Summary:

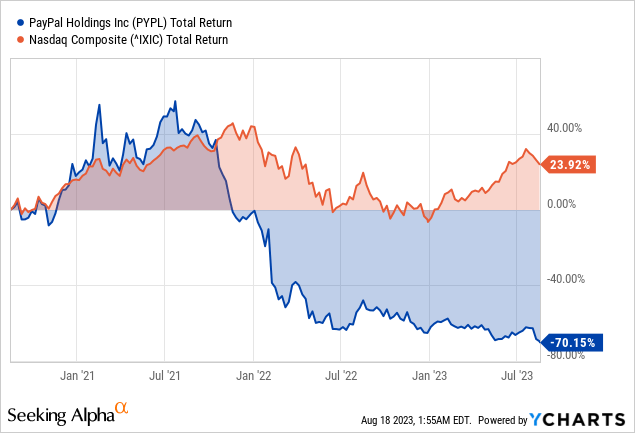

- PayPal has seen a significant drop in its stock price, making it an attractive deep-value play for long-term investors.

- The company has demonstrated strong growth in web traffic and market presence, positioning itself as a dominant player in the finance sector.

- PayPal’s stablecoin, strategic initiatives, and new CEO appointment contribute to its long-term growth and market leadership potential.

- Technically, PYPL is at a critical juncture, hinting at a possible price reversal.

chameleonseye

Investment Thesis

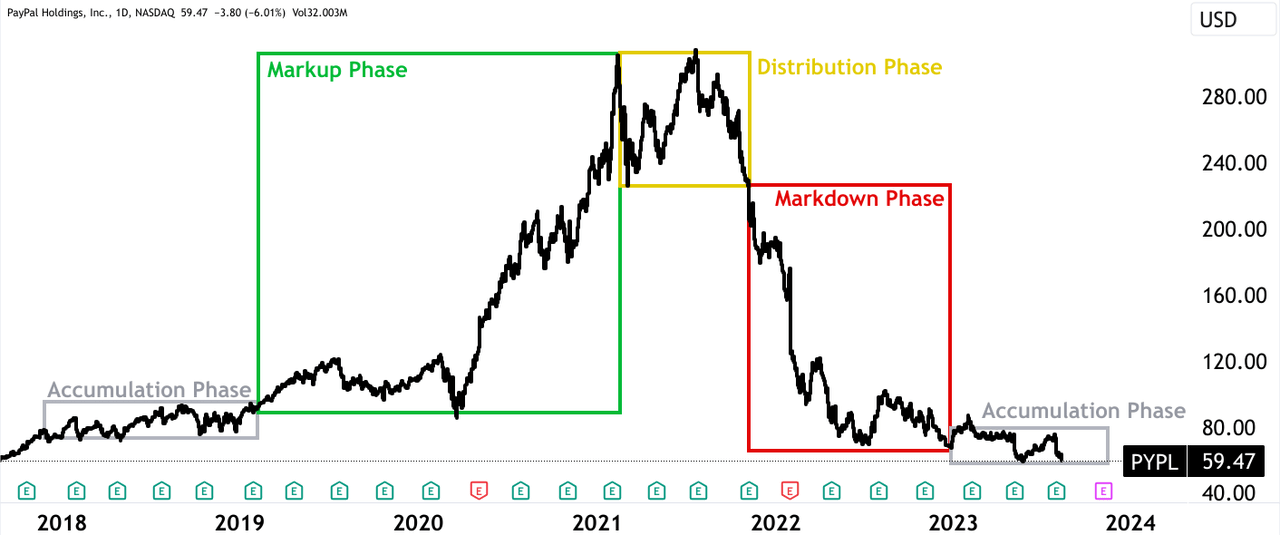

PayPal Holdings, Inc. (NASDAQ:PYPL) has emerged as a leader in the digital finance landscape, leveraging its consistent growth and strategic initiatives. PYPL has attracted unreasonably high valuation multiples post-pandemic, but the recent crash of around 80% from all-time highs, in combination with its growth outlook, portrays a compelling deep-value play for long-term investors.

This article explores the company’s strategic initiatives, development toward market share and competitive edge, the new CEO’s impact, the valuation outlook, and a technical assessment, which ultimately supports a strong buy rating for the stock in the next 24 to 36 months.

