Summary:

- PayPal’s stock has underperformed the S&P500 due to declining active accounts, declining margin, and lower take-rates. But these trends are not as bad as they seem.

- There is potential for Mr. Market to regain enthusiasm for PayPal due to healthy growth in TPV and new executive leadership.

- PayPal’s business is solid and expected to continue growing revenues and earnings, with over 20% EPS growth expected in the medium to long term.

- PayPal is trading at 15.7x P/E on guidance for 2023, and 11.3x EV/FCF based on last 12 months of cash flows. Applying this P/E multiple to my EPS estimate of ~$5.5 yields a stock price of $86, for a nice 40% return.

- The major risks here are big fallout in take rate, active accounts, and a poor capital allocation decision by the new leadership team.

Justin Sullivan

PayPal Holdings (NASDAQ:PYPL) is a battleground stock that has underperformed the S&P500 this year. Mr. Market has not been pleased with PayPal’s stock, most likely because of declining active accounts, declining margin, and lower take-rates.

However, I can see a future where Mr. Market regains enthusiasm for PayPal, as there is still a healthy growth in TPV, a key driver of the business. Additionally, the new executive leadership could act as a catalyst that turns around stock performance.

To be clear, I do not see PayPal’s business as a turnaround story. Quite the opposite, PayPal is a solid business that has consistently grown revenues and earnings. I’d expect that to continue over the medium to long term, leading to over 20% EPS growth.

This article dives first into revenue growth and its key drivers. Then explores the cross currents of expenses, as PayPal is experiencing expense pressure on transaction expenses, but doing better at managing non transaction expenses. After that, I discuss revenue and earnings expectations going forward, as well as valuation and risks of investing in PayPal.

Earnings Results in Q3 and Year to Date

PayPal reported Q3 earnings results that were better than expected, as both revenue and earnings rose. Total revenue increased by 8% Y/Y, and TPV (total payment volume) increased by 15%. Active accounts decreased by 1% Y/Y, and GAAP EPS declined by -19% Y/Y to $0.93. Non-GAAP EPS rose +20% to $1.30. Adjusted free cash flow was quite strong at $1.9 billion.

Although GAAP EPS declined in Q3, it is worth noting this is up by ~50% year-to-date. The executive team expects EPS to end the year at $3.75, which would be up by ~79% from last year.

Looking into the future, I see PayPal’s EPS could grow to the $5.50 range over the long term. More on how I got here later in the article.

Higher Revenue but Lower Take Rate

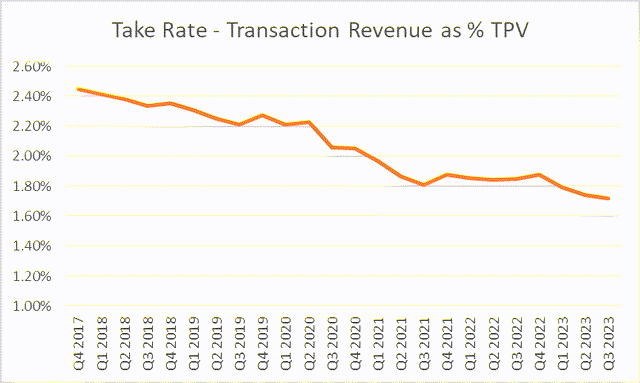

Notice that while revenue growth is quite healthy, it is growing slower than TPV. Why is that? That is because the take rate is moving lower, and this is a key challenge that PayPal needs to overcome.

Take rate is defined as transaction revenue as percentage of TPV. In Q3, PayPal processed $388 billion in TPV, and reported transaction revenue of $6.6 billion. Those results translate into a take rate of ~1.72%, lower by ~2 bps sequentially.

PayPal’s take rate has been declining for many years, as shown in the chart below.

PayPal filings, author calculations

The silver lining this quarter is that the rate of decline in take rate has slowed down, and the hope is that take rate stabilizes soon. The take rate decline is most likely driven by TPV migrating towards lower priced payment channels, such as Venmo and/or Braintree.

