Summary:

- PayPal is a global payment network with millions of active merchants and consumers, generating revenue through transaction fees.

- The company is expected to see accelerated revenue growth and improved margins, leading to a potential rerating of the stock.

- Despite concerns about competition and lower growth in customer accounts, PayPal’s core business has been growing faster than Apple Pay and Venmo.

Justin Sullivan

With the combination of a strengthening eCommerce market, significant cost reductions and big share buybacks, PayPal (NASDAQ:PYPL) is expected to see accelerated revenue growth and improved margins, which could lead to a rerating of the stock. In the short term, we see a price potential of $70.0 with a risk-reward ratio of 2:1. In the medium term (over the next three years), we believe that an IRR of 16% (or a price target of $95) is realistic, assuming the expected trend reversal occurs – and in particular the narrative around the challenging competitive situation calms down accordingly.

PayPal is a global, two-way payment network with 35 million active merchants and 400 million active consumers. It is present in over 200 countries/regions. PayPal generates revenue through transaction fees incurred between consumers using PayPal Wallet and merchants using PayPal Checkout. This two-sided network contributes more than 90% of the total transaction gross profit, making it the most important component of the company.

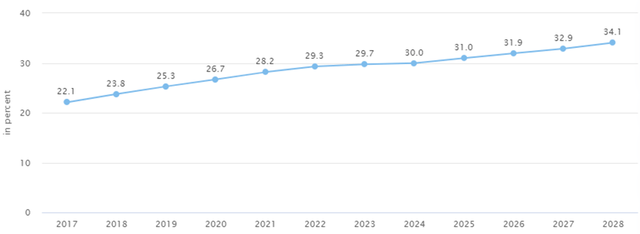

We continue to view online retail and eCommerce as an interesting long-term growth trend, especially due to the still low penetration rate of around 30%. In the medium term, we assume that the eCommerce market will grow globally in the low double-digit range.

Set-Up

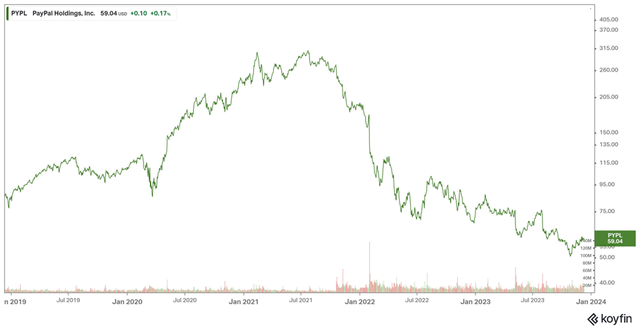

PayPal stock has lost about 20% of its value this year due to a variety of factors. On the one hand, this results from lower growth in customer accounts. On the other hand, gross profit margins have declined due to a shift from goods to services following the lifting of COVID restrictions. There is also intensive discussion about PayPal’s competitive situation in comparison to alternative payment methods such as Apple Pay, Google Pay as well as Stripe and Adyen. Ultimately, management lost the trust of capital markets by making extremely ambitious forecasts and making costly acquisitions during the COVID bubble. For example, in 2021 they wanted to take over Pinterest for $41 billion – today the value is $22 billion.

Investment Thesis

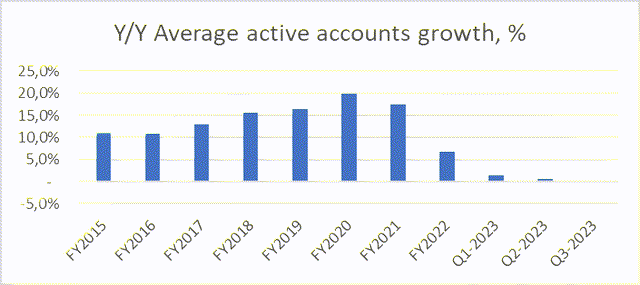

PayPal bears often point to disappointing customer account growth as evidence that the company is suffering from competition from Apple, Amazon and Google. With a number of new product launches and enhancements (including a redesigned PayPal app, Billpay, expanding Pay with Venmo merchant acceptance, and expanding BNPL acceptance), we expect future customer growth to be in the high single digits for realistic.

