Summary:

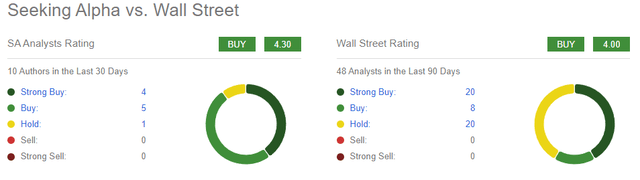

- The Seeking Alpha Analyst Community seems to be broadly bullish on PayPal. Wall St is split between Neutral to Bullish. I belong to the Neutral camp.

- PayPal’s revenue is showing some signs of a growth rebound. However, I believe the quality of this growth is poor and unsustainable.

- Transaction take rates are falling and the most important growth driver – active accounts – is showing signs of saturation amid signs of user-share loss.

- On the margins side, management’s efforts in controlling opex have been undermined by gross margin weakness driven by a dilutive revenue mix shift and hits due to credit losses on merchant loans, which are expected to continue.

- Valuations are undemanding, but I believe that alone is insufficient to make a compelling buy case. I prefer to wait and demand evidence of healthy growth turnaround and gross margin resiliency first.

urbazon/E+ via Getty Images

Sentiment review and thesis

I see an interesting contrast between the broadly bullish Seeking Alpha Analysts’ views on PayPal (NASDAQ:PYPL) and the mixed bullish and neutral views by Wall St:

Seeking Alpha and Wall St Sentiment on PayPal (Seeking Alpha)

In this case, I would have to side with the more cautious part of the Wall St crowd and Seeking Alpha Analyst JR Research. My reasons are simple:

- The quality of PayPal’s growth is an issue

- Despite opex control, PayPal’s gross margin pressures continue

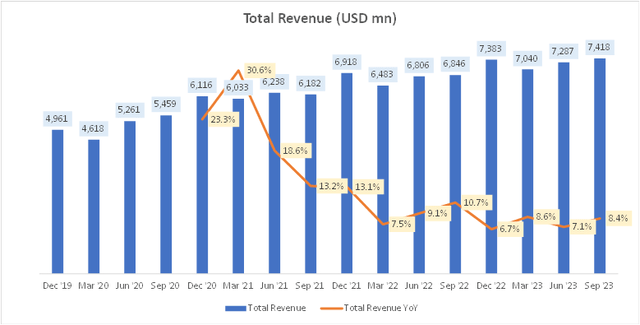

The quality of PayPal’s growth is an issue

PayPal’s revenue growth has moderated from 20%+ YoY to sub-10%:

PayPal Total Revenue (USD mn) (Company Filings, Author’s Analysis)

This moderation itself is not the main concern as it is in-line with a broader market-wide phenomenon. But let’s look at the composition of this growth:

Total Revenue is made up of 89.7% Transaction Revenue and 10.3% Value Added Services Revenue. We will focus on the big chunk that is Transaction Revenue, which is composed to Total Payment Volume (TPV) * Transaction Take Rate

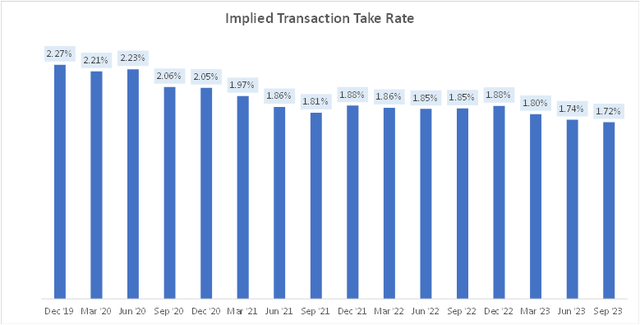

Implied Transaction Take Rate (Company Filings, Author’s Analysis)

The implied transaction take rate is showing has been steadily eroding over the last 3 years. This reflects a potentially weakening bargaining power over pricing.