Lower Active Accounts

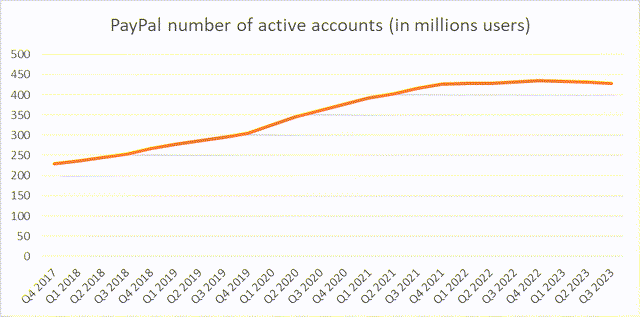

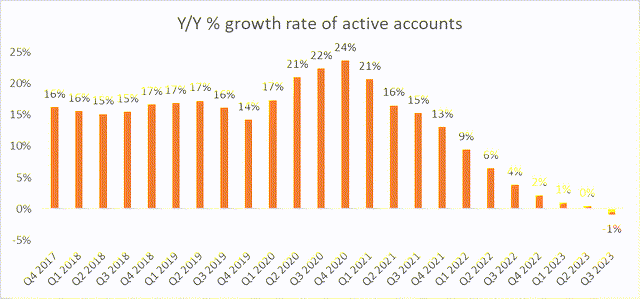

PayPal reported that there are 428 million active accounts, which is a 1% decrease Y/Y. As explained in my previous article, I believe that the decline in active accounts has been the major driver of poor stock performance, as Mr. Market rewarded the stock when active accounts were accelerating in 2021 (and the stock hit all-time high price of ~$308 per share).

The two charts below show the trend in active accounts, as well as the Y/Y growth rate.

PayPal Filings PayPal Filings, Author Calculations

This is the first decline in active accounts reported in a long time. However, I am not particularly worried about the decline in active accounts because it is a deliberate strategy by the executive team. As stated by the acting CFO in the earnings call:

“During the quarter, active accounts declined by 2.8 million as we continue to flush out low-quality customers, predominantly in Latin America and Southeast Asia. As a reminder, we said this would be a year where we churn off lower-quality actives and, in which, total accounts would decline.”

Simply said, PayPal is churning accounts that don’t generate as many transactions (and revenue), and as a result, active accounts are declining. That raises an important question. Are the accounts staying in PayPal’s network generating higher transaction volume?

The answer to that seems to be yes. I say this because of two reasons:

- TPV is growing, as discussed above.

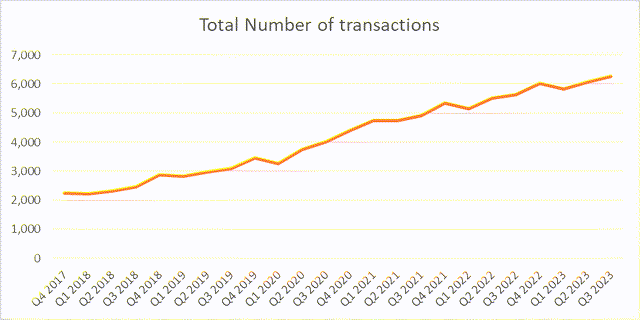

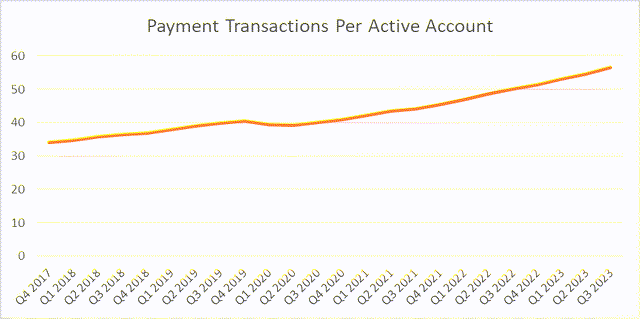

- The total number of transactions is growing, which means the accounts that are staying are generating higher transaction volume. We can see this by looking at PayPal’s total number of transactions and transactions per active account, which is shown in the two charts below.

The data says PayPal processed 6.3 billion transactions last quarter, this was up 11% Y/Y. This means PayPal generated ~57 transactions per active account, which is up 13% Y/Y.

So yes, the accounts staying are increasingly relying on PayPal’s products and services. This is good, as it supports an optimistic outlook for the business.

Operating Expenses Cross Currents

When analyzing PayPal’s business, there are many expenses to keep in mind. However, these expenses can be categorized in two buckets:

- Transaction related expenses.

- Non-transaction expenses that support the business, comprised of marketing, sales, R&D, etc. It’s fair to think of these as overhead.

I’ll discuss the two buckets in more detail.

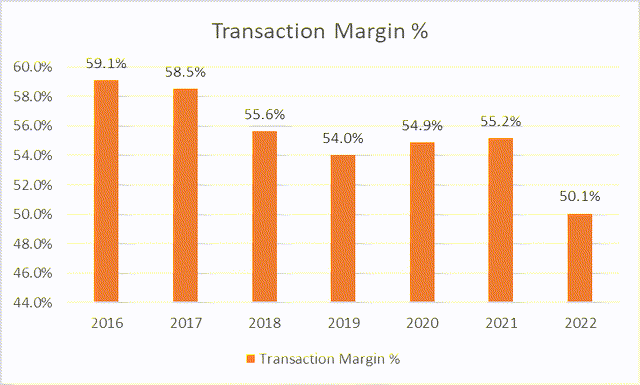

Transaction expenses have been a headwind for PayPal because it is growing faster than revenue. Transaction expenses grew by 21% Y/Y and credit losses grew by 22%, both faster than the total revenue growth of 8%. This trend means that the transaction margin, the amount of money made for each dollar of transaction revenue, is declining.

