Summary:

- PayPal’s Q3 results showcased a significant revenue increase to $7.4 billion, marking an 8% YoY growth, surpassing prior quarter performance and analysts’ forecasts.

- Despite a slightly conservative forecast for Q4, PayPal expects 6-7% revenue growth and a 10% rise in non-GAAP EPS.

- PayPal’s international expansion and growth outside the U.S., particularly in Europe and Asia, are positive signs for long-term growth.

- The expected consolidation of the stock price before an uptrend aligns with the 200-day exponential moving average, and breaking through the $75 resistance level could initiate a bull run.

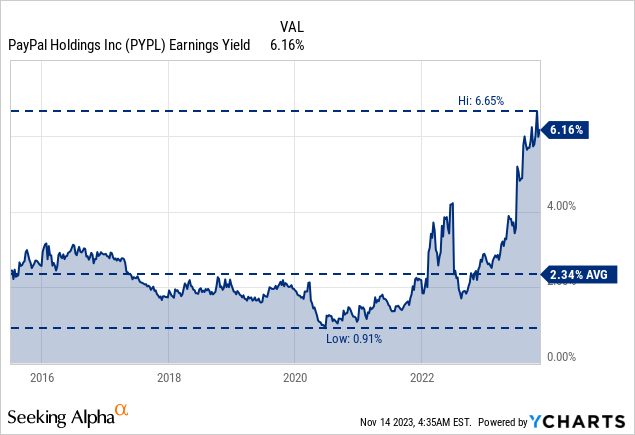

- An earnings yield of 6.16%, near an all-time high, in combination with a lower stock price, makes PayPal an attractive proposition for value investors.

dem10

Investment Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) Q3 results revealed impressive financial progress, with revenues soaring to $7.4 billion—an 8% increase from the previous year, surpassing analysts’ expectations. The adjusted earnings per share (EPS) also exceeded forecasts at $1.30, indicating a positive trend from $1.16 in the prior quarter and marking a significant improvement year-over-year.

Despite a conservative forecast for Q4, with anticipated net revenues and non-GAAP EPS marginally below analysts’ estimates, PayPal maintains a positive outlook, expecting 6-7% revenue growth and a 10% increase in non-GAAP EPS. The full-year projection for 2023 remains upbeat, with a projected 21% growth in non-GAAP EPS to approximately $4.98, up from $4.13 in the previous fiscal year. This forward-looking guidance reflects a strong belief in the company’s profitability and future financial success.

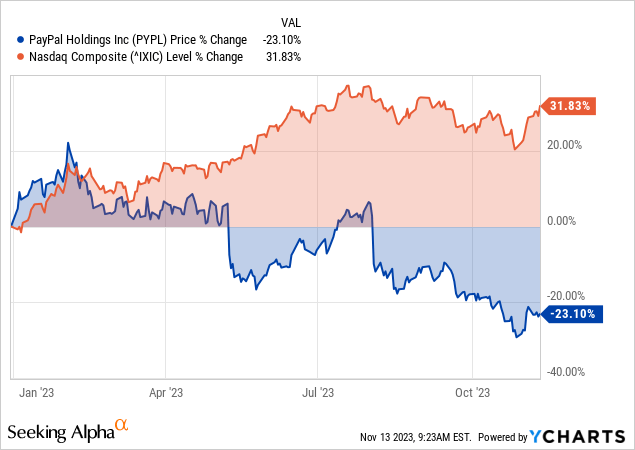

In our previous analysis, we explored PayPal’s fundamentals and showed that we have entered an accumulation phase for the stock, setting up a reversal trend in the short run. PYPL has dropped since then, offering a wider margin of safety, and in combination with the solid Q3 results, the strong buy rating is reaffirmed. The price may consolidate sideways for a few weeks before starting an uptrend towards ~$64 to interact with the 200-day exponential moving average. The stock must break through the resistance level at ~$75 to trigger a bull run.