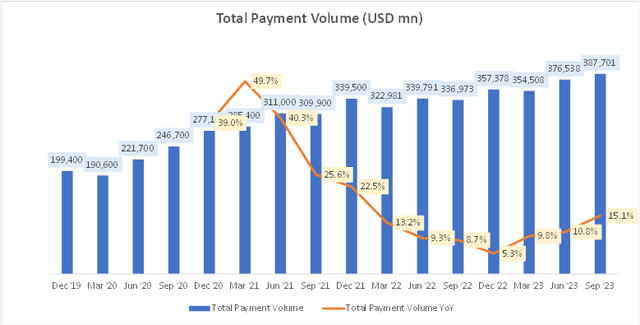

PayPal Total Payment Volume (USD mn) (Company Filings, Author’s Analysis)

PayPal’s TPV has started to rebound, which prima facie looks good. Now TPV is a function of Active Accounts * Average Payment Value * Number of Payment Transactions per Account

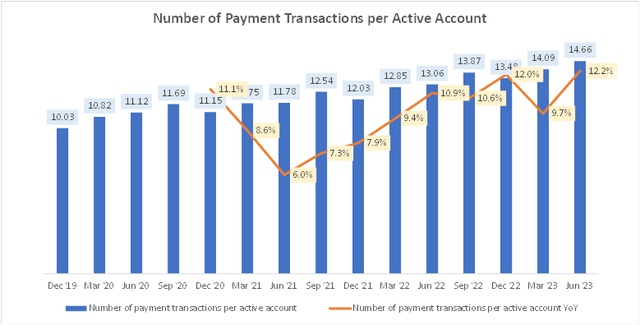

Number of Payment Transactions per Active Account (Company Filings, Author’s Analysis)

The number of payment transactions per active account is showing a steady increase and growing at double-digits. This indicates a higher frequency of use per account. The key thing to note here is that there would probably be a limit for this number. The growth track here cannot have as long a runway as active accounts for example. A counterargument to this would be the implications of interactions in a machine-to-machine economy, however, PayPal’s market position in such a circumstance is not well established yet.

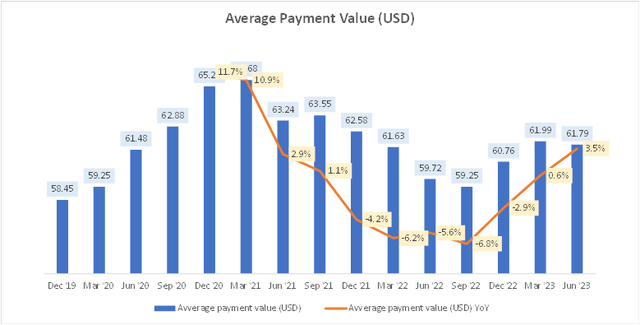

Average Payment Value (USD) (Company Filings, Author’s Analysis)

Average payment value is mostly stable. A long faster-than-economy growth runway cannot come from this variable unless the product/service mix of transactions materially changes to much higher-ticket items. I deem this to be unlikely.

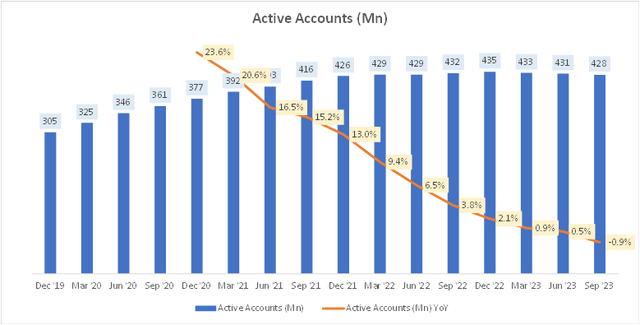

Active Accounts (Mn) (Company Filings, Author’s Analysis)

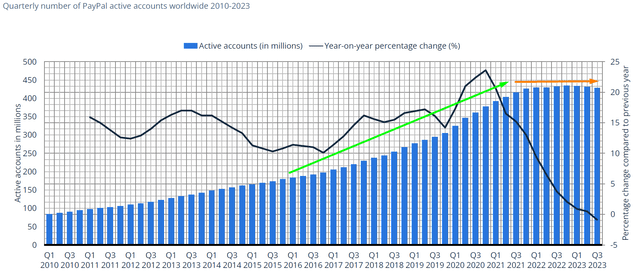

I posit that the most sustainable growth variable for PayPal’s business should be active accounts. And herein lies another growth issue; PayPal has weak growth in active accounts. In the last 2 quarters, the number of active accounts has fallen by $5mn. This makes me wonder whether PayPal has reached saturation levels in active accounts. This chart from Statista showing a longer time-series illustrates this more clearly:

PayPal’s Longer Term Active Accounts Trend (Statista, Author’s highlights)

Why are active accounts falling? It could be because of losses in user-share:

