Summary:

- We forecast that PayPal Holdings, Inc.’s stock price will appreciate over 180% in the next 2 years from $73 to our price target of $205.

- Fintech global market revenues projected to grow 6x from $245B to $1.5T by 2030.

- PayPal’s current valuation with driving factors such as Acquisitions, Stock Repurchase, and 27% CAGR TPV growth indicate the possibility for long-term compound growth.

- PayPal is a cost-efficient choice for fintech sector exposure compared to competitors.

hapabapa

Introduction

In our previous article we discussed the anticipation of a Fed Funds Rate cuts totally 220 bps by December of 2025. Historically, growth companies in the Technology sector outperform the other sectors during a period of low interest rates. We believe that Fintech has a strong opportunity for long-term growth. In this article, we explain why PayPal Holdings, Inc. is the leader in the Fintech industry and why we see it as undervalued.

Company

PayPal Holdings, Inc. (NASDAQ:PYPL) is a digital payments company. They utilize advancements in technology to enhance the convenience, affordability, and security of financial services and commerce.

Investment Thesis

Fintech firm PayPal Holdings, Inc. is undervalued and positioned for long-term exponential growth. They have solid fundamentals from their Total Payments Volume (TPV), which is 92% of their total revenues. We expect PayPal’s stock to rise from ~$73 to $205 within a span of 2 years.

FinTech Market

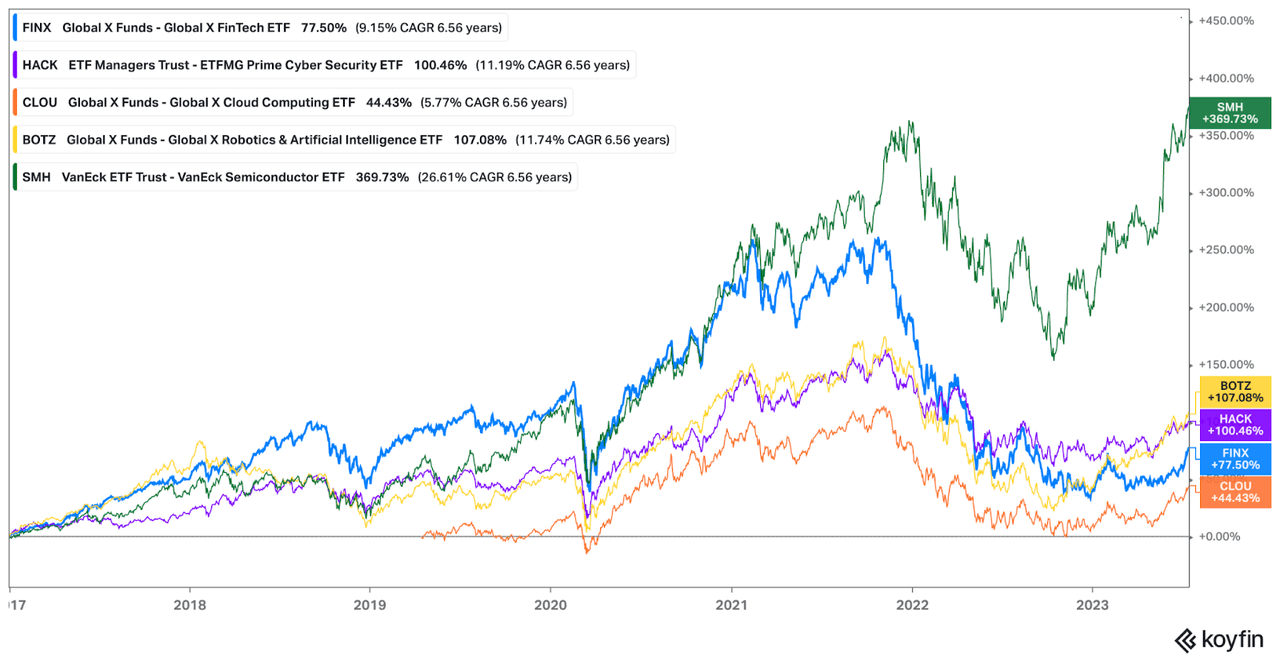

We see that fintech is currently undervalued as compared to other technology sectors.

Furthermore, Covid-19 was an unanticipated black swan event, which is why we made a comparison between the performance of sectors in the technology industry by their average performance before and after the pandemic.