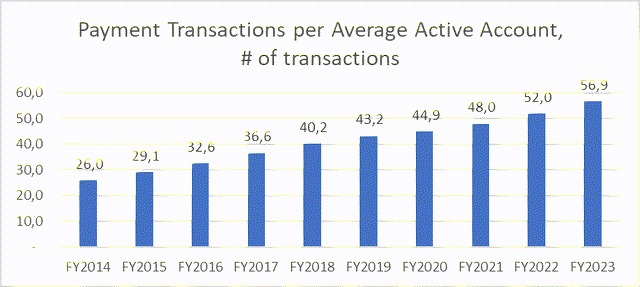

However, bears overlook the fact that the number of average transactions per user continues to grow solidly. The historically weak account growth can be explained by two factors. On the one hand, inflation reduced consumer spending, which resulted in fewer new consumers coming to PayPal. On the other hand, the eCommerce market somewhat normalized after the COVID boom, although these are customers of lower quality and profitability.

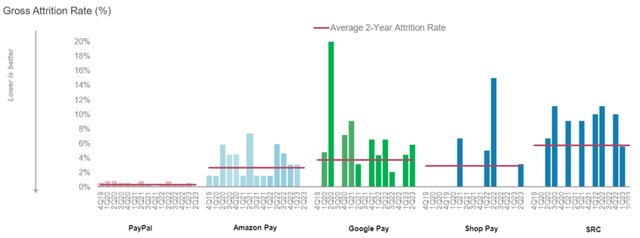

30% of users in the core product generate 80% of transactions. Therefore, it is unlikely that these “power users” would switch providers. If the competition were to take the butter out of PayPal, this should also be reflected in the data. The figure below shows merchant churn rates since Q4 2019, according to Morgan Stanley. PayPal’s churn rate is generally below 1%, highlighting the value of the network to merchants. In contrast, the rate for the competition is significantly higher. Apple is not included in this graph, but will likely perform similarly to Google Pay.

Morgan Stanley Sell Side Report

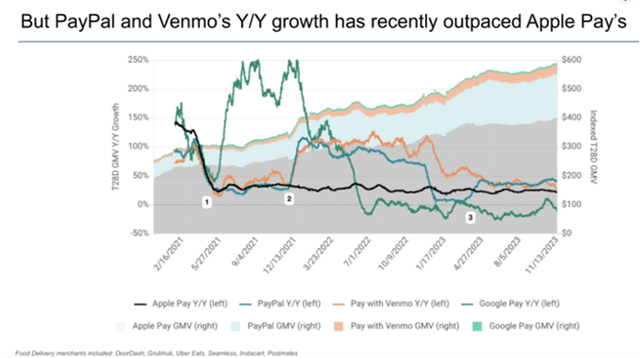

The market seems to perceive Apple as the biggest threat to PayPal. However, the following graphic from Yipit shows that PayPal’s core business has been growing faster than Apple Pay and its subsidiary, Venmo, since the middle of the year – despite a much higher starting point.

When making the comparison, it should also be noted that PayPal is by far the largest provider (80% vs. 30% for Apple Pay) in all relevant core markets (USA, Europe, UK) and has the highest acceptance rate among the world’s largest 1,500 retailers ( 79% vs. 28% for Apple Pay; page 7 in the linked investor update). Customers appreciate merchants’ high acceptance rate, and merchants in turn appreciate the higher conversion rate compared to other payment methods ( over 60% , according to a ComScore study).

Regarding the lower margins: This is due to a temporary trend after the corona pandemic. After COVID restrictions were lifted, there was a shift from goods and merchandise to services (e.g. travel), with PayPal more exposed to consumer goods spending. But according to management comments, this is a trend that will return in 2024. Visa also communicated a similar observation in its most recent quarterly reports.

In addition, PayPal is currently implementing a $1.9 billion cost reduction program for non-transaction-based cost items. This corresponds to around 19% of the respective costs, which in turn means higher margins. Adding to this is the recovery of the Chinese economy (there are signs of this in macro data), with these cross-border remittances posting higher margins than the core business.

