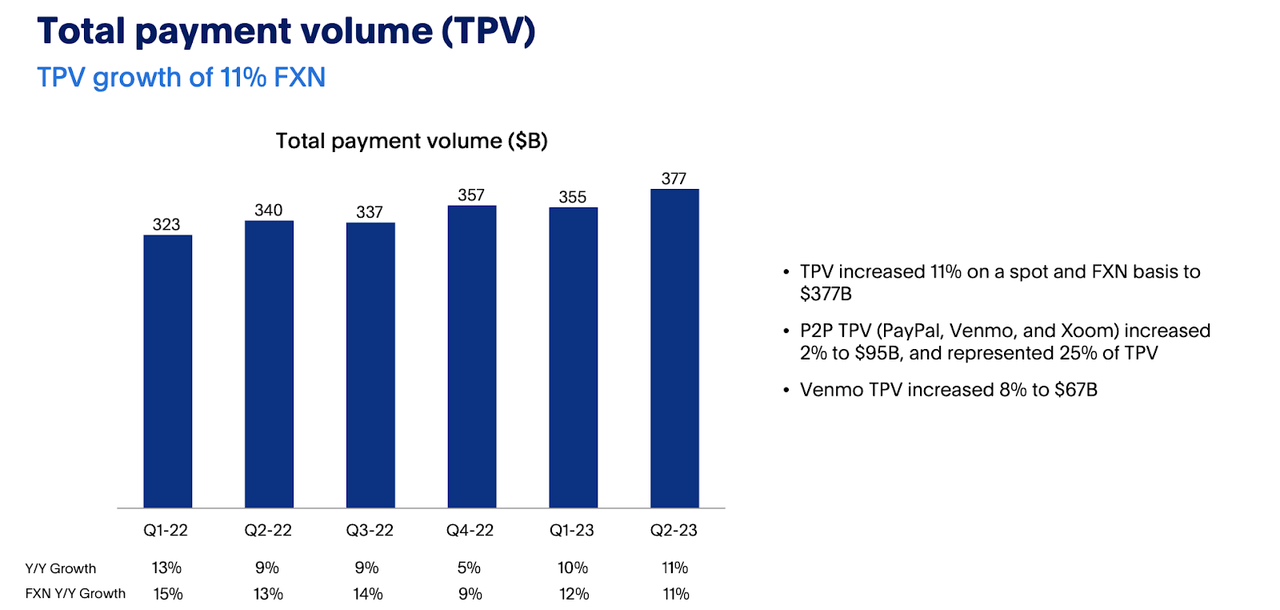

In its most recent quarter, PYPL delivered 11% YOY growth in total payment volume (‘TPV’) (11% on a constant currency basis). Some may know PYPL mainly for its peer-to-peer (‘P2P’) cash transfer services, but those grew by only 2% in the quarter. Branded and unbranded (Braintree) helped to offset those slow growth rates.