The performance before covid was strong and the performance after covid was a decline. However, the fintech sector revenues increased after covid, while the fintech ETF price decreased, which we see as a discrepancy.

|

Stock/ETF/Index |

Before Covid (01/01/2019-01/01/2020) |

After Covid (07/21/2022-07/21/2023) |

|

Fintech (FINX) |

+37.21% |

-0.18% |

|

Semiconductor (SMH) |

+63.25% |

+34.07% |

|

Cybersecurity (HACK) |

+24.09% |

+3.64% |

|

AI (BOTZ) |

+31.17% |

+29.61% |

|

Cloud Computing (CLOU) |

+4.78% |

+13.46% |

Koyfin

-source (Koyfin), input (author)

According to the Wall Street Journal the fintech sector has underperformed as it has been hurt by “vulnerability to higher interest rates, the disappearance of many pandemic-era catalysts and a more general reckoning for companies that followed growth-at-all-costs playbooks contributed to many fintech firms’ fall from grace.”

PayPal’s recent underperformance in the fintech sector can be attributed to factors beyond higher interest rates and the fading of pandemic-era catalysts. Key considerations include increasing market competition, with emerging players offering similar services often at lower costs, potentially eroding PayPal’s market share. The resumption of normal economic activities post-pandemic have led to a return to traditional payment methods, affecting PayPal’s growth rate. Additionally, a complex and evolving regulatory landscape presents potential challenges. However, despite these issues, PayPal’s robust core business, strong user base, established brand, and capacity for innovation still make it a promising long-term investment.

However, research by the Boston Consulting Group (BCG) shows that financial technology revenues are projected to grow sixfold from $245 billion to $1.5 trillion by 2030. In addition BCG said “The financial technology sector, which currently holds a 2% share of the $12.5 trillion in global financial services revenue, is estimated to grow up to 7%, of which banking fintechs are expected to constitute almost 25% of all banking valuations worldwide by 2030.” According to RBC “the outlook for the FinTech sector remains strong, with an anticipated compound annual growth rate (CAGR) of 20.5% heading towards 2030.” We see a mismatch in the high growth of the FinTech market compared to the low valuations.

What’s Driving Growth?

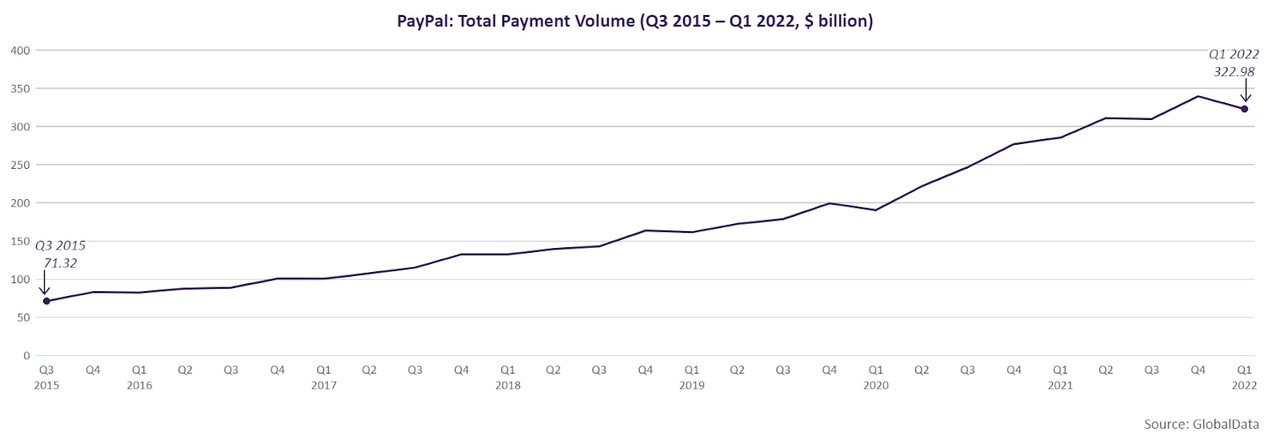

GlobalData

Despite some investors’ skepticism, PayPal’s growth potential should be evaluated based on long-term expansion and profitability, not just immediate market conditions. With its innovative, scalable business model, large user base, and brand recognition, PayPal is poised for sustained growth in the expanding digital payments industry. Its continual investment in diversifying services—from peer-to-peer transactions to business dealings, crypto trading, and buy-now-pay-later services—illustrates its adaptability. Furthermore, PayPal’s expansion into emerging markets and development of new revenue streams, such as in-store payments and advertising, signify considerable room for growth. Therefore, while current market dynamics may suggest a slowdown, PayPal’s strategic positioning and constant drive for innovation indicate it remains a viable growth company.

