Summary:

- PayPal reported strong Q1’24 earnings, beating estimates and showing healthy total payment volume and revenue growth.

- The company’s new CEO, Alex Chriss, is implementing new business strategies and building a new C-Suite to turn PayPal into a more focused and profitable company.

- Positive indicators of future growth include increased gross margin, expanded operating margins, and positive momentum in active accounts and revenue-driving metrics.

serg3d

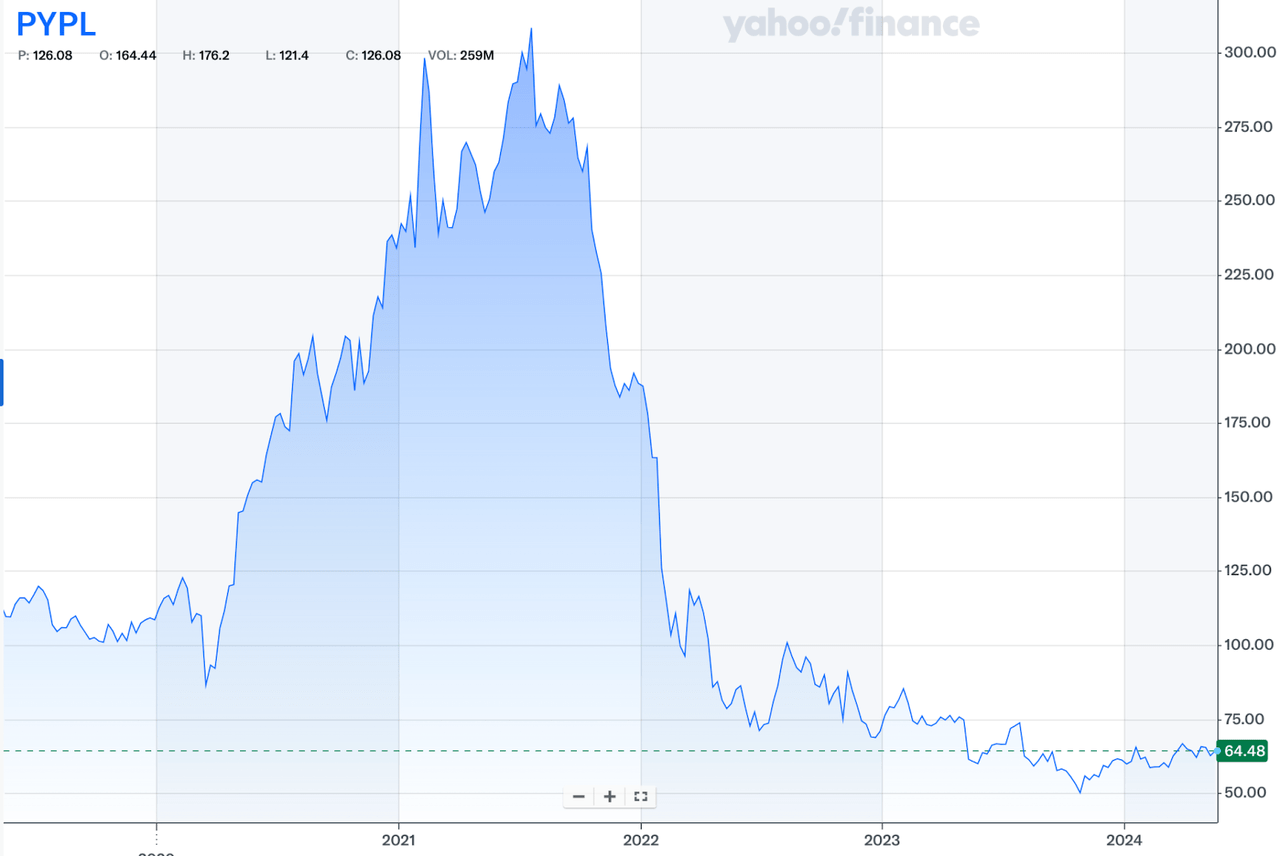

PayPal (NASDAQ: NASDAQ:PYPL) reported Q1’24 earnings on April 30th and beat estimates. However, the stock price still trended down and is trading below its April 30th per-share price of $67.92. I still believe PayPal is still in a strong position to meet healthy returns in FY24. By building his own C-Suite, PayPal’s earnings reflect Alex Chriss’ intentions to turn PayPal into a more focused and profitable company, and I view their Q1’24 earnings to be the start of PayPal’s turnaround strategy. Key financial metrics indicate healthy total payment volume, Q/Q revenue growth, and reflect resilient consumer spending. Additionally, PayPal has demonstrated higher operating leverage due to expanding operating margins, tying directly into PayPal’s FY24e shareholder wealth creation and future value, prompting my Strong Buy rating.