Web Traffic & Competitive Tides

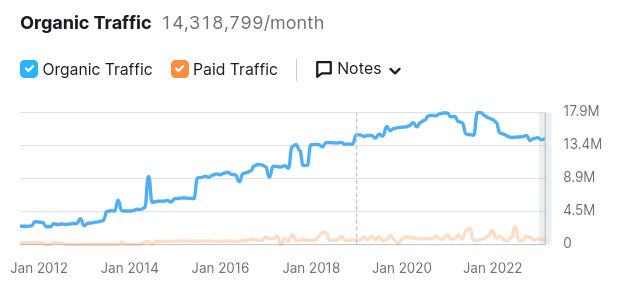

In today’s ever-evolving digital landscape, understanding web traffic dynamics is crucial for any business aiming to stay competitive. PayPal demonstrates a robust trajectory in its web traffic and market presence, positioning itself as a dominant player in the finance sector.

Over the past decade, PayPal’s organic traffic has grown steadily, with a Compound Annual Growth Rate (CAGR) of 17.27%, reaching monthly organic traffic of 14.3 million. The sustained growth highlights its strong online visibility and brand recognition.

However, its organic traffic dropped significantly in early 2022 from a level near 18 million per month, a nearly 20% drop from the all-time high due to fierce competition in the industry. Nonetheless, considering recent traffic trends (desktop users) on PayPal.com, the platform’s total traffic has surged by 8.05% compared to the previous month, suggesting that PayPal continues to attract and engage a widening user base.

Domain Overview | Semrush

Key Metrics Remain Healthy

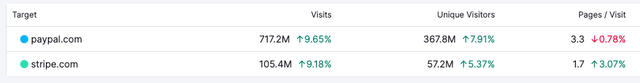

PayPal’s web traffic has demonstrated remarkable growth of 9.65% in total visits in the last month, suggesting an expanding user base and heightened online engagement. Correspondingly, unique visitors have risen by 7.91%, reinforcing PayPal’s capacity to attract new audiences consistently.

The average user interaction on PayPal’s platform is equally remarkable, with users viewing an average of 3.3 pages per visit. This figure, which has increased by 0.78%, suggests that users actively explore the platform’s offerings, potentially indicating higher interest and engagement.

Furthermore, the average visit duration is an impressive 5 minutes and 34 seconds, marking a significant 5.03% improvement. This underscores the platform’s ability to capture user attention, facilitating extended interactions conducive to achieving business objectives.

Finally, PayPal’s diligent efforts are reflected in its bounce rate, which has decreased by 5.38% to 29.47%. A lower bounce rate indicates improved user engagement and content relevance, implying that visitors find the content and offerings on PayPal’s platform more aligned with their expectations.

Comparative Analysis With Stripe

A comparative analysis with a close competitor, Stripe, offers further insights into PayPal’s standing. While both platforms have experienced growth in visits (PayPal: 9.65% vs. Stripe: 9.18%) and unique visitors (PayPal: 7.91% vs. Stripe: 5.37%), PayPal maintains a significant lead in both metrics, indicating a stronger market presence. Additionally, PayPal’s higher pages per visit (3.3 vs. Stripe’s 1.7) further emphasize its ability to capture and retain user attention.

