Summary:

- PayPal’s intrinsic value is $125 per share, representing 75% upside, even while accounting for a loss of market share.

- If the management were to use 100% of FCF toward buybacks, they could repurchase all outstanding shares within the decade. A stark contrast to the “dead money” argument.

- Fastlane, PayPal’s new passwordless checkout solution, is now rolling out. It significantly improves merchant conversion rates and consumer experience, a win-win situation for both.

- While the take rate and transaction margins have been trending down, PayPal now has a way to achieve the profitable growth that CEO Alex Chriss has been promising.

Justin Sullivan

My previous PayPal (NASDAQ:PYPL) article covered my investment thesis for the company; it’s a simple but powerful one. I showed that PayPal is priced for 0% growth in free cash flow to the firm (FCFF) for the next decade. Any growth would result in the company being undervalued. However, the thesis is expanding. Now it’s no longer a matter of if the business will grow at all; it’s about how much. Many investors have been cautiously waiting on the sidelines to see if PayPal can reinvigorate themselves under the new CEO Alex Chriss, and we are now seeing the fruits of his labor. PayPal remains one of the biggest opportunities in the market, and in this article I will detail why.

Why patience is bound to pay off

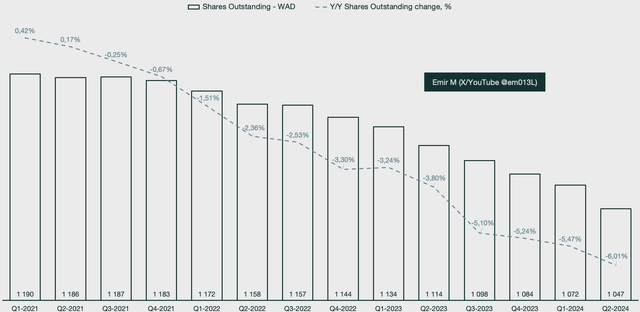

The PayPal stock quote has been rangebound for 2 years, pedaling between $50 and $95. During this period, management has committed most of their free cash flow towards stock repurchases. As per the Q2 2024 earnings call, PayPal CFO Jamie Miller confirms that 100% of the free cash flow (FCF) will be committed towards buybacks:

Given the strong start to the year, we are raising our 2024 free cashflow guidance to approximately $6 billion. We are also increasing our share buyback plan to $6 billion compared to our prior guidance for at least $5 billion.

I have received a lot of pushback in regard to PayPal being dead money, often citing various opportunity costs associated with the stock. However, I am not too worried about that considering the commitment from the management in regard to stock repurchases. I decided to run a small exercise where I simulate how long it would take PayPal to repurchase all their outstanding diluted shares. Here are the assumptions:

- Share price is stagnant at $72 or less

- Dilution set to 1.3% annually

- 100% of free cash flow is committed towards buybacks

- 8% revenue compounded annual growth rate (CAGR)

- 19.67% free cash flow margin

Emir Mulahalilovic

The result is that within a decade, PayPal will have repurchased all of their outstanding shares through their buyback program. It would be even faster if the stock price were to drop. I understand that this scenario is farfetched, and I don’t put much weight into it, but I use this example to show the unlikelihood of the claim that PayPal will remain dead money. I expect the management team to keep repurchasing shares while the stock price is suppressed.

The beauty in regard to share repurchases is that they, just like investments, compound. If PayPal can grow their free cash flow margins and grow their revenue, combine it with the compounding effect of taking shares off the public market, and that creates a powerful situation. Shareholders won’t need to wait until 2032 to see a big impact; this is already felt on a quarterly basis as of right now.

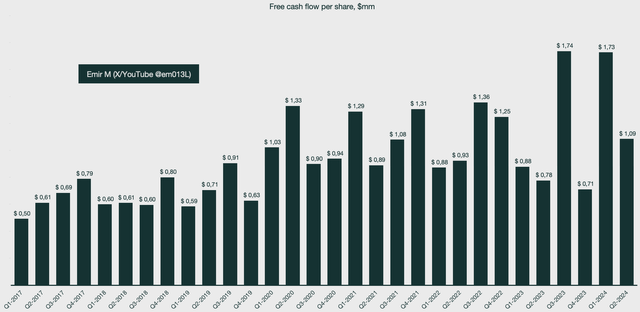

Emir Mulahalilovic, PayPal SEC Filings

The risk many investors associate with this simple proposition is that they don’t believe that PayPal will be able to sustainably grow their free cash flow, and that in turn collapses the repurchase arguments. While the notion of PayPal successfully being suppressed for another 8 years is an unserious one, PayPal’s consistency in generating free cash flow has historically been spotty on a quarterly basis. Some of this can be explained; for example, holiday seasons or major events like the Olympics boost spending and, in turn, free cash flow. However, I am not able to explain the pattern we have been seeing for the past 8 years.

