Summary:

- PayPal’s stock has fallen significantly over the past two years, presenting an attractive opportunity for investors.

- The company has shifted its focus to share buybacks instead of aggressive acquisitions, capitalizing on its available cash reserves.

- PayPal’s valuation is favorable compared to its peers, and its venture into the cryptocurrency market presents growth opportunities.

- Due to the interesting risk/reward we currently rate PayPal as a strong buy.

Justin Sullivan

Introduction

PayPal (NASDAQ:PYPL) got slaughtered over the last two years. PYPL has fallen as much as 81% from its ATH to its current bottom on the 18th of August 2023. This is one of the stocks of higher quality that is now down significantly. While the stock definitely has plenty of headwinds, such as increasing competition, rising costs, C-suite issues, margin compression,… Nonetheless, we believe PYPL now provides an attractive opportunity to invest in a high-quality company with room for share appreciation.

In this article, we will take a look at PYPL’s current valuation and what to expect for the future. We will compare them to competitors, take a look at the charts, take a look at the risks, and much more.

We believe PayPal has the potential to become a remarkable turnaround story as the current valuation is attractive and provides an interesting risk/reward opportunity. As such, we believe PayPal is a strong buy.

PayPal: An Acquisition Monster

Let’s first start with the start of PayPal. The company, which was initially founded by many well-known investors and founders, including Elon Musk and Peter Thiel, was initially a part of eBay (EBAY) but was split off in 2014. In addition, the company was one of the early adopters of Bitcoin (BTC-USD) transactions for merchants back in 2014.

PayPal has a history of doing acquisitions, including successful ones like Braintree and Venmo, for $800M back in 2013, but unfortunately, there were less successful ones such as Honey. PayPal acquired Honey for $4B, and it is, in our view, a bad acquisition as this was the time that PYPL let go of its payment-focused acquisitions.

In October 2021, there were rumors that PayPal was considering a $45 billion takeover offer for Pinterest (PINS), which raised significant concerns about the company’s strategy as they were expanding beyond its core business model. To say the least, shareholders were not amused.

We believe companies that show strong organic growth are more likely to perform compared to companies that grow by acquisitions. If a company grows by acquisition, it is crucial that the company has an excellent acquisition record.

Essentially, the question one has to ask themselves is: “Could the company have used the money to build these competencies themselves?” If the answer is no, then an acquisition is smart, but only at the right price.

Switched Focus To Share Buybacks

In recent years, the company has shifted away from its aggressive acquisition strategy. Instead, PayPal has focused on repurchasing its own shares, totaling $4.9B over the past year. While this strategy is debatable due to the strongly decreasing stock price. The company still has plenty of cash available for further share repurchases.

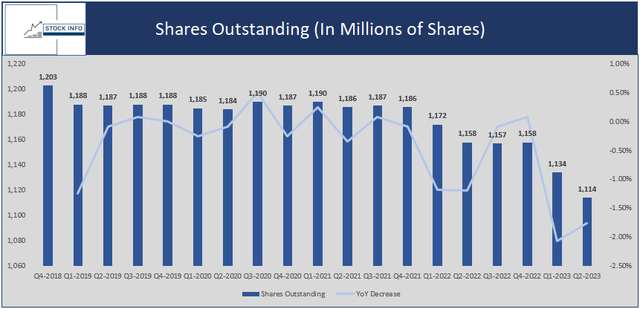

We believe the company can now repurchase a significant portion of its outstanding shares at an attractive valuation. The chart below shows how the outstanding shares have evolved over the last 5 years.

Stock Info

You can see that PYPL has clearly decided to start aggressively buying back its shares in 2023 as the stock price plummeted. PayPal is expected to do $5B in total share repurchases in 2023. Unfortunately, the company has bought a lot of rather expensive stock due to the quickly declining share price. Nonetheless, it now is an interesting time for PYPL to buy back its shares aggressively.