Vast User Base Paves Τhe Way Amidst Industry Competition

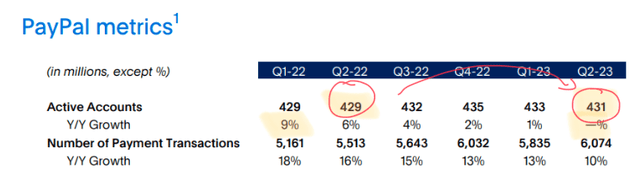

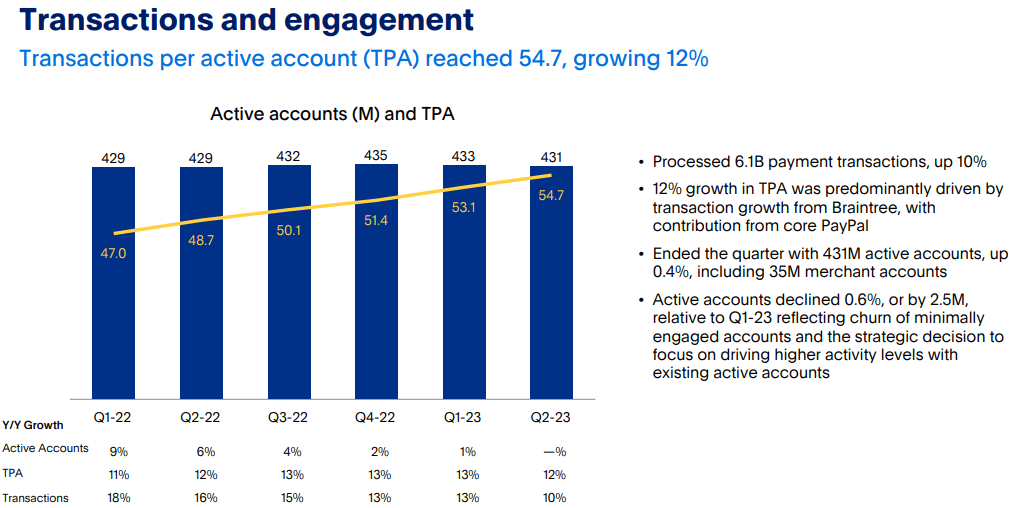

Despite a gradual slowdown, the company maintains a substantial user base and has demonstrated a consistent user growth trend in recent quarters. From Q1-22 to Q2-23, active accounts remained relatively stable, ranging from 429 million to 431 million. This includes user and merchant accounts (35 million), contributing to PayPal’s versatility as a payment solution for a broad spectrum of users, from individuals to businesses. However, the YoY growth rate has steadily declined, indicating a potential saturation in its market reach. Over this period, YoY growth dropped from 9% to below 1%, signaling the weakness of its strategies to reignite expansion.

Considering the broader industry landscape, PayPal’s growth outlook is influenced by the Global Payment Processing Solutions Market’s projections. The market is anticipated to experience robust expansion, with an estimated USD 63.48 billion growth between 2022 and 2027. This growth trajectory translates to a CAGR of 12.18%. Despite slowing growth, PayPal’s current user base and market share position it favorably to tap into this market growth.

To secure growth, PayPal prioritizes customer retention and engagement within its existing user base to counteract the sluggish YoY growth. This includes enhanced personalized offerings, rewards, and seamless experiences. PayPal also explores untapped markets and demographics geographically and among underserved segments. For instance, if PayPal uses emerging technologies such as blockchain and cryptocurrencies to expand its service portfolio, it may attract tech-savvy users and capitalize on the growing interest in decentralized finance.

Surge In Payment Transactions

PayPal has demonstrated consistent growth in its payment transactions, bolstered by its expanding active account base. Specifically, in Q2-23, PayPal reported processing 6.074 billion payment transactions, representing a 10% YoY increase but with a slower growth rate. A closer look at Transactions per active account (TPA) that reached 54.7 reveals a 12% YoY growth attributable to Braintree’s transaction volume, a subsidiary playing a pivotal role in driving the company’s transaction growth.

Q2-23 Investor Update

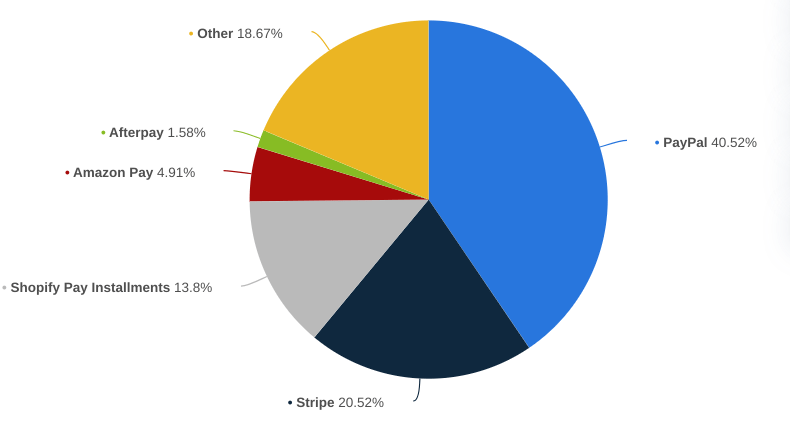

PayPal’s 40.52% Market Share Dominance

PayPal had nearly 55% market share in 2020, but the fierce competition has taken significant market share away from the fintech conglomerate. However, there are positive signs of stabilization, and PayPal currently holds a market share in the global online payment processing industry, with a commanding position of 40.52% as of July 2023, which stabilized its market share YoY (July 2022: 41%) and indicated PayPal’s ability to preserve its market share.

