Summary:

- In our last article on PayPal, we gave the tired bulls some good news and some bad news.

- Unfortunately that thesis is playing out as expected and PayPal is destined to become a value play.

- We look at the Q1-2023 results to see where we are in this journey.

DNY59

In our last article on PayPal Holdings Inc. (NASDAQ:PYPL), we gave the tired bulls some good news and some bad news.

The good news is that PYPL does have a respectable valuation. 4.3% adjusted free cash flow yield or 23 times GAAP earnings are actually very nice valuations relative to what madness transpired over the markets in the last 2 years. The bad news is that it is not remotely low enough if you understand the history of bubbles. Bubbles end with extreme undervaluation and we are not there yet.

If you embrace that forecast, the best way to play it is to sell cash secured puts at $60 or lower strikes, after the stock takes rough tumble. We rate this a hold at present. Marrying our thinking on PYPL with our outlook on the market, makes us believe that a longer term buying opportunity will present itself in late 2023.

Source: One Of The Best Values In Growth

Refusing to buy the stock paid off once again and PYPL headed sharply lower after what appeared to be a decent quarter.

One Of The Best Values In Growth

We look at the Q1-2023 numbers and tell you why we are more optimistic for returns from here but are not ready to buy just yet.

Q1-2023

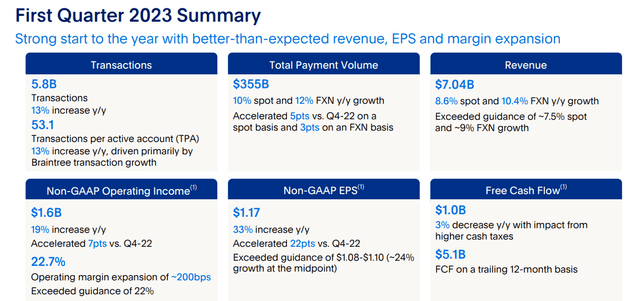

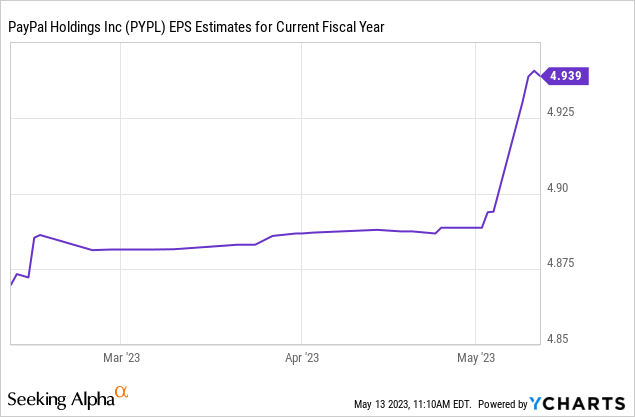

Q1-2023 delivered both revenues and earnings that were better than expected. Now, in the last 6 months we have had no shortage of the analysts community downgrading estimates to help setup “beats”. This was not the case for PYPL though. Earnings estimates were relatively flat going on and the analyst community was not pitching any favors. You can see that in the chart below. The big bump up came after the results.

So PYPL did one of those true earnings beats and numbers were also far ahead of where we thought they would land.