PayPal’s growth is driven from a number of key decisions, but specifically its most important measure of growth: Total Payments Volume (TPV) which generates 92% of total revenues.

I. Acquisitions:

One of their main strategies for driving growth has been acquiring companies that help drive their TPV growth. Many investors judge that companies who constantly acquire other firms to achieve growth are doing so due to weak prospects for their core legacy business. However, that is not the case here.

Acquisitions, instead of indicating weak legacy businesses, can be strategic tools for business growth, innovation, and competitiveness. They offer access to new technologies, skills, and markets, potentially enhancing a company’s core operations and long-term shareholder value. Thus, investors should view acquisitions as strategic adaptations, focusing on the rationale behind these moves and management’s execution capabilities.

PayPal had acquired companies to gain international exposure and provide value-add to their customers. TPV is the metric that will determine PayPal’s revenue growth. which has improved due to the acquisition of direct revenue generating companies like Paidy and companies that provide value-added services to the consumers and merchants, indirectly driving TPV growth.

-

An example of an indirect driver of TPV growth is their biggest acquisition to date of Honey, a browser extension that automatically applies online coupons to ecommerce websites, for $4.4 Billion (Forbes). This acquisition was able to increase their number of users by gaining Honey’s 17 million monthly users (Forbes). Furthermore, PayPal gained Honey’s large amount of data and personalization tools and digital coupons (Forbes).

-

In addition, PayPal has acquired 15 companies since its IPO in 2015. One of the other biggest acquisitions is Zettle in 2015 for $2.2 Billion which is their point-of-sale platform for in-store merchants. This makes them competitive in the POS hardware market and increases their product offerings.

-

They also acquired Paidy in 2021 for $2.7 Billion (PayPal) which is their Japanese payment processing service and GoPay which is their China based payments processor. PayPal will “compete with domestic payment giants Alipay, owned by Alibaba-affiliated Ant Group, and WeChat Pay, owned by Tencent Holdings Ltd, as China fully opens up its financial sector (Reuters).” Their focus on gaining market share internationally has helped drive growth.

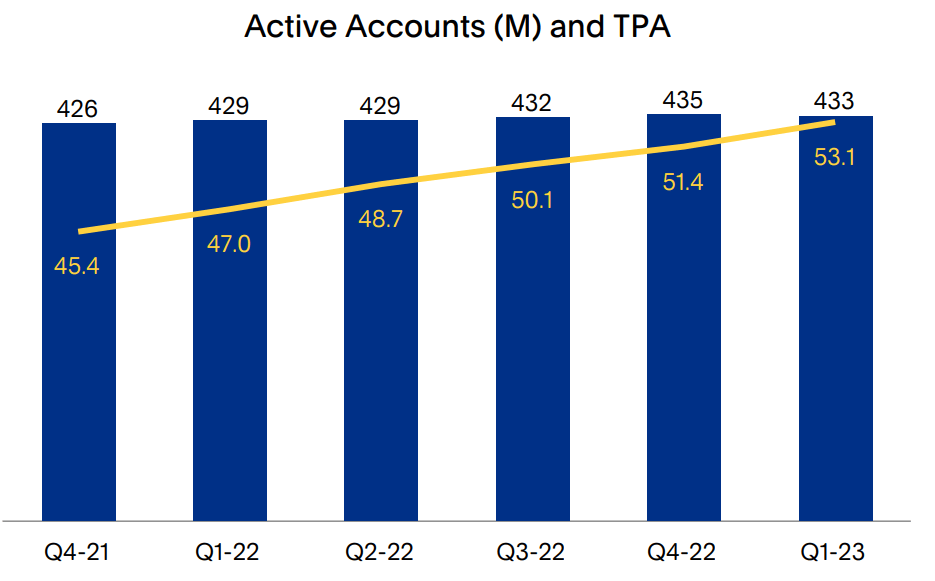

II. Active Accounts

PayPal is also introducing a Venmo Teen account which will increase their total transaction volume. There are about 26 million people between the ages of 13-17 which will drive PayPal’s total users while competing with Block Inc.’s Cash App Teen Account. This is expected to improve their TPV growth. Active accounts growth has improved 1% YoY, but adding teen accounts to the Venmo platform will boost account growth an additional 3% YoY. Moreover, PayPal’s transactions per account have grown 13% YoY, further improving TPV.

