Summary:

- Over the past 5 years, investors have had a tough time with PayPal Holdings, Inc.: the stock is down 27% vs. the S&P 500 Index’s total return of 97.31%.

- But I believe January 25, 2024, when the company says it will announce a new strategy, is going to change the game for PayPal Holdings.

- The company is still in great shape financially, planning to spend $5 billion in FY2023 on buybacks. That’s 16.9% of FY2023 consensus revenue and ~7% of total market capitalization.

- Based on my calculation, PayPal has a growth potential of 53.8% by the end of 2024. The technical picture agrees with this finding.

- I rate the PayPal Holdings, Inc. stock as a “Strong Buy.”

chameleonseye

My Thesis

Over the past 5 years, investors have had a tough time with PayPal Holdings, Inc. (NASDAQ:PYPL) stock: compared to the S&P 500 Index (SP500), which gained 97.31% (total return), the stock has declined ~27% over the period, losing all of its post-pandemic growth in a matter of months:

However, I think that the current state of the company, its renewed approach to future development, the favorable valuation, and the recent technical breakout make PYPL one of the best GARP stocks (growth at a reasonable price) on the market today.

My Reasoning

PayPal, separated from eBay in 2015, is a global technology platform for digital and mobile payments. It operates in 200+ markets, accepts various currencies, and offers products like PayPal, Venmo, and Braintree for online and offline transactions.

In Q3 2023, PayPal reported adjusted EPS of $1.30, up from $1.08 the previous year, exceeding the consensus of $1.23. Revenues increased by 8% to $7.4 billion (9% FX-adjusted), with adjusted net income rising by 14% to $1.43 billion. Total payment volume grew by 15% to $387.7 billion, contributing to the revenue gain. Active accounts slightly decreased to 428 million. In general, PayPal’s growth rates looked good, and the decline in active accounts was not very dramatic, so the stock didn’t fall further.

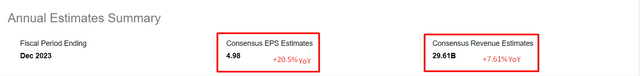

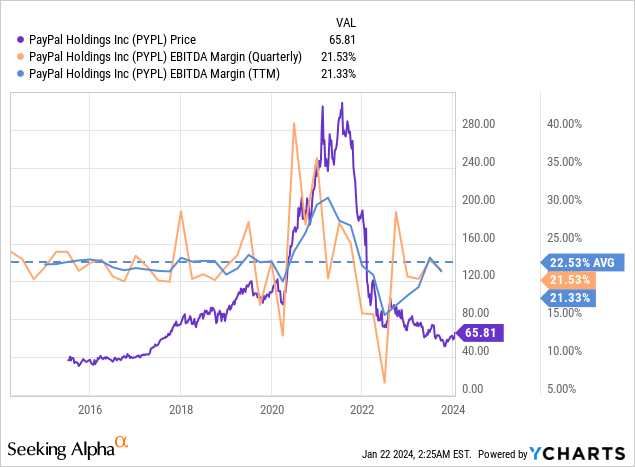

Although the company’s margins fell slightly QoQ, they were generally in line with their 10-year average on both a TTM and quarter-on-quarter basis.

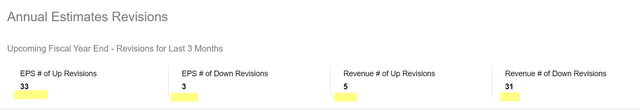

In my opinion, this reassured Wall Street analysts, who lowered their revenue growth forecasts due to the projected decline in active accounts but raised their bottom line forecasts (i.e., taking margins into account).