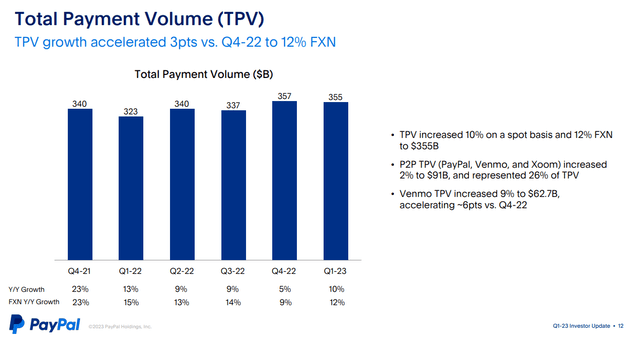

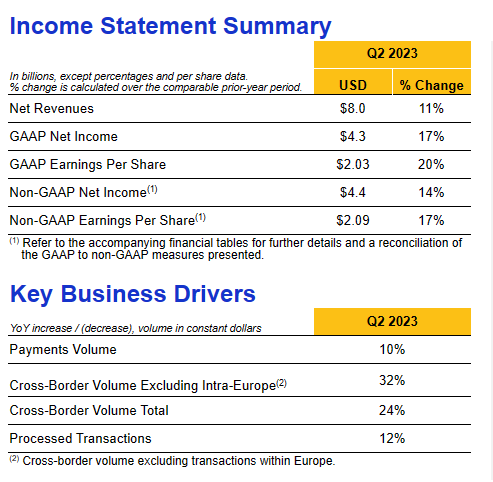

Total payment volume was up by 10% and 12% if you took out forex impact.

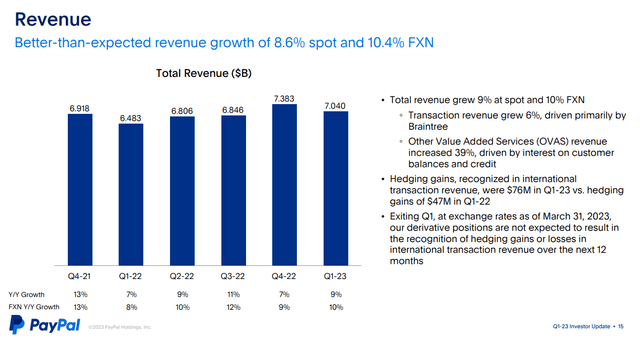

Revenue growth which tends to follow the above metric (though not always perfectly), also came in the same ballpark.

If you looked around for companies that are exposed to the same volume trends on consumer spending, you did not get much better than this. Visa (V) for example showed revenue gains of 11% and payment volume growth of 10% for their quarter ended March 31, 2023 (note that it is their fiscal Q2). Visa stock is up fractionally since then.

VISA Q2-2023 Results

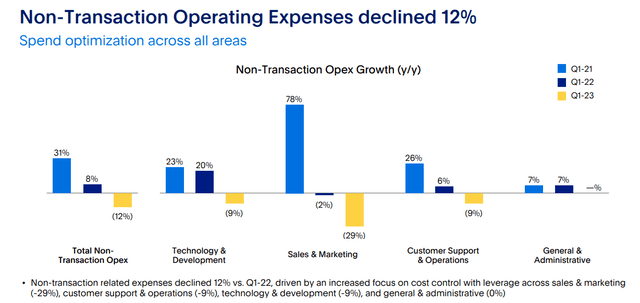

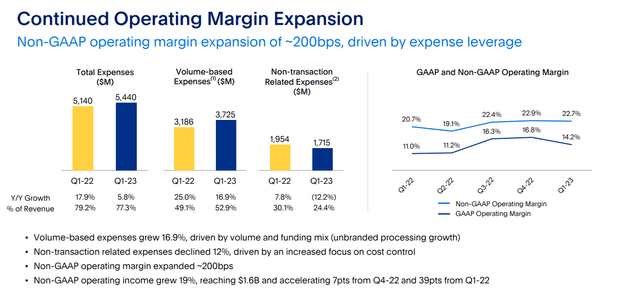

PYPL did well here relative to what anyone expected and coupled that revenue growth with a decline in non-transactional expenses.

The margin expansion again proved the bears wrong and PYPL is leveraging its business quite nicely at this point in the cycle.

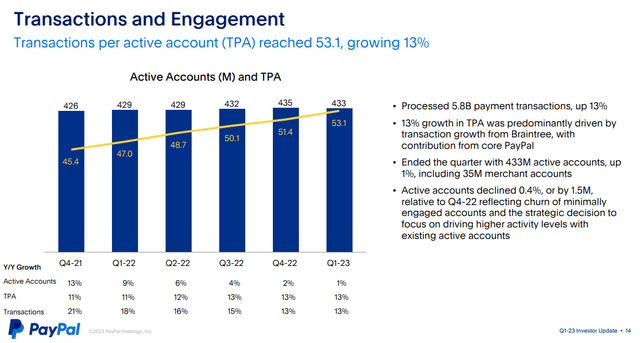

If there was one small piece of bear fodder, it came from total active accounts. There was a small drop to 433 million from 435 million.

