Summary:

- PayPal Holdings, Inc. has been nothing but a pain for almost two years.

- However, I am calling a bottom this time on valuation, technicals, and turnaround potential.

- Psychology plays a huge role in market returns. What is hated today will be loved tomorrow.

JasonDoiy

It has been a holding and averaging down process with PayPal Holdings, Inc. (NASDAQ:PYPL) over the last year or so. I remember thinking during my first buy, below $200, “It is down so much already. The stock was just trading above $300 a few short months ago. It will come back.” So far, the only thing that has come back is regrets over my decisions to buy then and the painful process of averaging down, even as recently as doubling my position in one of the accounts at $63.39. PayPal Holdings, Inc. stock has further dropped a cool 2.50% since my last buy.

As Cheap As Never

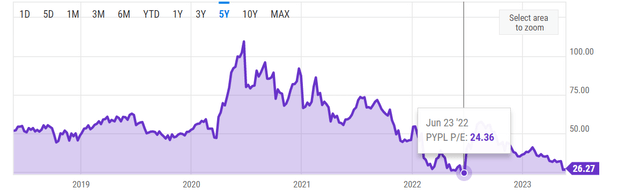

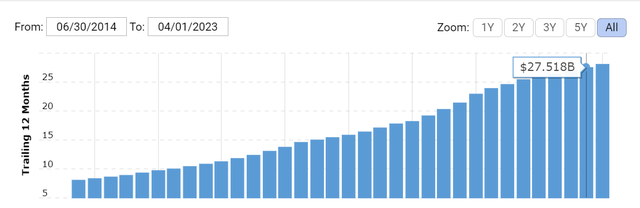

It is quite obvious – in hindsight – that PayPal’s stock was egregiously overvalued in 2021, as was most of the market. The difference is that, while technology stocks appear to have regained most, if not all, of their mojo back, FinTechs, like PayPal are still in the dumps. In fact, the words “still in the dumps” may suggest they are at least retaining their status, but they are actually still losing ground, as PYPL stock is down nearly 17% YTD. This despite the company’s revenue increasing over time over any trailing twelve months period over nearly a decade, as shown below (in billions).

PYPL Revenue (Macrotrends.net)

Quite a bit of this multiple-compression is warranted. After all, no company deserves a premium forever, and if even the lofty standards are met, stocks of highly valued companies tend to underperform once the euphoria dies down. But things have gone too far with PYPL here. Using 2022’s revenue of $27.51 billion, the stock is trading at 2.50 times sales.

In terms of earnings, with a forward multiple of 12.50 based on 2023’s EPS estimate of $4.95 and an expected earnings growth rate of 15%/yr for the next five years, PayPal stock is trading at a Peter Lynch-esque Price-Earnings/Growth (“PEG”) of 0.80.

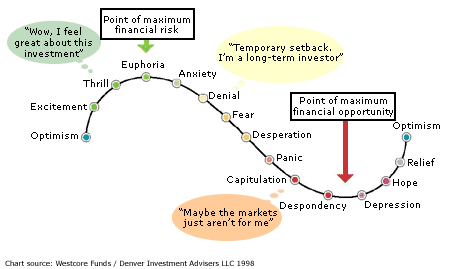

Psychology

As a totally unrelated comparison (in terms of sector), NVIDIA Corporation (NVDA) is trading at a price-sales multiple of 26. But then, it may not be that unrelated if you think about the famous market cycle shown below. It wasn’t long ago that NVDA investors (I was one) felt despondent, but within a few short months (and a few AI sprinkles and cherries on top) we are back to the euphoria stage. I am not suggesting that PYPL stock will see such reversal in a short time, if at all. But I can safely say PayPal investors are far from even being in denial, as the pain is too real to ignore when your stock falls from $300 to $60 despite sometimes reporting good earnings and raising guidance.

Market Cycles (Westcore Funds)

Looking Up

Speaking of earnings, despite margin concerns, PayPal’s Q1 earnings and guidance have a few things that suggest a turnaround is in the works.