The company bought back 7.40% of its outstanding shares starting from Q4 2018, but as seen in the table above, the company only decided to aggressively start buying back shares after Q4 2021. Since then, the outstanding shares have decreased 6.07%. Especially during the last two quarters the company bought back 44 million shares, representing a decrease of 3.8% since Q4 of 2022.

Too Cheap To Ignore?

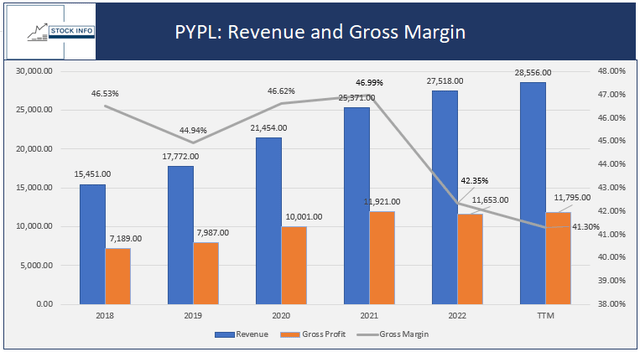

Looking at the significant downfall the stock had over the last months, we would almost think the company has lost its ability to make money. Nevertheless, the company is still a machine, generating $11.795B in gross profit on a TTM basis.

Stock Info with Seeking Alpha

But, as can be seen in the chart above, the problem is the slowing revenue growth and the significant decrease in gross margin, from almost 47% in 2021 to 41.30% on a TTM basis. We believe it is a must that the company’s gross margin starts to stabilize or start increasing again. We believe the company has the ability to do so, as we will discuss further in the article.

Nonetheless, when we look at PayPal, we can see that the company is still a cash flow machine. The company generated $5.107B in FCF in 2022. When looking at this number, the company currently has an FCF Yield of 7.40%, which is incredible for a large cap like PYPL. This indicates that the company is able to buy itself back in 13.5 years.

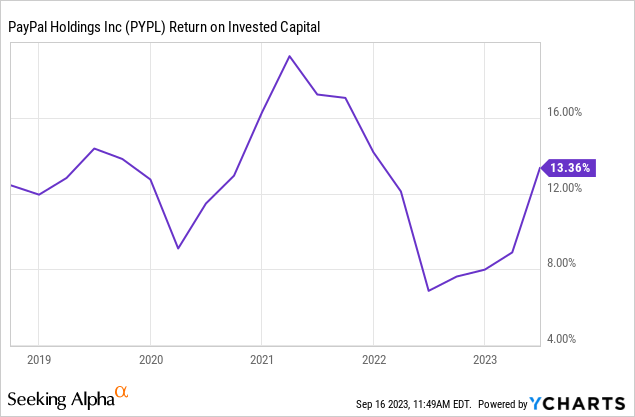

Furthermore, PayPal has a 5Y revenue CAGR of 12.24%, which is still a nice amount of growth in revenue. While this is slowing down, we believe PayPal should be able to turn the tide and continue to grow at a CAGR of around 10%. In addition, the company has a ROIC of 13.36%, which indicates that for every $100 the company invests in its business, it can generate an additional $13.36 in operating income.