One could argue that this was more than offset with transactions per account growing 13%. But this is the difference between bull runs and bear runs. During the former the slightest positive news is embraced to blow more air into a bubble. If there was news about PYPL expanding into Moldova, then investors would be happy to add that country’s GDP equivalent to PYPL’s market cap. Why not, right? During the latter you can do everything right and still get punished mercilessly. This was the key piece that got many analysts to start taking down their buy ratings. It seems silly and even illogical but the stock they felt was a buy at $300, is now a sell at $60, even though every valuation metric has improved by leaps and bounds.

Outlook

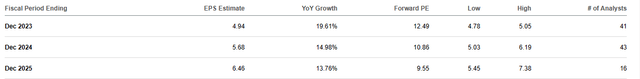

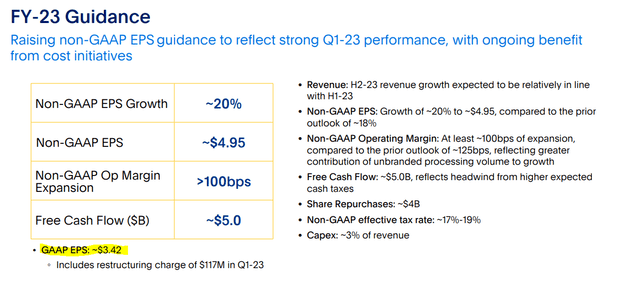

If you are expecting the find the impact of analyst downgrades in the earnings area, you are out of luck. Earnings are expected to go up at a strong double digit rate for 2024 and 2025

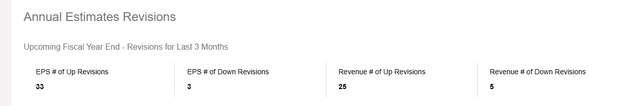

In fact, it is rare to see so many “up revisions” to earnings alongside a tanking stock.

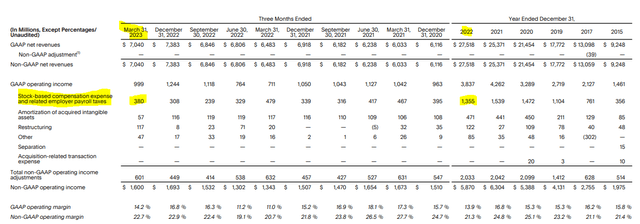

So if you want to say this makes no sense, we are with you there. If there is a bear leg to the PYPL thesis, it is that we really have to stop this silly non-GAAP number discussion. That 12X earnings what people refer to comes from the adjusted earnings estimates. GAAP numbers are still pretty poor in comparison. PYPL still trades at 18X GAAP numbers.

The bulk of this GAAP to non-GAAP differential comes from stock based compensation. You can see the near $400 million of quarterly expense for this number in non-flashy slides at the end of the PYPL presentation.

