Summary:

- Investors are discouraged by PayPal Holdings stock’s drastic decline, and given the substantial losses, many are debating whether they should keep holding the shares.

- A study conducted by Comscore found that websites that provide PayPal Checkout as a checkout option generate more sales than those that do not provide the service.

- PayPal has teamed up with ConsenSys in an effort to broaden its customer base and expand its product and service offerings within the lucrative cryptocurrency market.

- PayPal also now provides a service for Venmo users called crypto on Venmo.

- I rate the PayPal Holdings stock as a Buy, as I think that, despite any short-term setbacks the firm may experience, it will prosper in the long run.

chameleonseye/iStock Editorial via Getty Images

Investment Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) is a leading technology platform company in the digital and mobile payments space. The company possesses a powerful brand and a customer base that is continuously expanding.

The core payments business of the company has shown significant expansion over the past few years, and the business’s expansion into new areas, such as peer-to-peer payments and shopping platforms, has helped the company diversify its revenue streams. PayPal Holdings, Inc. has also established partnerships with major businesses, which has assisted in expanding its reach and bolstering its brand. The ever-increasing use of mobile and digital payment methods is one of the primary forces propelling PayPal’s expansion. This trend has accelerated as a result of the COVID-19 pandemic, and PYPL is well-positioned to benefit from this shift in the market. In addition, the company’s expansion into new areas and partnerships ought to assist in driving the company’s continued growth in the future.

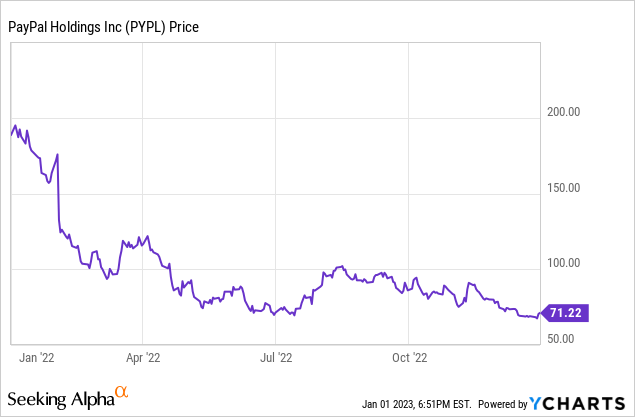

However, rapidly rising interest rates hurt the company’s results in 2022. Investors are discouraged by the stock’s drastic decline, which has brought it close to its 52-week low today. Given the substantial losses, many are debating whether they should keep holding the shares.

PayPal’s Competitive Advantage

One of the most important factors that have contributed to PayPal’s rapid expansion is the company’s success in simplifying and improving the checkout experience for online retailers. Because of its many advantages, PayPal’s solution has emerged as the front-runner among e-commerce platforms. Additionally, the payment infrastructure offered by PayPal serves not only merchants but also customers, and the company benefits from a two-sided network effect as a result. Therefore, the value that a customer receives from utilizing the payment service is directly proportional to the number of merchants that are utilizing the platform on the other side of the transaction, and inversely.

One illustration of this phenomenon is the preponderance of PayPal in online shopping cart transactions. The corporation maintains almost 400 million active consumer accounts in addition to its 35 million active merchant account holders.

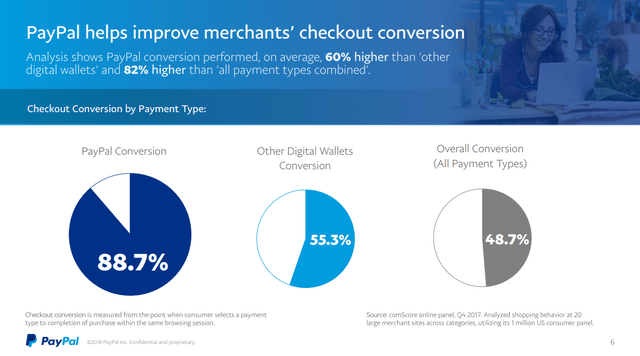

In addition, a study conducted by Comscore found that websites that provide PayPal Checkout as a checkout option generate more sales than those that do not provide the service. As a consequence of this, merchants make use of PayPal checkout as a result of its efficiency, and customers search for the PayPal checkout button as a result of their faith in the brand.

However, the company’s recent performance does not reflect the importance of PayPal in the credit services market.

