Summary:

- I explain management’s core strategy and how this translates into the financials.

- PayPal has no operating leverage; however, management has a credible strategy in place to change this and stabilize the Take Rate which is important for investor sentiment.

- My reservations with PayPal lie with execution and this is a key determinant behind my wait-and-see approach.

FG Trade

PayPal’s Core Strategy

In my last article on PayPal Holdings, Inc. (NASDAQ:PYPL), PayPal Making Promising Moves Under The Surface, I dove into the strategic initiatives that PayPal is working on. This is worth a read for investors who want a deeper understanding of what management is focused on.

PayPal continues to experience solid payments volume growth. I have it penciled in for 11% this year, down from 12.6% in 2023 but up from 8.6% in 2022. Revenue growth has generally been in line with payments volume growth. It was up 8.5% in 2022 and 8.2% in 2023, but I expect revenue growth to decline materially this year into the ~6% range. Case in point, management is guiding mid-single-digits for Q3. This is not necessarily a bad thing though; it reflects management’s strategy.

PayPal’s payments volume growth has been high because its lower-margin unbranded card processing segment has been growing faster than its higher-margin branded checkout. For example, it is processing more Uber payments (via Braintree) than payments from consumers using PayPal to buy clothing online from retailers using its network. PayPal makes more money on a $50 clothing purchase within its network than a $50 Uber ride.

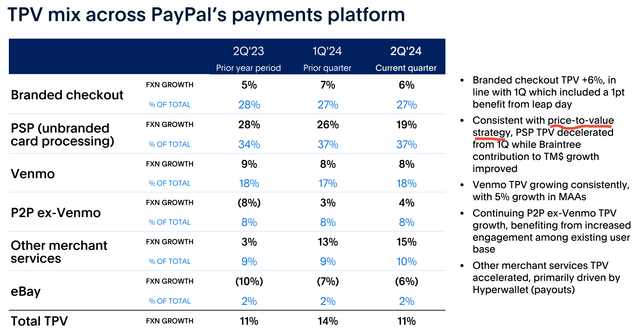

In its Q2 2024 earnings presentation, PayPal provided a slide with the following table:

PayPal Q2 2024 Results Presentation

The layout of this slide correlates with management’s strategy.

The first item is Branded checkout because the small-to-medium size business (‘SMB’) transacting with a PayPal user is PayPal’s bread and butter.

The second item is Unbranded (mainly its Braintree business) and notice management’s comments, “Consistent with price-to-value strategy, PSP TPV decelerated from 1Q while Braintree contribution to TM$ growth improved.” [Note: TM = transaction margin] Management has started to focus its contract renewals on higher margins or selling additional services into the existing price structure to increase the overall profitability of its unbranded transactions. CFO Jamie Miller had this to say on the Q2 earnings conference call in response to an analyst question about this:

So first well, let’s just talk through the Braintree growth and what’s really driving that. We set out this year to really reorient the team with Braintree around profitable growth. And as we’ve done that — we’ve had just a number of conversations with customers, both around contract renewal, but also just around our holistic relationship and really getting into understanding how we partner, what the margin structure is, how we provide value-added services, just the overall value-to-value exchange that we have got.

And honestly, they’ve been really positive conversations as we — and just on a total relationship basis sort of thing. As we looked at that, there are certain situations where as we’ve gotten into the discussion, we are willing to accept a lower share of revenue in exchange for a higher margin contract. There are other situations where, as we work with our customers, we are able to sell value-added services in ways that we just haven’t done before.

If this strategy is successful, we should expect to see lower payment volume and revenue growth but more profitable growth. This comes back to my earlier comment that 6% revenue growth this year is not necessarily a bad thing.

PayPal’s big problem is that its Take Rate continues to decline, quarter after quarter, year after year. It was over 3% in 2016. It is on pace for 1.86% this year. Management needs to stabilize this decline. Until it does, the stock could continue to suffer from negative sentiment. If it can stabilize the Take Rate, or heaven forbid even grow it (a little), then the story changes materially and investors will have more tangible insight into the real, long-term potential of this business.

Related to PayPal’s big problem is the fact that its cost and expenses have grown almost as fast as its revenue. Over the last 7 years, annual revenue growth has averaged 15.6% while annual cost and expense growth has averaged 15.2%. I’m projecting costs and expenses will increase more than revenues this year-management has talked about spending more on marketing in the second half-and if I’m right, costs and expenses will have grown slightly more than revenues from 2017 to 2024. Simply put, PayPal’s business has not had any operating leverage. This has to change. The question is, how aggressive does management need to be in these Unbranded contract renewals? This will be a key factor to watch. They may need to get even more aggressive with this price-to-value strategy.

PPCP and Fastlane

PayPal is playing defense with its Unbranded price-to-value strategy, but it is going on offense with its PayPal Complete Payments (PPCP) and Fastlane Branded strategy.