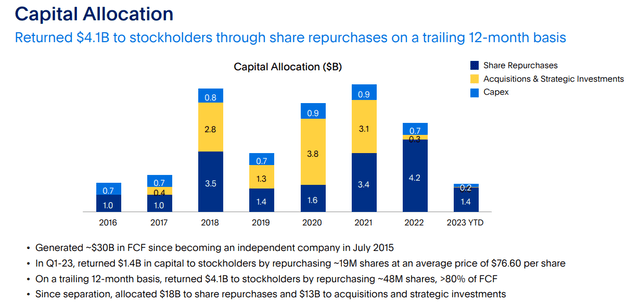

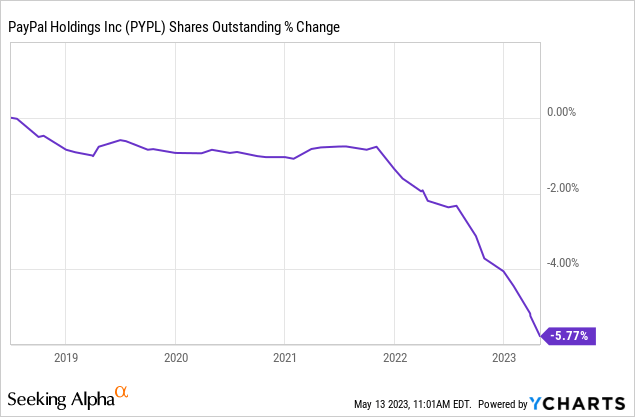

This trends to close to $1.5 billion annually and then PYPL turns around and uses its “free cash flow” to buy back the same stock. So this is the main gripe that bears and those sitting on the fence (like us) have with the PYPL model.

Heck, even they admit it here if you look closely enough at the slide above. PYPL has spent $18 billion on share repurchases since separation. Total share count was essentially flat between 2018 and end of 2022 for PYPL. It was only after 2022 that the share count started declining.

So that period between 2018 and 2022 was the timeframe of extremely poor capital allocation as PYPL bought back its inflated stock to offset stock based compensation. Only when the price declined enough relative to its free cash flow, did PYPL start making a dent in its shares outstanding.

Verdict

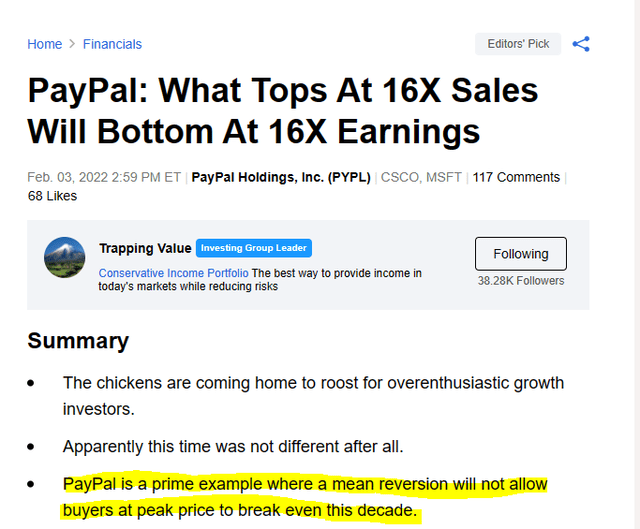

We wish we could tell you that you could go hand over fist here but the valuation is still demanding. Yes you have growth but without new accounts showing up, you are likely to start tracking nominal GDP for revenue growth. We would not put 18X GAAP earnings in the category of cheap for such stocks. We would certainly not put it as cheap when we believe a recession is close by. We had previously used this title without the “GAAP” included.

What Tops At 16X Sales Will Bottom At 16X Earnings

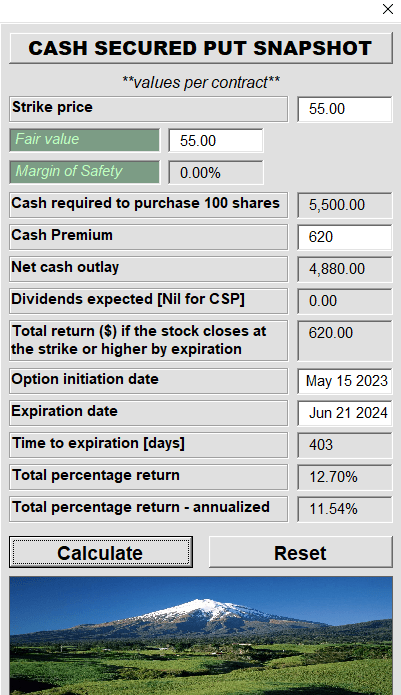

Of course, since then inflation has proven more persistent and interest rates have headed far higher. In such an environment, we would look for a minimum of 16X GAAP earnings as the buy point. We are close here to a significant bottom and one that will reward the patient buyers. If we were forced to pick a play here it would be to aim for the $55 strikes on longer dated cash secured puts.

Author’s App

The margin of safety is acceptable and it provides a solid income for waiting.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.