Summary:

- PYPL remains substantially undervalued, despite another strong quarterly earnings report, an upward guidance revision, and several other favorable developments.

- The stock market is a voting machine in the short term, and it appears that the market’s sentiment is substantially lagging behind PayPal’s rapidly improving fundamentals.

- My discounted cash flow model indicates that the current valuation is an exceptional opportunity.

Sundry Photography

Investment thesis

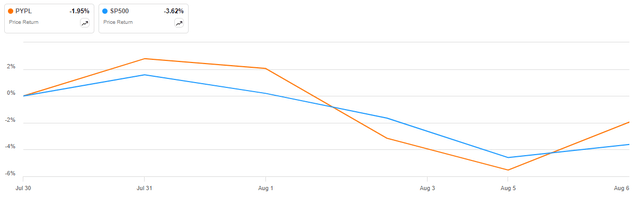

My previous bullish thesis about PayPal (NASDAQ:PYPL) (NEOE:PYPL:CA) did not age well as the stock declined by 1.63% over the last three months. Despite this negative movement, I remain firmly bullish about the stock.

The company delivered another strong quarter recently and the notable guidance boost is a huge green flag, in my opinion. There are other favorable developments that also back my bullish stance, which I describe in my thesis update. Moreover, the stock is still extremely cheap. All in all, I reiterate my “Strong Buy” rating for PYPL.

Recent developments

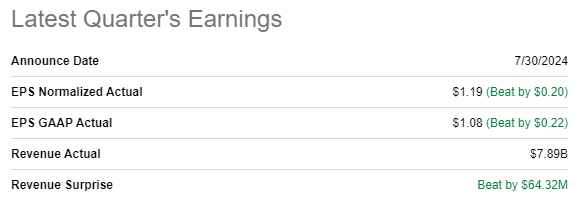

The latest quarterly earnings were released on July 30, when the company topped revenue and EPS consensus estimates. Revenue grew by a solid 8.2% YoY. The company continued exercising solid operating leverage as the operating margin expanded YoY from 15.4% to almost 17.9%. As a result, the adjusted EPS expanded YoY from $1.16 to $1.19. I see solid revenue growth together with expanding profitability as a strong bullish catalyst.

Seeking Alpha

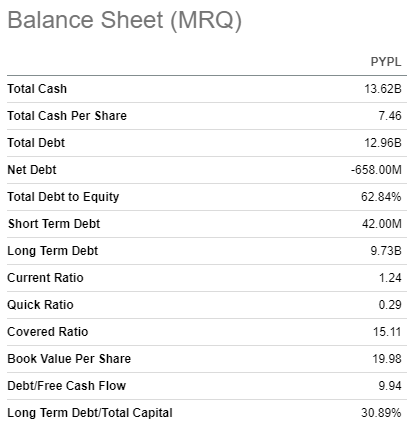

As a result of a strong revenue and operating margin performance, PYPL generated $1.5 billion in cash from operations [CFO]. The Q2 2024 looks much better compared to the negative CFO delivered in the same quarter last year. The company’s balance sheet is still a fortress, with the cash balance around $660 million higher than the total debt. Having a healthy balance sheet is crucial, as it provides PYPL with greater financial flexibility to allocate its capital efficiently.

Seeking Alpha

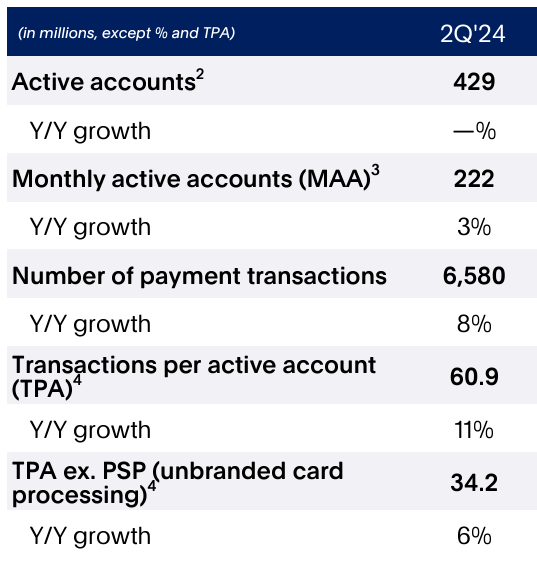

Strong financial performance was driven by robust dynamics in key operating metrics. The number of payment transactions grew by 8% YoY and the TPV grew by 11% YoY, meaning that the average transaction amount also expanded. Notably, TPV grew much faster compared to a modest 3% growth in active accounts, signaling that the company prioritizes high-quality growth instead of growth at all costs, which is always a more sustainable strategy, in my opinion.