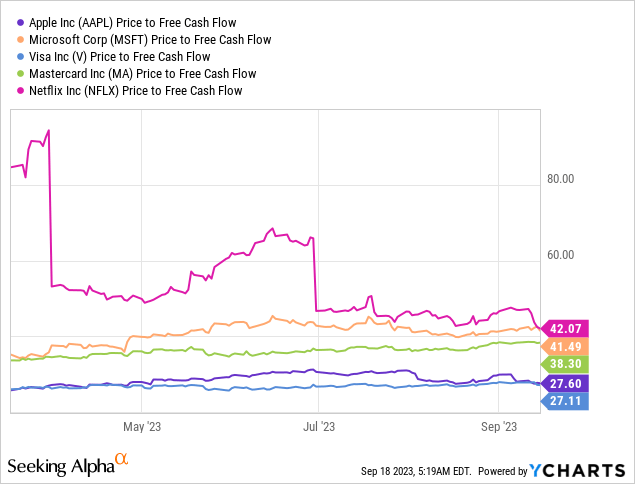

Ycharts

We are strong believers in free cash flow (FCF), which is one of the most important metrics when valuing a company. The company is an FCF-generating machine and is able to use that cash to buy back shares at a very attractive valuation. As such, we believe the company will continue to aggressively buy back shares if the shares continue to trade at these levels. We believe this is currently the best option for PYPL, and we would rather see further buybacks than an acquisition.

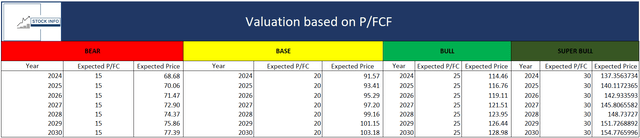

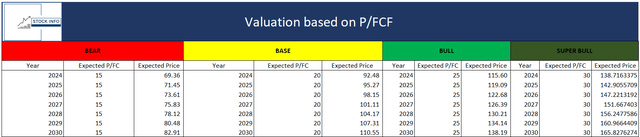

Let’s take a look at a possible valuation based on P/FCF for PYPL stock. While we could have used a DCF model as well, I think evaluating PYPL on a P/FCF basis in a bear, base, and bull cases is interesting.

Ycharts

As can be seen in the chart above, PYPL is currently trading at a relatively low P/FCF. Nonetheless, for the bear case, we will assume a P/FCF of 15 for the following years. For the base case, we used a P/FCF of 20, which is close to the valuation it is currently trading at, which in our opinion is still quite conservative for a company like PayPal.

For the first model, we will assume an FCF growth of 1% per year, due to the conservative estimate we already calculated for P/FCF. In addition, we assumed a yearly decrease in shares outstanding of 1%, which is quite conservative considering they have repurchased 3.8% of the shares outstanding in the last 2 quarters alone. As such, the 1% share depreciation year-over-year assumption seems very fair.

Stock Info

As seen in the table above, even when we look at the bear case PYPL should reach $68.68 for 2024. Nevertheless, an important sidenote we will need to take into account is that the FCF might decline in the following year. Still, the current share repurchases would make it for that as we are quite conservative with our estimates.

In case PYPL keeps trading around the current 20x P/FCF mark, we could see a $91.57 share price for 2024. When we look at the bull and super bull cases the share price gets a lot more exciting for the bulls in the next 2 years. When we look at the valuation of mature companies like Apple (AAPL), Microsoft (MSFT), Netflix (NFLX), Visa (V), and Mastercard (MA), we can see that these are trading at a way steeper valuation, as we can see in the chart below.

Ycharts

Sure, PYPL might not have the MOAT some of the companies above have, but for the cash-flowing machine PYPL is, a possible revaluation towards 25x P/FCF isn’t out of the question in our opinion.

In addition, we will share our model in case we see a decrease in shares outstanding of 2% per year, all other metrics remain the same.

Stock Info

As can be seen, the bulls expect a revaluation of the company, pricing in more growth for the company.

Peer Comparison and The Payment Business

PayPal is still performing well, one important metric we look at is total payment volume, also known as TPV. During Q2, PayPal’s TPV increased 11% year-over-year to $376.5B, very impressive if you ask me. To specify, US volume grew 9% YoY and non-US volume grew 14% YoY. This shows that payment volume is still going up and especially internationally PayPal still has remarkable growth numbers.

Unfortunately, the total take rate (total revenue divided by TPV) has been declining over the last few quarters. This isn’t something we would like to see, but these declines are fairly modest. In addition, PayPal’s management team mentioned that foreign currency changes affected their results, mainly due to the strength of the US dollar.