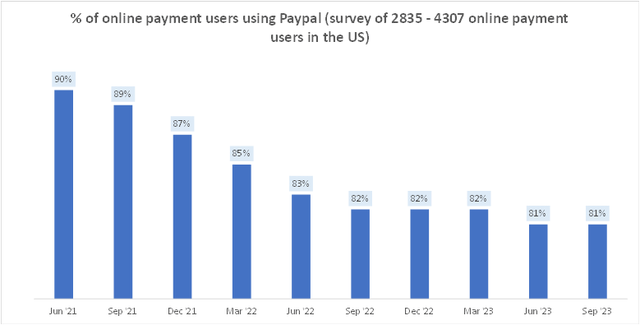

% of online payment users using PayPal (Statista, Author’s Analysis)

Looking at quarterly survey data of 2,835 to 4,307 online payment users in the United States, the portion of online payment users using PayPal has fallen from 90% to 81% over the last 10 quarters. The new CEO certainly has a tough ask to turn this around since share losses are typically difficult to undo.

Despite opex control, gross margin pressures continue

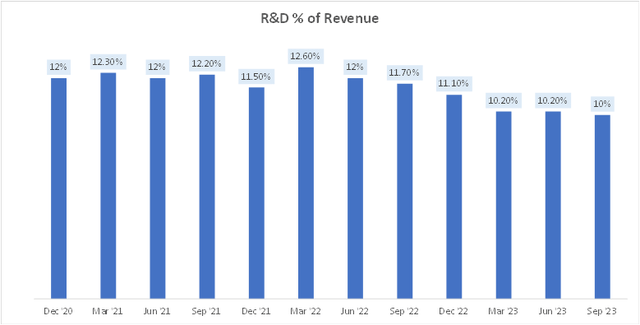

PayPal has realized operational efficiencies by cutting down on R&D intensity:

R&D as % of Revenue (Company Filings, Author’s Analysis)

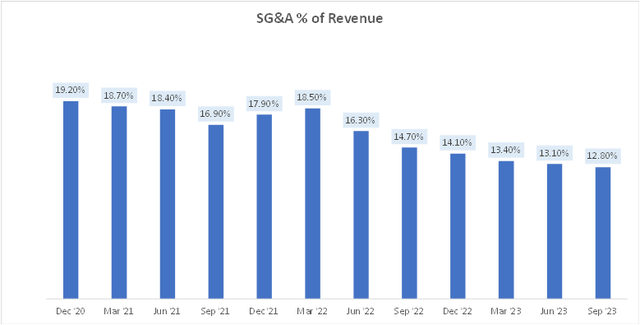

And SG&A:

SG&A as % of Revenue (Company Filings, Author’s Analysis)

Over the last 6 quarters, a total of +830bps of operating margin benefit has been created due to cost control on these 2 opex drivers.

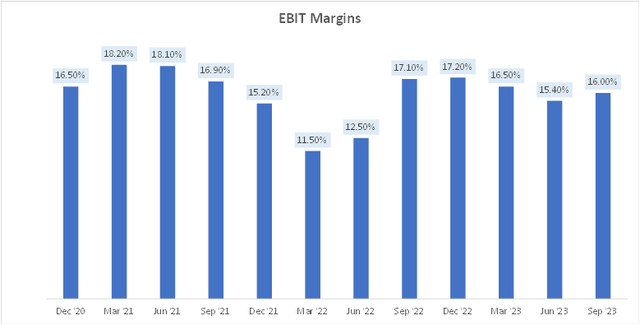

However, EBIT margins have not seen a corresponding improvement (only a +450bps improvement over the same time frame):

EBIT Margins (Company Filings, Author’s Analysis)

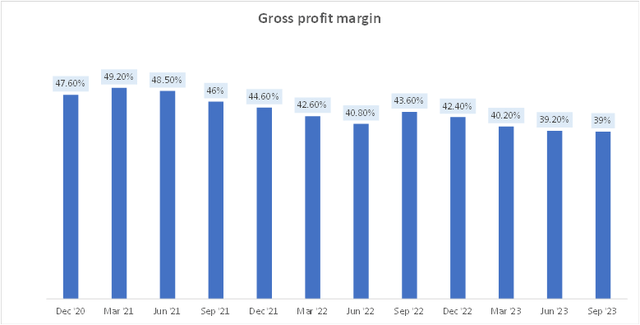

This is because gross profit margins have been on a steady decline:

Gross Profit Margins (Company Filings, Author’s Analysis)

Management attributes some of the decline in gross profit margins (they refer to transaction margins as the key driver) to a mix change toward unbranded merchant checkout which is margin-dilutive for PayPal. However, another spanner in the works leading to gross profit margin pressures is a deterioration in the creditworthiness of loans lent to merchants. In Q2 FY23, Acting CFO Gabrielle Rabinovitch admitted that:

Overall, PayPal Business Loans was about a 90 basis point drag to transaction margin… and this is approximately 2x what we expected at the beginning of the quarter.