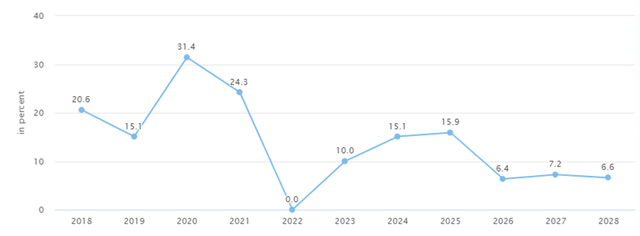

As already mentioned, PayPal’s growth is strongly linked to the growth in the eCommerce sector. After the COVID boom, growth rates have slowed in 2022 and 2023 (see figure below). However, the market appears to be returning to its long-term growth trajectory. It is also positive that the negative effect of the loss of exclusivity with eBay expired in 2022, which meant that the growth rates in 2023 were comparatively poor (background: PayPal was a spin-off from eBay. Part of the spin-off agreement was, that PayPal loses its exclusive status as a payment provider on eBay).

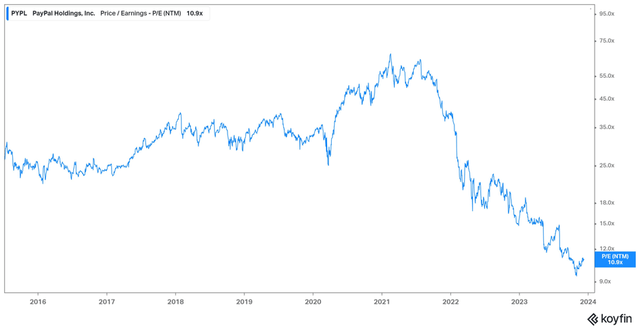

Lastly, PayPal has a solid balance sheet with significant free cash flow and currently has a $15 billion share repurchase program. In the last three quarters, the number of shares outstanding has been reduced by 5% since Q4 2022. With the amount still available (approximately $10 billion), PayPal can buy back an additional 15% of the currently outstanding shares at current prices. We believe this is a sensible capital allocation decision, especially given the historically low valuation at a P/E ratio of 11.

Peer group comparison

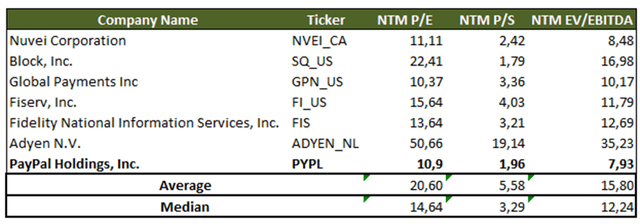

The table below shows a valuation comparison of PayPal’s peer group with the traditional players – Global Payments (GPN), Fiserv (FI), Fidelity National Information Services (FIS) and the tech players – Nuvei (NVEI), Block (SQ), Adyen (OTCPK:ADYEY). It is clear that PayPal trades below the average/median of the peer group. The divergence between Adyen and PayPal is particularly interesting, with PayPal’s subsidiary, Braintree, recently growing faster than Adyen and at least gaining market share in Europe.

The current risks should already be priced into the historically low P/E valuation of 10.9. We believe the market is extrapolating from weaker post-coronavirus growth and underestimating the turnaround in fundamentals. Our risk-reward ratio is 2:1 and we see a 12-month price target of around $70.0. We consider a price target of $95 to be realistic for the next three years. This is based on the continuation of the share buyback program, a higher EPS result than consensus expected and a sentiment switch in PayPal shares.

Risks

One risk in our investment thesis is that we may overestimate PayPal’s moat.

Another risk could be that customer growth does not return to historical trends, which could make a re-rating in the P/E valuation unlikely. However, management communicated stabilization in the quarterly reports, which is positive for the share.

The new CEO, Alex Chriss, previously worked at Intuit and has built a good track record. In his previous positions, Chriss was primarily involved in product development. One risk is that Chriss reverses PayPal’s cost-cutting program and increases capital spending, which could undermine our thesis of rising margins. Whether this will actually happen remains to be seen, as Chriss only started his role on September 27, 2023.

Conclusion

We believe at current prices PYPL is an attractive stock to buy. We think the market overreacted to the competitive narrative around PYPL’s moat. Any change in narrative should lead to a big multiple re-rate in this stock. Meanwhile, the eCommerce-market is reaccelerating, the company is cutting costs and buying big amounts of its stock back. The next earnings reports are going to be crucial. We will be closely watching the growth of active accounts and margins. After being a loser in 2023 and the end of tax loss harvesting, we think the set-up for a buy in PYPL is attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.