PPCP is a turnkey platform for SMBs geared towards simplifying their operations and allowing for easy, ongoing software upgrades with the latest features. If I have a small online clothing retailer and I sign up for PPCP, I may pay a little bit more, but I get the advantages of PayPal’s giant network and ongoing product updates without having to keep implementing major changes to my order and payment processing capabilities. This also allows me to maintain the most current security features.

Fastlane, which PPCP is optimized for, is a feature for PayPal users that stores all their information so that they can be verified and checkout quickly while shopping online.

Taken together, the goal of PPCP and Fastlane is to increase point-of-sale conversions, so more merchants will want to use it, even if it costs a bit more, and more consumers will want to use PayPal for an easier, safer, and consistent online shopping experience-which altogether enhances the greater value of PayPal’s two-sided network. This is the “flywheel” that management refers to, but it has become more like a hamster wheel in recent years given the absence of operating leverage.

Reservations

I would encourage anyone investing in PayPal to spend time using their service across online merchants, if not already. I started doing this about a year ago more than I ever had before. Outside of eBay where PayPal tends to work flawlessly, I would estimate that I have some sort of issue about 20% of the time-much more so if it is a Shopify Inc. (SHOP) website. Some of these issues may occasionally be related to my VPN or my use of the Brave browser, but not always, as I still have issues without the VPN on other major browsers. Now it would be easy for me to simply conclude that PayPal has issues, however, for all I know, its competitors are even worse. I would not be the least bit surprised if Shopify is much worse. I mention all this to say that products like PPCP and Fastlane can be very valuable if they work as promised, but that remains to be seen. Investors have to realize that the actual successful implementation of these promised products from a technology standpoint is a hurdle.

Another obstacle that PayPal needs to surmount is consumers simply not being aware of the benefits of using a product like Fastlane for a consistent, one-click experience. Here is where some marketing spends ahead of the holidays could produce returns. Last year, when I was Christmas shopping, I noticed that I could buy just about everything I wanted directly from merchants at lower sale prices than I could through Amazon.com, Inc. (AMZN). Where these merchants had PayPal, I could then do so quickly with a consistent checkout experience. Said differently, Fastlane gives merchants a potential tool against Amazon. This is the potential value of PPCP and Fastlane to merchants, but I question how well this is being marketed, if at all, and if network users truly understand the benefits. I wonder if this is why so many online shoppers continue to manually input their credit cards each time.

I can think of one website in particular where I am getting ready to make a large purchase where I will probably just input my credit card because I recently had issues trying to use PayPal and had to go through their customer service, which was a painful process. The chat and phone service were terrible, but the people did go out of their way to make it right, somewhat exceptionally I must say.

If I’m CEO Alex Chriss, I’d take $10 million or so and give it to a team to start slowly buying all kinds of items, all over the world, using all sorts of browsers, security features, etc., and then start addressing all the bugs and issues while suggesting enhancements.

This is my main reservation with PayPal: execution. My second reservation is: will merchants and consumers really understand the value? If I hadn’t started researching the stock and writing about it here, I probably wouldn’t. I am not saying that this is the case with PayPal’s management, but I’m always wary of management teams living inside their own corporate bubble.

Execution or Dividends

PayPal needs to grow revenues at the same rate as payment volume to stabilize the Take Rate. This path coincides with more profitable growth and the introduction of a measure of operating leverage into the business. They are improving in regard to this, and they have a credible strategy to get there. They need to execute in the weeds though to ultimately justify a higher-margin product.

I have PayPal at roughly fair value. I don’t own the stock now, but I am obviously watching to see how this strategy goes. I don’t see the stock outperforming the market by any material amount until there is more indication that management is executing on its core strategic initiatives. One quarter is not enough.

The case can be made that PayPal should start paying a dividend now, but I’ll give them the benefit of the doubt. If management does not clearly execute on this strategy by the end of 2025, then it will be time for the Board to consider a significant dividend as this stock will simply be confirmed as a dividend play on mediocre, nominal GDP-type revenue growth with no operating leverage. For now, it’s too early to tell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information presented here is general in nature and designed for do-it-yourself and professional investors. It does not have regard to the investment objectives, financial situation, and the particular needs of any person who may read this. Recommendations are not personalized investment advice specific to the situation of any one individual, family, or organization. In no way should it be construed as personalized investment advice. True Vine Investments will not be held responsible for the independent financial or investment actions taken by readers. This content is never an offer to buy or sell any security. This content includes a disclosure of any relevant securities held by Joshua S. Hall or his immediate family. Client portfolios managed by True Vine Investments may hold positions in securities covered here. Securities in these portfolios may be bought or sold at any time in order for True Vine Investments to satisfy its fiduciary obligations to clients. All data presented by the author is regarded as factual, however, its accuracy is not guaranteed. Investors are encouraged to conduct their own comprehensive evaluation of financial strategies or specific investments and consult a professional before making any decisions. Positive comments made regarding this content should not be construed by readers to be an endorsement of Joshua Hall’s abilities to act as an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.