Summary:

- PayPal’s stock has dropped significantly and is now trading at multi-year lows, presenting a buying opportunity.

- The technical indicators suggest that PayPal’s stock is oversold and could see a rebound in momentum and sentiment.

- Despite a temporary slowdown in user growth, PayPal’s revenues have continued to grow, indicating potential for future growth once the economic situation improves.

JasonDoiy

We’ve seen many exciting buying opportunities throughout the recent bear market phase (especially concerning high-quality tech stocks). We witnessed Meta Platform’s (META) drop below $90 (now above $300). We saw Nvidia (NVDA) fall into our $100-$120 buy-in zone (currently around $450). We saw Tesla (TSLA) crash to our ultra-low buy-in level of around $100 (now about $250). The market often picks on high-quality stocks it detests briefly, revaluing them sharply higher as the sentiment improves in the weeks following the capitulation-style lows.

Now, of course, we see PayPal (NASDAQ:PYPL) trading around multi-year lows. PayPal recently reported Q2 results that were in line with estimates. Nevertheless, despite delivering robust earnings results, the market found a reason to sell the news, enabling PayPal’s stock to drop by around 20% from its recent high.

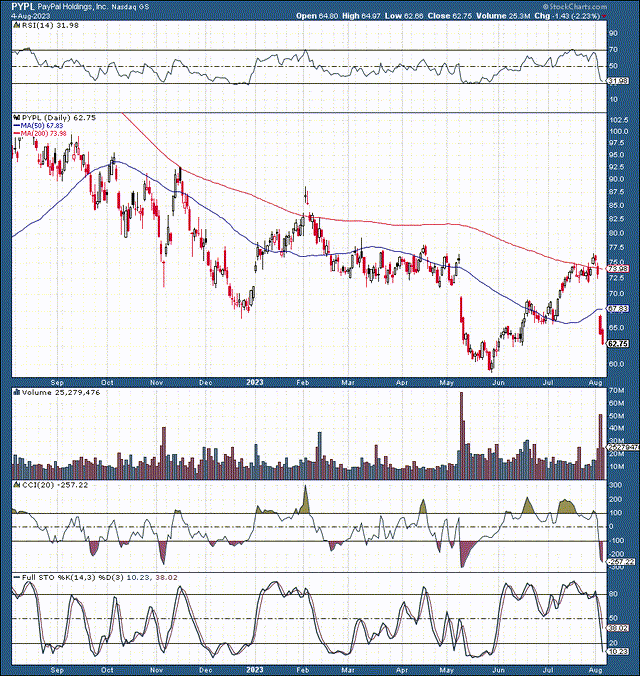

PayPal: 1-Year Chart

PYPL (StockCharts.com)

PayPal’s stock is about 80% below its 2021 all-time high of more than $300 a share. Now we see the stock’s RSI approaching 30, implying PayPal’s shares are substantially oversold. Additionally, the CCI hit negative 200-300, further illustrating the oversold nature of the stock. Also, we have the full stochastic dipping to around 10, implying the momentum and sentiment could become more constructive soon. We’ve also seen substantial downside volume during the recent selloff, indicating capitulation and panic-like selling may have occurred in PayPal’s shares.

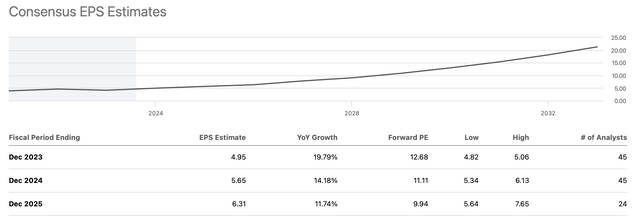

Aside from the technicals, PayPal trades at an abnormally depressed 11 times forward consensus EPS estimates and could be as cheap at ten times forward earnings if PayPal achieves higher-end EPS projections next year of around $6 (I think it will).

