Summary:

- PayPal reported third quarter results and although results were still solid, growth is slowing down a bit.

- Over the long run, I assume that PayPal will continue to grow its top line and improve its margins.

- Additionally, PayPal is using share buybacks in an aggressive, but clever way.

- The stock remains a “Buy” and is still undervalued.

serg3d

After PayPal Holdings, Inc. (NASDAQ:PYPL) was almost declared dead and a terrible investment in the last few quarters (after the stock declined more than 80% from its previous all-time high), it seems now like sentiment is slowly turning around and everybody seems to get more bullish on the financial technology company.

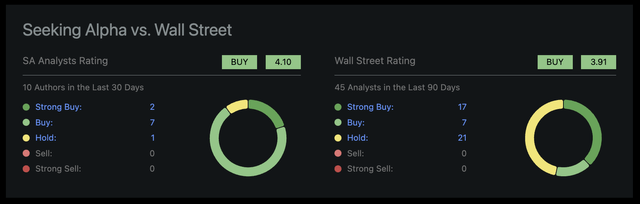

Not only are Wall Street analysts rather bullish, Seeking Alpha analysts are also somewhere between bullish and very bullish. Additionally, the Seeking Alpha Quant Rating is also at 4.85 (out of 5) and is therefore flagging PayPal as a “Strong Buy” at this point.

I have been bullish about PayPal for several quarters and while I might have been bullish too early, I don’t think I was wrong in the long run. And since my last article was published in August 2024 in which I argued that the bears are getting it wrong, the stock increased another 10% and is now 60% above its bottom around $50 and gained 53% in the last twelve months.

Last week, PayPal reported its third quarter results and although investors seemed a little disappointed by the results (as the stock dipped a little bit), I will explain once again why I think the company from San Jose will continue its turnaround and climb higher in the coming quarters.

Quarterly Results

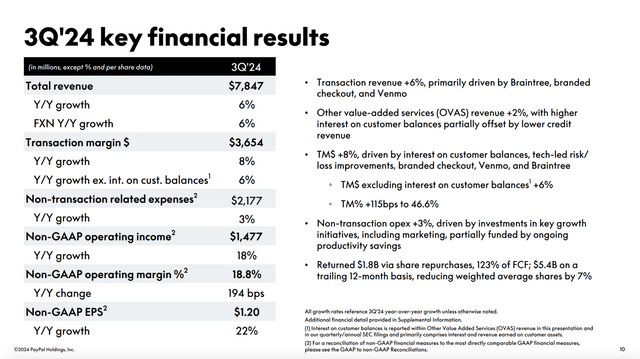

We start by looking at the third quarter results for fiscal 2024 and while PayPal did beat expectations for earnings per share, it missed revenue estimates by $90 million. Revenue increased from $7,418 million in Q3/23 to $7,847 million in Q3/24 resulting in 5.8% year-over-year growth. And while the top line grew only in the mid-single digits, operating income increased 19.1% year-over-year from $1,168 million in the same quarter last year to $1,391 million this quarter. Diluted net income per share increased from $0.93 in Q3/23 to $0.99 in Q3/24 – resulting in 6.5% year-over-year growth. And finally, free cash flow increased 31.2% year-over-year from $1,101 million in Q3/23 to $1,445 million in Q3/24.

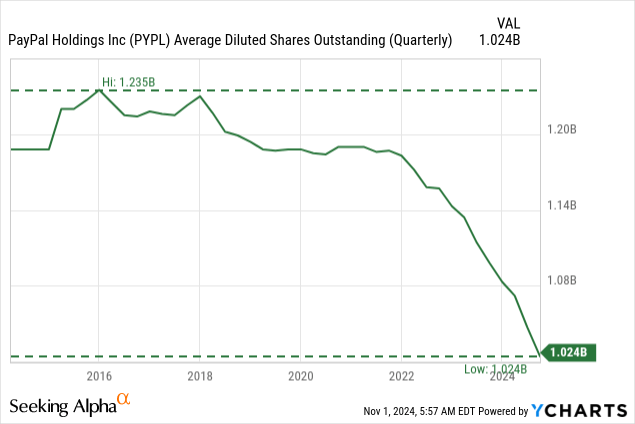

Interestingly, net income declined by $10 million from $1,020 million in Q3/23 to $1,010 million in Q3/24. Earnings per share increased only due to the declining number of outstanding shares. I have mentioned several times that share buybacks are important for PayPal and I also pointed out several times that share buybacks are a good strategic move in my opinion. In the last twelve months, the number of diluted shares outstanding decreased from 1,098 million in Q3/23 to 1,024 million in Q3/24 – a decrease of 6.7% in only twelve months. And during the last 12 months, PayPal spent about $5.4 billion on share buybacks.

