Summary:

- The deceleration in PayPal’s revenue can be attributed to the broader slowdown in the fintech market’s growth. Consequently, PayPal must adopt a more aggressive stance in competition.

- I have conducted a valuation to estimate PayPal’s potential stock price value. In the most optimistic scenario, the suggested present stock price is $75.42, with a future stock price projection.

- A stock price of $308, is distant in the short term. Given this perspective, I rate PayPal as a “hold”. I believe there are better opportunities in this market.

DNY59

Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) is widely recognized as one of the pioneers in the digital payments industry. However, after experiencing rapid revenue growth from 2019 to 2021, primarily driven by increased consumer spending during the pandemic, fueled by government stimulus checks, this growth has since decelerated. This trend aligns closely with the projections and prevailing trends in the fintech market.

I assessed PayPal’s valuation using a discounted residual income model, considering three potential revenue growth scenarios: 1.9%, 4%, and 9%. In the most optimistic scenario, PayPal could have an intrinsic stock price of $75.42, representing an 18.6% upside from its current stock price of $63.57, and a projected future stock price of $145.45, indicating a significant 128% potential increase and an annual return of 21%.

In the most conservative scenario, the implied stock price is $63.60, which closely mirrors the current stock price of $63.57. The future stock price is estimated at $121.78, implying a 91% potential upside.

Overview

Company

PayPal’s business model primarily revolves around payment processing, with its unique offering being consumer credit services. However, when compared to other fintech companies like Wise plc (OTCPK:WPLCF), it becomes apparent that PayPal isn’t significantly different. Wise offers a similar array of services, including its debit card, multi-currency support, and cost-effective international transfers. The key distinguishing factors lie in Wise’s ability to provide bank details in multiple currencies (EUR, USD, GBP, etc.), pay interest on deposits, and even establish partnerships, such as the one with Interactive Brokers Group (IBKR). While PayPal is widely accepted as a payment method by numerous merchants, individuals can easily open accounts with both companies to access their respective benefits. In essence, PayPal’s competitive advantage primarily stems from its size, as smaller competitors strive to catch up. However, being “big” doesn’t guarantee a lasting advantage, and over time, it may erode.

Services offered by PayPal (Investor’s presentation)

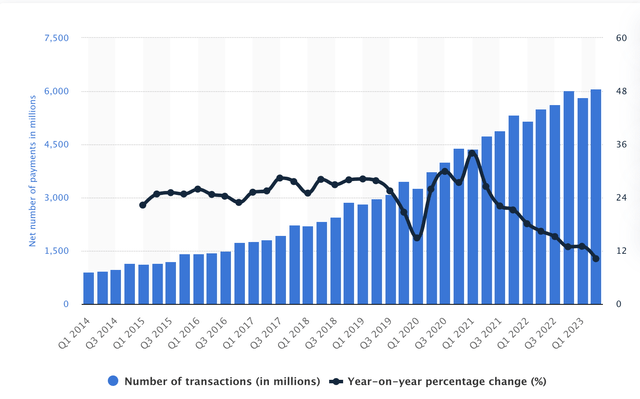

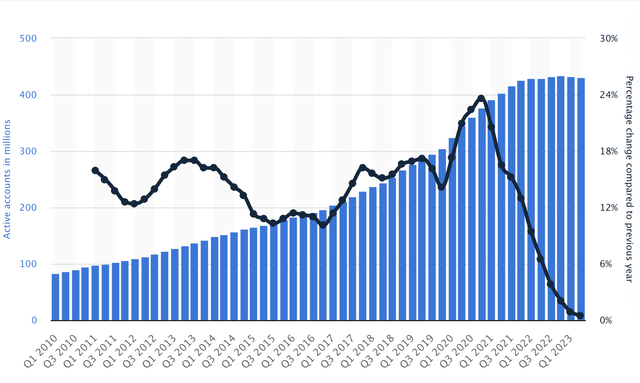

The substantial 80% drop in PayPal’s stock price from its 2021 peak can be attributed mainly to slowing user growth and transaction volume. This decline is fundamentally tied to PayPal’s nature as a fintech company that specializes primarily in transactions. The two primary growth avenues available to PayPal are:

A] Expanding its customer base.

B] Evolving into a bank by growing its consumer credit division.

The challenge lies in convincing potential users why they should choose PayPal over other fintech options. This skepticism renders any growth strategy related to expanding the customer base essentially ineffective.