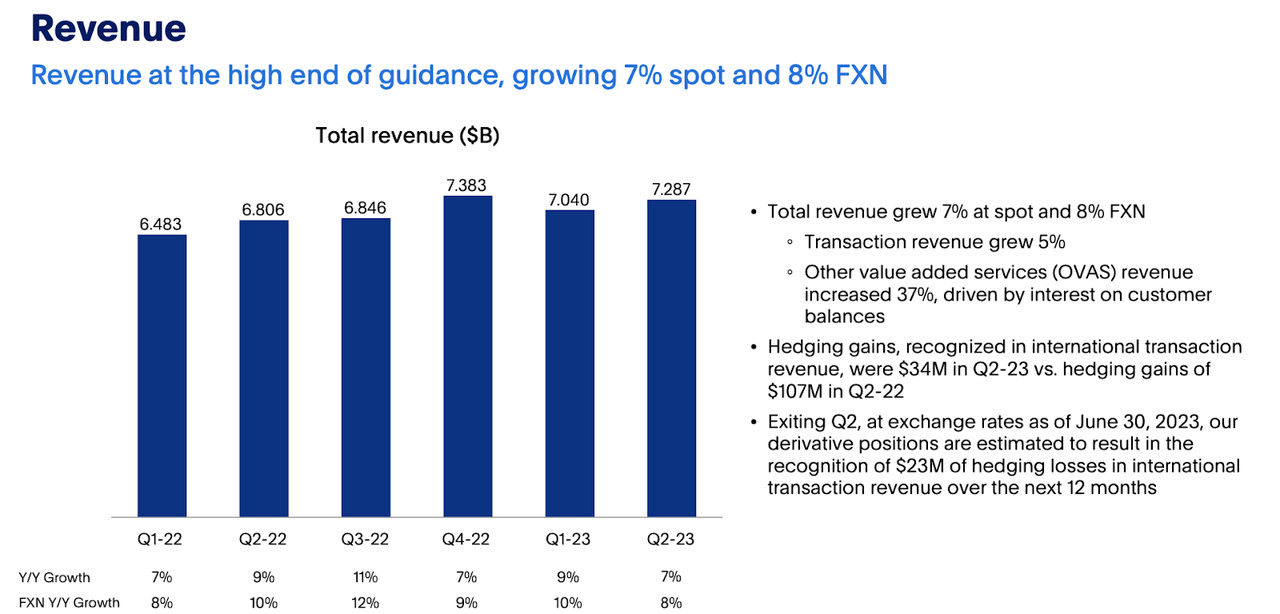

PYPL delivered 7% YOY revenue growth (8% constant currency), coming at the high end of guidance. Much of the growth was driven not by an improving macro but instead by higher interest income on customer balances.

