Summary:

- PayPal’s shares have appreciated due to improved user growth and strong Q2 earnings, but the company still faces significant competitive challenges.

- Despite trading at attractive multiples, PayPal’s lack of major competitive advantages could hinder aggressive growth and make it a potential value trap.

- Rising competition from FedNow and Apple Pay poses significant risks to PayPal’s ability to acquire new users and sustain its turnaround.

JHVEPhoto/iStock Editorial via Getty Images

For a few years, PayPal’s (NASDAQ:PYPL) shares have been losing their value as the company was unable to stop the decline of its active user base, which undermined the business’s growth prospects. This was considered a major red flag by lots of investors. However, things started to gradually change for the better earlier this year, which prompted the appreciation of PayPal’s shares which are currently up by a double-digit rate since the start of the year.

The issue though is that while it looks like the worst for the company is behind it, PayPal could be considered as a value trap at the current price. While the company trades at attractive multiples, the lack of major competitive advantages could undermine the turnaround efforts and prevent PayPal’s business from growing at an aggressive rate in the foreseeable future.

Is This the Start of a True Recovery?

Back in March, I wrote an article about PayPal, where I noted that as long as the company fails to revive the growth of its active users, it’s unlikely that its shares will be able to greatly appreciate anytime soon despite being undervalued. Since that time, the Q1 and Q2 earnings reports came in, which showed that PayPal is on track to fix the major issue that led to the underperformance of its shares in recent years. Thanks to this, PayPal’s shares have appreciated by ~10% since the time that article was published.

Right now, it’s good to see that things within PayPal are improving. The recent earnings report for Q2 showed that the company’s revenues increased by 8.2% Y/Y to $7.9 billion and were above the estimates by $80 million. At the same time, the non-GAAP EPS of $1.19 was also above the expectations by $0.20.

What’s more important is that the number of active accounts increased Q/Q for the second quarter in a row and stood at 429 million accounts at the end of Q2. In addition to that, the company managed to increase its total payment volume by 11% to $416.8 million, while its transaction margin dollars were up 8% to $3.6 billion, in large thanks to the great performance of its branded checkout product.

Considering that the U.S. economy continues to grow at a reasonable rate, retail sales are growing as well, and inflation is on track to return to 2% annually, it’s safe to assume that the macro picture will remain solid in the following quarter. This should help PayPal grow its business as well and the company has already increased its profit guidance for the year.

At the same time, by trading at 16 times its forward earnings, PayPal appears to be undervalued against the broader market and could be considered a decent investment by some people. However, PayPal continues to face several major challenges that could undermine its turnaround in the foreseeable future and potentially make the stock a value trap.

Major Risks To Consider

While it’s good to see things at PayPal improving, it’s still too soon to call the ongoing turnaround within the company a major success for now. The biggest issue is that while the number of active accounts in Q2 improved sequentially, it was still down 0.5% Y/Y. This is still a problem considering that the performance of the company’s stock is highly dependent on whether PayPal’s active users are growing or not. For years, PayPal’s earnings were mostly improving, but its shares started to gain momentum only earlier this year after the decline of active users stopped. That’s why, until the active user count increases Y/Y and returns to the previous levels, it would be premature to celebrate victory.

Although the macro environment is improving and should make it easier for PayPal to achieve its goals, there’s a case to be made that it would be much harder for the company to acquire new clients going forward. This is due to the rising competition.

The Federal Reserve’s FedNow service is slowly gaining momentum a year after its launch and could pose a major threat to PayPal in the future. FedNow’s Indian alternative UPI is currently India’s biggest real-time payment system that processes the majority of digital payments in the country, while its Brazilian alternative Pix is now used by 15 million companies and over 150 million Brazilians. This shows that the governmental instant payment system could be a major player in the payment processing business if launched and expanded correctly.

In addition to that, PayPal also faces tougher competition from Apple’s (AAPL) Apple Pay system, which in a matter of years attracted over 640 million users across the globe and is currently used by over 45 million Americans for purchases. The data suggests that Apple has recently overtaken PayPal as the favored digital wallet, which indicates that the competition is heating up. In addition to that, the launch of the Tap to Cash for Apple Pay which was announced in June could make it much harder for PayPal to compete with Apple in the future.

All of this shows that going forward, it’s going to be much harder for PayPal to compete against the government and Big Tech, while at the same time to acquire new users and properly execute the turnaround. Just as it’s the case with any other payment processing company, PayPal’s business is made of charging fees for the facilitation of payments between different parties. There’s nothing revolutionary about it and that’s the main reason why it could be much harder for the company to avoid a loss of market share in the future.

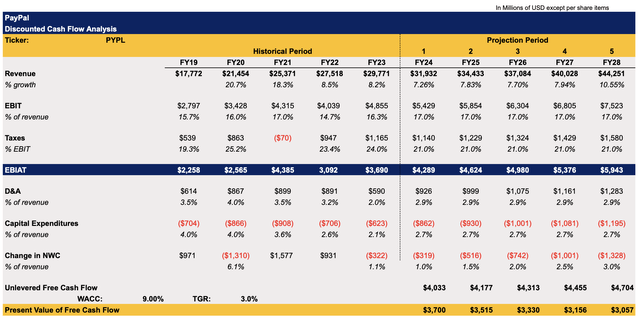

On top of all of that, it also seems that the upside for PayPal’s shares appears to be limited right now. Back in March, my DCF model showed that PayPal’s fair value is $66.56 per share. Given the relatively successful performance of the company in the last two quarters, I decided to update my model, which can be seen below.

The revenue assumptions for the current fiscal year were slightly increased, as PayPal was able to exceed expectations in the first two quarters of 2024. At the same time, the revenue assumptions for all the other upcoming years closely correlate with the overall consensus. As a company with a simple business model, it’s unlikely that there will be a significant and instant bump in the growth rate anytime soon. The EBIT assumptions now also closely mirror the street expectations. The assumptions for all the other metrics mirror PayPal’s historical performance.

PayPal’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

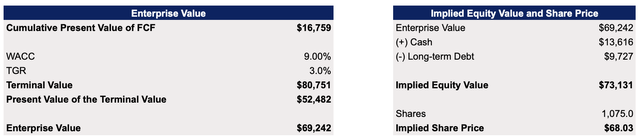

The updated model shows that PayPal’s fair value is $68.03 per share, which is slightly above the previous calculations, primarily thanks to an increase in growth rate assumptions that were caused by the better-than-expected performance in Q1 and Q2. However, this also means that the upside is not that significant, and the margin of safety is almost non-existent at this stage.

PayPal’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

It’s good to finally see that PayPal has stopped losing its active users. However, due to a lack of major competitive advantages and the fact that the company’s shares appear to offer little margin of safety, I stick with my opinion that PayPal is a HOLD at best. I believe its stock will likely trail the S&P 500 in the foreseeable future, largely thanks to the macro environment. But at the same time, investors shouldn’t expect explosive growth happening anytime soon, since PayPal doesn’t have a major edge in the payment processing business that could’ve differentiated it against dozens of other competitors that offer similar services.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.