In 2022, PayPal altered its growth strategy, shifting its focus from aiming to reach 750 million users by 2025 to retaining its existing user base and increasing their activity. However, the question remains: how can they boost user activity? The only viable approach is to make PayPal as essential as a traditional bank account, as merely linking a credit card to PayPal for online purchases doesn’t offer significant differentiation. Wise, for example, has taken steps in this direction by offering interest on deposits, account details, and facilitating cost-effective international transfers, effectively creating a comprehensive financial ecosystem. PayPal’s superior aspect lies in its ability to serve as a debit card in countries where competitors’ cards are unavailable. Nonetheless, this advantage is limited to certain regions, as competitors expand their debit card offerings globally.

Another consideration is the possibility of PayPal being intrinsically undervalued. However, in the absence of a clear future growth plan that outlines how it will generate greater returns for shareholders, it becomes challenging to justify a stock price return to its intrinsic value. This raises questions about whether it would be more prudent to sell the stock and wait for its valuation to potentially decrease over time.

Number of Transactions for PayPal (Statista) Evolution & Projections of Active Accounts PayPal (Statista)

Despite these challenges, there remains a glimmer of hope for PayPal to grow its customer base and, consequently, its revenue. By emulating the strategies of its competitors, PayPal can retain users, partly because of its longstanding presence in the fintech market, which may enhance its perceived trustworthiness among potential users.

Market

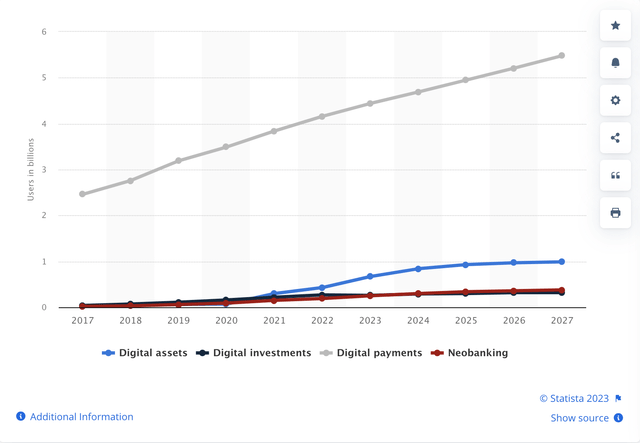

When examining user projections from 2023 to 2027, a noticeable slowdown becomes evident in the overall market. This contrasts sharply with the remarkable growth witnessed from 2017 to 2023, which boasted a Compound Annual Growth Rate [CAGR] of 11.26%. Now, the expected CAGR for 2023-2027 is a mere 1.94%. This deceleration mirrors a similar trend in digital assets, neobanking, and digital investments.

This stagnant growth trajectory implies that PayPal will need to expand by capturing market share from its competitors. Given the constrained growth prospects in its operating market, PayPal cannot rely on organic growth at minimal cost.

Fintech Sector Segments and their respective growth projections (Statista)

Furthermore, traditional banks are also embracing digitalization. The majority, if not all, of them offer e-banking, digital wallets, digitally approved accounts, credit cards, loans, and other digital services. Consequently, the gap between fintech companies and traditional banks is likely to narrow in the future.

Financials

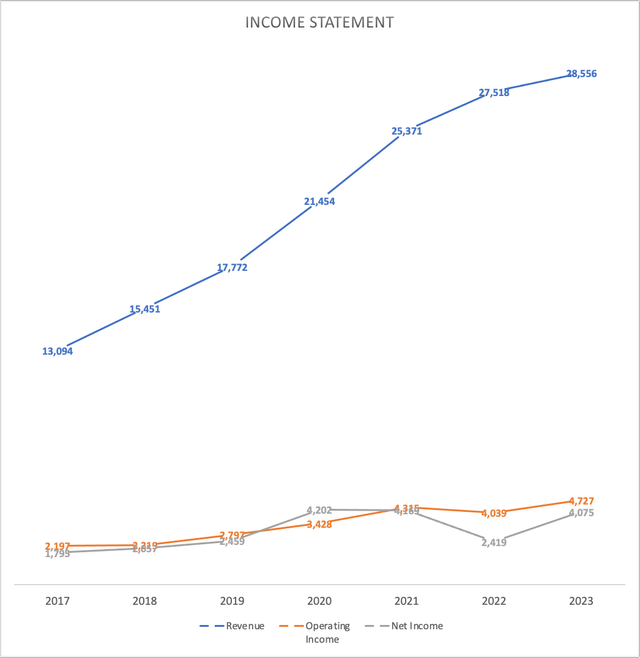

PayPal currently finds itself in a reasonably stable financial position. However, a notable decline in margins has been evident since 2020, a period when PayPal, alongside many other “digital” companies, experienced a surge in demand due to the pandemic-induced shift towards online alternatives.