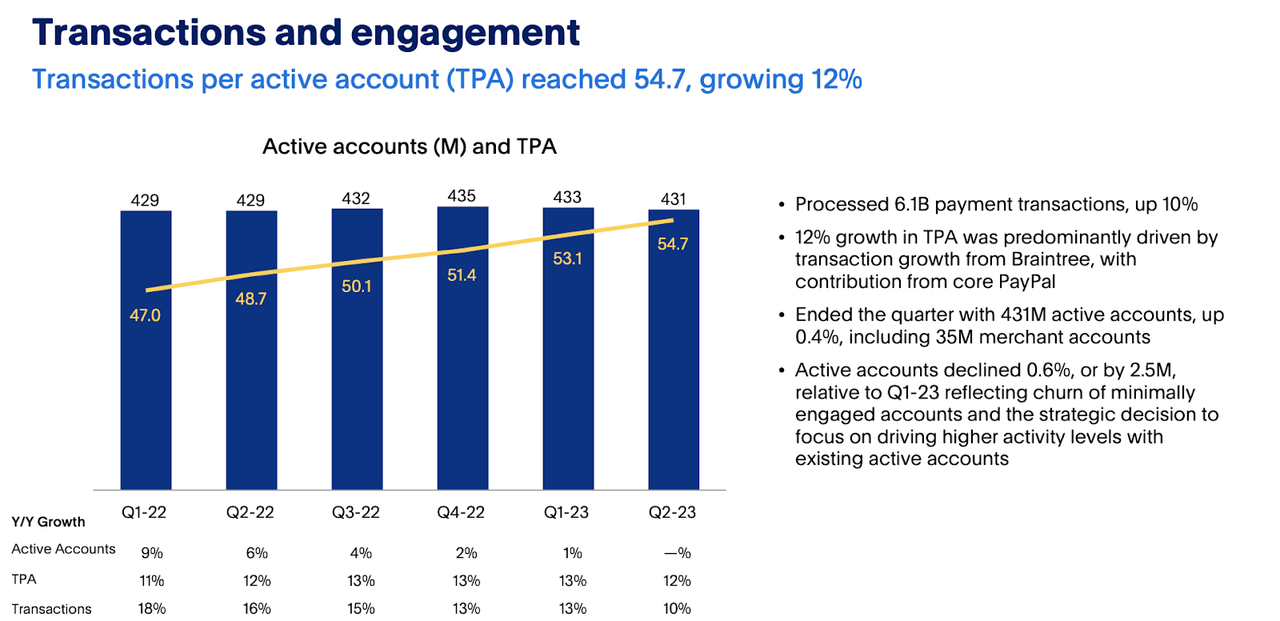

The stock’s slide post-earnings may be due to the second straight quarter of sequential decline in active accounts. The company noted that this mainly reflected “churn of minimally engaged accounts” but there might not be a reprieve until such churn runs its course. PYPL nonetheless still saw solid gains in transactions per active account.

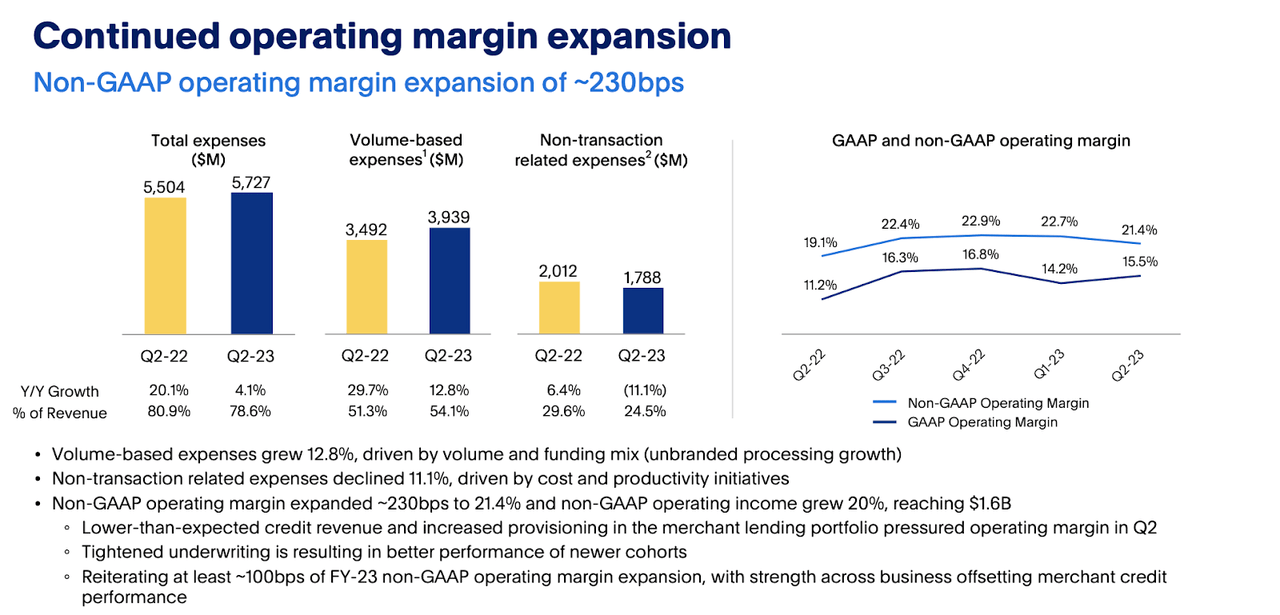

PYPL delivered yet another quarter of solid margin expansion, with non-GAAP operating margins expanding 230 bps to 21.4%. The main driver of the margin expansion was a lower fixed-cost expense structure. Management continues to expect at least 100 bps of non-GAAP operating margin expansion for the full year.