We can look at further metrics that are important for PayPal. Revenue is split up in two different segments: on the one side, we have transaction revenue which increased from $6,654 million in Q3/23 to $7,067 million in Q3/24 (resulting in 6.2% year-over-year growth) and revenues from other value-added services, which increased from $764 million in Q3/23 to $780 million in Q3/24 (resulting in 2.1% year-over-year growth).

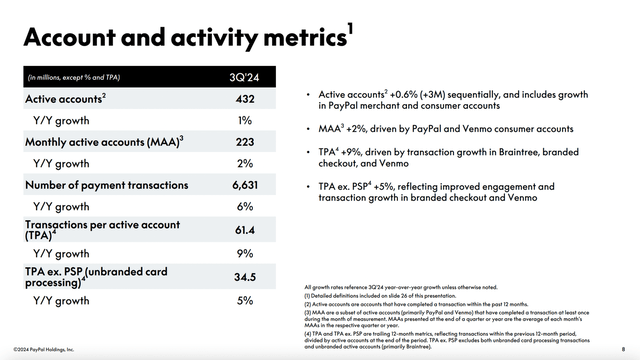

One of the bigger issues in the last few quarters was the number of active accounts, which was stagnating or declining. But now, the number of active accounts increased a little bit from 428 million in Q3/23 and 429 million in Q2/24 to 432 million in Q3/24. It is now the third consecutive quarter with a growing number of active accounts. Aside from active accounts, we can also look at the number of monthly active accounts, which increased from 218 million in Q3/23 to 223 million in Q3/24 – resulting in 2.3% year-over-year growth.

Additionally, the total payment volume increased 9.0% year-over-year from $387,701 million to $422,641 million. And payment transactions per active account increased from 56.6 in Q3/23 to 61.4 in Q3/24 – resulting in 8.5% year-over-year growth.

Growth Slowing Down

When looking at the growth rates above, we still see operating income and especially free cash flow growing at a high pace. And top line growth is still solid, but when looking at the last few quarters, we can see growth slowing down.

|

Growth year-over-year |

Revenue |

Total Payment Volume |

Total Active Accounts |

|

Q1/23 |

8.6% |

9.8% |

0.9% |

|

Q2/23 |

7.1% |

10.8% |

0.5% |

|

Q3/23 |

8.4% |

15.1% |

-0.9% |

|

Q4/23 |

8.7% |

14.7% |

-2.1% |

|

Q1/24 |

9.4% |

13.9% |

-1.4% |

|

Q2/24 |

8.2% |

10.7% |

-0.5% |

|

Q3/24 |

5.8% |

9.0% |

0.9% |

A problem we can see, is total payment volume growth slowing down. In Q3/23, total payment volume increased 15.1% year-over-year and in Q3/24 growth was only 9.0%. And revenue growth also slowed down – while revenue growth in previous quarters was mostly in the high single digits, it was only in the mid-single digits in Q3/24.

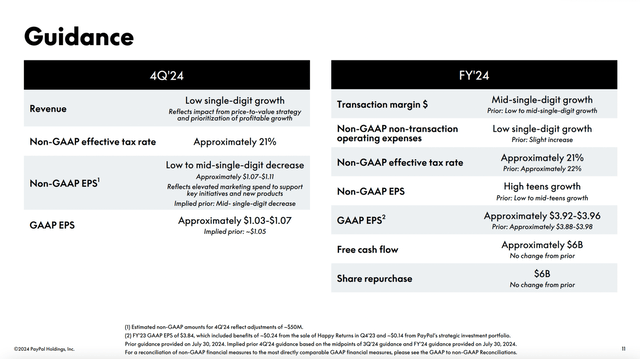

Aside from growth slowing down in the last few quarters, PayPal is also expecting low growth rates for the fourth quarter. In Q4/24, revenue is expected to grow in the low-single digits.