The online payment business is highly competitive, which lots of companies within the industry have experienced over the last year. The only companies holding up fairly well are Visa (V) and Mastercard (MA), which seem to be in a league of their own. PayPal has suffered from the increasing complexity of the payment business, as can be seen in their declining gross margins as we talked about earlier.

Nonetheless, PayPal’s Braintree competes with companies like Adyen (OTCPK:ADYEY) and privately held Stripe. Adyen suffered as well, as the stock got slaughtered after its recent earnings. As such, PYPL isn’t the only company suffering in the current climate. Nonetheless, Braintree posted very consistent growth numbers, 30%+ revenue growth, and 30%+ volume growth respectively. Management mentioned that they believe Braintree’s currently has a lot of momentum and is experiencing continuous success. Furthermore, Venmo has been a very effective customer acquisition tool for PYPL as it utilizes PayPal’s internal network to quickly transfer funds between users free of charge. This is a clear competitive advantage compared to banks and their ACH transfers.

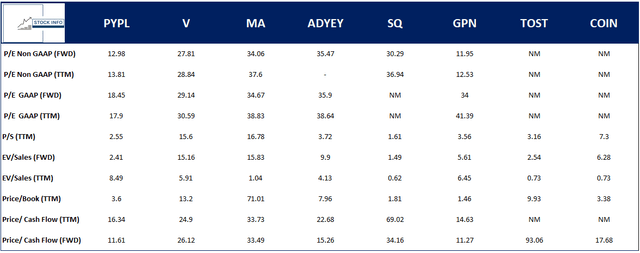

When we look at the table below in which we compare PayPal to its peers, we can see that PYPL looks relatively cheap compared to its peers. We must admit it is hard to compare PYPL with both Visa and Mastercard as they are quite different. Nevertheless, it is important to look at both of these companies as they are a major part of the payment industry. For reference, we also included Coinbase (COIN) due to PYPL’s decision to start competing with Coinbase in the world of crypto.

Stock Info with Seeking Alpha

As can be seen in the chart above, PYPL is much more attractively priced compared to the giants Visa and Mastercard. With a P/E GAAP of 17.9 compared to 29.14 and 34.67 for V and MA respectively.

In addition, on a P/E GAAP basis, PYPL is the most attractive stock out of the bunch. Furthermore, Block (SQ) is the only stock that is more attractive on a P/S basis. On a price-to-forward cash flow basis PayPal is the second cheapest only losing to Global Payments (GPN). Toast (TOST) is looking fairly expensive at a 93.06x price to forward cash flow.

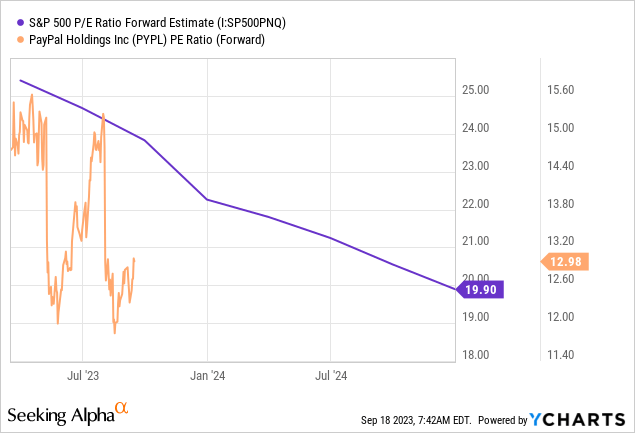

With a current forward PE of 12.98, PYPL is much more attractive than the S&P 500’s (SPY) forward PE ratio of 19.90 as can be seen in the chart below.

Ycharts

We also mentioned COIN due to PayPal’s entry into the crypto market. More specifically, the company announced that it will launch its own stablecoin, named PayPal USD (PY-USD). Due to PayPal’s large user base of 400 million users and the company operating its own crypto wallet, they can be a serious threat to Coinbase, which only has 100 million users.