The ongoing transition to electronic payments and increased e-commerce, which the coronavirus epidemic further hastened, had boosted PayPal’s growth. Although there are niches in the acquiring market, PayPal is the undisputed e-commerce leader, creating a protective moat.

A few new rivals have emerged due to what appears to be a concentration of fintech innovation in the e-commerce sector, even though growth slowed in 2022 as the company overcame some headwinds. The company could face additional headwinds if the economy worsens.

The ongoing global shift towards e-commerce presents a substantial growth avenue for the entire industry, including PayPal. Therefore, given its platform’s relative ease and security, PayPal will continue to be a preferred partner in the online world, yet, the company’s market position does not allow it to impose terms on other participants or eat up an ever-increasing market.

Leading online payment processing solutions globally 2023 | Statista

PayPal’s Stablecoin Opens The Gate For Crypto Adoption In Traditional Finance

PayPal’s introduction of a fully backed stablecoin, PayPal USD (PYUSD), has the potential to bring about significant long-term benefits to the company from a fundamental perspective.

This move aligns with the ongoing shift towards digital payments, blockchain technology, and the expanding Web3 ecosystem. By launching a stablecoin that’s 100% backed by US dollar deposits, short-term US Treasuries, and similar cash equivalents, PayPal aims to bridge the gap between traditional fiat currency and the emerging world of digital assets.

Firstly, PayPal’s stablecoin can enhance its role in the evolving digital payments landscape. As the exclusive stablecoin within the PayPal network, PYUSD offers a seamless method for users to transition between fiat and digital currencies. The combination of PayPal’s established payments expertise and blockchain’s efficiency can facilitate faster transfers, reducing friction for inexperienced payments, remittances, international transactions, and more. As a result, this will likely strengthen PayPal’s appeal to consumers, merchants, and developers seeking convenient, low-cost, secure payment solutions.

PayPal

Furthermore, by leveraging the Ethereum blockchain and adhering to transparency standards, PayPal USD can tap into the growing Web3 community. This opens doors for integration with external developers, wallets, and web3 applications, boosting adoption and usability. The compatibility with Web3 environments positions PayPal as pivotal in expanding digital assets into mainstream use cases.

Interestingly, PayPal’s focus on regulatory compliance and its partnership with Paxos Trust Company, a licensed trust company, bolsters confidence in the stability of PayPal USD. Regularly publishing reserve reports and third-party attestations will enhance transparency, reassuring users about the backing of the stablecoin. Finally, this adherence to transparency and regulation will enhance PayPal’s credibility and trustworthiness in the digital finance space.

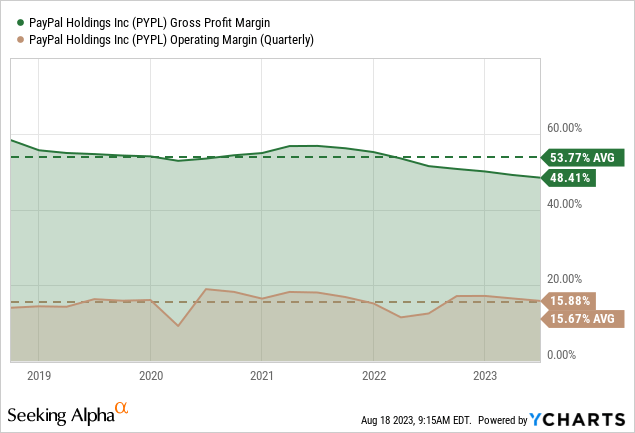

PayPal’s Margin Makeover

While the loss of the lucrative eBay relationship significantly impacted margins, the company’s focus on cost-cutting and long-term strong growth will eventually drive solid margin expansion in the long run.

PayPal is decreasing expenses as its growth slows to maintain its adjusted operating margins. Therefore, PayPal anticipates its adjusted operating margin to improve by “at least” 100 basis points in 2023.

However, PayPal’s net margin of 14.27% places it competitively in the industry, and the improvement is due to its strategy to improve transaction margin dollars. As it is management’s long-term focus, net margin may improve considerably, providing a solid foundation for its long-term financial outlook.

