Summary:

- PayPal lost more than 15% in value after a double beat on revenue and EPS.

- Analysts are causing fear by overblowing lower operating margin guidance when prices are low.

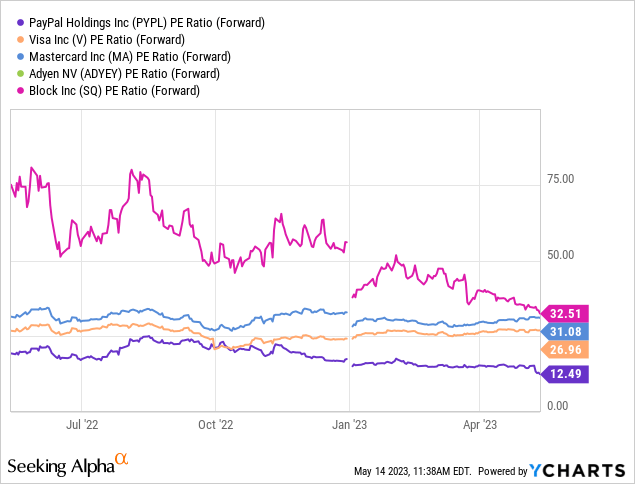

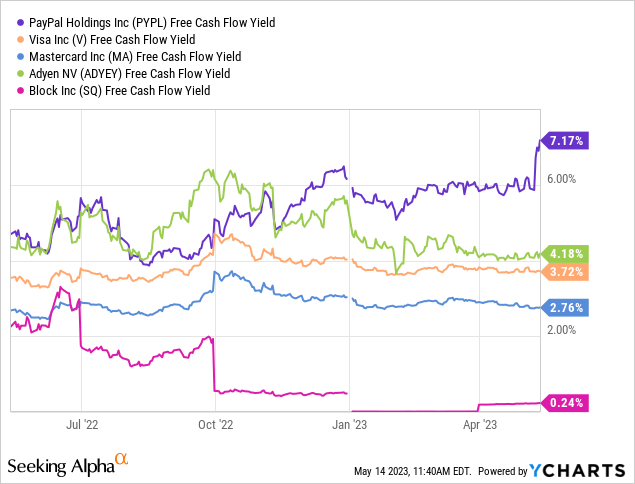

- On a valuation aspect, PayPal is by far the cheapest in the sector, with the stock trading at 12.5x forward price-to-earnings ratio and a free cash flow yield of 7.17%.

- Although stock-based compensation is still way too high, it is finally shrinking while increasing the effectiveness of the $4 billion in stock buybacks for FY23.

JasonDoiy

PayPal (NASDAQ:PYPL) has lost favour of investors since the end of 2021 and has been consolidating over the past year. As some of you already know, I like to be a contrarian, this time around PayPal is my contrarian idea. The sentiment shifts in growth stocks are so volatile and reckless that it is quite easy to take advantage of. If no-one wants the stock, I will buy it. We have seen this with Meta Platforms (META), were I told investors that all the worries they had were unimportant as their core cash flow business was still intact. Meta easily doubled over the span of a few months. PayPal is currently not as cheap as Meta once was, but it is getting close. Nonetheless, PayPal is still growing revenue and EPS so it could also deserve a higher multiple than Meta. Let’s dive in.

Q1 revenue & earnings beat

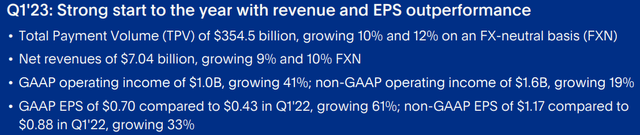

The company beat on both revenue and EPS estimates in the first quarter of 2023. Still, the stock sank 12% after the release because of the headline of lower guidance on operating margins.

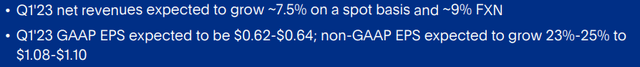

However, I saw a lot more positive things than negative in the earnings report. First of all, PayPal exceeded their guidance that was given in the fourth quarter of 2022. Net revenues beat 9% vs 7.5% expected. EPS beat $0.70 vs $0.64 expected.

22Q4 Earnings Presentation 23Q1 Earnings Presentation

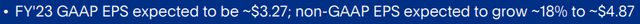

Additionally, full year EPS guidance has been raised from $3.27 to $3.42, which would mean 61% EPS growth in 2023. Personally, I find it quite remarkable how quickly the company has shifted their focus to cost-efficiency.

