Summary:

- PayPal’s robust financial performance, improved guidance, and strategic partnerships support a ‘Strong buy’ rating with an 83% upside potential.

- Key partnerships with Shopify, Fiserv, and Adyen, along with new features like Fastlane and Venmo’s ENS integration, enhance PayPal’s growth prospects.

- Valuation analysis via DCF and P/E ratios indicates PYPL is undervalued, with a fair share price estimate of $126.

- Economic recession risks and competition from tech giants like Apple and Google are potential challenges but do not outweigh PayPal’s strong growth prospects.

Alexandros Michailidis

Introduction

I had a ‘Strong Buy’ thesis for PayPal’s (NASDAQ:PYPL) (NEOE:PYPL:CA) stock in June. The recommendation keeps up well because the stock gained 3.5%, compared to +2.8% from the S&P 500.

The company’s recent financial performance is robust, and improved guidance suggests that the management’s goal to ensure sustainable and profitable growth is achievable. Aggressive expansion of partnerships and rolling out new features likely helps PayPal to build a robust basis to maintain growth for longer. PayPal’s valuation looks too cheap to ignore with an 83% upside potential, making PYPL a ‘Strong buy’ again.

Fundamental analysis

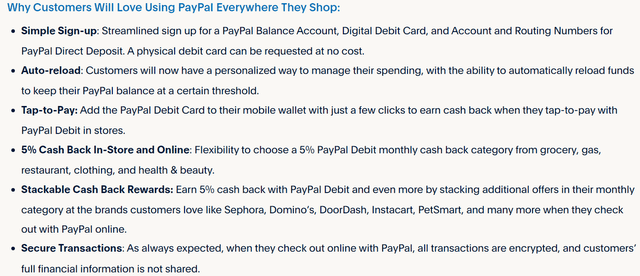

PayPal’s constant commitment to improve its offerings for customers and expand its partnership network is one of the primary reasons why I am bullish. On September 9 PayPal announced that the company has expanded its partnership with Shopify (SHOP). PayPal’s wallet transactions will be integrated into Shopify Payments in the U.S. Shopify is one of the world’s fastest growing e-commerce ecosystems, and partnership with this company looks very promising for me as a PYPL investor. Earlier in September, PayPal introduced a new feature, ‘PayPal Everywhere’.

In late August, PayPal also has expanded its global strategic partnership with Fiserv (FI). According to the press-release, the expanded partnership will help to streamline how Fiserv’s merchants enable PayPal experiences for their customers. Fiserv provides financial services technology solutions to nearly 10,000 financial institution clients. Due to Fiserv’s massive scale and footprint, this partnership expansion also looks interesting.

PayPal also unveiled important steps to improve customers’ checkout experiences during the last month of Summer 2024. On August 6, PayPal rolled out its new Fastlane feature. “With Fastlane, we are bringing an accelerated guest checkout to businesses of all sizes, helping them to drive more sales”, said the company’s CEO, Alex Chriss. By the end of August, Fastlane by PayPal was brought to Adyen’s (OTCPK:ADYEY) enterprise and marketplace customers in the U.S. Adyen is one of the key players in the European digital payments industry with a $44 billion market cap.

Venmo is one of PayPal’s star products that saw a massive 30% increase in monthly active users in Q2. The company has recently integrated Ethereum Name Service (‘ENS’) into Venmo, which will enable users to send cryptocurrency simpler by entering a readable ENS name rather than using complicated wallet addresses.

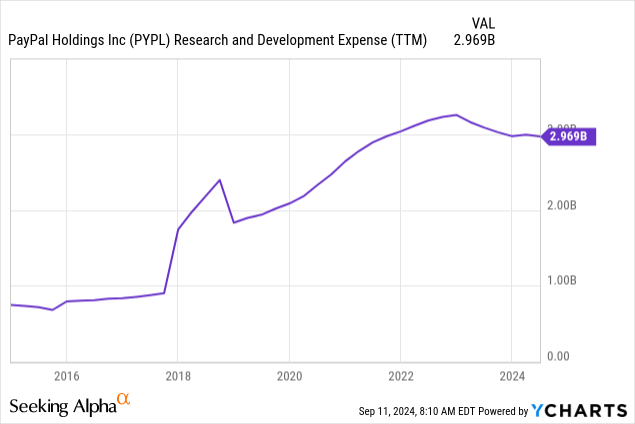

I think that given PYPL’s substantial $3 billion TTM R&D spending, we can expect more interesting features and partnerships to roll out soon. Moreover, PYPL is financially strong, with $13.6 billion cash as of the latest reporting date and quite low total debt (compared to PYPL’s market cap).

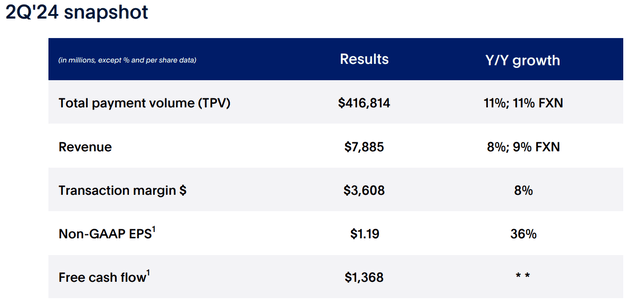

These enhancements increase chances that improved experiences for users as well as expanded PayPal’s reach will drive more value for shareholders in future. PayPal does not only focus on the future but is also committed to demonstrate solid performance in 2024. The Q2 revenue grew by 8.2% on a YoY basis. Revenue strength was supported by the robust 11% YoY growth in the total payment volume (‘TPV’).