Despite the temporary slowdown, PayPal should continue growing revenues and increasing profitability in the years ahead. Additionally, PayPal could have a management shakeup and can cut costs to improve margins, leading to improved profitability and higher EPS. Moreover, the growth risks are exaggerated, as PayPal remains the market leader in global payment processes. The market is overreacting to the economic slowdown, and PayPal’s stock got taken behind the woodshed.

Fortunately, the market’s irrationalism has created an excellent buying opportunity, as PayPal’s stock is dirt cheap right now. Moreover, the company deserves a much higher multiple than the 10-12 times forward earnings we see. PayPal’s stock should go much higher due to increasing revenues and profitability, multiple expansion, and improved sentiment overall.

It’s like Benjamin Graham said – In the short run, the market is a voting machine, but in the long run, it’s a weighing machine. The market is voting no for PayPal’s stock now. However, as the market reprices PayPal, it should weigh its stock price much higher in the years ahead.

PayPal – Another Buying Opportunity Has Arrived

It’s remarkable just how much the market hates PayPal right now. The sentiment surrounding PayPal’s stock is about as bad as I’ve seen. Additionally, We see many hallmark signs of a substantially undervalued company here, and the technical image should improve soon. The stock is approaching a forward-P/E multiple of 10, has significant growth prospects, and its price should not stay down for long. Also, PayPal likely made a long-term bottom around the $60 level, and the downside should be minimal here. We could see PayPal’s stock stabilize in the $60-$65 range and start moving higher soon.

Why The Latest Drop Occurred

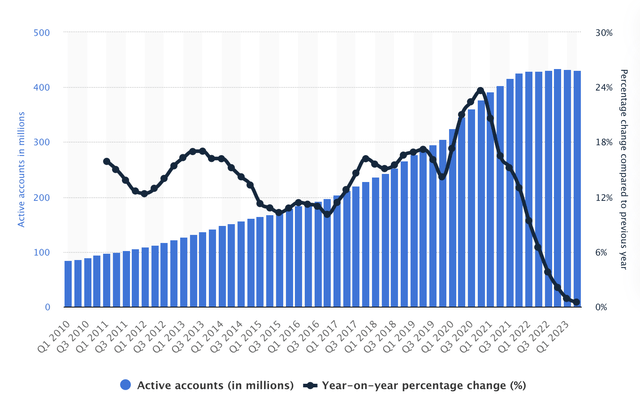

The market found a reason to sell the news concerning PayPal’s stock. The primary reason for the selling pressure was the decline in active accounts, from 433M in March to 431M in June. However, the economy is going through a transitory slowdown. Therefore, it is expected to see active account numbers stall, stagnate, or even decline temporarily during the challenging economic phase.

PayPal Global Users

PayPal user growth (Statista.com )

Yes, PayPal’s user growth has slowed recently. However, PayPal has about 430 million active users globally. Also, user growth could have stalled due to the challenging macroeconomic environment and may return once the global growth outlook improves. Furthermore, I want to emphasize that PayPal’s stock is down by 80% from its 2021 high, and PayPal’s stock is priced for Armageddon, never mind an economic slowdown.

Everything else looks good – PayPal’s non-GAAP Q2 EPS of $1.16 came in as expected. Revenue came in at $7.3B, beating the consensus estimates by $30M, illustrating a YoY increase of approximately 7.4%. Now, I’d like to draw your attention to an interesting phenomenon. Despite active users being flat YoY, revenues grew considerably, implying PayPal’s revenues could continue climbing despite a temporary stagnation in user growth. Additionally, we could see revenues increase more than anticipated once the economic slowdown concludes and PayPal’s user number return to growth.

PayPal’s total payment volume, “TPV,” reached $376.5B last quarter, growing by 11% YoY. PayPal also processed 6.1 billion payment transactions, a 10% YoY increase. PayPal reiterated its full-year 2023 GAAP EPS guidance of $3.49 vs. $2.09 last year, a 67% YoY increase. Additionally, PayPal reaffirmed its 2023 full-year non-GAAP EPS guidance of $4.95. Therefore, we see PayPal is dirt-cheap, trading at only about 12.5 times this year’s EPS estimates.