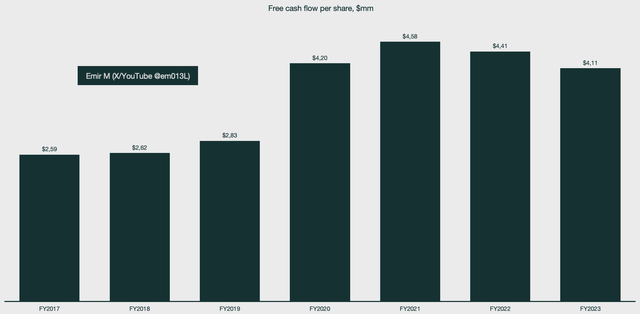

Emir Mulahalilovic, PayPal SEC Filings

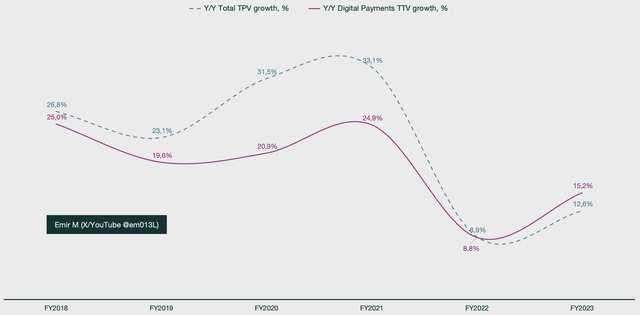

When looking at the same chart but on an annual basis, it smooths out the periods, and we can get a better look. It is clear that the pandemic and immediate post-pandemic boost to online sales had a huge impact that is now acting as a drag. If we normalize the growth between fiscal years (FY) 2019-2022, it suddenly does not look all too scary.

Emir Mulahalilovic, PayPal SEC Filings

What’s important to remember is that while the PayPal of old was no disaster, even though the stock market would have you believe that it was, it’s not the same company under Alex Chriss. PayPal is guiding for $6 billion of FCF; it’s the largest print, even compared to the glory days of the pandemic. Alex Chriss has stressed the term “profitable growth” ever since he took on the role of CEO, and we are starting to see the fruits of the labor.

The transformation is here

Before Alex Chriss took over as CEO, investors were briefed on what PayPal was working on in terms of new technology. A lot of the focus was on the checkout experience, with talks about boosting conversion rates.

First, let’s look at why there was a need for change at the company in the first place. PayPal operates in competitive landscapes across both the payments processing business and also the checkout option business. Over time, some investors have cited a “race to the bottom” for companies operating here, due to the competitive nature of the industry. The term refers to different companies undercutting each other to be the favored solution for various forms of digital payments.

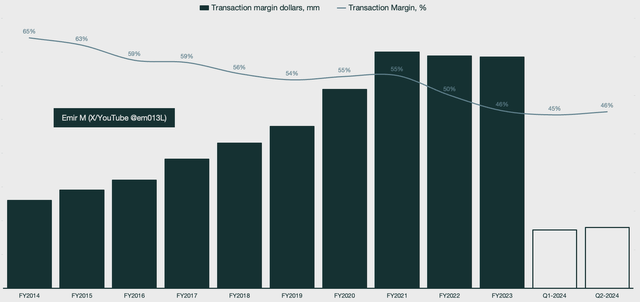

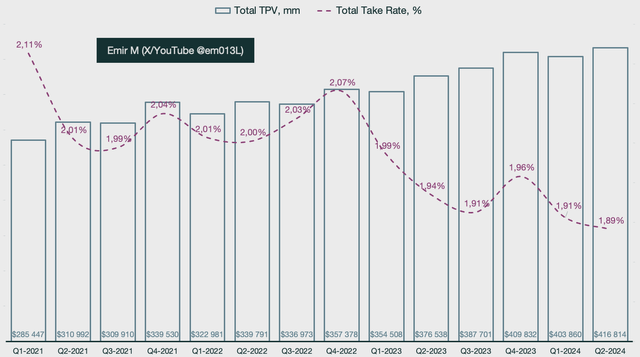

Emir Mulahalilovic, PayPal SEC Filings

If we look at the transaction margin, we can see a steady downtrend the past decade. However, it finally seems to have bottomed around ~46%. As a reminder, the transaction margin formula is:

- (Net revenues-Transaction expenses-Transaction and loan losses)/Net revenues

The take rate is another metric that has seen steady declines, implying margins are being competed away. We still do not have any firm indications of it reversing at the time of writing. The formula is simply net revenues divided by total payment volume (TPV).

