Summary:

- PayPal’s shares are trading at lower multiples due to a lack of growth in active users.

- Despite a rebound in Q4 and positive market sentiment, PayPal still hasn’t fixed the major issue that caused the depreciation of its stock in recent years.

- At the current price, PayPal’s upside appears to be limited.

Justin Sullivan

As the stock market is reaching new highs, shares of PayPal (NASDAQ:PYPL) continue to trade at lower multiples in comparison to the broad market due to the lack of growth of active users. While some investors called PayPal the next Meta Platforms (META) since the latter faced a similar growth issue a couple of years ago that was quickly fixed, it’s unlikely that the payment processing company will face a similar fate. Unlike Meta Platforms, which managed to quickly resolve the user growth issue, PayPal’s user count has been declining for several quarters in a row and the end of the exodus of users is nowhere near in sight.

Therefore, until PayPal’s user count is once again growing, it’s unlikely that its shares will significantly appreciate anytime soon. That’s why I recently closed my long position in the company at a slim profit since there are much better growth opportunities that the market currently offers.

Turnaround In The Making?

Back in November, I opened a long position in the company after its shares found a decent technical support level and were expecting to rebound thanks to the overall positive market sentiment. That’s exactly what has happened as PayPal’s shares have appreciated by ~13% since that time.

In part, this growth was achieved thanks to the decent performance on PayPal in Q4. The latest earnings report that was released last month showed that the company’s revenues increased by 8.1% Y/Y in Q4 to $8 billion and were above the street consensus by $130 million. At the same time, the payment transactions increased by 13% to 6.8 billion, while the payment transactions per user on a TTM basis were up as well.

Such a growth of major metrics was the result of the improvement of the American economy that was caused by the rise of economic activity. The U.S. GDP growth rate in Q4 was 3.2%, while the consumer spending rose by 3%. Considering that the growth projections for the U.S. GDP for 2024 were recently increased, while the payment processing market is expected to continue to expand and grow at a CAGR of 13.6%, it’s safe to assume that PayPal will continue to report decent numbers this year.

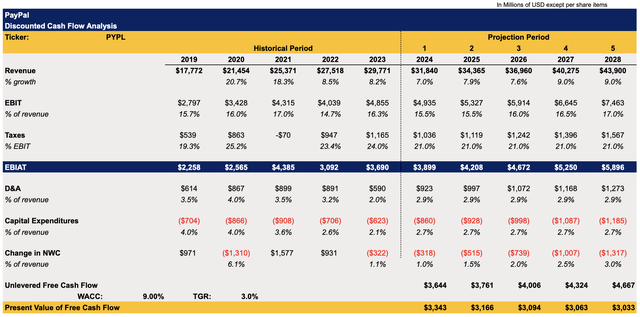

The only question at this stage is whether PayPal’s shares have the potential to appreciate as well given their underperformance in recent years. My DCF model below assumes that the company’s top line will grow at a rate of 7% to 9% in the following years, which is mostly in-line with the street expectations. The earnings estimates are also close to the street projections, while the tax rate in the model for the following years stands at 21%. All the other assumptions for other metrics correlate closely with the company’s historical performance. The WACC in the model is 9%, while the terminal growth rate is 3%.

PayPal’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

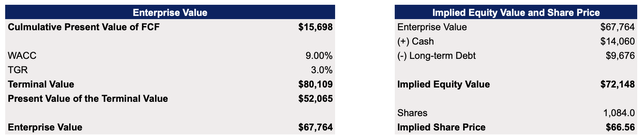

The model shows that PayPal’s enterprise value is $67.7 billion, while its fair value is $66.56 per share, which is close to the current market price.

PayPal’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

My model is not that far away from the current consensus. The street believes that the upside is less than 10% while Seeking Alpha’s quant system gives PayPal a grade of ‘D’ for valuation and an overall rating of HOLD. Considering this, it’s safe to assume that PayPal is currently fairly valued and the overall upside appears to be limited.

While generally, I stick to holding shares even if they exceed my price target as long as they have momentum going for them that’s backed by various growth catalysts, it appears that PayPal is still far away from stopping the exodus of active users that was behind the major depreciation of its shares in recent years. That’s why even though the business has shown a decent performance in the recent quarter and will likely meet its guidance in the quarters ahead thanks to the improving macro picture, I recently decided to close my position in PayPal as its growth story is stalling.

Lack of User Growth Is A Major Red Flag

While in Q4 PayPal’s revenues were up, it ended the quarter with only 426 million active accounts, down from 435 million a year ago. This was the fourth consecutive quarter of active accounts decrease and it indicates that a fundamental change of the business model is needed in order for PayPal to revive its growth story. That’s why it’s safe to assume that until PayPal manages to grow the number of its active users, any momentum that its shares have will likely be short-lived.

The issue though is that it appears that a solution to the user issue is nowhere near in sight. The latest bottom-line guidance for 2024 came below the consensus. While the street expected PayPal’s adjusted EPS for 2024 to be $5.53, the management guided for an EPS of ~$5.10. This indicates the current approach of focusing on making the most of the value from the more profitable users to mitigate the user growth issue is not working. That’s why it was no surprise that PayPal recently received dozens of downward revisions and will likely fail to convince the market that the improvement is on the horizon.

One of the greatest disadvantages of PayPal is that the fees that it charges to facilitate transactions are mostly higher when compared to its competitors such as Stripe, Wise, Payoneer, and others. This creates an incentive for people to ditch PayPal for other services that offer to facilitate transactions at more attractive rates.

At the same time, the rise of FedNow in the United States could make PayPal less relevant in the future. The Brazilian domestic alternative of FedNow is expected to reach a 40% share of the online shopping market in the country after being launched only a couple of years ago. If FedNow manages to penetrate the American market at a similar rate while other alternatives continue to offer more attractive rates to facilitate transactions, it will become nearly impossible for PayPal to properly fix the user growth issue anytime soon.

Considering all of this, it’s safe to assume that PayPal’s upside is likely to be limited in the foreseeable future. The company has greatly benefited in the past from the pandemic-related policies that resulted in higher usage of online payment services. But as the active user count continues to decrease, the number of reasons why holding PayPal’s shares for the long-term is not worth it is increasing.

The Bottom Line

At this stage, the only thing that is likely to result in a major continuous appreciation of PayPal’s shares is the news about the growth of the active user base, which has been declining in recent quarters. Unfortunately, due to the tough competitive environment and a lack of major company-related growth catalysts, it seems that it might take a while for such a thing to happen.

Therefore, I’ve recently closed my long position in PayPal at a slight profit and deployed capital elsewhere as the market is offering much better opportunities at this stage. I’m also rating PayPal as a HOLD right now since it’s likely that its shares will continue to trade close to the current market price without moving much in either direction. This is mostly due to the fact that there are no major growth catalysts to push the shares higher, and at the same time the selling pressure is likely to be limited after the latest round of profit-taking.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.