investor presentation Q4 22

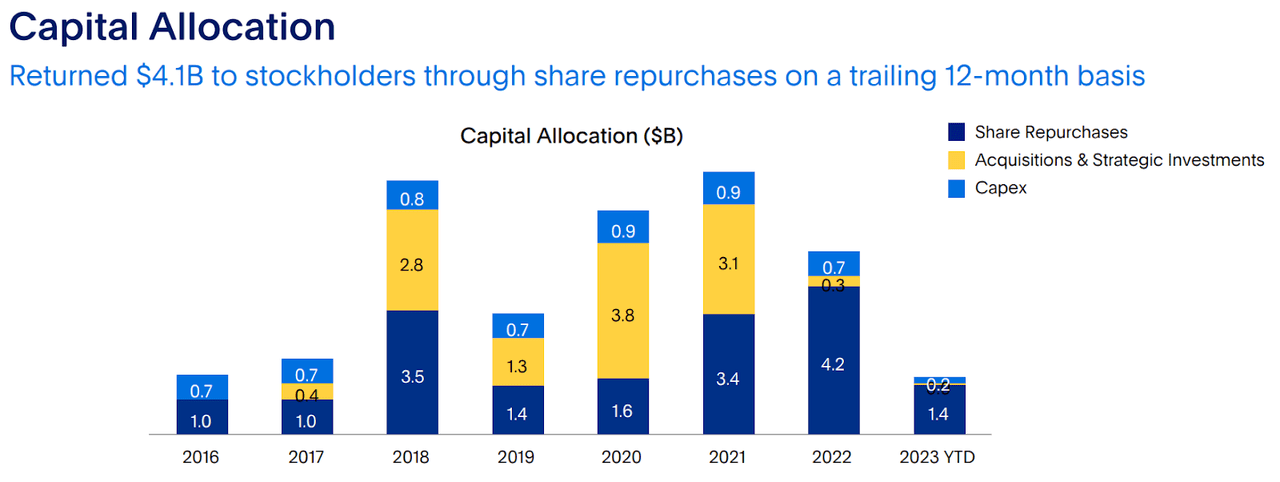

III. Share Buy-Backs

PayPal returned $4.1B to stockholders through share repurchases on a trailing 12-month basis. They have allocated a majority of their profits back into the business more through Share Repurchasing than Acquisitions in the past 2 years. Since separation from eBay, PayPal has allocated $18B to share repurchases and $13B to acquisitions and strategic investments.

Investor presentation Q1 23

IV. International Expansion and Foreign Market Growth

PayPal intends to grow their business by increasing its international presence because they have improved margins in international markets. 45% of active accounts were outside the U.S. as of December 31, 2022. US TPV growth has slowed down to 12% YoY from 21%. However, International FX Neutral YoY Growth has improved from 5% YoY to 12% in Q1 numbers in just 1 year. Management has emphasized that they will continue to focus on international business and the numbers reflect this trajectory.

V. Buy Now Pay Later and PayPal Credit

PayPal has tapped into the microloans market opportunity allowing over 32 million PayPal users to benefit from their Buy Now Pay Later (BNPL) solutions in the past two years alone. These BNPL solutions have been successfully deployed in seven core countries, including the US, UK, Australia, France, Germany, Italy, and Spain. BNPL’s widespread adoption has raised $32.7B in TPV since launch and 198% YoY cumulative growth (Q1 ’23 vs Q1’22). This success has led to 300k+ merchants having BNPL on their shopping pages. PayPal Credit, which constitutes PayPal Pay Later, generates about 8% of PayPal’s total revenues. They report that consumers spend 30% more on purchases if they use PayPal’s financing options, further adding to payment volume growth.

Why PayPal?