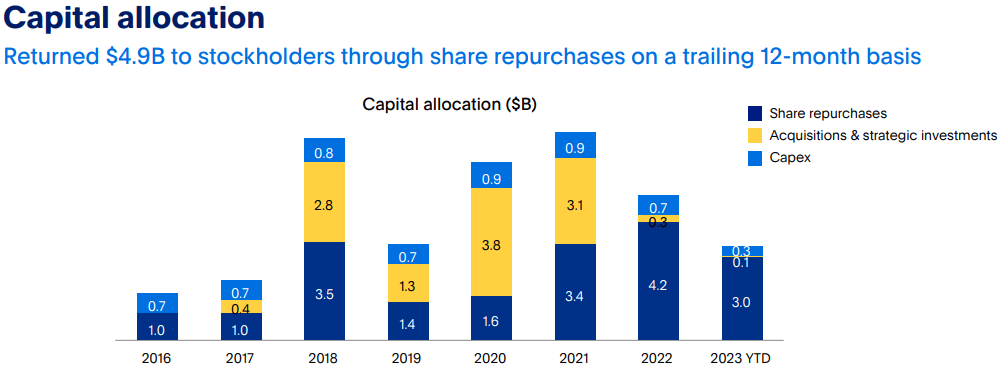

Strategic Buybacks Fuel Growth & Reward Shareholders

On a trailing 12-month basis, PayPal has returned $4.9 billion to stockholders via repurchases (buybacks of 63 million shares), highlighting a focus on enhancing shareholder value. This practice continued in Q2-23, as PayPal repurchased approximately 22 million shares at an average price of $68.89 per share, totaling $1.5 billion. The ongoing trend of buybacks signifies the company’s confidence in its growth trajectory.

Since becoming an independent company in July 2015, PayPal has generated approximately $29 billion in free cash flow (FCF). This underscores its financial strength and capacity to fund various growth initiatives. The allocation of $19 billion towards share repurchases and $13 billion for acquisitions and strategic investments underscore its focus on rewarding shareholders and driving strategic expansion.

Over five years, PayPal has consistently reduced its Diluted Weighted Average Shares Outstanding to 1.14 billion. This trend indicates potential benefits in earnings per share for existing shareholders, given a constant or growing net income.

Q2-23 Investor Update

Inside PayPal’s Journey Of Innovation, AI, & Market Leadership

PayPal’s focused efforts on new product innovations, efficient A/B testing, and enhanced time-to-market capabilities are driving significant improvements in its operational efficiency and customer experience.

By consistently delivering on its roadmap and investing in platform infrastructure, tools, and AI-driven software development processes, PayPal is establishing a competitive edge. The company’s commitment to continuous experimentation, with over 300 experiments launched in the year’s first half, leads to incremental customer benefits and drives cumulative improvements in key metrics, including branded checkout growth.

PayPal’s expansion into the buy now, pay later space and innovations like pre-approved amounts for consumers contribute to accelerated traction in this sector. The company’s efforts in onboarding and introducing new experiences are leading to higher engagement and lifetime value among its customer cohorts.

One of PayPal’s strategic initiatives is the rollout of passkeys in the US and Europe, streamlining the checkout log-in experience and enhancing authorization rates. This initiative positions PayPal to maintain and extend its lead over competitors, promoting continued growth.

Moreover, PayPal’s focus on differentiated wallet experiences for both PayPal and Venmo users aligns with the company’s belief that unique and scaled data sets are essential for leveraging AI’s power to drive actionable insights and deliver differentiated value propositions to customers.

Internally, experimenting with an AI-driven PayPal assistant indicates the company’s commitment to harnessing AI technology to enhance customer interactions and experiences. By envisioning the integration of this assistant into its consumer app, PayPal is poised to elevate its service offerings further.

In addition, PayPal’s growth in the Payment Service Provider (PSP) business (nearly 30% on a currency-neutral basis), strong partnerships with major tech companies, and expansion of value-added services internationally are contributing to the company’s robust performance. The rollout of PayPal Complete Payments, a PSP merchant solution, has garnered substantial interest and participation from key channel partners.

PayPal is effectively implementing PayPal Complete payments with various channel partners (Adobe, LightSpeed, Recurly, Shift4, Shopify, Stacks Payments, UltraCare, Wix, and WooCommerce). Notably, over 25 channel partners are slated to go live by 2023. Based on offering a modern and streamlined checkout experience, PayPal enables numerous SMB merchants to access its innovative solutions. Finally, the company’s ability to leverage its platform capabilities and AI models is key to its market leadership.