Past Coverage

I covered PayPal in mid-March of 2024, where I discussed PayPal’s turnaround strategy led by their new CEO Alex Chriss, a favorable interest rate environment, and PayPal’s acquisition of Paidy. My previous buy rating coincided with an intrinsic value and target share price of $104 per share. At the time of my prior valuation, PayPal was trading at $65.05 per share. Within the last few months, the stock’s price showed signs of resistance in the $67.00 area and support around the $62.50 area. With the company’s recent earnings report, I am writing to review my opinion on PayPal’s future value.

What Happened?

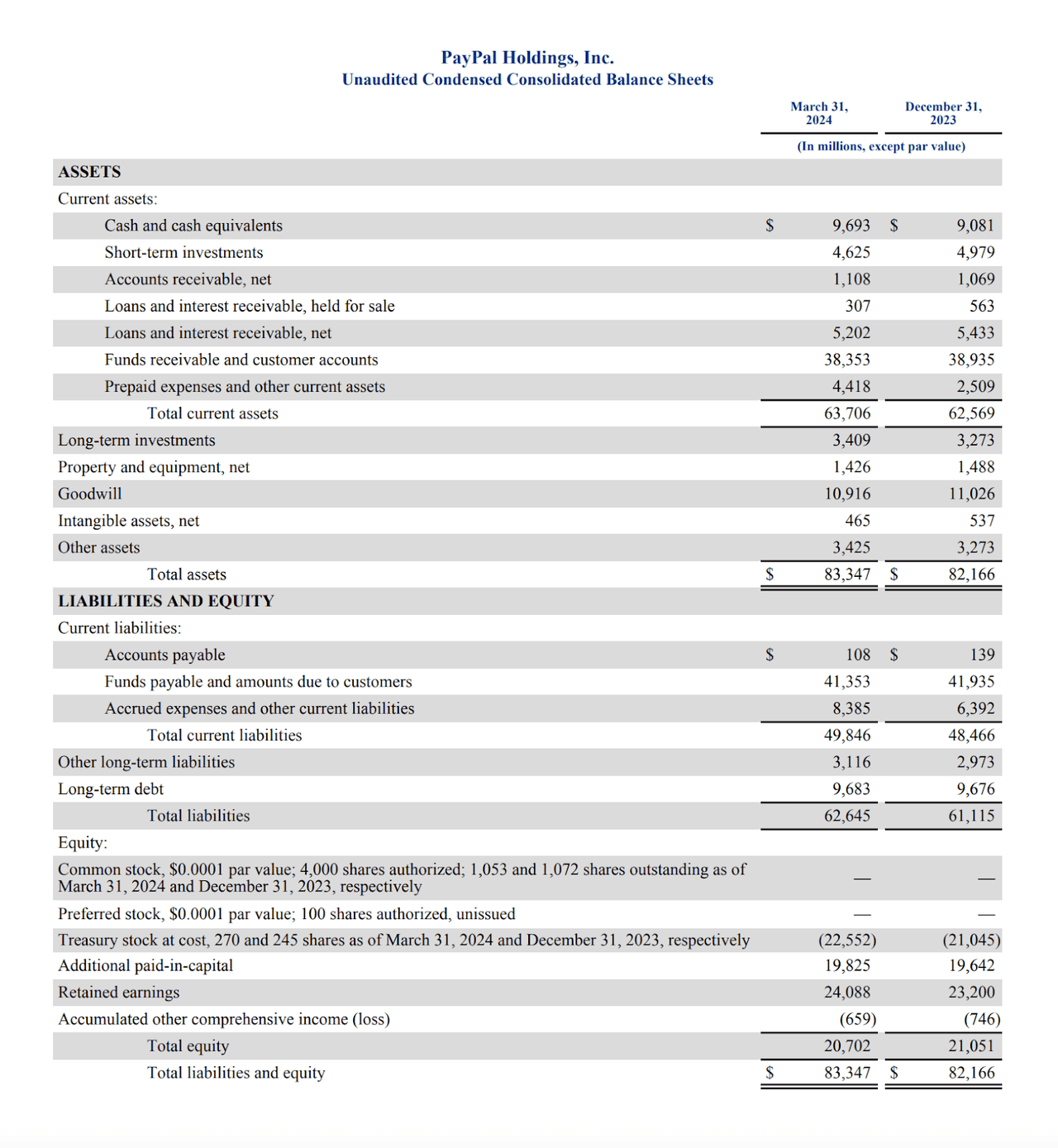

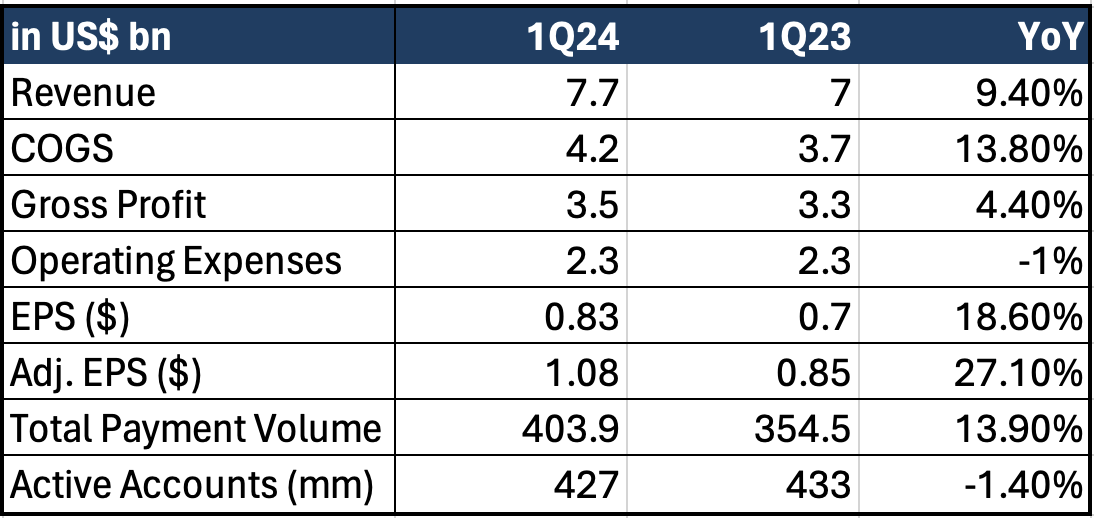

PayPal’s earnings Q1 2024 earnings release met expectations as it made up 23.94% of my FY24e forecasts. Revenue growth increased by 9% and aided in beating prior guidance of a mid-single-digit profit increase. EPS, under PayPal’s new non-GAAP methodology which now factors in stock-based compensation and employer payroll taxes, increased 27% to $1.08 vs. $.85 in Q1’23, while, with respect to the previous non-GAAP methodology, the company’s EPS would have increased 20% to $1.40 from $1.17 in Q1’23.

PayPal’s forward guidance for Q2’24 and FY’24 indicates non-GAAP EPS growth to be low double-digit growth and mid to high single-digit growth, respectively. This guidance aligns with my expectations, and the share price also climbed alongside the publication of PayPal’s Q1’24 results. Following my FY24e projections, I believe PayPal will reach my expectations through its turnaround strategy.

The newly appointed CEO, Alex Chriss, indicates implementation of new business strategies to fine-tune products and increase revenues. Alongside new initiatives, Chriss recently built out a new C-Suite. Isabel Cruz was appointed chief people officer. Michelle Gill is now serving as vice president of PayPal’s small business and financial services unit, tasked with product and service creation for small businesses. Diego Scotti was appointed as the executive vice president of PayPal’s consumer group, global marketing, and communications organization, a newly developed department helping with customer connection. And, Jamie Miller was appointed Chief Financial Officer.

