Summary:

- PayPal has undergone a major management overhaul, and the new CEO has his work cut out for him.

- The company’s stock is historically cheap, with low valuations compared to its past performance and expectations for future earnings growth.

- Despite recent troubles, PayPal’s new management team and attractive valuation create a compelling long-term case for the stock.

Justin Sullivan

Background

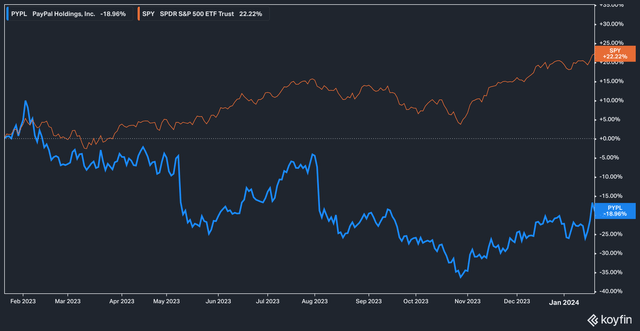

We have been bullish on PayPal Holdings, Inc. (NASDAQ:PYPL) for some time (you can read our prior coverage here, here, and here), but until now it has not been an easy ride: from the time of publication of our first piece of research, PayPal stock has fallen by ~19%, compared with a 22% gain in the broader S&P 500 (SPY).

This underperformance has been applauded by PayPal bears who believe that the company’s offerings are largely undifferentiated from peers and that there is little discernible moat at the company. On some level, perhaps that is true–PayPal was a genuine innovator in the payments space at its debut, but since then a proliferation of competitors have entered the scene.

However, several things keep us bullish on the outlook of the stock, and we’ll unpack those thoughts in this article. Let’s dive in!

Management & Innovation

One thing we pointed out in prior research is the fact that PayPal is currently at the very beginning of a major management overhaul–incoming CEO Alex Chriss has technically only had full reign over the company for less than a month since the company announced that the final string of attachment between PayPal former CEO Daniel Schulman had been cut in the form of Schulman exiting the board of directors on December 31st.

With that in mind, we remind readers that even though Chriss was announced as the successor CEO many months ago, he is newly–and firmly–in charge. While we expected him to move quickly, a handful of moves have transpired in the last 60 days that have raised our eyebrows a bit.

The first was a relatively under-the-radar announcement, first floated in December, was the separation agreement between PayPal and Peggy Alford, who served as Executive Vice President for Global Sales and Merchant Services and had been with the company since 2011. While we won’t speculate as to the nature of the separation, it is nonetheless a very, very big deal. Global Sales and Merchant Services is, after all, the very lifeblood of PayPal’s revenue–the departure of the person responsible for leading that effort is a strong signal to us that under Chriss, things at PayPal will be different.

Other executive changes have been underway as well: CFO Jamie Miller stepped into the role on November 6th, 2023; Archie Deskus was named Chief Technology Officer on November 2nd, 2023; and Susan Kereere took the reigns of Global Markets (to replace Alford) effective January 1st, 2024.

Kereere’s announcement is notable for her background: she most recently led Fiserv, Inc.’s (FI) merchant business following leadership stints at Visa Inc. (V) and American Express Company (AXP). In other words, Kereere is an executive well-versed in the merchant services world where PayPal wants to capture market share.

The second move from Chriss which has made waves is the announcement that on January 25th, PayPal will host a keynote address on the company’s plans for the future. While a keynote address isn’t exactly revolutionary, we think the quickness of the announcement shows that management is serious about selling (with a sense of urgency, no less) the new vision for PayPal.

The fact that the keynote is scheduled just ahead of the company’s next earnings (February 7th), where management will presumably provide 2024 guidance, is also notable. While of course we cannot know exactly what will be the subject of the keynote, some commentators believe that it will be largely dedicated to the application of A.I. to PayPal’s formidable roster of merchants and clients, which is likely to reduce authorization and payment friction.

Valuation & Expectation

No matter how you slice it, PayPal is historically cheap.

In the last three years, PayPal’s forward P/E estimates have fallen from just above 65x to ~12x today, while forward EV/EBITDA estimates have declined from 45x to 9x. While we can agree that the market previously assigned ludicrously high valuations to PayPal in the past, we are inclined to think that today’s valuations are similarly ludicrous given the fact that no major disaster has beset the company. Indeed, in our opinion, the only thing the company has fallen short of at this time is losing a bit of ground to competitors, something which the aforementioned new management team will certainly aim to claw back.

Analysts, for their part, have yet to change their tune meaningfully on the stock. Of the 47 analysts who cover PayPal, 24 rate it a Hold, 16 a Buy, and 7 a Strong Buy, with no analysts having a Sell or Strong Sell rating as of this writing.

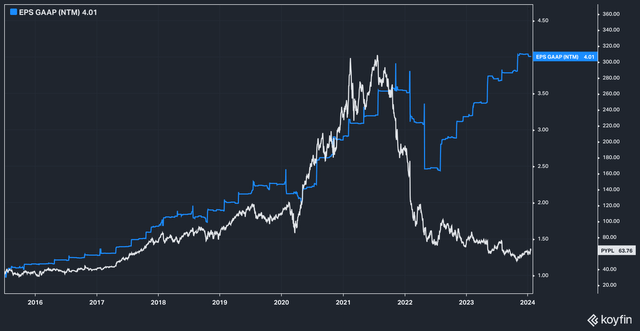

PYPL Stock vs GAAP EPS Expectations (Koyfin)

What is most interesting about this is the fact that, since the stock began its long descent, forward earnings expectations have recovered (on a GAAP EPS basis) from their lows in mid-2022 and now exceed their prior high while the stock was richly valued.

We do not think that the stock will fully regain its former glory any time soon, but the growing chasm between the stock’s price and the company’s EPS growth seems to be moving in opposition–something we think isn’t likely to last forever. It also further reinforces our idea that PayPal is not a broken company, but rather that investors are down on the stock, thereby creating a potential value play.

The Bottom Line

PayPal has had its share of troubles in the last three years, without a doubt. However, a newly refreshed management team is finally in place that is set to renew the company’s vision and, hopefully, reinvigorate investors on the company’s prospects. That, combined with the company’s historically cheap valuation, creates a compelling scenario for us, and we remain bullish on the outlook for PayPal in the long term.

Risks to our thesis include failure to continue to adapt to a changing merchant/customer payment ecosystem, or excessively conservative guidance from management, which would be likely to create near-term downward pressure on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations—buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgment at the time of writing and is subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.