A New CEO – Seems Like A Good Choice

The appointment of Alex Chriss as the new President and CEO of PayPal holds significant support for the company’s long-term fundamental growth. Chriss brings extensive experience in technology, product leadership, and a proven track record of driving growth in the small business and self-employed segments. This background aligns well with PayPal’s role as a digital payments platform and its focus on serving consumers and merchants.

Under Chriss’s leadership, Intuit’s (INTU) Small Business and Self-Employed Group experienced substantial growth, with a CAGR of 20% and 23% in customers and revenues, respectively. This success indicates his ability to foster growth engines within business segments and establish market-leading platforms. His leadership overseeing Mailchimp’s acquisition demonstrates his ability to expand a company’s capacity and customer base.

PYPL

Technical Crossroads & Potential Price Ascension

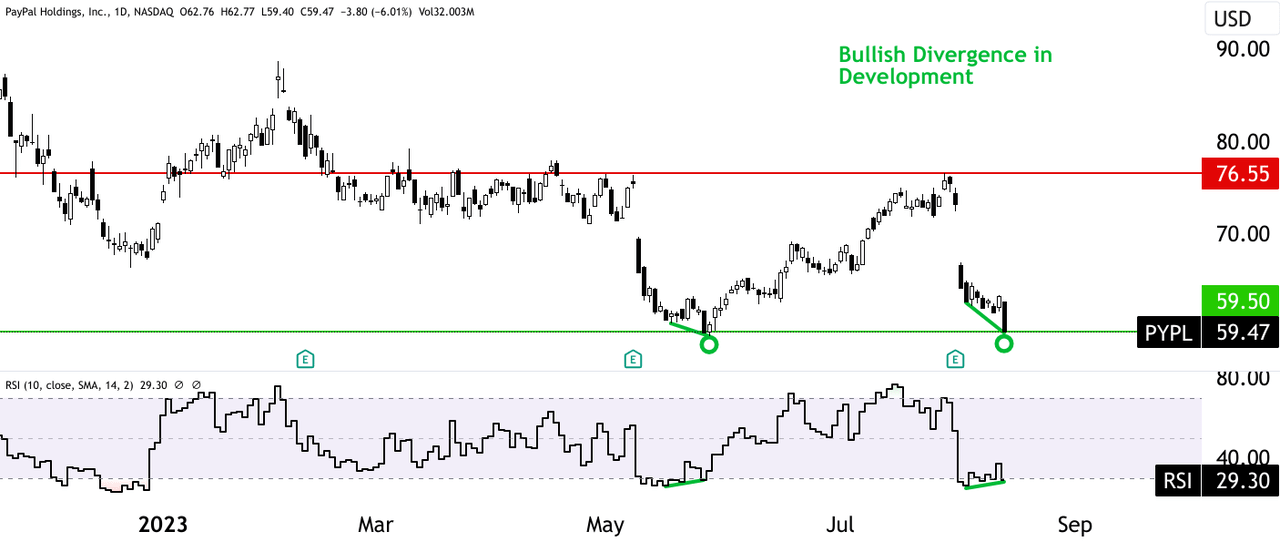

PayPal’s stock is at a pivotal juncture from a technical standpoint. The recent formation of a double bottom around $59.50, marking a six-year low, carries significance. Notably, the pattern was accompanied by a bullish divergence in the Relative Strength Index (RSI), hinting at a possible long-term shift towards a bullish trajectory. In short, the technical setup implies the potential for a vital price reversal.

Looking ahead, a notable resistance level at approximately $76.55 has materialized during the ongoing accumulation phase. A decisive breach above this resistance is pivotal. Once breached, this could trigger a markup phase characterized by robust bullish momentum. The stock may experience rapid appreciation during this phase.

Delving into historical data and projecting forward, there is potential for PayPal’s stock price to scale heights and reach an all-time high of over $300 within the next 3-5 years. The bullish momentum highly depends on the company’s fundamental progressiveness and the favorable outcomes of its strategic initiatives.

Takeaway

In an era of digital evolution, PayPal’s journey has been marked by adaptability, innovation, and strategic positioning. Despite facing challenges such as shifts in web traffic, competition, and evolving market dynamics, PayPal has showcased resilience and a commitment to growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.