Transaction Triumph: Q3 Sees Stellar 15% TPV Growth Amid Global Expansion

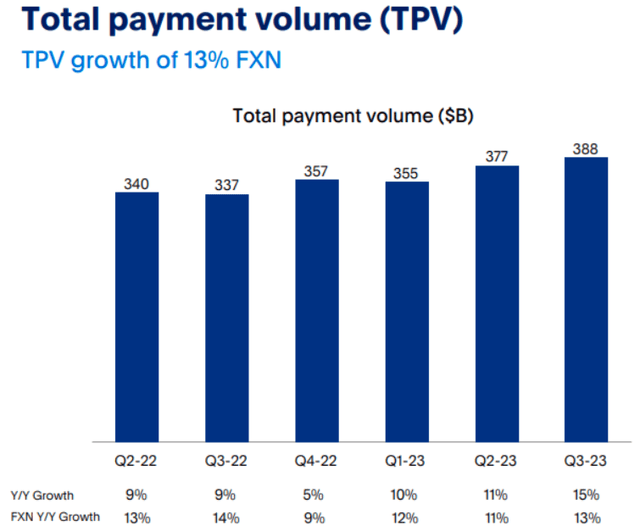

In Q3 2023, PayPal reported a total payment volume (TPV) of $388 billion, reflecting a 15% increase on a spot basis and a 13% growth on a foreign exchange-neutral (FXN) basis, suggesting robust growth in transaction volume. The key takeaway is that PayPal continues expanding its market reach and increasing the overall volume of transactions processed.

The 13% FXN growth suggests that currency fluctuations did not significantly affect this growth, which can be seen as a positive sign for investors. Such growth is typically associated with increased revenues, as PayPal earns fees on the TPV. Therefore, the strong TPV growth positively indicates PayPal’s revenue potential.

Additionally, the P2P TPV, encompassing PayPal, Venmo, and Xoom, grew by 4% to $97 billion, accounting for 25% of the total TPV. While this growth is positive, it is relatively modest, especially compared to the overall TPV growth. The 4% growth suggests a competitive environment or saturation in P2P payments, given that the service has been around for quite some time.

However, the fact that it represents a quarter of TPV demonstrates the continued significance of P2P in PayPal’s ecosystem. While the modest growth in P2P TPV may not be a significant price driver, it still contributes a substantial portion to the overall TPV, which is reassuring.

PayPal’s Earnings Presentation

Further, Venmo TPV experienced 7% growth, reaching $68 billion. Undoubtedly, this is a positive development, especially since it caters to a younger demographic. Venmo’s growth adds diversity to PayPal’s revenue streams, particularly among younger users. Tapping into a younger market can be considered a long-term asset.

Similarly, branded checkout TPV saw an approximate 6% FXN increase, which is relatively steady compared to previous quarters. This consistency in growth suggests that PayPal’s branded checkout service is maintaining its position in the market. Thus, steady growth in branded checkout TPV demonstrates PayPal’s stability and reliability as a payment service provider.

The unbranded processing TPV exhibited substantial sequential growth of approximately 32% FXN, outperforming previous quarters (28% in Q2-23 and 30% in Q1-23). The strong growth indicates that PayPal’s unbranded processing services are in demand.

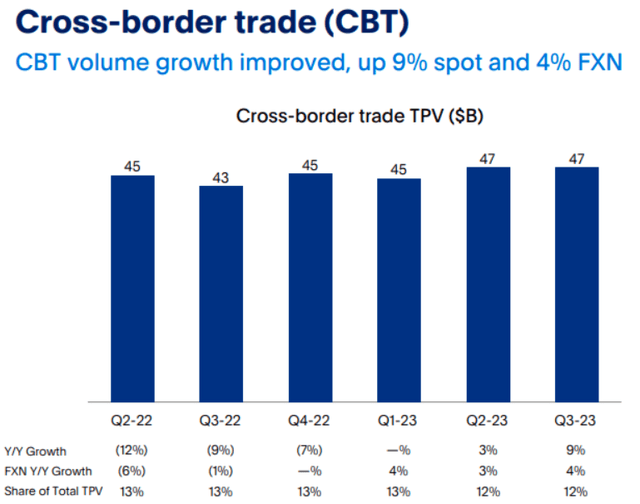

In the same direction, cross-border transactions (CBT) volume growth improved, with a 9% increase on a spot basis and a 4% FXN growth. The growth was driven by intra-European corridors but offset by softness in EU-UK activity. CBT TPV represented 12% of TPV, compared to 13% in Q3-22. Cross-border trade primarily comprises e-commerce goods-related activity and has limited exposure to travel recovery.

Therefore, the improved CBT volume growth, especially within the European corridors, is a positive sign. However, the softness in EU-UK activity might be a concern, as it could be related to ongoing uncertainties such as Brexit.