PYPL’s latest earnings presentation

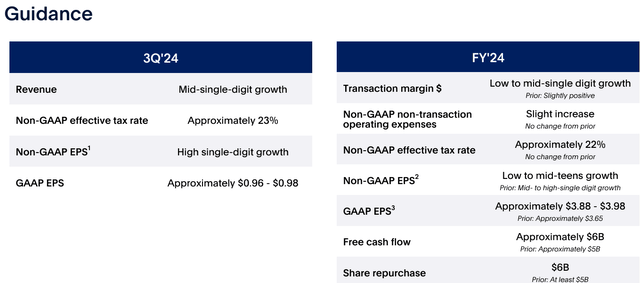

The vital part is that the management is confident in the ability to sustain strong performance for longer. I see it from the 2024 fiscal-year EPS guidance and stock buyback boosts. The management now expects the EPS to be within the $3.88-$3.98 range, notably higher than the previous guidance of around $3.65. The company is expected to convert its bottom-line success into higher free cash flow and more generous stock repurchases. Such a notable guidance boost is a massive positive sign for investors.

PYPL’s latest earnings presentation

Analyzing details of the earnings call made me even more optimistic. The management announced that new interesting partnerships and features are likely to be rolled out by the end of summer, which will likely be positive for investors as it will help in expanding PYPL’s ecosystem. What is also important is that the management once again emphasized its commitment to seeking more operating efficiencies. This will likely be beneficial for the company’s bottom line.

As a financial services company, PYPL significantly depends on the health of the broader U.S. economy, and the situation looks bright from this perspective as well. I know that some readers might disagree with me given the recent uptick in the unemployment rate and stagnating manufacturing PMI index, but I do not share this pessimism because of two important reasons.

First, the current 4.3% unemployment level is still notably below compared to the last decade’s average of 4.75%. Second, in September 2022, it was announced that the Fed’s officials projected a 4.4% unemployment rate as a result of the monetary policy tightening. Since inflation is heading down and the unemployment rate is now very close to the Fed’s targets, I think that the Fed is now ready to start cutting interest rates.

Lower interest rates will highly likely boost economic activity, and the pivot in the manufacturing PMI index will be inevitable with cheaper loans. Moreover, in June the World Bank upgraded its outlook for the global economy, and the resilience of the U.S. economy was the primary reason for this optimism. This is another positive sign for PYPL’s investors, in my opinion.

My optimism is also backed by the recent upgrade for PYPL to Buy from a reputable source like Argus Research. According to Argus’ analyst Stephen Biggar, he sees steady progress in the management’s turnaround plan and PayPal has several competitive advantages to grow payment volumes, in his opinion.

Valuation update

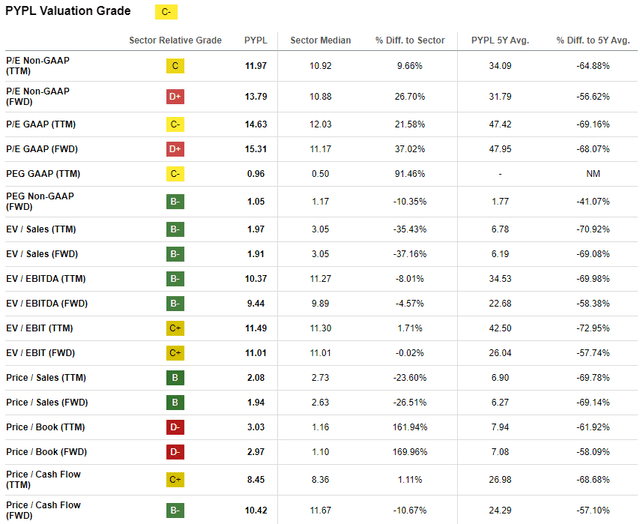

The stock price decreased by 2.6% over the last 12 months, substantially lagging behind the broader U.S. market. PYPL delivered a 2.2% YTD return, also slower than the S&P 500. The stock is undervalued from the valuation ratios perspective. Most of the current valuation ratios are more than two times lower compared to the company’s historical averages.