Emir Mulahalilovic, PayPal SEC Filings

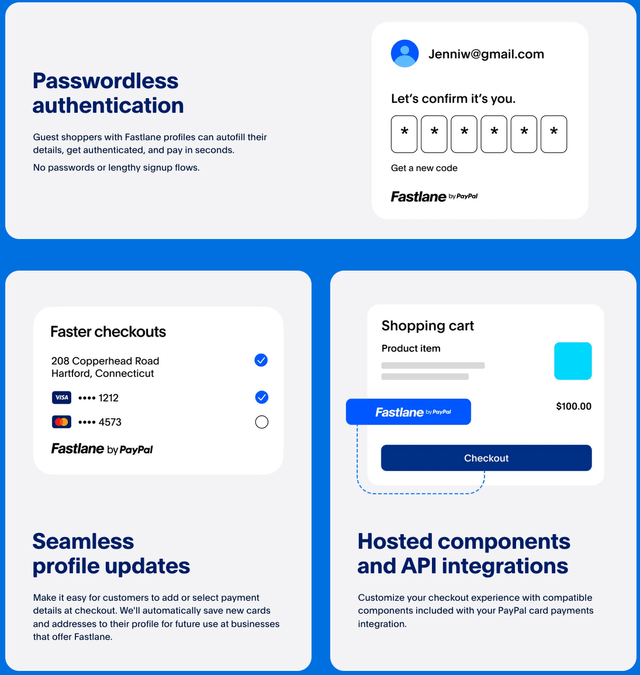

PayPal seeks to combat this decline with services that provide value to both the customer and the merchant, creating a healthy win-win relationship. PayPal’s new product Fastlane has been in the works for a while now and is just starting to roll out in the United States market. PayPal offers Fastlane for free to merchants throughout the year, and in 2025 it will also start rolling out globally.

The concept is simple in nature but very difficult in execution. The core of the product is around the concept of passwordless checkout, removing as much friction as possible in order to convert more carts into purchases. There are various online shopping studies, but most roughly align with this report published by Capterra:

- 66% of consumers expect online checkout to take less than 4 minutes

- 82% of consumers abandon their carts if the checkout process is too complicated

- 75% of consumers use a burner email for online shopping

- 43% of consumers prefer to use guest checkout

Fastlane solves all of these issues, and there are merchant testimonies to support that. Fastlane works by leveraging PayPal’s vault of financial instruments, the largest of its kind in the western world. Here’s a note from CPO John Kim during the PayPal Management Meeting Conference about a year ago:

we have 5 billion instruments that are vaulted on PayPal today. To give you some context, there is about 21 billion cards out in the western world. That includes prepaid cards, credit cards and debit cards. So, about 25% of those cards that are in circulation are on PayPal in our vault

When a user checks out as a guest at a Fastlane-enabled merchant, they simply receive a code to confirm their identity. Their details are autofilled, allowing them to save a lot of time on entering an address, adding financial instruments to pay with, signing up with an email, and other tedious activities associated with checking out.

PayPal

According to PayPal, guests are checking out approximately 32% faster; those are massive results in the competitive space of e-commerce. Fastlane profiles are also shown to convert at 80%; that is compared to an industry average of 50% for guest checkouts.

The customers win by having a more seamless and frictionless experience, and the merchants win by boosting conversion rates and gaining access to the PayPal vault.

PayPal was in a race to the bottom due to competition, but what if the competition recognizes your strength? Fastlane is so good that Adyen (OTCPK:ADYEY) has decided to partner with PayPal to offer the Fastlane solution to its own clients. Here’s what Adyen CEO Pieter van der Does has to say about the partnership:

The expanded partnership with PayPal further strengthens Adyen’s ability to provide global enterprises with seamless payment flows and top-quality guest shopping experiences,

PayPal is a payment brand name that shoppers trust, and we’re excited to take our collaboration another step further in the US, utilizing our combined expertise to raise the bar for our customers

PayPal is not stopping with Fastlane; they have grander schemes in the works to leverage network effects as the largest player in the space. I mentioned Vault earlier and how it is powerful in ensuring correct and up-to-date customer details for their checkouts. However, it can also enable superior ads tailored to each shopper’s habits. This is hinted at during the Q2, 2024 earnings call by Alex Chriss:

We are building an end-to-end platform, spanning the full commerce journey with superior customer experiences and sales conversion from start to finish. PayPal is one of the only players with both sides of the network, consumer and merchant at scale globally and with the infrastructure to support it. That is incredibly hard to replicate and a powerful foundation on which to launch new innovations including Fastlane and the Ads platform that we are in the early stages of building.