PayPal’s Earnings Presentation

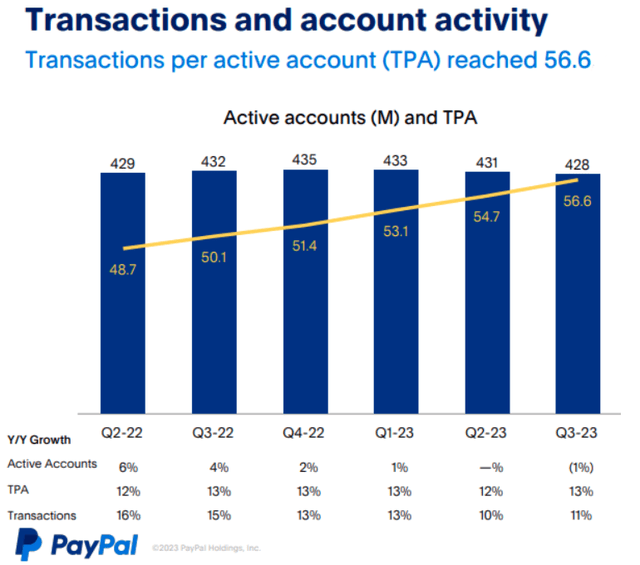

PayPal ended the quarter with 428 million active accounts, including 35 million merchant accounts. The number of active accounts declined by 0.6%, reflecting churn among minimally engaged accounts and the strategic decision to focus on increasing TPA levels among existing active accounts.

However, diving into more details, transactions per active account (TPA) reached 56.6, growing by 13%. This growth is predominantly driven by transaction growth from Braintree, signaling elevated user activity and engagement. Therefore, the decline in active accounts is a counterbalance of the sequential drop in active accounts and can be seen as an effort to optimize the user base for higher engagement and profitability.

PayPal’s Earnings Presentation

Moreover, transaction margin dollars declined by 3% due to negative lapping impacts from lower gains on foreign currency hedges and merchant contractual compensation that did not reoccur in Q3-22. This decline was partially offset by interest on customer balances. However, the decline in transaction margin dollars was mainly due to one-time factors, which may not be a significant concern for investors, especially since it was partially offset by interest income.

Lastly, 45% of active accounts were outside the U.S. as of September 30, 2023. International FXN TPV growth accelerated by 5 percentage points compared to Q2-23, primarily driven by strength in Europe and improvement in Asia. PayPal’s international expansion and growth outside the U.S. are positive signs. Hence, capturing international markets, particularly in Europe and Asia, is a valuable asset for the company.

International diversification can contribute to increased revenues and long-term growth, with the Average Payment Volume (APV) increasing by 3%, mainly driven by foreign exchange translation. Therefore, the APV growth, driven by FX translation, indicates that PayPal is effectively capitalizing on currency fluctuations to increase transaction volume.

Falling Prices + Soaring Earnings = A Golden Opportunity for Value Investors

Despite a decline in its stock value, PayPal has shown a remarkable increase in earnings, leading to an elevated Earnings Yield of 6.16%, near all-time highs. This contrasts with its historical range over the past decade, where the Earnings Yield fluctuated between a low of 0.91% and a high of 6.65%, with an average of 2.34%. Currently, PayPal’s Earnings Yield ranks better than 85% of companies in the Credit Services industry, signifying a solid performance relative to its peers.

However, focusing solely on earnings yield can be misleading, especially for cyclical companies where high yields may peak during business cycle apexes but are not sustainable. A more holistic indicator is the Forward Rate of Return (Yacktman), which for PayPal stood at ~20% for the quarter ending in September 2023. The high Forward Rate of Return further strengthens the attractiveness of PayPal as an investment, considering its potential for growth and profitability in the coming years.

Therefore, the drop in PayPal’s market value, mixed with its strong earnings growth, suggests a wider margin of safety. Investors can buy shares at lower prices, which are potentially undervalued, while benefiting from a company showing robust operational efficiency and promising future returns.

Takeaway

The analysis underscores and supports the accumulation phase (initiated from the last coverage) for PayPal’s stock, suggesting a potential reversal in the short term. The wider margin of safety, combined with solid Q3 results, reinforces a strong buy rating. The expected consolidation of the stock price before an uptrend aligns with the 200-day exponential moving average, and breaking through the $75 resistance level could initiate a bull run.

In conclusion, juxtaposed with soaring earnings and a high Forward Rate of Return, PayPal’s falling stock prices present a golden investment opportunity. The combination of underpriced shares and solid operational performance makes PayPal an attractive proposition for investors seeking value and long-term growth potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.