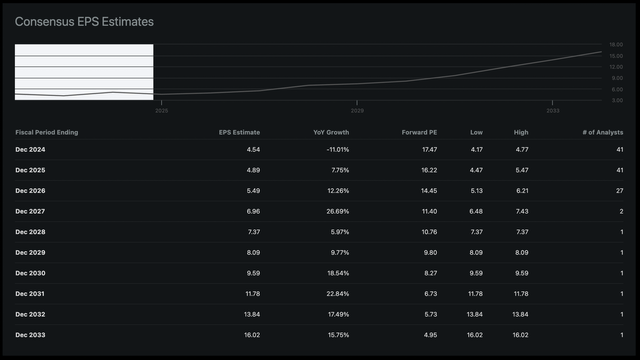

But while management is not so optimistic for fiscal 2024, the picture is different when looking at analysts’ expectations for the next decade. We cannot only see that analysts are getting a little bit more optimistic again and are increasing estimates slightly. We also see analysts expecting high growth rates in the next ten years and between fiscal 2023 and fiscal 2033 analysts are expecting a CAGR of 12.13%.

Consensus EPS Estimates for PayPal (Seeking Alpha)

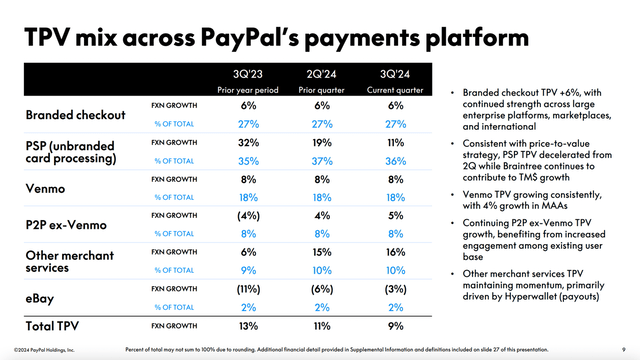

When looking at these rather high growth rates, we have to ask where this growth should come from, and we can look at several different drivers of growth. We start with the top line, which is the most important driver of long-term growth. And while eBay was still declining year-over-year, it is only responsible for 2% of total payment volume and therefore not really an issue. Revenue is especially stemming from Branded Checkout, which is responsible for 27% of TPV and from PSP (unbranded card processing), which is responsible for 36% of TPV.

And while branded checkout has grown 6% in the last few quarters, unbranded card processing is still growing 11% in Q3/24, but growth slowed down from 32% in the same quarter last year. Aside from these two, Venmo is also responsible for almost one fifth of total payment volume and grew 8% year-over-year in the last quarter.

In case of Braintree – the unbranded card processing – management is expecting lower near-term revenue in Q4/24 as well as in 2025. But over the long run, management is expecting revenue growth to accelerate again. And aside from the unbranded checkout, which has been a driver of growth for PayPal in the past, high hopes rely especially on Venmo. During the last earnings call, management stated:

With Venmo, we’re making progress in executing our strategy to shift from solely a P2P service to a central part of consumers’ financial lives. Our new leadership team is taking a fresh look at Venmo, and we’re completely transforming and upgrading the user experience. We know that we inherited one of the strongest P2P brands and see an opportunity to prioritize innovations that unlock Venmo’s value. We believe that Venmo will eventually have multiple monetization levers.

And in the short term, management is seeing two meaningful contributors to higher revenue for Venmo. A first contributor could be the Venmo debit card as the company is still in the early days of driving adoption, but the trends are encouraging, and monthly active debit card accounts grew 30% in the quarter. This is especially worth mentioning as the average revenue per account is 4 times that of all Venmo accounts. And a second way to contribute to growth is Pay with Venmo, which is a seamless way to pay online.