The transaction margin was 45.4% in Q3 and declined by 50 bps sequentially. Transaction margin has also been declining for years, as shown in the chart below.

PayPal filings, Author calculations

Transaction margin is an area that PayPal’s new leadership needs to improve. Transaction margin has been going down for years, with a particularly large decline in 2022, as shown in the chart below.

To offset transaction expenses, non-transaction expenses have been trending much better. They declined by 3% Y/Y in Q3, which is great because it shows results from the executive team’s cost-cutting initiatives.

While the transaction expenses have been rising fast, non-transaction cost-cutting efforts have been enough to drive the operating margin higher by 20 basis points sequentially. By letting accounts churn and focusing on higher revenue generating accounts, PayPal is offsetting the margin pressure that’s coming from higher competition. All of this is leading to healthy EPS growth this year.

New Leadership

PayPal recently hired Alex Chriss as CEO, and Jamie Miller as CFO. The most recent earnings call was the first one for Alex Chriss as CEO of PayPal, and my assessment of his comments is quite positive because of two reasons.

First, I believe the risk of mistakes in capital allocation moved lower after hearing his vision for the company. During the earnings call, he alluded to focusing on internal operations and execution, rather than looking for acquisition opportunities to increase revenues and profits. I believe this greatly reduces the risk of a large M&A transaction, as those tend to be value destructive. Admittedly, this was my fear.

Second, I believe he’s laser focused on margin stabilization and profitable growth. That means active accounts should continue to decline, but that’s fine if margins stabilize. On the call, he said “we will be guided by margin-accretive revenue growth”. Mr. Market will be watching margins closely, and likely to turn more optimistic on the stock if margins improve.

Overall, executive leadership transitions can be tricky, and this is a risk. But it seems to me that the new CEO is quite focused on the right things, and more likely than not to have a positive impact. His actions and results could be the catalyst the stock needs to turn around performance.

Expectations for Medium and Long Term

The following comments will be focused on GAAP EPS, as opposed to non-GAAP EPS. The major difference between GAAP and non-GAAP EPS is stock based compensation, which is a real expense that cannot be ignored.

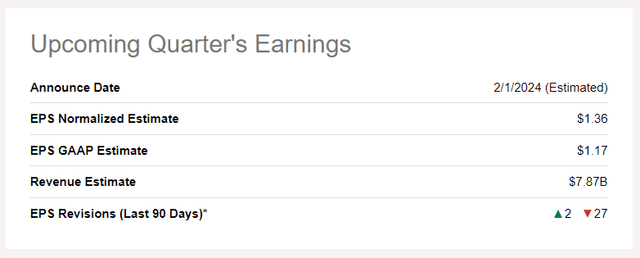

The executive team expects to generate $3.75 in EPS this year, which implies $1.20 EPS in Q4. Consensus expectations are at $1.17 currently, implying that if earnings come in as the executive team expects, then PayPal will deliver another earnings beat next quarter.

However, the results next quarter are probably not as important as the outlook for future years. A quick review of 2022 numbers should put some context (readers that know PayPal well can probably skip this part).

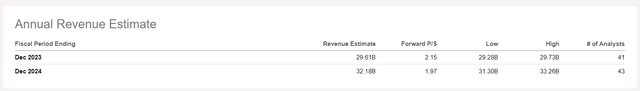

PayPal generated $27.5 billion in revenue in 2022 and is on track to generate somewhere in the range of $29.3 to $29.7 billion in 2023.

Transaction expenses were $13.7 billion (transaction margin ~50% as shown above), and non-transaction expenses were $9.9 billion in 2022.

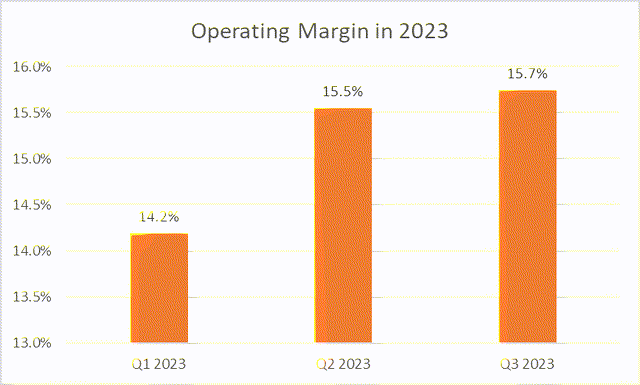

Operating income was $3.8 billion in 2022 for an operating margin of about 14%. The appealing side of PayPal is that operating margin is already trending higher in 2023, as shown in the chart below. PayPal is a margin expansion story.