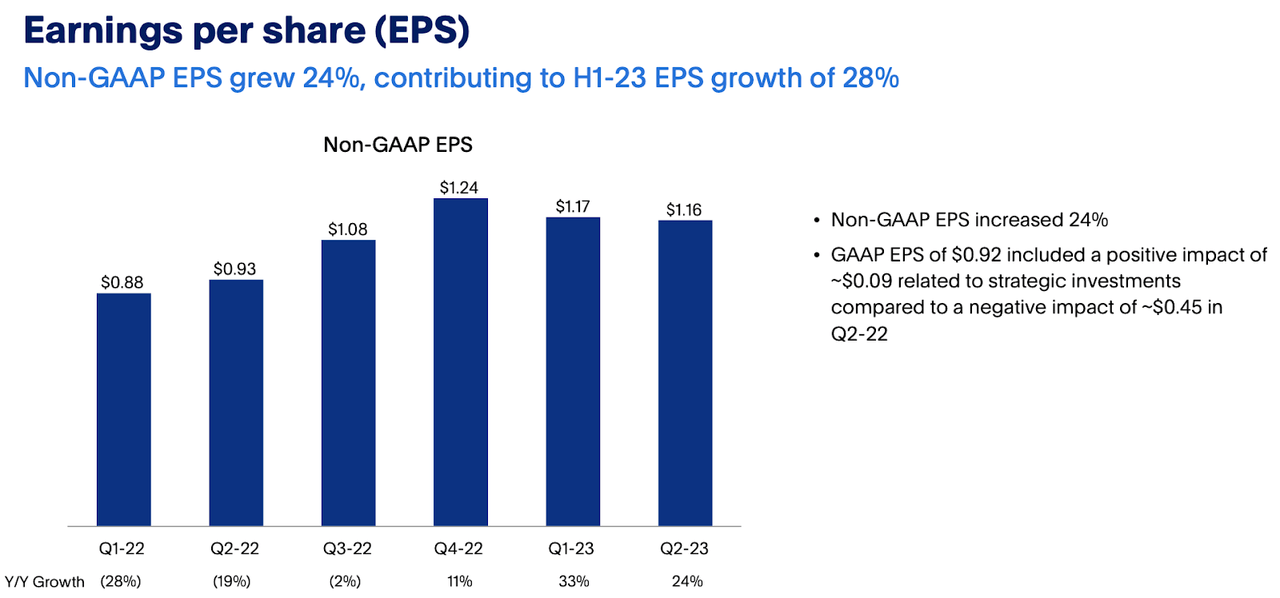

PYPL delivered $1.15 in non-GAAP earnings per share, at the low end of guidance. That still represented a remarkable 24% YOY growth rate.