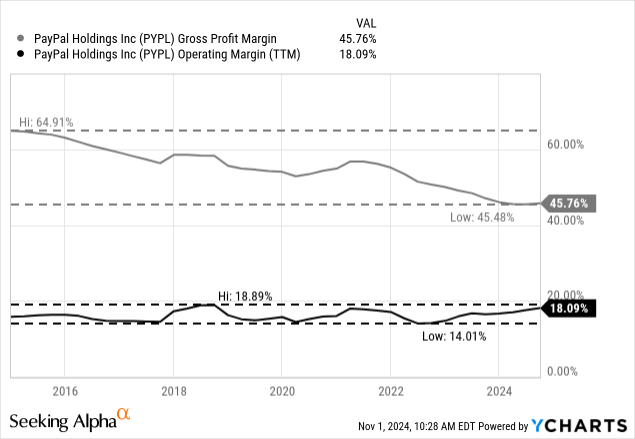

A second driver of growth can be improving margins. When looking at the numbers in the last few years, we actually see gross margin constantly declining. Operating margin, however, seems to improve slightly and, in this case, an improving operating margin is more important. Over the long run, management is focusing on margin improvement, and we can actually be optimistic that operating margin will improve in the years to come.

A third and final driver of growth are share buybacks and as I already mentioned above, management is using share buybacks in an excessive way right now. And as long as PayPal remains undervalued (we will get to this) I would also argue for share buybacks to continue. In the recent past, PayPal spent almost its entire free cash flow on share buybacks and if management continues to do so, it can spend at least $5 billion annually on share buybacks. With a current market capitalization of $80 billion, this is enough to repurchase 6.25% of shares within 12 months. Additionally, we can also mention $7,272 million in cash and cash equivalents as well as $4,647 million in short-term investments and in theory, PayPal could use parts of this amount for share buybacks as well. We should not forget that PayPal has $9,976 million in long-term debt and at some point that debt has to be repaid.

When combining these three – top line growth, potentially improve margins slightly and share buybacks, PayPal should at least be able to grow in the high single digits.

Buy Now, Pay Later As Risk

I have already discussed Buy Now, Pay Later in previous articles and underlined that it is a way for PayPal to increase revenue and sustain growth. The company does not disclose numbers regularly and I could not find much data. In 2022, PayPal reported a total transaction volume of $20 billion that was paid with BNPL. In October 2023, PayPal disclosed that the BNPL volume increased by 900% since the launch in November 2020, but without knowing the numbers in November 2020, we can not really calculate absolute numbers.

And while BNPL might offer a huge growth opportunity, it might also pose a risk for PayPal. First, the risk for fraud and credit default risk is much higher for PayPal. When PayPal is only processing transactions, the risk for PayPal is very limited (similar to Visa Inc. (V) and Mastercard Incorporated (MA), which are only processing the payments but are not exposed to the default risk). On the one side, the risk for fraud is higher as PayPal wants to offer everybody a quick seamless payment process. And such a process with lowered standards of background checks is increasing the risk of becoming a fraud victim.

Additionally, it is also increasing the risk of lending money to people which are not really credit-worthy. Of course, we are often talking about small amounts of money as these purchases are often only for $50 or $100, but BNPL is also available for amounts of $1000 or $2000 and for example when travelling people are using it. And while the damage from one person defaulting is very limited, the huge amount of customers is also posing the risk of a larger number of customers defaulting. I don’t know if the comparison is accurate, but in my opinion, we can compare BNPL to credit cards in several ways and the default rates might be similar.

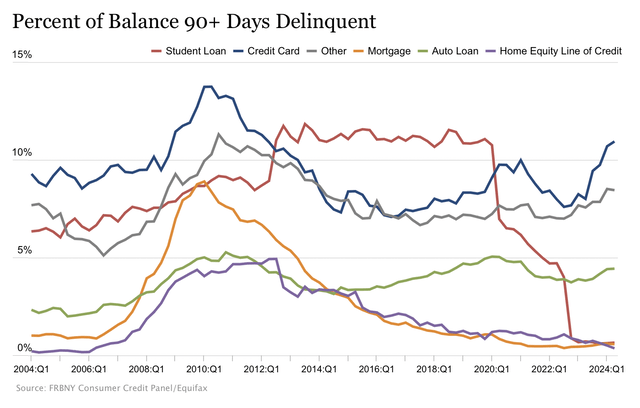

Household Debt and Credit Report

And according to the latest Household Debt and Credit Report, the default rate for credit cards was 10.9% in the second quarter of fiscal 2024. If the default rates for BNPL are a similar high, we are actually talking about potentially billions of dollars for PayPal – in 2022, it would have been about $2.2 billion at risk, and now the amount is probably much higher.