However, I am cautious about putting too much weight into my valuations in regard to intangibles. What I am looking for in recent quarters, since Alex Chriss took over the CEO role, are hints for future growth. The current financial results do not yet reflect the impact of Alex Chriss or the executives he has appointed. By understanding the trajectory of the business, we can more accurately project future performance in our valuation models.

Luckily, there is so much margin of safety in regard to PayPal’s fair value, even after the recent run-up, that we can afford to be a bit patient with increasing our growth and profitability numbers in our models.

Valuation – still one of the best opportunities in the market

Despite the perceived poor business that investors have labeled PayPal as in recent years, they have actually gained market share. Keep in mind that it’s only recently that bears mention that competition is coming for PayPal’s lunch, but in reality, all the same players have been around for over a decade, and during that period, PayPal still grew its market share. We can weigh PayPal’s TPV growth against the global digital payments total transaction volume growth as a proxy for the online payments market as a whole.

Emir Mulahalilovic, PayPal SEC Filings, Statista

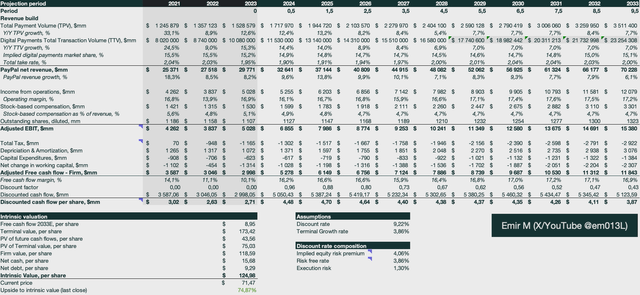

I currently project PayPal to lose market share slightly until 2030, before stabilizing and recapturing market share to return to a mean. I see PayPal growing their total take rate as a result of Fastlane from 2025 onwards, albeit at a slow rate. I have not included impact from the ad platform, as it is still very intangible and would not be remotely accurate. However, that also means that any financial performance from an ad platform is optionality, meaning I get it for free without paying for it. This is similar to what I did when I valued Tesla, where I purposely excluded RoboTaxi, Supercharger networks, and the robotics business.

For those unfamiliar with my previous articles, I capture share dilution on a per-share basis. This means that I have to adjust for the stock-based compensation (SBC) impact in the operating income. Instead, I dilute the outstanding shares, and each period outputs discounted cash flow per share. The reason I don’t think it makes sense to have SBC as an expense impacting FCF is because it implies that the money spent can’t be leveraged when in fact it can.

The model utilizes the following assumptions:

- Implied Equity risk premium for the month of August: 4,06 (calculated by Professor Aswath Damodaran)

- Risk-free rate of 3.86%

- Execution risk set to 1.3%, implying moderate execution risk for the next decade

- Statista forecasts transaction value until 2028; the remaining periods are extrapolated

The risk-free rate doubles as the terminal growth rate. Since valuations are not static, we have to use what the market is implying at the time of doing the valuation. I use the risk-free rate as a proxy for longer-term economic growth in the United States, which is why the terminal growth rate might seem high to some investors.

Emir Mulahalilovic, PayPal SEC Filings, Statista

This leaves us with an intrinsic value of $125 per share, a 75% upside from current trading levels.

Summarizing thoughts

Investors have long waited for a business transformation in order to get excited for PayPal. It is here now. Fastlane represents such a strong ecosystem proposition that even competitor Adyen decided to partner with PayPal. The frictionless guest checkout solution boosts merchant conversion rates and allows for quicker and less frustrating checkout for consumers, a true win-win for both parties. The reason Fastlane won’t so easily be replicated is because it utilizes PayPal’s network vault, the largest of its kind. It currently stores around 25% of all issued cards in the west, equating to around 5 billion instruments.

PayPal is not a perfect business by any means. Transaction margins and take rates have been trending downward and creating a cause for alarm within investor circles. I believe that Fastlane, once monetized in 2025 and onwards, will bring positive change to both.

Currently, the upside to my fair intrinsic value is about 75%, speaking of severe undervaluation. In my model, I don’t include expectations for PayPal’s ad business, it’s PYUSD stablecoin or any other currently intangible factors. These provide optionality, meaning that any financial performance from them is essentially free, and I did not pay for them.

The risks associated with PayPal now are largely undermined by the fact that even assumptions are resulting in an almost 100% upside to fair value. The risks include Fastlane pilot numbers not being representative of the market as a whole, which could make it a less attractive offering. Another risk bears like to bring up is the stock being “dead money,” since the quote has been range bound for 2 years. This too can be dismantled in an extreme but simple buyback exercise. If PayPal were to keep committing 100% of their FCF towards buybacks, like they have pledged for 2024, then PayPal will have repurchased every outstanding share by 2032. I don’t mind being patient at these levels, and continue to have a strong buy rating for PayPal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.