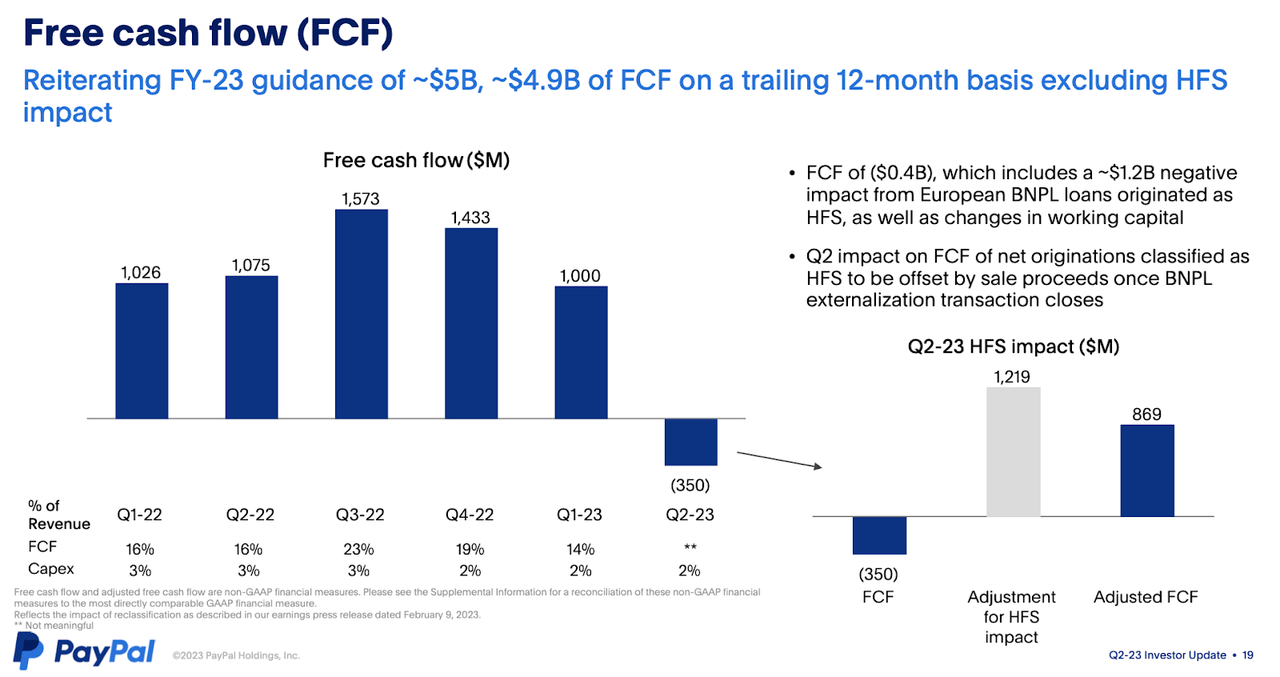

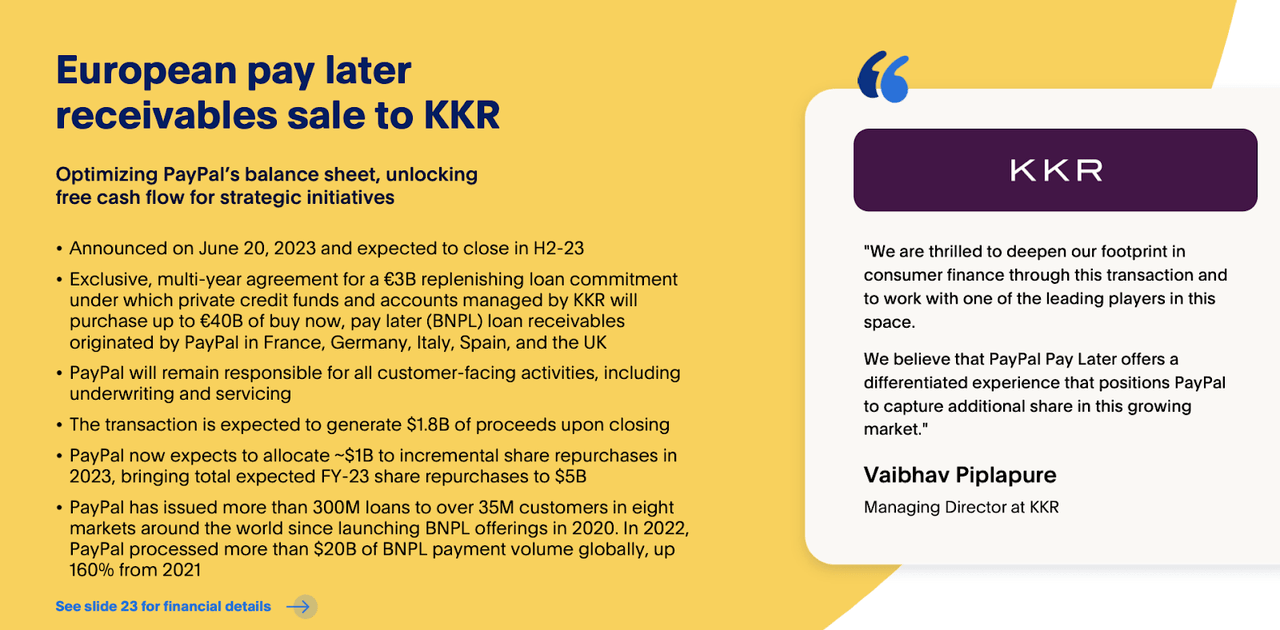

PYPL saw free cash flow turn negative in the quarter, but that was mainly due to it holding on to much of its originated European BNPL loans.

