Summary:

- PayPal’s ‘moat’ continues to deteriorate.

- Competition in the payment industry is increasing.

- PayPal’s direction is not a positive one.

JasonDoiy

PayPal (NASDAQ:PYPL) is an American financial company that provides online payment systems across the globe.

Anyone who has taken a closer look at PayPal’s business model may not be surprised that the stock is down around 75% from its 52-week high. PayPal’s management has not adjusted its business model to an increasingly competitive global payments market very well. While competitors continue to decrease fees and improve services, PayPal continues to operate in a manner, where it believes its business model will remain intact regardless of the market environment.

Further, there seem to be an unnecessary exuberance about the stock, and a belief that a bottom is in. But as Peter Lynch famously reminds us, just because a stock down significantly does not mean it can’t fall further. The reality is PayPal is a dinosaur, and management’s lack of willingness to change course will likely make things worse for PayPal.

PayPal continues to overcharge its customers in a globalized environment:

PayPal is famously known for charging high fees while offering nothing in return that separates itself from its customers. Fees can range from 2%-3.5% for domestic transactions and up to 4.5% for international transactions. Furthermore, PayPal is now increasingly relying on a global customer base to grow its revenue. While Americans might be willing to put up with PayPal’s excessive fees, the international market is a lot more competitive, and with increasing competition from the likes of Payoneer and Wise, and other similar online payment systems, it is unlikely PayPal will be able to make the inroads that it wants onto the international market.

Take Payoneer for example, which, unlike PayPal, is well known for not charging excessive fees. If you pay someone from a Payoneer-Payoneer account there are zero fees. This is not the case with PayPal, which charges fees regardless of who you transfer to. Furthermore, when transferring payment in USD the maximum Payoneer charges on an ACH transfer is 0-1%. On top of that for international payments, PayPal forces its customers to transfer payment into their account in the local currency. This is not always an issue with competitors, who allow the customer to choose which currency they would prefer to transact in. Furthermore, PayPal adds an additional 3-4% currency exchange fee. Quite often at least for those receiving payments across borders costs can add up to 7-8% of the total value of the payment, compared to PayPal’s competitors where costs are usually 1-2%. This is a significant difference and is especially expensive for those freelancers, who might not only have to pay this massive transfer fee but also local taxes. And while PayPal is competitive compared to local U.S. players such as Stripe, which also charges atrocious fees as well, it will not be able to compete with global competitors, who have set out on a path of simplicity, easy KYC, and low fees.

PayPal also has a much more bureaucratic setup, which has led to class action lawsuits in the past. This includes class actions lawsuits for arbitrarily holding payment, due to what they call security concerns, which means new accounts quite often have to wait for long periods to get their payment cleared. PayPal admits that it receives interest on its fees, which at minimum is an ethical issue and a conflict of interest. Competitors on the other hand have clearly stated they do not charge interest. PayPal has also been criticized for poor customer service and a lack of clarity on its policies. All of this in turn is likely to turn users away from the payment service.

PayPal is losing market share:

PayPal has been losing market share for a while, falling from 55% in 2020 to a 44% market share, which is what the latest estimates showing . Adding to the growth issues, the global payments market is expected to grow at around 10% for the next 5-6 years, far less than the previously projected 13-14%, and most of that growth is going to come from Asia-Pacific. If PayPal is going to compete, charging its customers in the Asia-Pacific region 7-8% every time they make a transaction it is not likely going to sit well with the vast majority of its Asian user-base, who now have an increasing plethora of alternatives. Expect PayPal to lose market share as we move forward, as customers, especially those dealing in cross-border services-based commerce, choose to avoid PayPal. But it’s not only services-based payment such as freelancers but also payments for e-commerce. PayPal makes it very hard for e-commerce users to transact and provides poor backend services for payment. This is an issue that has plagued eBay as well, which has resulted in the company faring poorly in recent times.

As a result, PayPal’s market share could fall significantly, in the next few years. The reality is the global online payments market requires no propriety technology, and now that the initial days of the industry are over competition is only likely to increase.

A note on Venmo

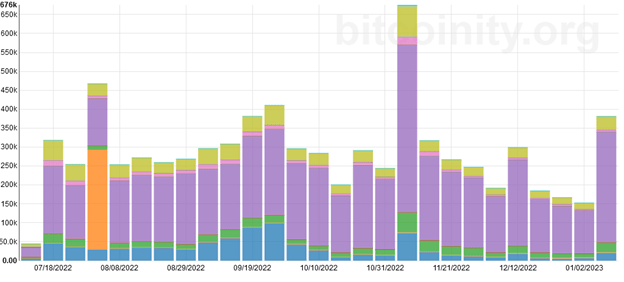

PayPal’s fortunes are set to further decline due to subsidiary Venmo’s dependence on crypto trading, which will hit PayPal’s overall revenue, as volumes continue to hit multi-year lows. While many investors believe this is the end of the downcycle, the current market environment is likely setting up another leg down in stocks as interest rates continue to rise, and liquidity continues to tighten. As a result, a lot of the cryptocurrency trading volume is also likely to slowly come down too, from the previously higher levels, which means that Venmo which has been outpacing the overall growth, and has become an ever larger part of PayPal’s overall revenue, will slowdown, further bringing down growth.

The overall positive sentiment, which is in large part on Venmo,(this despite the recent increase in crypto prices), is misguided. Global central banks are not ready to stop the rate increases, and that means things may get worse before they get better, as liquidity continues to tighten. Therefore, liquidity driven assets, and global transactions are both likely to be affected negatively for the foreseeable future. This on top on the company already losing market share, should further bring down both revenue and margin.

Bitcoin Volume (Bitcoinity)

PayPal’s financial outlook

The stock currently trades at around 40x earnings, which makes it expensive, considering the financial outlook for the company. The forward P/E estimates by analysts, currently stand at 16x earnings, but these estimates assume a significantly higher growth in earnings per share (i.e $4.77 in 2023, up from an estimated $4.00 in 2022), than is likely. Especially since the twin effect of lower crypto trading revenue from Venmo, and a slowdown in transactions, is likely to hit the bottom-line, and therefore, analysts are likely overestimating growth. Current projections by analysts expect increase of single digits (around 7-8%) in terms of revenue. In addition, 2022 operating revenue is on track to fall slightly, which means operating revenue in 2023 may be even lower, as headwinds take hold.

Considering that margins will also be under pressure, and discount rates have been increasing, PayPal is likely to see its stock go down further. While many investors believe this is the end of the downcycle, the current market environment is likely setting up another leg down in stocks as interest rates continue to rise, and liquidity continues to tighten. As a result, a lot of the trading volume is also likely to slowly come down too, from the previously higher levels.

Going forward, PayPal may not have the competitive advantage that is required to compete in the global market, and management has been reluctant to take the steps to ensure that the company is competitive with its peers. Investors will be cautious with this stock, while many called for a bottom, there is little indication that any such bottom is in. We are currently in a consolidation phase for the stock and could see another leg down soon. Investors should therefore remain cautious.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.