| Revenue | Operating Income | Net Income | Operating Margin % | Net Income Margin | |

| 2017 | 13,094 | 2,197 | 1,795 | 16.78% | 13.71% |

| 2018 | 15,451 | 2,219 | 2,057 | 14.36% | 13.31% |

| 2019 | 17,772 | 2,797 | 2,459 | 15.74% | 13.84% |

| 2020 | 21,454 | 3,428 | 4,202 | 15.98% | 19.59% |

| 2021 | 25,371 | 4,315 | 4,169 | 17.01% | 16.43% |

| 2022 | 27,518 | 4,039 | 2,419 | 14.68% | 8.79% |

| 2023 | 28,556 | 4,727 | 4,075 | 16.55% | 14.27% |

PayPal’s income statement (Financial Reports)

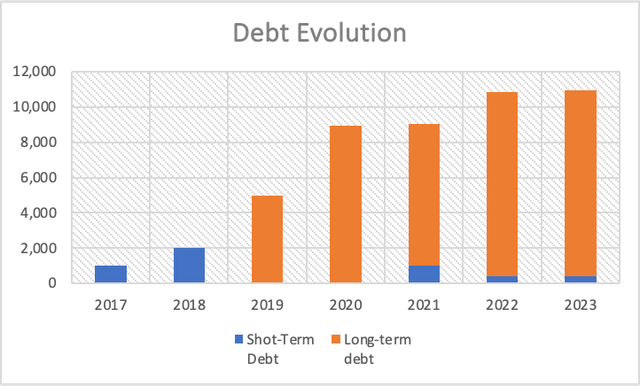

Examining PayPal’s debt levels prior to 2019, at the onset of the pandemic, painted a promising picture. The company had minimal debt and was well-positioned to deliver exceptional returns, given the substantial growth opportunities presented by the consumer migration to digital services and e-commerce. However, beginning in 2019, PayPal’s debt escalated significantly. This increase was necessary to capitalize on the vast growth potential. PayPal needed to expand its customer service workforce and invest in infrastructure to handle the influx of payments.

| Shot-Term Debt | Long-term debt | Cash | |

| 2017 | 1,000 | 2,883 | |

| 2018 | 1,998 | 7,575 | |

| 2019 | 4,965 | 7,349 | |

| 2020 | 8,939 | 4,792 | |

| 2021 | 999 | 8,049 | 5,197 |

| 2022 | 418 | 10,417 | 7,776 |

| 2023 | 418 | 10,549 | 5,504 |

Debt Evolution (Financial Reports)

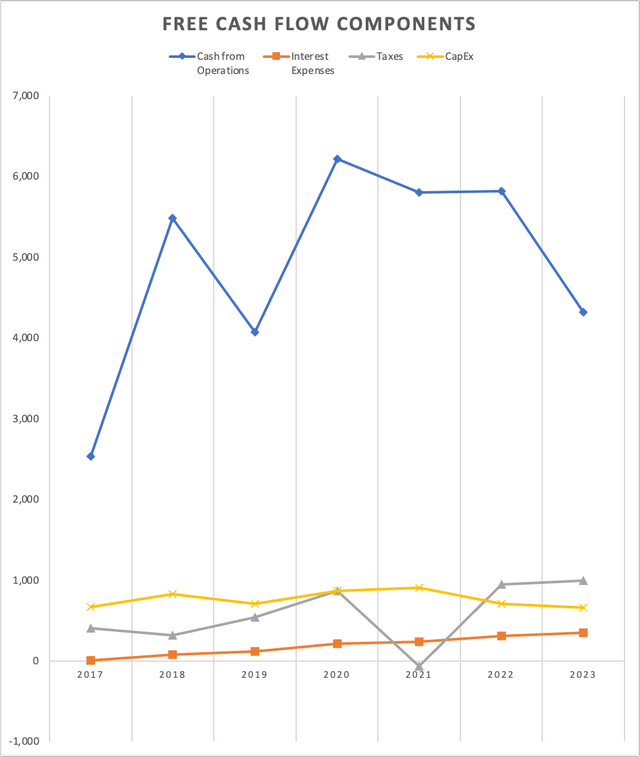

Additionally, when we consider the free cash flow, it becomes apparent that cash from operations suffered a significant decline, dropping from $6 billion to $4.3 billion. This decline can be largely attributed to changes in net operating assets.