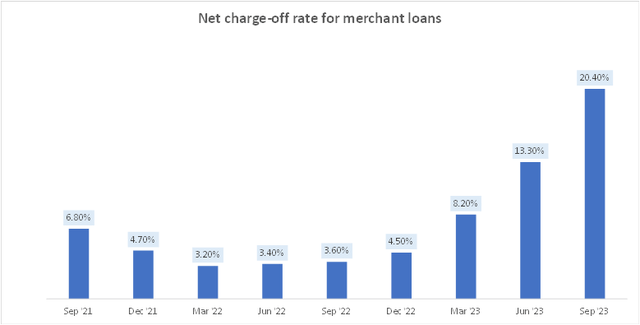

This problem occurred because PayPal relaxed their standards on lending to merchants. The result of this mistake? A sharp increase in the net charge-off rate (basically bad debt writeoff) for merchant loans:

Net charge-off rate for merchant loans (Company Filings, Author’s Analysis)

Looking at it from another perspective, unrecoverable merchant loans have climbed to 37.4% of value-added services revenue. That’s about almost 4% of overall revenues in scale. Now it makes sense for why the impact on gross margins was material at almost 100bps.

In Q2 FY23, management expected this pressure to last until the end of FY23. Q3 FY23 was in-line with this previous expectation:

Consistent with our expectations going into the quarter, Q3 saw a higher level of pressure on transaction margin dollar and rate performance due to several lapping and more transitory factors that we’ve discussed on past earnings calls.

– Acting CFO Gabrielle Rabinovitch in the Q3 FY23 earnings call

As management themselves have been surprised by worse-than-expected margins before, I am reluctant to believe that these headwinds would have cease in Q4 FY23 or even Q1 FY24. I prefer to wait for proof of gross margin stability first.

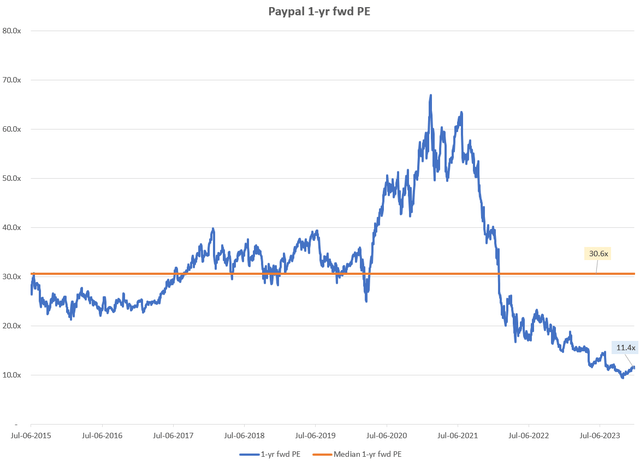

Valuations are lower but growth rebound and margins resiliency needs to be proven

PayPal 1-yr fwd PE (Capital IQ, Author’s Analysis)

Yes, valuations are lower as PayPal is currently trading at a 1-yr fwd PE of 11.4x; much below the longer-term median of 30.6x. Probably these are acceptable valuations for a buy. However, readers familiar with my investing approach will know that I necessarily require proof of turnaround in key operating momentum. I never invest on depressed valuations alone. This helps me avoid value traps (when the stock continues to get cheaper and cheaper to no apparent end). In this case, I demand a growth rebound and proof of gross margins resiliency before becoming a buyer on PayPal.

Takeaway

I struggle to find the bullish case for PayPal. I see glaring issues with the quality of growth as the company appears to be reaching saturation in the number of active accounts along with some signs of user-share loss. And there is no sign of respite in gross margin pressures that is undermining much of management’s effective opex control.

Yes, valuations are probably undemanding but I don’t think valuations alone are sufficient for making a buy-case. To avoid value traps, I demand a turnaround in operating momentum first in these circumstances. This way, I may not capture the initial rally in the stock. But that is a tradeoff I am willing to accept to reduce the risk of downside volatility.

Rating: Neutral/Hold

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.