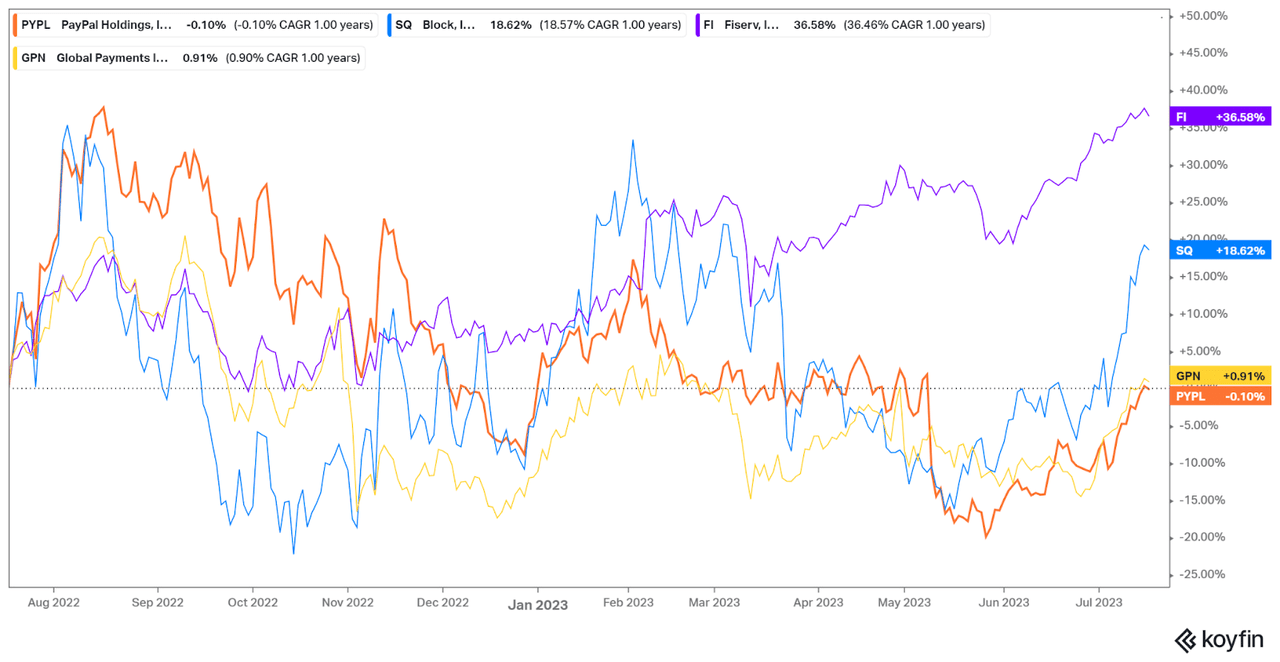

While we believe the entire fintech industry is undervalued, we performed an analysis between PayPal’s competitors to determine which stock has the most performance opportunity. The comparison is between the three top competitors. PayPal has reduced optimism towards its stock due to its competitor, Block Inc., having lower price offerings which is more attractive to Small and Medium Businesses (SMBs) looking to cut costs. SMBs don’t have the ability to spend extra on their fintech hardware and payment processing. They are focused on trying to increase their ability to spend in other areas. For example, a small taco shop in Gainesville, FL needs more money to pay for their ingredients to support demand (we can use a better example). However, we believe this to be a US public sentiment occurrence as it does not support the performance of PayPal’s revenues.

PayPal has a large international presence and a more diverse range of product offerings than Block Inc. About 42.56% of their revenues come from the international market (10K 2022). More products allow more businesses to access PayPal’s services and international presence allows for further user growth. Both of these give PayPal their competitive advantage in having a larger Total Addressable Market (TAM) than Block Inc.. There are three main points to prove this. First, “card payment acceptance with the Block Inc. app is currently available in the US, Canada, Australia, Japan, the United Kingdom, Republic of Ireland, France and Spain. We currently don’t support payment card processing outside of these countries or in U.S. territories such as Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and Northern Mariana Islands (Squareup.com).” Second, “Block Inc.’s hardware is subject to testing and certification for compliance with country-specific regulations, such as for FCC compliance in the United States, or Restriction of Hazardous Substances (RoHS) compliance in the EU. Therefore, Block Inc.’s hardware is only approved for use in the country for which it is intended. For example, hardware sold or intended for sale in the United States is not approved for use in Australia, Canada, Japan, Republic of Ireland, the United Kingdom or France (Block Inc.up.com).” Third, “cross-border card payments are unsupported. This means that card transactions attempted outside of the country where you activated your Block Inc. account can’t be processed with Block Inc. However, you can accept cash transactions while traveling internationally (Block Inc.up.com).”