Also, there’s controversy regarding the recent decrease in PayPal’s gross margin. Many companies, including PayPal, have had to deal with temporary price increases, higher costs, slower growth, and a transitory challenging economic atmosphere. Thus, it’s normal to see margin compression and temporary declines in profitability. We’ve seen this dynamic play out with many top tech stocks over the last year, and it may be PayPal’s turn here. While PayPal is going through a slowdown, its growth outlook should improve. Meanwhile, PayPal’s stock is trading like it’s going out of business, and there’s a significant long-term buying opportunity here.

The Valuation Perspective – Too Cheap to Ignore

PYPL (SeekingAlpha.com)

PayPal should provide about $5 in EPS this year. While consensus estimates illustrate PayPal could earn about $5.65 in EPS next year, higher-end estimates imply PayPal should make around $6 in EPS in 2024. Moreover, PayPal should deliver around $7 (or more) in EPS in 2025, suggesting PayPal’s stock may be trading below a 9 P/E multiple relative to its 2025 earnings expectations.

Revenue growth (SeekingAlpha.com )

Despite the slowdown, PayPal’s revenues should expand by approximately 8% this year and continue growing by about 8-12% in the coming years. Also, we could see better-than-anticipated revenue expansion as the economy improves and growth returns for PayPal. The increased revenues should lead to improved margins and more robust profitability as PayPal advances. Therefore, we could see PayPal’s stock move significantly higher in the coming years.

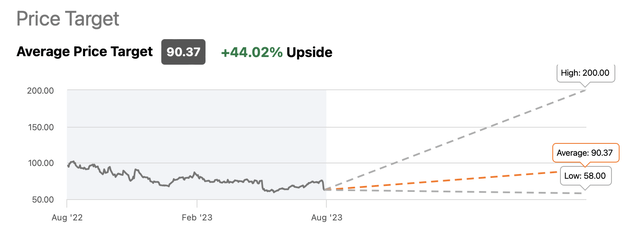

High Reward Potential for PayPal Stock

Price targets (SeekingAlpha.com )

The average one-year price target is approximately $90 for PayPal’s stock. This dynamic illustrates that PayPal could appreciate by around 44% to achieve the consensus estimate in the next twelve months. Moreover, higher-end estimates range up to $200, suggesting PayPal may have much more upside (roughly 222%) in a bullish case outcome. Additionally, we see the lowest price targets are slightly below $60, implying that PayPal’s downside is minimal here and the risk/reward ratio is very high.

Where PayPal’s Stock Could Be Heading

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $29.8 | $33 | $37 | $42 | $47 | $52 | $58 |

| Revenue growth | 8% | 11% | 12% | 12% | 11% | 11% | 10% |

| EPS | $5 | $6 | $7.15 | $8.50 | $10 | $11.80 | 13.85 |

| EPS growth | 20% | 20% | 19% | 19% | 18% | 18% | 17% |

| Forward P/E | 10.5 | 15 | 20 | 25 | 23 | 22 | 20 |

| Stock price | $63 | $108 | $170 | $250 | $272 | $303 | $350 |

Source: The Financial Prophet

Risks to PayPal

Despite having significant growth and profitability prospects, PayPal faces threats. One of the most substantial and imminent threats to PayPal is the increasing competition in online payment processing. Google, Apple Pay, and other platforms continue expanding and could continue taking market share away from PayPal. Additionally, PayPal faces increasing issues due to poor management. PayPal reportedly needs better customer service. Moreover, we see weak profitability metrics as margins decrease due to expanding prices and higher costs. PayPal also has a sentiment problem, and we could see PayPal’s stock stuck in the mud until better sentiment returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!