That impact is expected to be offset once its transaction to sell BNPL loans to KKR closes. I don’t see issues with free cash flow conversion here given that PYPL is a true digital-first fintech operator with minimal capital expenditure requirements.

PYPL continued to prefer share repurchases as its means to return cash to shareholders, repurchasing $1.5 billion of stock in the quarter. I expect the company to continue on this path as long as the stock remains this cheap.

PYPL ended the quarter with $14.4 billion of cash and investments versus $10.5 billion in long-term debt, representing a strong net cash balance sheet.

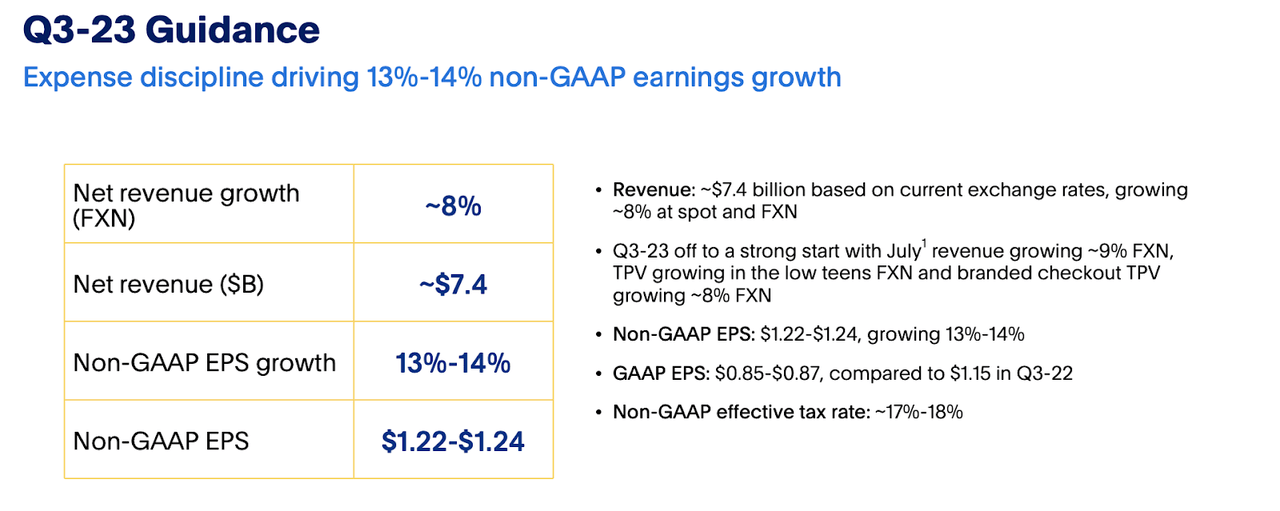

Looking forward, management is guiding for 8% constant currency revenue growth and up to $1.24 in non-GAAP EPS In the third quarter. There may be some upside to those targets given that July revenue was noted as growing 9% on a constant currency basis.