|

PYPL |

SQ |

FI |

GPN |

|

|

Performance (TTM) |

-0.10% |

36.56% |

18.62% |

0.91% |

|

Fwd P/S |

2.80 |

2.32 |

4.42 |

3.44 |

|

Fwd Rev Growth |

8.31% |

9.99% |

6.13% |

6.22% |

|

Fwd P/E |

15.05 |

46.40 |

17.57 |

10.99 |

PayPal has underperformed its peers in the past 12 months while having a similar growth rate. We believe this is our opportunity to get into the fintech sector at an attractive price. PayPal compared to Block Inc. is trading at 3x the forward P/E ratio and that is why we believe PayPal is a better choice of investment for exposure in the fintech sector. Block Inc. has had problems with profit margins and has operated at a net loss for the past 2 years but it’s stock price does not reflect the loss. PayPal is comparatively dominant in the international markets compared to Fiserv and Block Inc. PayPal, however, has profited in net income of $1.17 EPS, a growth of 20% since last year. PayPal has also landed significant deals while bidding against competition with key players that help drive TPV. These include companies such as Uber, Spotify, Microsoft and Shopify.

Koyfin

-source (Koyfin), input (author)

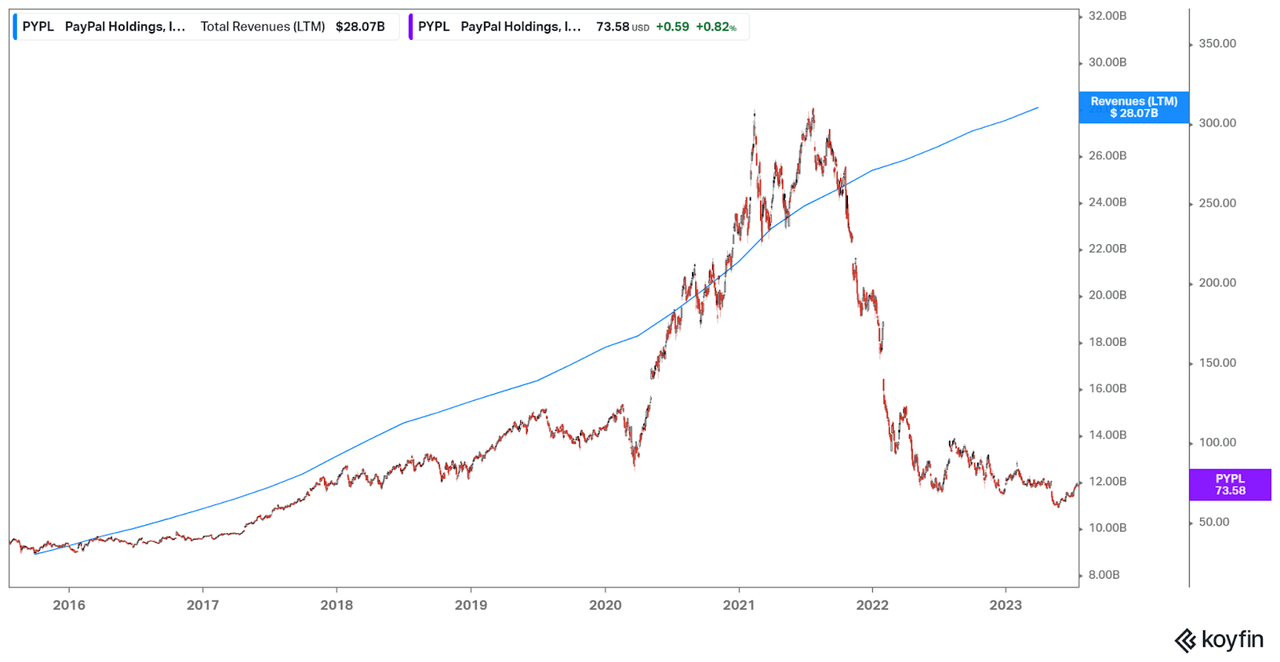

Valuation

Koyfin

As mentioned earlier, TPV generates 92% of PayPal’s revenues, therefore it is an accurate indicator of PayPal’s growth. Looking at the chart for TPV, the growth rate of TPV has only been increasing with time, but there is a disparity when it comes to the performance of the PayPal stock. A “gator mouth” refers to a situation where there is a significant disparity between a company’s key performance indicators which presents a potential investment opportunity due to the market’s temporary mispricing or undervaluation of a stock. After all-time highs in 2021, PayPal’s stock performance has underperformed compared to the TPV which has only accelerated with time. This vacuum between growth and stock price performance has the potential to yield strong returns.