PayPal filings, Author calculations

Over the next 5 years, I would expect the transaction margin to remain challenged, but eventually stabilize at 45% as lower profitable accounts are churned. I’m expecting non-transaction expenses to be the tailwind to operating margin, as those should grow slower than revenue.

With TPV growing at double digits (driven by Braintree and Venmo), I’m expecting revenue growth to stay around the 7-8% range it’s been in. After all, PayPal does have a pretty strong position in the payments industry. The take-rate will probably stay challenged, and I’d expect that to keep declining towards the ~1.5% range (from 1.72% in Q3).

PayPal’s free cash flow profile is rather stable. If management continues to redeploy buybacks (and does not waste precious free cash flows into value destructive investments), PayPal could repurchase around ~30% of shares outstanding, assuming ~$4 billion in repurchases each year for the next 5 years.

Altogether under these assumptions, I believe PayPal could grow EPS to around $5.5 over the next 5 years, for a CAGR of ~22% with 2022 as the starting point. Simply doing what it’s doing, PayPal is on track to clip EPS growth at quite healthy levels in my view.

Valuation

Under the fundamentals described above, PayPal’s valuation is a compelling argument for the stock.

PayPal trades at ~$59, or 15.7x P/E on the EPS guidance of $3.75 for 2023. Applying this very same multiple to my earnings estimate of $5.5 yields a stock price of approximately $86, for a nice 40% return.

The P/E ratio of the S&P500 is 20.4x according to The Wall Street Journal, so PayPal is cheaper than the market today. Of course, any multiple expansion assumption would make the case for buying PayPal even more compelling. Applying the S&P500 multiple yields a stock price of about $114.

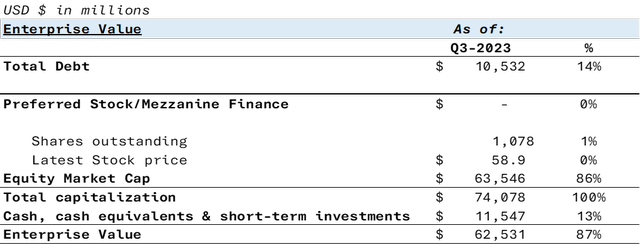

In addition to an attractive P/E multiple, PayPal is also trading at a highly attractive EV/FCF of just 11.3x on $5.5 billion in free cash flow generated in the last 12 months. This means PayPal is trading at quite an attractive free cash flow yield of about 8.8%. The enterprise value calculation is shown below:

PayPal filings, Author calculations

Important Risks to Keep in Mind

There are several risk factors that could derail my optimistic outlook and investment in PayPal. As I see it, the most important risks to keep in mind are as follows:

Take-rate moving down well below the 1.5% range, and getting there quickly would be catastrophic for the stock. I am expecting take-rate to move lower by about 7 bps per year, on average. But if take rates move lower faster than that, it won’t be good for the stock.

Active user growth eventually stabilizing (and ideally growing), and PayPal’s ability to keep the accounts that generate the most transactions at healthy margins. I expect PayPal to lose 2% of its active accounts each year, but if they lose more than this, it won’t be good for the stock.

Out of control transaction expenses could be a blow for the stock. For the margin growth story to play out, transaction margin must stabilize at some point. If it keeps moving lower, then it cannot be good for the stock.

Let’s also recognize that non-transaction expenses could also derail the story, though these expenses should be more controllable by the executive team, in my opinion.

Corporate taxes under a tight US government budget are a serious risk in PayPal (and most equities in the US). The US government has a bloated budget and high debt load, so it could decide to raise corporate taxes to raise more money, though politically this isn’t a popular move. For the $5.5 in EPS I mentioned above, I am assuming a stable effective tax rate of 23%.

And of course, the executive team could make mistakes. As mentioned above, this is a new executive team and that is a risk.

Investor Conclusion

PayPal stock has an interesting return potential of ~40% if the company can manage to maintain its current pace of TPV growth, stabilize transaction margin, stabilize operating margin, and manage its take rate decline. There’s no doubt some pressure on the business, but that is exactly the opportunity, and the reason PayPal is trading at an attractive valuation.

PayPal is trading at 15.7x EPS guidance for 2023, which is lower than the S&P500 P/E of 20.4x. My outlook for EPS is for it to keep growing at a healthy clip. I would expect EPS to approach $5.5 over the next five years, which would lead to a stock price of approximately $86, for a nice 40% return.

There are many risks involved, of course. But PayPal’s valuation mitigates much of this risk, and as long as PayPal continues doing what it’s doing, the stock should do well over the next 5 years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.