PayPal’s Q2 earnings presentation

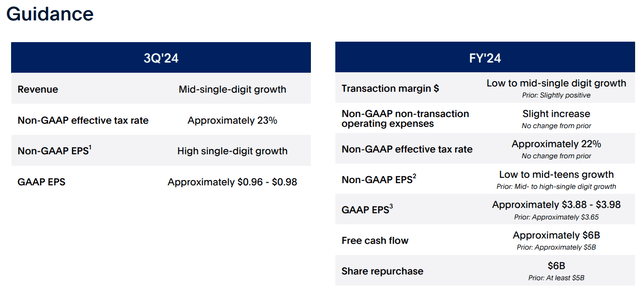

Overall, PayPal’s performance so far in 2024 is likely keeping up better than the management expected. This can be seen from the improved full-year guidance. The management expects that transaction margins will be better than initially planned, which is a strong bullish indicator. The free cash flow is expected by the management to be $6 billion, a billion above previous guidance, even despite the expansion of PYPL’s share repurchase plan.

PayPal’s Q2 earnings presentation

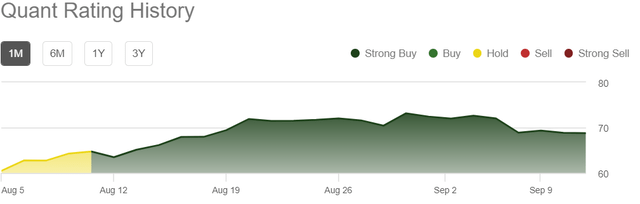

I think that PayPal’s becoming a ‘Strong buy’ Seeking Alpha Quant stock is also a solid bullish sign for investors. PYPL also received an upgrade to ‘Buy’ from Argus Research, also supporting my bullish stance.

Valuation analysis

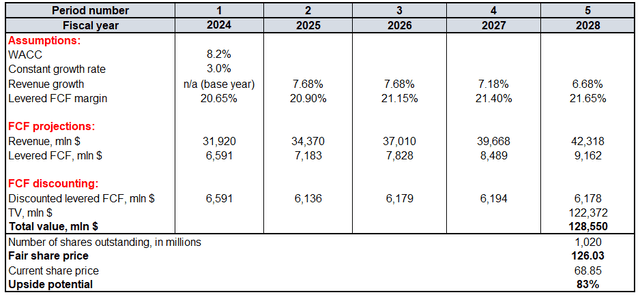

I start my valuation analysis with the discounted cash flow model, which is also called ‘DCF’. PayPal’s WACC is 8.2%. I reiterate the same conservative 3% constant growth rate for the terminal value (‘TV’) calculation.

Revenue growth projection between 2024 and 2026 is based on consensus. For the years 2027 and 2028 I incorporate a yearly 50 basis points revenue growth deceleration. Base year TTM FCF margin is 20.65%. To be conservative, I expect that PYPL’s FCF margin will improve only by 25 basis points every year. According to Seeking Alpha, there are 1.02 billion PYPL shares outstanding. Fair share price estimate is $126, according to the DCF.

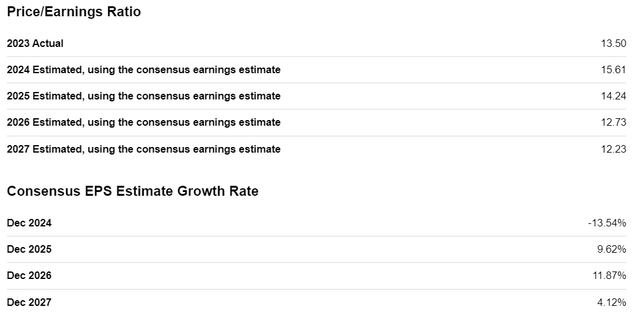

The upside potential is substantial, and I can cross-check it by looking at valuation ratios. PayPal’s current P/E ratio is 13.5, extremely low for a growth company. Since FY 2024 is a ‘Transition Year’, the GAAP EPS is forecasted to decline this year compared to 2023. However, consensus expects the EPS to return to growth in 2025-2027. Looking at PYPL’s current and forward P/E ratio, I am confident that the stock is undervalued.

In summary, PYPL’s valuation is compelling from the DCF point of view and the P/E ratio’s point of view.

Mitigating factors

The company’s financial performance significantly depends on total payment volume. According to Statista, there is a 56% probability of the U.S. falling into economic recession by July 2025. The overall economic activity will likely suffer in this case, adversely affecting PYPL’s TPV. The TPV shrinkage will inevitably mean a decline in PayPal’s transaction-based revenue. If the trend of increasing unemployment rate in the U.S. persists for longer, this will also highly likely adversely affect overall spending in the economy.

PayPal’s innovations and ventures into new areas appear promising. On the other hand, there is always a significant level of uncertainty and execution risk when companies embark on new projects. Innovations might require higher-than-expected budgets, or benefits from introducing new features might come out lower than costs. Electronic payments space is rapidly transforming, with powerful entrants like Apple and Google significantly expanding into this industry over the last few years. Innovation speed is vital because technologies might become obsolete in the modern fast-paced world.

Conclusion

PYPL’s upside potential makes the stock a no-brainer ‘Strong buy’. The market sentiment appears to be lagging as the new management demonstrates strong commitment to improving PayPal’s offerings and certainly prioritizes creating value for shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.