Among the various metrics analyzed, one significant indicator was the Price-to-Sales ratio (P/S). In 2016, PayPal’s P/S ratio stood at 4.43x; its lowest valuation before its recent current lows. It’s essential to note that past trends in stocks don’t guarantee future performance. However, when considering the vacuum effect and factoring in PayPal’s robust growth potential, this comparatively lower P/S ratio suggests an intriguing opportunity for investors seeking exposure to the fintech sector.

Our Stock Price Calculation

|

Steps |

Equation |

|

(1) Historical P/S (since June 30th 2016) = 7.11 conservatively |

|

|

(2) Current Market Capitalization= $82422 M |

Current price/share ($73.46) Total shares outstanding (1122) |

|

(3) Current P/S= 2.9 |

82422 TTM Sales (28075) |

|

(4) Average 3-year revenue growth rate (including 2023) = 8.36% |

(7.51%+8.95%+8.63%) 3 Source: Seeking Alpha |

| (5) Compounded revenue with the 3-year growth rate = $32,965m |

28,075 1.08362 |

|

(6) Future expected Market Capitalization = $230.755b |

(7*32.965) |

|

(7) Stock price estimate in 2 years (Dec 2025) = $205.66 |

230.755 / 1.122 |

PayPal lowered its guidance for fiscal 2022 in April, calling for total payment volume (TPV) growth of 13% to 15% and revenue growth of 15% to 17%. Revenue and TPV growth had both been 19% to 21% range at the start of the year. This combined with negative analyst ratings may have caused PayPal’s price to sales to be lower for 2023. High P/S multiples are not always indicative of future growth. In some cases, high P/S multiples may be due to market speculation or hype. However, looking at multitude of factors such as future revenue growth, acquisitions, ,TPV, and its increasing presence in international markets, it would be fair to label PayPal’s stock to be undervalued.

Valuing PayPal at a minimum of 7x sales, as a growth company, can be justified considering its vast user base, dominance in the growing digital payments sector, continuous product innovation and diversification, and expansion into emerging markets. The potential for cross-selling within its active accounts, leveraging industry growth, and monetizing new services such as cryptocurrencies and buy-now-pay-later options indicate avenues for revenue growth not captured in current sales. Its trusted brand further warrants a premium valuation. Despite this high multiple compared to historical norms, these factors combined imply that PayPal’s future revenue growth potential may warrant such a valuation. Still, this outlook is forward-looking and depends on market conditions, competitive dynamics, and effective strategy execution.

After thorough evaluation of the company, we have set a price target of $205 per share. We calculated future revenues from their TTM revenues of $28.075B, compounded by their 3 year CAGR future growth rate of 8.36% (conservatively) to arrive at a value of $32.96B revenue 2 years from now.

We then calculated that the stock is currently trading at 2.9x P/S and we expect this to revert back to its historical mean average of 7x P/S (conservatively calculated). We calculated the future expected market cap to be $230.755B. We then divided this by the number of outstanding shares of 1.122B from the Q1-10 Q.

Conclusion

PayPal’s shares are trading at 2.9-times the company’s trailing twelve-month sales while it has historically traded at an average of 7x P/S since Q2 2016. It has traded at an average of 8.10x P/S in the past 5 years.

In terms of pricing predictions, We are of the opinion that PayPal should be valued at a minimum of 7x its sales from the past year, considering its enhanced fundamentals. This figure represents the average price-to-sales ratio for the company over the past 8 years, suggesting a potential 180% increase in current price.

Our hypothesis could be jeopardized if PayPal fails in its implementation and doesn’t succeed in growing TPV across its businesses or adding new active accounts. This could occur due to competitors like Block Inc. dominating the market share, which could result in a stagnation in PayPal’s account growth and would increase worries about a shrinking business. Whether this risk factor holds any weight will only be revealed with time. However, the management has a strong plan to revitalize growth and improve international margins which is why we are rating PYPL stock as a ‘BUY’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.