Seeking Alpha, PYPL, Oakoff’s notes

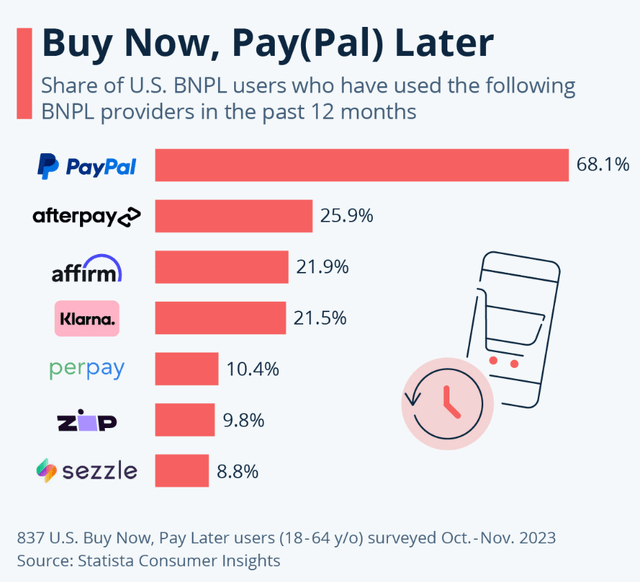

In June 2023, PayPal and KKR announced a multi-year relationship for European buy now, pay later (“BNPL”) receivables, projecting $1.8 billion in proceeds upon closing in H2 FY2023. In my opinion, PayPal will thus further consolidate its position on the already quite stable ground of this rapidly growing market.

Based on the data from Statista Consumer Insights, PayPal is actually the most popular BNPL option in the United States. The company’s interest-free “Pay in 4” option was used by 68% of surveyed BNPL users in the past 12 months. Afterpay comes in 2nd place with a reach of 25.9%, followed closely by Affirm and Klarna.

Having such a large share of such a fast-growing market even while struggling to maintain margins while revenue growth lags behind the rest of the sector is what PayPal has been doing in recent quarters. With the arrival of the new CEO, I, like many legacy (and new) investors, have hope for change.

Why now? Just a few days ago, an interview aired on CNBC with new CEO Alex Chriss, who made it clear that he has a plan. On January 25, 2024, we expect the announcement of a new development strategy for the company which should change the market’s perception of PYPL’s future growth. Alex explained that the company has access to billions of transactions that go through the company on a regular basis. Knowing what worries SMEs and other PYPL customers, the company plans to use AI and leverage all this data to provide a better value proposition.

What I also liked about Alex’s answers was the understanding and awareness that the “former PayPal” spent a lot of time, money, and effort on mergers and acquisitions, losing focus on developing the core operating business. “If it ain’t broke, don’t fix it” – that’s the phrase that came to mind when Alex raised this issue. By trying to pick up growth by a percentage point or two, PayPal has increased its operational risk. Now all the focus is being put on “profitable growth,” according to Alex’s words – that’s exactly what I think was missing before. This is something that should change the game.

As the event on January 25 should be followed by the fourth quarter results release (expected on or about February 1, 2024), let’s take a look at what is priced in for PYPL.

Management’s 4Q FY2023 guidance anticipates 6%-7% revenue growth on a spot basis and 7%-8% on an FX-adjusted basis, with non-GAAP EPS of $1.36, representing 10% growth from the prior year. For FY2023, PayPal forecasts non-GAAP EPS of $4.98 (up from $4.95), reflecting a 21% growth from FY2022. Operating margin improvement is expected to be 75 basis points, as the company is actively reducing its cost structure, targeting at least $1.3 billion in savings for FY2023. The market, in turn, expects faster sales growth and earnings per share in the middle of the management’s guidance range.

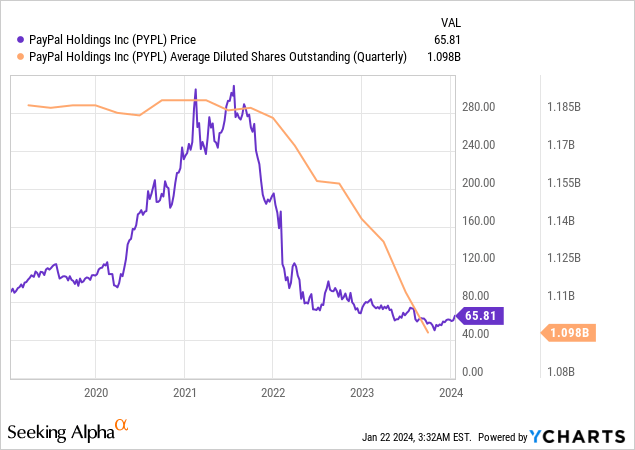

In Q3 2023, PayPal repurchased 23 million shares for $1.4 billion. The company now plans to reinvest free cash flow (“FCF”) in the business, acquisitions, and buybacks, with an expectation of $5 billion in repurchases for FY2023.