PYPL’s Recent Performance

Further analyzing PayPal’s earnings report, there are many positive indications of future growth. Their gross margin in Q1’24 was 45% versus 47% in Q1’23. Their operating margins expanded by 1% YoY due to their ability to decrease their variable costs as sales increased. Variables costs such as general and administrative costs fell 8.48% to $464mm in Q1’24. Sales and marketing operating expenses fell 3.44% to $421mm in Q1’24. I expect these trends to remain steady or experience a slight margin contraction as PayPal’s turnaround strategy consists of reinvesting cashflows to improve existing business units and bring more value to customers.

Q1 2024 Earnings Report

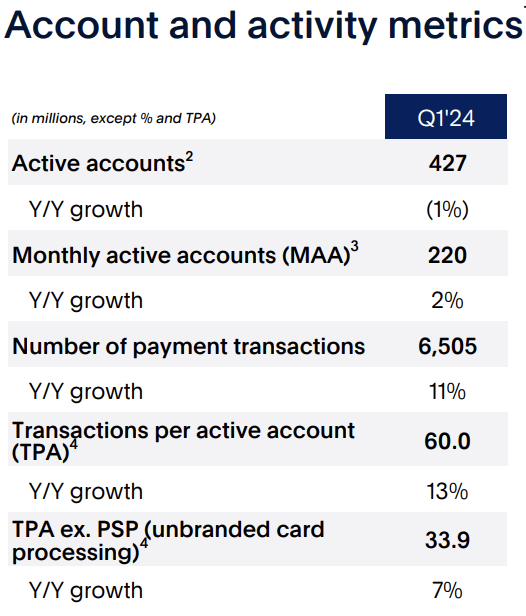

Alongside the positive notions of growth, I would like to point out PayPal’s total payment volume increased 13.9% from $354.5mm in Q1’23 to 403.9mm in Q1’24. This 13.9% growth shows signs of momentum as the total payment volume in Q1’23 YoY was 10%. This growth was also supported by active accounts, monthly active accounts, number of payment transactions, and transactions per active account.

Q1 2024 Investor Presentation

The positive indications of total payment volume are further supported by the momentum seen in PayPal’s account and activity metrics. The momentum seen in Q1’24 reveals a decrease of 1% YoY in active accounts, but this is .4% less than the previous year. The lower percentage decrease of active accounts YoY indicates lower customer churn, which signifies a trend toward growth.

The positive signals, given from active accounts, are also shared within their other account and activity metrics. Not only did active accounts signify a positive outlook, but almost every revenue-driving metric in Q1’24 showed signs of strength. Monthly active accounts, for example, increased by 2%, while both the number of payment transactions and the number of transactions per active account rose by 11% and 13%, respectively. These metrics, in my opinion, are core drivers of revenue, customer satisfaction, and higher use cases of PayPal. Even though PayPal experienced 1% lower active accounts, I believe the quality of the customer is increasing as the number of payment transactions and activity increased significantly.

Is PayPal a Good Investment?

In my opinion, Q1’24 earnings were strong and indicate PayPal’s future value to be solidified in its ability to continue improving operational efficiencies and increasing value to customers. This report touched on PayPal’s Q1’24 strong revenue growth of 9%, 27% increase in EPS, stronger margins, and growth in core revenue drivers. These metrics are in line with expectations, specifically targeting my valuation, as Q1’24 revenues made up 23.94% of FY24e.

I believe my FY24e valuation can be met, as PayPal also retains a strong balance sheet. Their balance sheet directs me to believe their turnaround strategy will be implemented with rigor, but safely. For example, their cash flows and assets have increased more than their liabilities YoY. Their cash balance increased by 6.74% YoY from $9.1bn in Q1’23 to $9.7bn in Q1’24. Their current and long-term assets further increased by 1.44% in the same period. On the contrary, their long-term debt increased by 0.07% and their overall current and long-term liabilities increased by 2.50% in the same period.

I believe the company’s ability to reinvest in its business, due to their financial positioning, will benefit PayPal as it undergoes its turnaround strategy. By Siloing these customers into three different business units (consumer, small business, and large enterprise), PayPal will be able to leverage its data and innovation to tailor a product offering specific to the needs of different customers. To implement this consumer oriented business model, Chriss also hired four new executives. With their years of expertise, these executives have taken charge of the key business units and will aid in developing PayPal’s consumer-oriented model.