I am not comparing PayPal’s valuation ratios to the sector median because the company has an unmatched profitability, and I believe that stocks of companies with stellar profitability deserve premium compared to the sector. Moreover, the sector PayPal represents is “Financials”, a mature industry where leading banks demonstrate modest revenue and EPS growth rates. PayPal is not a bank, which makes comparing the company’s multiples to the sector median slightly irrelevant.

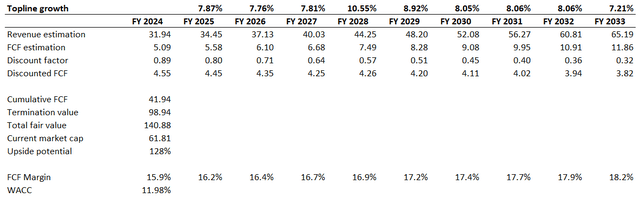

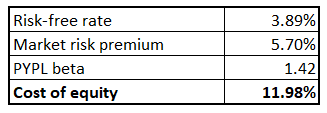

Looking only at valuation ratios is never enough for me. Therefore, I proceed with the discounted cash flow [DCF] simulation and the cost of equity will be the discount rate for my financial model. Below, I calculated PYPL’s cost of equity using the CAPM approach. All variables are easily available on the Internet. PYPL’s cost of equity is 11.98%.

Author’s calculations

I rely on consensus estimates for my revenue growth trajectory assumption. I think that an 8.3% revenue CAGR projected for the next decade is fairly conservative for my DCF. I am also confident with this long-term revenue CAGR, as it is not higher than Statista’s projected 9.52% growth rate for the global digital payments industry for 2024-2028.

I use a 15.9% TTM FCF ex-SBC margin for FY 2024 and project a modest 25 basis points yearly expansion of the metric. I expect the FCF margin expansion to be modest due to the intense competition in the digital payments industry.

The stock is significantly undervalued. My calculations suggest that the business’s fair value is around $141 billion, more than twice as high as the current market cap.

Risks update

Despite another strong quarterly earnings and notable guidance boost, the stock did not rally much after July 30. The stock market is a voting machine over the short term, and it appears that investors are still very cautious about PYPL after the stock crashed in 2022 from its pandemic highs. As we see, it takes numerous quarters for the stock to regain investors’ trust, and investors should be patient.

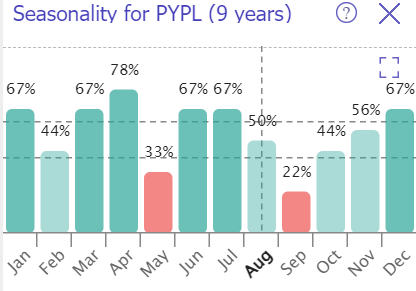

If we look at PYPL stock’s long-term seasonality trends, we can see that September is by far the weakest month for this stock. Therefore, despite substantial undervaluation, it is probable that the stock might show a mild pullback in September.

TrendSpider

The competition in digital payments is intense, which is a significant risk even for such a large player like PayPal. In recent years several technological giants like Apple (AAPL), Amazon (AMZN), and Google (GOOG) entered the market. There are also other younger emerging players like Block (SQ) and Coinbase (COIN) that also overlap with PayPal in some services. PayPal’s pioneering status in the industry gives it a competitive edge, but with such formidable rivals joining the game, there is a risk of losing the market share.

Bottom line

To conclude, PYPL is still a “Strong Buy”. The company demonstrates top line strength coupled with the management’s financial discipline, which ultimately leads to profitability expansion and balance sheet improvements. It appears that the market sentiment is substantially lagging behind PayPal’s rapidly improving fundamentals, as the valuation is still extremely attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.