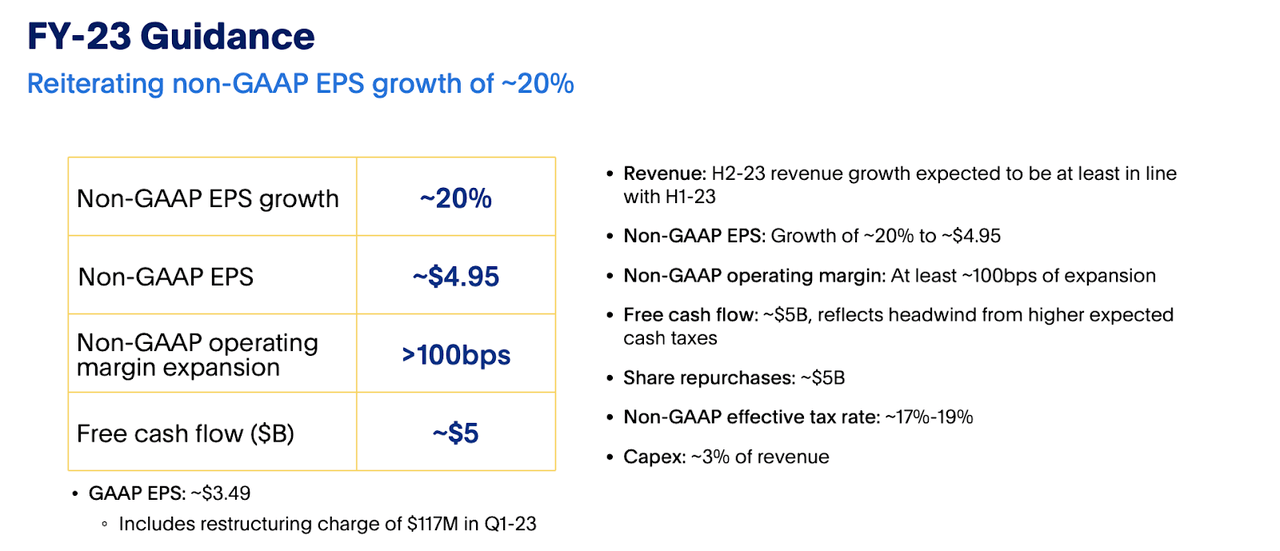

For the full year, management reiterated expectations for 20% non-GAAP EPS growth to $4.95, representing 100 bps of margin expansion YOY.

On the conference call, management noted observations that “e-commerce growth appears to have stabilized in the mid-single digits, substantially above our estimates when we entered 2023.” While Braintree’s unbranded checkout volumes continue to lead the way, management noted that even their branded checkout volumes saw a solid recovery, with growth rates accelerating to 6.5% in June and further to over 8% in July. Management expects branded checkout volumes to continue to accelerate throughout the rest of the year, culminating in an acceleration to “low double-digit growth by Q4.”

Management did note “some deterioration in our business loans portfolio” but the impact is expected to be contained given that it represents less than 15% of their overall credit portfolio. Management noted that it could be a beneficiary of AI, though that clearly has not led to an AI rally. Management noted that many of their developers have been using AI tools and have seen a “20% to 40% increase in engineering productivity.”

I should note that subsequent to the end of the quarter, PYPL named Alex Chriss as the successor to CEO Dan Shulman. I do not anticipate the transition to lead to any change in capital allocation, given that the low stock price more or less dictates a near-term investment strategy.

Is PYPL Stock A Buy, Sell, or Hold?