A second major risk we should mention are the regulatory headwinds that might lower profitability. Regulators are obviously arguing similarly and see BNPL also very similar to credit cards and want the companies – including PayPal – to be treated the same way with the same rules. In May 2024, the U.S. Consumer Financial Protection Bureau issued an interpretive rule that will treat BNPL lenders essentially as credit-card issuers. The Financial Technology Association is suing the U.S. Consumer Financial Protection Bureau to block that new rule, and we probably have to wait and see what will happen in the coming months and quarters.

Intrinsic Value Calculation

And although PayPal’s stock price has moved slowly away from its previous bottom, I don’t think we should call the stock expensive. At $300, PayPal was clearly expensive, and it will certainly take a few more years before such a stock price could be justified. And while we should not take $300 as a psychological anchor, we should also not take the bottom around $50 as an anchor and argue that the stock increased already 60%.

In the end, we always must determine an intrinsic value by using a discount cash flow calculation or look at least at simple valuation multiples. Using stock prices from the past as anchors and to argue what stock price might be reasonable is always wrong in my opinion. We all know that stock prices are driven by sentiment, and sentiment is driving stocks to extreme highs and lows – meaning that a stock is often overvalued as well as undervalued. And in the case of PayPal, I would argue that PayPal was overvalued at $300 and undervalued at $50. And both prices are not a good basis to use for comparing stock prices.

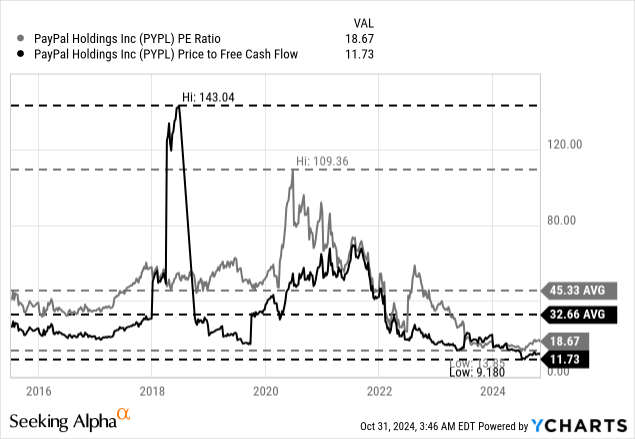

Currently, PayPal is trading for a price-earnings ratio of 18.7 times earnings. And this is certainly not cheap, but it is certainly not expensive considering the growth rates PayPal was reporting in the last few quarters. And especially the price-free-cash-flow ratio is extremely low with PayPal trading only for 11.7 times free cash flow. And for a business growing at least in the mid-to-high single digits, this is still indicating a bargain.

Additionally, we can also use a discount cash flow calculation to determine an intrinsic value. As always, we are calculating with a 10% discount rate and with 1,024 million diluted shares outstanding. And as basis for our calculation, we can use the free cash flow of the last four quarters. We could either use the reported number of $7,045 million or the adjusted number of $5,310 million. And as I am rather cautious, I would rather use the lower, adjusted number as basis for our calculation.

For starters, PayPal must grow between 3% and 4% from now until perpetuity in order to be fairly valued. But in my opinion, we can argue for a higher growth rate in the next few years. We could be optimistic and assume 12% growth – in line with analysts’ assumptions – for the next ten years, followed by 4% growth until perpetuity. This leads to an intrinsic value of $147.29 for PayPal and the stock would still be clearly undervalued.

Of course, 12% growth seems rather optimistic when looking at the reported numbers in the last few quarters, but even when assuming growth rates that are a little lower, we still get an intrinsic value of at least $100 to $120 and in my opinion, PayPal clearly is a “Buy”

Conclusion

In my opinion, PayPal remains a “Buy” – maybe even a “Strong Buy”. But with growth rates slowing down a bit and a recession being on the horizon, I would be a bit more cautious about the next few quarters. Nevertheless, the stock price of $80 is still not justified for PayPal – even if we assume lower growth rates in the next few quarters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.