| Cash from Operations | Interest Expenses | Taxes | CapEx | |

| 2017 | 2,531 | 7 | 405 | 667 |

| 2018 | 5,480 | 77 | 319 | 823 |

| 2019 | 4,071 | 115 | 539 | 704 |

| 2020 | 6,219 | 209 | 863 | 866 |

| 2021 | 5,797 | 232 | -70 | 908 |

| 2022 | 5,813 | 304 | 947 | 706 |

| 2023 | 4,316 | 350 | 990 | 660 |

Behaviour of PayPal’s FCF Components (Financial Reports)

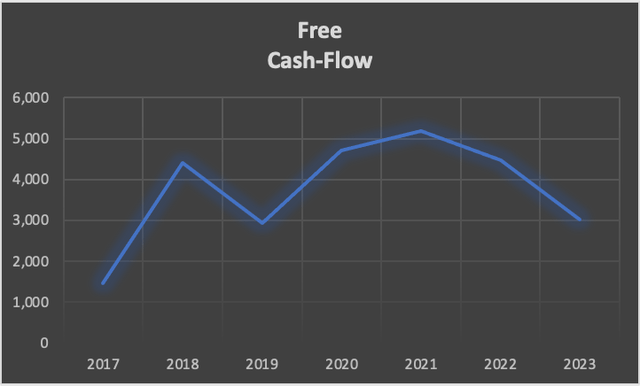

| Free Cash-Flow | Margin % | |

| 2017 | 1,466 | 11.2% |

| 2018 | 4,415 | 28.6% |

| 2019 | 2,943 | 16.6% |

| 2020 | 4,699 | 21.9% |

| 2021 | 5,191 | 20.5% |

| 2022 | 4,464 | 16.2% |

| 2023 | 3,016 | 10.6% |

PayPal’s Free Cash Flow (Financial Reports)

In summary, an analysis of PayPal’s financial data suggests that the company is not in dire straits at the moment. However, the continued deterioration of operating margins could eventually put PayPal in a precarious financial situation.

To address the aforementioned challenges, PayPal has implemented cost-cutting measures, including layoffs and office closures. These strategic actions are anticipated to result in savings of approximately $1.3 billion in 2023.

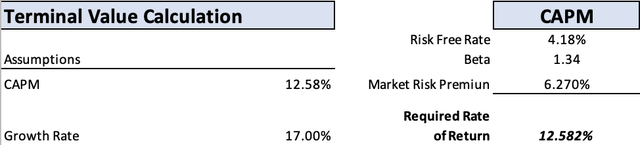

Valuation

To assess the value of PayPal, I have employed a residual income valuation method. In this valuation, I have assumed a long-term EPS growth rate of 17%, and the required rate of return is calculated using a straightforward Capital Asset Pricing Model (CAPM).

Variables for Terminal Value Calculations (Author’s Calculations)

Next, I delve into projecting future revenues, which are grounded in the aforementioned user growth rate of 1.9%.

| Total | Operating Income | |

| 2023 | $29,670.0 | $4,708.6 |

| 2024 | $32,390.0 | $5,140.3 |

| 2025 | $33,005.4 | $5,238.0 |

| 2026 | $33,632.5 | $5,337.5 |

| 2027 | $34,271.5 | $5,438.9 |

| 2028 | $34,922.7 | $5,542.2 |

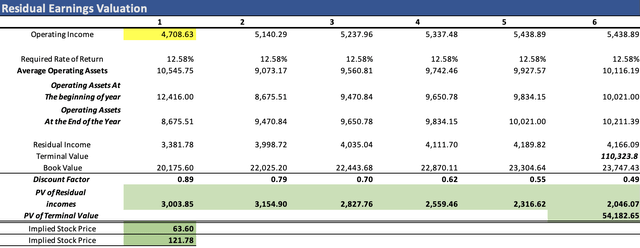

Subsequently, I construct the discounting model, where you can observe the process of deriving the residual income and subsequently discounting it.