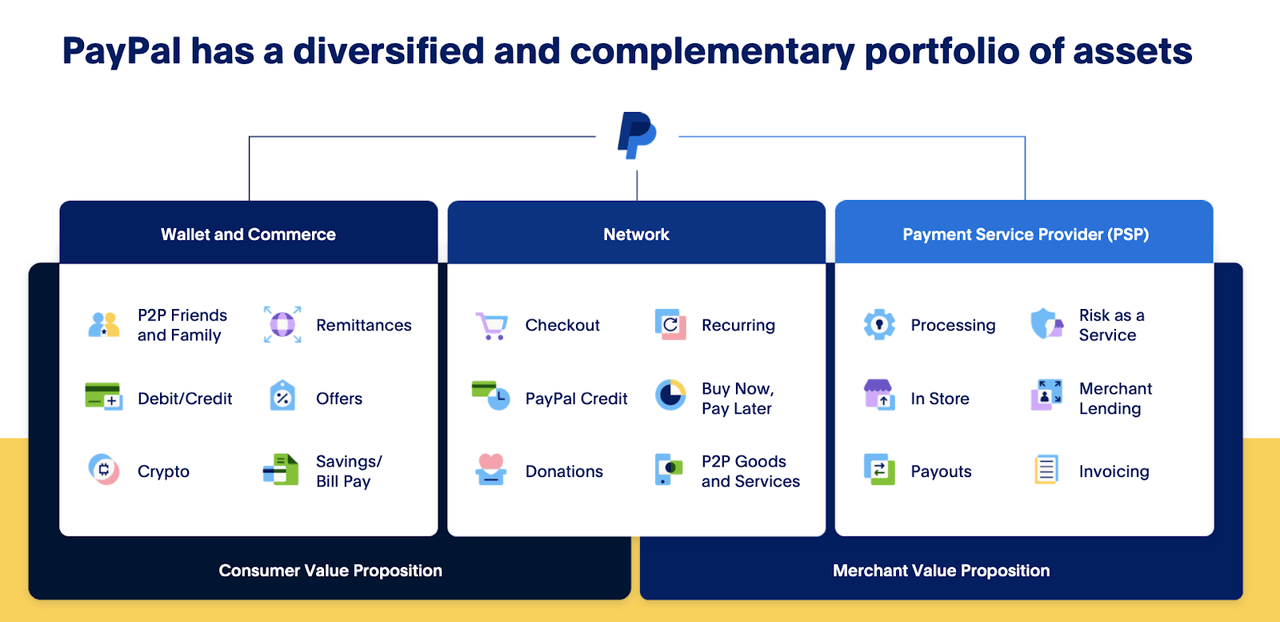

PYPL offers a wide portfolio of financial services catering to both consumers and merchants. My personal view, however, is that the growth thesis for PYPL mainly lies in its ability to drive greater adoption of e-commerce through branded and unbranded services.

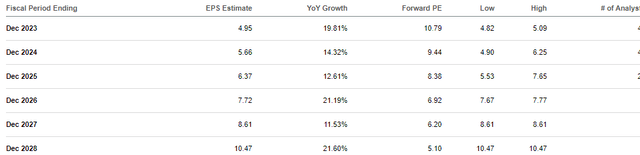

As of recent prices, PYPL traded at just under 11x earnings with operating leverage expected to stay center stage over the next decade.

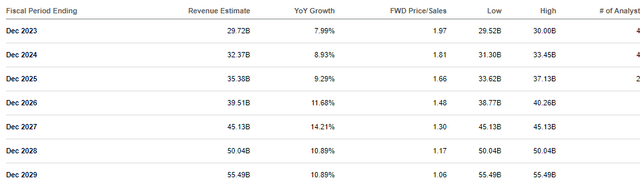

Consensus estimates call for an eventual return to around 9% top line growth with resilient growth over the next decade.

Between competition from Apple Pay (AAPL) and other global payment giants like Adyen (OTCPK:ADYEY), there are plenty of reasons to remain cautious about the potential for multiple expansions. But the fact remains that this is a stock trading at less than a 1x PEG ratio in spite of a net cash balance sheet, high free cash flow generation, and a committed share repurchase program. At even just 15x earnings, PYPL would be offering substantial upside on top of strong forward growth.

What are the key risks? It is possible that PYPL is already in secular decline, facing intense competition. I am of the view that the company can offset any potential decline through further monetizing its P2P transaction user base, as well as ongoing operating leverage, but the secular decline may prove more extreme than expected. It is possible that the competition intensifies in terms of price, with PYPL eventually needing to offer consumer rewards or lower its take rates in the process. The stock price does appear to be pricing in such risks. Investors should closely monitor for weaknesses in MAUs and revenue as those are likely to be the areas where warnings might appear. PYPL’s net cash balance sheet and share repurchase program offer some downside protection, but may ultimately prove insufficient to prevent an implosion in the stock price if competition intensifies.

For now, it looks like PYPL is enjoying solid growth in its unbranded checkout volume while doing all the right things in terms of cost rationalization and capital allocation. I reiterate my strong buy rating due to the attractive setup but caution that due to the competition risk, this is a position that requires close monitoring.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, ADYEY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!