- PayPal raised its Non-GAAP EPS guidance for FY 2023, guiding up to $4.95 in EPS, a growth rate of ~20%. Buried within the investor update is the fact that net revenue has tripled from $9.2 billion in 2015 to $27.5 billion in 2022. While growth rate has definitely slowed down, PayPal is still growing.

- When companies with millions and billions in users report their users count, the skeptic in me thinks “So what? I have a PayPal account too and I barely use it.” However, PayPal reported that Transactions Per Active Account (“TPA”) was up 13% YoY in Q1, indicating a true uptick in activity instead of dormant presence.

- Frequent readers of my articles know that I pay special attention to a company’s ability to generate cash from on-going operations, AKA, Free Cash Flow (“FCF”). Despite the stock’s horrendous fall from $300 in 2021 to $60 in 2023, the company’s FCF is actually a picture of calmness over the last 5 years with a median quarterly FCF of $1.04 billion and a mean of $1.24 billion. The tight range between the mean and median suggests symmetrical distribution, meaning the company has been doing what it does consistently but the market’s interpretation has wildly fluctuated.

- The company highlighted cost discipline in its Q1 report as well as for the rest of FY 2023. When past highfliers finally admit to overspending and cut back, it usually is a sign of a turnaround.

- The company repurchased nearly 50 million shares over the last 12 months, with 19 million in Q1 when the stock was trading at its then-recent lows. This is smart on the company’s part, and I expect more of this in the on-going Q2 especially given the further beat-down the stock has taken. PayPal is expected to spend about $4 billion in FY 2023 on share repurchases, and it may not be a bad thing for investors in the long run if the company spends about $60 a share in doing so!

Technical Indicators

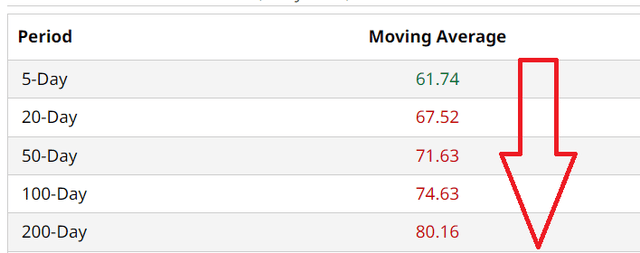

It should surprise no one that PayPal Holdings, Inc. stock is in the doldrums technically as well, with the moving averages getting progressively worse as we move from 200-Day all the way to 5-Day. This suggests the stock has not found a bottom yet and likely has more room to fall.

PYPL Moving Avgs (Barchart.com)

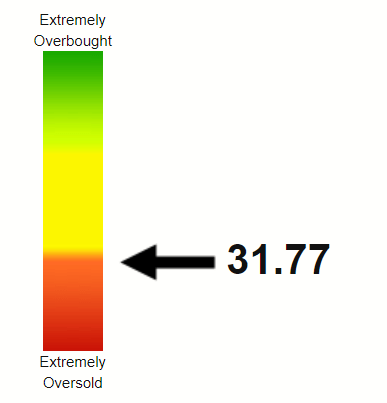

And that maybe the silver-lining or, more fittingly, darkest before dawn. Should PYPL stock continue getting sold off, the stock’s Relative Strength Index (“RSI”) will go below the textbook definition of being extremely oversold. Under extremely oversold conditions, even the slightest hint of good news is usually enough to spark a violent turnaround to the upside.

PYPL RSI (Stockrsi.com)

Conclusion

The contrarian in me always looks for the alternatives when the crowd is going on way. Sure, there is unity in numbers but not in herd behavior. I sure do have some bad calls over the years but it is easier to spot a herd. I called Meta Platforms, Inc.’s (META) bottom when the entire world hated the stock, threw my weight behind NVDA before its turnaround, and recently bailed out on NVDA due to it ridiculous valuation (remains to be seen how correct this call is).

This time, PayPal Holdings, Inc.’s continued downtrend in 2023, despite moderation valuation and decent earnings report, has convinced me that the market has overreacted to the downside. PayPal Holdings, Inc. stock is both undervalued and hated, just the type I love. While the short-term may bring more pain, I fully expect to be rewarded in a matter of months (less than 6), if not years.

In short, I’ve paid you enough, PayPal. It is time to pay me back, pal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.