As such, PayPal might be able to rapidly take market share from its competitors within the crypto space. Furthermore, the blockchain and cryptocurrency sector is poised for strong growth for the remainder of the decade, as we discussed in one of our articles.

We believe PYPL is attractively valued when compared to competitors and is currently priced like a value stock. If the company is able to reactivate its growth the multiples could quickly expand, which would make a valuation like we mentioned in our bull and super bull cases more likely.

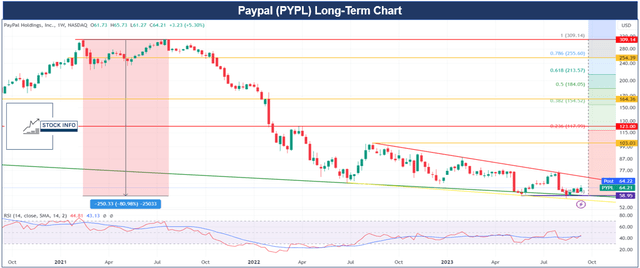

Technical Analysis

In this article, we already discussed PayPal’s technical analysis and even analyzed the option chain so we could look at where the stock might be heading.

As can be seen in the chart below, PYPL had a rough two years, plummeting close to 81% from top to bottom. The stock fell below $60 for the first time and May, a price the stock hasn’t seen since 2017. The stock is currently in a strong downtrend, but over the last month, the stock seemed to have bounced off its lows. Nevertheless, it is crucial for the bulls that the stock breaks above the red trend line resistance, which lies around the $71-$72 level. If that happens, the stock could move toward $100 fairly quickly as there isn’t much resistance left.

Immediate support for the stock can be found at the recent lows between $58 and $60 per share. If PYPL breaks below that level, the green and yellow trendline supports should act as support. Nonetheless, these supports are quite weak, a break below these trendlines would put us in “no man’s land”.

The stock is currently trading below all of its EMA’s daily and weekly, indicating that the bears are currently in control. Nonetheless, we believe the current technical analysis provides traders with a very interesting risk/reward opportunity.

Stock Info with Tradingview

Conclusion

In summary, PayPal has weathered a challenging two-year period, experiencing a substantial decline in its stock price. Despite facing various headwinds such as heightened competition, rising costs, C-suite issues, and margin compression, PYPL now presents an enticing investment opportunity.

With new CEO Alex Chriss, who is a former Intuit (INTU) executive at the wheel, we believe the company is setting itself up for a great future. Alex Chriss has a strong track record and seems like an excellent manager who might be able to turn PayPal around.

Furthermore, the company has shifted its focus away from aggressive acquisitions toward substantial share buybacks, capitalizing on its available cash reserves. This move aligns with the company’s potential to repurchase a significant portion of its outstanding shares at an attractive valuation, given its recent stock price decline.

When evaluating PYPL’s valuation, it’s clear that the company remains a cash flow powerhouse, boasting a Free Cash Flow (FCF) yield that’s particularly attractive for a large-cap company. Its 5-year revenue Compound Annual Growth Rate (CAGR) of 12.24% demonstrates ongoing growth potential, even if it’s slowing compared to previous years. Furthermore, PYPL is favorably priced in comparison to its peers, with a lower Price-to-Earnings (P/E) ratio, attractive forward P/E, and great price-to-cash flow numbers.

Additionally, PayPal’s venture into the cryptocurrency market, with the launch of its own stablecoin (PY-USD), presents significant growth opportunities. The company’s large user base and existing crypto infrastructure position it well to compete with established players in the crypto space.

From a technical analysis standpoint, PYPL has faced a downtrend but recently showed signs of a potential rebound, with critical resistance levels around the $71-$72 range. While the stock currently trades below its Exponential Moving Averages (EMA), it presents a compelling risk-reward proposition for traders.

In conclusion, despite recent challenges, PayPal’s strategic shifts, valuation, growth potential, and competitive positioning in the cryptocurrency space make it an attractive investment opportunity, and we rate it as a strong buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.