How The Imminent Recession Impacts The Company

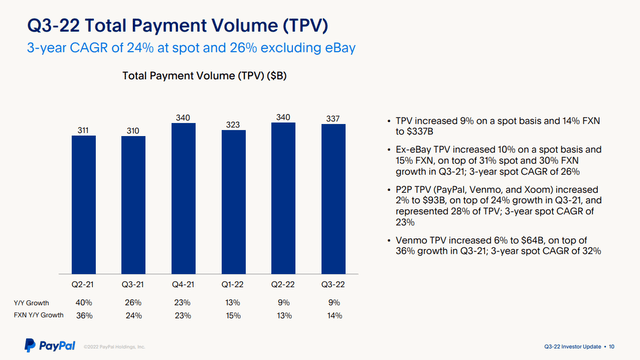

PayPal had a fantastic year in 2021. The corporation reported a total payment volume (TPV) of $1.25 trillion over the course of a year, an increase of 33%, and added 49 million net new active accounts to its platform. PayPal was booming as a result of the coronavirus outbreak, driving consumers to online commerce and electronic payments. In 2022, the narrative, however, shifted.

As a result of the Federal Reserve’s aggressive interest rate increases to tame skyrocketing inflation, there are signals that the economy is weakening, and many experts believe a recession is imminent.

PayPal has taken a hit as a result of this. Because the company generates more than 90% of its revenue from transaction fees based on the activity on its platform, a slowing economy can hurt, as consumers spend less.

In the third quarter, TPV increased 9% year-over-year, with revenue rising 11% and PayPal attracting 2.9 million new accounts. These statistics indicate that the company is still increasing, but they also suggest that the rate of growth is slower than it was in previous years.

So what does the company do to get back on track?

PayPal In The Cryptocurrency Market

consensys.net

PayPal has teamed up with ConsenSys in an effort to broaden its customer base and expand its product and service offerings within the lucrative cryptocurrency market.

In accordance with the agreements, the digital cryptocurrency wallet offered by ConsenSys known as MetaMask has been updated to include PayPal as a payment method for transactions involving cryptocurrencies. Users of MetaMask will now be able to buy and transfer the second-most popular cryptocurrency known as Ether in a seamless manner by just logging into their PayPal accounts.

The highlighted integration will assist MetaMask in broadening its client base to include customers who use Web3 apps such as play-to-earn games and metaverse applications, amongst other types of applications. In a similar fashion, PayPal will be able to acquire momentum among users of Web3 applications, the number of which is continuously increasing.

Initially, only certain users located in the United States are able to take advantage of the PayPal option that is included in MetaMask. The functionality will eventually be made available throughout the entirety of the United States. This action speaks well for the continued expansion of the company’s crypto endeavors.

Aside from this most recent development, PayPal now provides a service for Venmo users called crypto on Venmo. This feature enables users to buy, hold, and sell cryptocurrencies without ever leaving the Venmo app. Customers can check out the latest bitcoin developments within the app as well. Additionally, the corporation makes its cryptocurrency service available to customers in the United Kingdom. This service enables customers to buy, hold, and trade digital currencies such as bitcoin, bitcoin cash, Ethereum, and Litecoin directly from their PayPal accounts.

Another point in the plus column is the launch of a function known as Checkout with Crypto, which enables users to change the value of their cryptocurrency holdings into traditional cash without any hassle at the point of sale.

All of these efforts indicate that PayPal is still in a strong position to quickly join the expanding cryptocurrency industry and, therefore, get its revenue growth rate back to its previous levels. This is particularly important in light of the epidemic, which has brought greater attention to the significance of digital currency transactions.

Conclusion

Overall, significant user growth, strategic acquisitions, and a favorable macroeconomic environment helped PayPal Holdings, Inc.’s shares perform strongly up to the first half of 2021. However, the company’s stockholders had a terrible year last year, which has led many investors to think about dumping PayPal stock.

Although there are risks to take into account, such as how a potential recession would affect the business, the company’s solid financial performance and dominant position in the digital payment industry indicate that it is well-positioned for future success. Another plus is that the business is adept at overcoming obstacles and adjusting to the new digital world. I rate PayPal Holdings, Inc. stock as a BUY as I think that, despite any short-term setbacks the firm may experience, PayPal will prosper in the long run.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.