Before joining PayPal, Cruz was the people leader for Walmart’s (NYSE: WMT) global technology, services, and corporate teams. Through this role, she led strategies that promoted talent and human capital, for over 30,000 associates globally and worked with their U.S. e-commerce business. I believe that Cruz was chosen to lead PayPal’s human resources due to her experience in attracting, retaining, and developing talent. I see Cruz as a figure who can redefine PayPal’s talent and mold it into one that is more consumer-oriented, inherently impacting product development as well. One example is CashPass, which provides users with personalized cashback offers through the use of AI and is furthered by 3% cash back offered by PayPal on online purchases; each attribute is geared toward the consumer.

Gill was previously the senior vice president at Intuit (NASDAQ: INTU) overseeing their QuickBooks money platform software company. Prior to Intuit, Gill served as the CFO and then EVP of Sofi’s consumer lending and capital markets. At Sofi, she managed their products and streamlined their engineering and product development, restructured the firm’s balance sheet to diversify its capital structure, merged its lending business under one company, and succeeded in her growth strategy in unfavorable regulatory conditions. As Gill has success in the fintech sector, her skills can be leveraged to help PayPal implement its new consumer-oriented business strategy. She will lead the development of value propositions, geared towards small business owners, by harnessing PayPal’s existing ecosystem and capabilities.

Scotti came from Verizon (NYSE: VZ), where he served as the EVP and Chief Marketing Officer. Previously, Scotti held experience as J.Crew’s Chief Marketing Officer and also held experience at American Express (NYSE: AXP). His leadership, at Verizon, led to the development of their brand, reputation, and all things related to the consumer experience. Therefore, I view Scotti to be a seasoned professional that understands the initiatives required to create a consumer oriented value proposition.

Miller most recently came from EY, where she served as their Global CFO, and also retains years of business executive experience. She has a strong track record in returning positive financial results after instilling financial and operational reform. Her strategies have successfully led companies through challenges and transformed them while focusing on a value proposition that emphasizes consumer-centricity and company growth. Therefore, I believe that Miller’s position, as PayPal’s CFO will yield positive results and help drive growth and profitability.

I believe the development of the new business units and added executives will only help PayPal achieve its goal. The executives have shown robust experience and the ability to implement strategies that are consumer-centric. I believe these shared experiences will help PayPal remain focused on the customer and continue to build its payment platform with an emphasis on the consumer. This may be the aspect that allows PayPal to hone in on a differentiated consumer experience and I view this to be a strong reason to invest in their future value.

Management Change Fails

As the company experienced stagnant growth and increasing competition, International Business Machines Corporation (NYSE: IBM), a hardware and information management software provider experienced several leadership changes. One example is Arvind Krishna who replaced Ginni Rometty as CEO in 2020. This was the company’s attempt to center its efforts toward industries like cloud computing and AI. But, IBM’s growth continues to be meager, increasing revenues by just 2% last year as it faces threats from other tech leaders like Amazon AWS and Microsoft Azure. I see this similar to PayPal’s situation with the company facing slowing user growth, and, in an attempt to revitalize its business, has appointed new leadership as discussed above.

However, PayPal’s situation differentiates in several ways. First, PayPal is half the size with a market cap of just under $70 billion compared to IBM’s $150 billion market cap, which allows the company to be more versatile in its approach. Second, PayPal has a clear-cut strategy that is already at play and working by focusing on the consumer, cutting down cash-burning projects, and expanding into international markets as discussed in my previous coverage of the company. Lastly, unlike IBM which has a highly segmented revenue breakup creating difficulty in strategic growth initiatives as competition emerges from all angles, 92% of PayPal’s revenue comes from transaction revenue, allowing them to distinctly target aspects of its business model and pivot on that one segment to facilitate growth. For example, PayPal is currently pushing projects such as Fastlane, Smart Receipts, and CashPass, targeting transaction revenues, resulting in total payment volume increasing by 13.9% YoY.

Takeaways

Overall, I believe PayPal’s management change with Alex Chriss at the helm will reignite the company’s growth in its core product segment and boost longevity, sustainability, and future value. The company’s Q1’24 earnings report shows that management’s changes are having a significantly positive impact, with momentum already being realized as monthly active account and total payment volume both increased. These factors all strengthen my bullish case and Strong Buy rating with a price target of $104. In the company’s next quarterly report, I’ll be looking out for these bullish signs and this sense of momentum as PayPal attempts to harness its user growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.