Residual Income with a 1.9% revenue growth (Author’s Calculations)

In conclusion, we can observe that the implied stock price is $63.60, which closely aligns with the current stock price of $63.57. Additionally, the projected future stock price stands at $121.78, indicating a potential upside of 91%. This suggests that, under the assumption of a revenue growth rate of 1.9%, PayPal is presently fairly valued.

However, this projection is based on the lower end of the growth estimate spectrum. What if PayPal manages to achieve higher revenue growth rates, say 4% or even 9%?

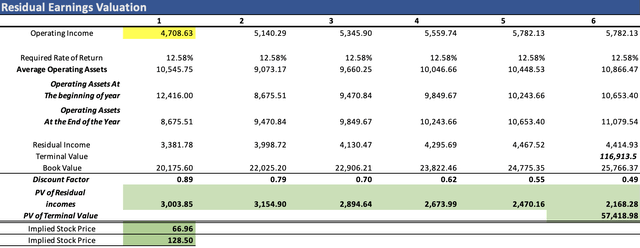

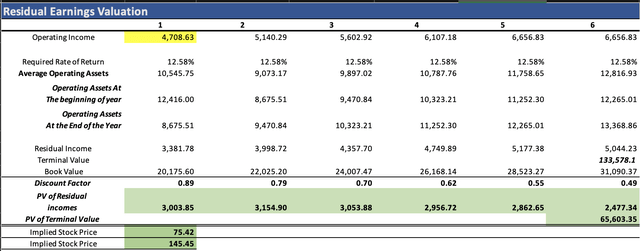

The implied prices for these scenarios are detailed below:

Residual Income Valuation with a 4% revenue growth (Author’s Calculations) Residual Income Valuation with a 9% revenue growth (Author’s Calculations)

As you can discern, in the best-case scenario, PayPal could potentially achieve an intrinsic stock price of $75.42. This would represent an 18.6% increase from its current stock price of $63.57, with a projected future stock price of $145.45, signifying a remarkable 128% upside and an annual return of 21%.

However, as you might have noticed, a stock price of $308 (a 384% upside), as seen in July 2021, is a distant prospect, and it’s doubtful that we will witness such a price point in the next six years, the timeframe for this projection. These projections imply that a return on an investment in PayPal is almost guaranteed as well as returns superior to that of the broader market.

According to my models, PayPal is currently trading close to its fair value. Therefore, if you acquire it at the present valuation, it is a sound choice. However, from my perspective, the stock is a “hold” recommendation, since there are other stocks in more dynamic markets with the potential of offering better potential returns.

Risks to Thesis

I perceive very few risks to this thesis, with perhaps the only one being a resurgence in online spending, akin to what we observed during the pandemic era. This is considering that I have already factored in and modeled various reasonable revenue growth scenarios (1.9%, 4%, and 9%).

If there were to be an upsurge in online spending, it would create ample room for PayPal to potentially grow at an even more robust pace of 9%. This would naturally drive the valuation higher. However, it’s important to recognize that such a surge would likely indicate seasonality in PayPal’s business, with prices returning to more reasonable levels afterward.

Furthermore, PayPal has the potential to further reduce costs beyond the initially planned $1 billion in savings for 2023. I believe that PayPal has the capacity to achieve this, but it would necessitate automating its customer relations processes or, at the very least, mitigating customer complaints. Currently, customer relations is the largest employment sector within PayPal, as well as in companies like Mastercard Inc. (MA) and Visa Inc. (V).

Conclusion

In conclusion, as we assess the value and prospects of PayPal, we find a company that has navigated the digital payments landscape with notable success. While my financial analysis indicates that PayPal is presently trading close to its fair value, the potential for growth remains contingent on various factors. The various revenue growth scenarios, ranging from 1.9% to 9%, paint a dynamic picture of PayPal’s potential trajectory. Furthermore, while we anticipate minimal risks to my thesis, a resurgence in online spending or the company’s ability to further cut costs could alter the landscape. As we look ahead, it’s clear that PayPal’s journey is influenced by the ever-evolving digital finance sector, the competition it faces, and its own strategic decisions. In this context, PayPal remains an intriguing player, but investors should carefully consider their options within this dynamic marketplace, since there are other choices with better potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.