To give you some context, $5 billion is ~16.9% of fiscal 2023 consensus revenue and about 7% of total market capitalization. PayPal generated an absolutely insane amount of FCF, which gave the company the ability to buy back about 7.6% of total shares outstanding (SBC included in the calculation), which wasn’t enough to turn the stock around in the recent quarters.

Now imagine that PayPal: a) hasn’t lost the ability to generate that much FCF; and b) the new development plan, which will be announced on January 25, will bear its first fruits as early as 2024. I expect PYPL stock to start growing very quickly thanks to the buybacks and the change in market perception.

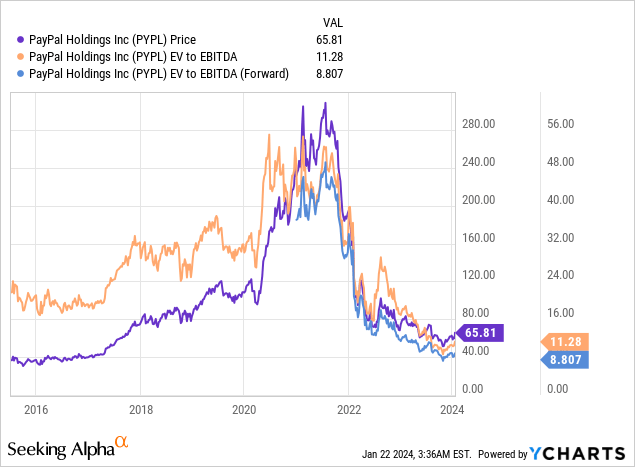

Given the company’s declining revenue growth in recent quarters and the uncertainty surrounding the success of management’s new plan, I would estimate that PYPL deserves 15x in EV/EBITDA, which is well below its long-term average but not unreasonably high for a mature fintech company in my opinion. Also, buybacks tend to inflate multiples due to their artificial support.

If we assume PayPal generates $32.1 billion in revenue in FY2024 (the current consensus estimate) and the full-year EBITDA margin increases to 25% considering the cost-cutting initiatives mentioned above, then PYPL’s enterprise value should be $120.4 billion. I adjust this value to the net debt of $11.236 billion, which gives a growth potential of 53.8% by the end of 2024.

Risks To My PayPal Thesis

Investing in PayPal Holdings Inc. carries inherent risks that investors should carefully assess. Firstly, market risk is a significant factor, as PYPL’s stock is susceptible to broader economic conditions, interest rate changes, and global events, contributing to potential fluctuations in its stock price.

In the payments market, PayPal confronts intense competition from established brands such as Apple Pay, Visa’s Checkout, MasterCard’s Masterpass, and American Express’s Later Pay services. Moreover, digital products from tech giants like Meta and Google contribute to a highly competitive landscape. The diverse range of payment options available to consumers at the point of sale necessitates PayPal’s continuous adaptation to evolving customer preferences.

While PayPal strives to maintain its market position, the risks associated with competition and changing consumer preferences are heightened. The company must not only contend with the challenge of offering superior convenience and pricing but also address the increasing demand for mobile payment services.

Management changes introduce an additional layer of risk, as the effectiveness of the new leadership team in navigating challenges and implementing strategic decisions will significantly impact the company’s performance and response to emerging risks. The ability of PayPal’s leadership to effectively respond to these dynamic market conditions and drive strategic initiatives will be crucial in determining the company’s success amid intensifying competition and evolving customer expectations.

Your Takeaway

Despite the galaxy of risks surrounding the company, I am inclined to believe in the best. 2024 should be a year of change, and I look forward to January 25 to learn what the new management’s plan is for the future development of the company. By all fundamental standards, PYPL looks like a classic “Strong Buy”: The market has absorbed the expectation of sales stagnation, valuation multiples are quite low, and we can expect further buybacks and cost cuts as well as profitability-led top-line growth. What’s not to like here? Moreover, the technical picture is promising as the stock price has recently broken its long-term weekly downtrend line to the upside and the fundamental growth potential I identified in my valuation analysis is right at the next logical strong level:

TrendSpider Software, Oakoff’s notes [weekly chart – trendline breakout & 20MA added]![TrendSpider Software, Oakoff's notes [weekly chart - trendline breakout & 20MA added]](https://static.seekingalpha.com/uploads/2024/1/22/53838465-17059138230882115.png)

So based on all of the above, I rate the PYPL stock as a “Strong Buy.”

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.