22Q4 Earnings Presentation 23Q1 Earnings Presentation

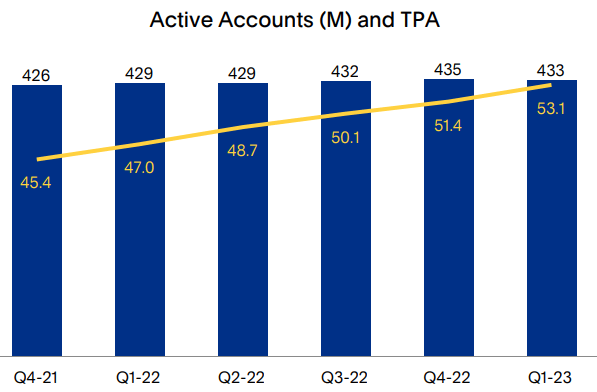

One worrisome point in the earnings report was the decrease in active accounts, which was probably PayPal’s own fault. PayPal’s recent $2,500 fine debacle did not do any good and is likely the cause of the closure of some accounts. The company/ management should be more careful with these kind of things. Nevertheless, transactions per active account has increased by a solid 13%, mainly driven by Braintree.

23Q1 Investor Update

Coming back to the worries of the analysts on lower guidance on the operating margins. PayPal’s revenue is mixed with the segments PayPal, Venmo and Braintree. Braintree, which got acquired by PayPal back in 2013, is a mobile and web payment system for e-commerce companies. The Braintree segment is growing quicker than PayPal and Venmo, but does have lower margins. Therefore, PayPal can beat revenue on lower operating margins, because of a different business mix. So, not really a problem.

Valuation, stock-based compensation and stock buybacks

On a valuation aspect, PayPal is the cheapest in the sector. The stock is trading at 12.5x forward price to earnings ratio. Before the rise of Meta, Meta was trading at a similar 10.7x price to earnings ratio.

In addition, PayPal’s free cash flow yield hit an all-time high of 7.17%. This makes the stock extremely attractive, as free cash flow is mostly used to reward shareholders. The current free cash flow yield is almost matching the 8.58% yield of Meta back in November 2022. Mastercard (MA) has one of the highest premiums in the sector due to its large moat.

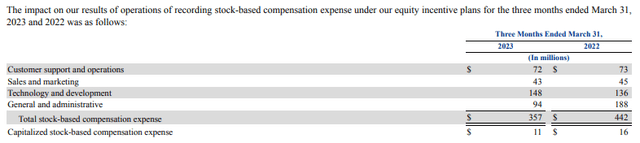

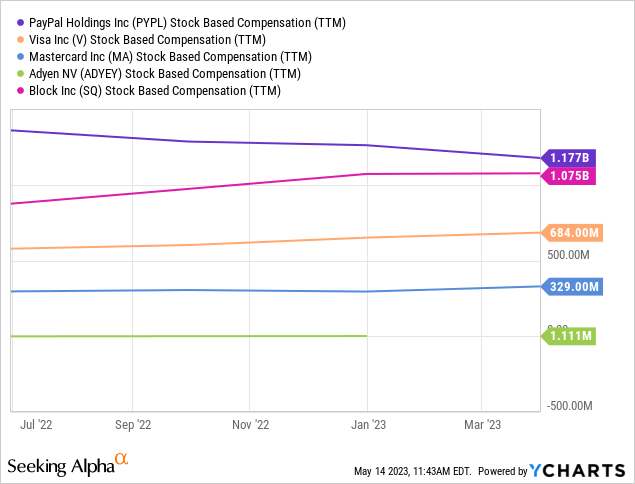

Nevertheless, the company still has some improvements to do in the stock based compensation department. They are giving away the most SBC in the sector, by far. Even though, Visa (V)’s revenues are a lot higher, their SBC expense is 50% lower, which does not make a lot of sense. Block (SQ)’s SBC is an even a bigger problem as a percentage of enterprise value.

As a result, share buybacks have not been effective over the past 3 years and most of the buybacks have gone to employee stock options.

Yet, there is some relieving news in the latest earnings report. Stock-based compensation has decreased by 19% year-over-year. Before earnings I suspected it would’ve stayed flat, but somehow they managed to drop it substantially.

Takeaway

Analysts will always turn the switch from bullish to bearish when the stock is falling, and are always late when the new rally comes around. PayPal has got to a point where its valuation is attractive, while there is still room for improvement in cost-efficiencies. Free cash flow has not grown the last 3 years, but the renewed focus could push the free cash flow yield even higher to 8-9%. Though, it will be important to keep your eyes on the stock based compensation. Currently, 25% of buybacks is used on SBC. This at least has to go down below 10%.

The competition is for sure high in fintech, with even monopolies like Alphabet (GOOGL) and Apple (AAPL) joining the fight. Yet, this does not mean there is no more room to grow. The total addressable market (TAM) is gigantic and is growing further with the popularity of e-commerce and other online services. Also, anti-trust issues have a real chance to plague the large monopolies. PayPal’s largest contributor of revenue is America, expanding presence elsewhere is not an unrealistic goal to reach.

I rate PayPal a Buy. I have doubled down on my position at $68 a share. Right now, I have a 4.2% allocation of the company in my portfolio, I am not overly concentrated and happy to leave it there. I do feel I am missing some business strength and trust in the management to afford a higher concentration. Overall, PayPal’s risk-reward is quite attractive at these prices. Further business improvements are likely to boost the stock higher with renewed momentum.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial advisor. Investing is your own responsibility. I am not accountable for any of your losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.