Summary:

- PayPal has strong fundamentals and growth opportunities in the digital payments industry, particularly in the Buy Now Pay Later segment and through Venmo.

- Despite facing strong competition and upcoming management changes, the company generates significant revenues and has a robust cash flow, allowing for aggressive share buybacks.

- With an 80% drop in market valuation from its peak, PayPal presents an attractive long-term investment opportunity and is rated as a buy.

Justin Sullivan

Investment Thesis

PayPal Holdings (NASDAQ:PYPL) is a leader in the highly contested digital payment industry with 435 million active users and $1.3 trillion in total payment volume (TPV) as of the end of 2022. PayPal has been a trusted payment solution for a number of years now, with reputable brand and an array of partnerships such as Starbucks, Microsoft, etc. The market has punished PayPal since its peak market valuation at $357 billion in 2021, since then PayPal has suffered a decline of approx. 80% to its current market valuation of $77 billion, positioning it in a very attractive position for a long-term investment opportunity.

Business Overview

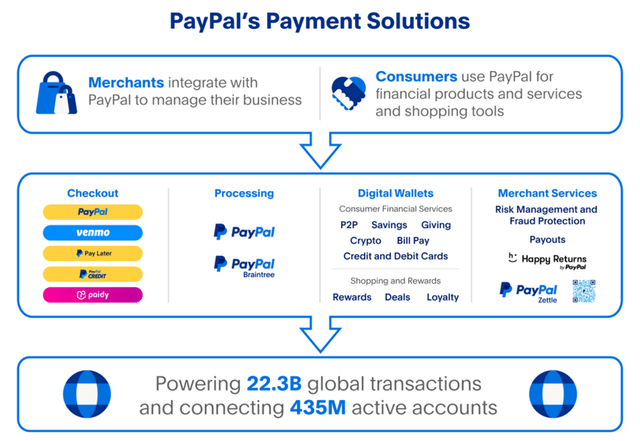

PayPal is a leading technology company offering digital payment solutions through its platform for both merchants and consumers. PayPal’s two-sided network connects more than 430 million active users in more than 200 markets through its diverse payment solutions under names such as PayPal, Braintree, Venmo, PayPal Credit, PayPal Zettle, etc. Its payment platform allows consumers to send and receive payments, withdraw funds, hold balances on their accounts, etc. The company primarily generates revenues through the fees charged for each transaction completed, it has other revenue streams such as foreign currency conversion fees, instant transfer fees, cryptocurrency transaction facilitation, and other value-added services.

PayPal Payment Solutions (PayPal Annual Report)

Financial Overview

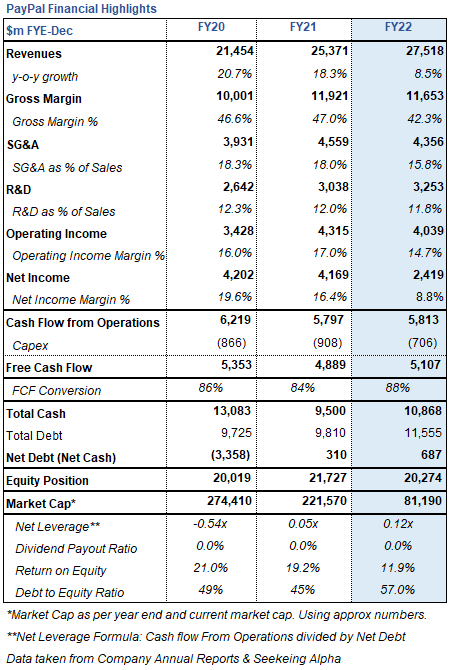

PayPal Financial Highlights (PayPal Annual Report & Seeking Alpha)

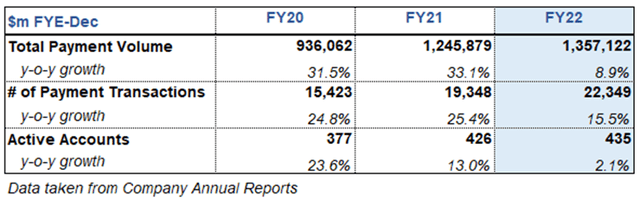

During 2022, PayPal increased revenues to $27.5 billion, which amounts to an 8.5% increase compared to the previous year. Despite generating revenue growth in the high single digits, these results were a decrease in the rate of growth experienced during the previous years. The decrease was a result of a growth slowdown in the total payment volume (9% vs. 33% in 2021), number of payment transactions (16% vs. 25% in 2021), and active accounts (2% vs. 13% in 2021) recorded by the company during 2022. However, it should be noted that the total payment volume increased to a whopping $1.36 trillion in 2022 in comparison to $1.25 trillion in 2021.

PayPal Key Metrics (PayPal Annual Reports)

We can also see a deterioration in different parts of the income statement, for example, operating income decreased by ~$275 million when compared to the previous year as a result of higher COGS and higher R&D spending. Furthermore, the net income for the year decreased by more than 40% resulting in a net income margin of 8.8%. As we can see the company recorded a lower revenue growth rate, while at the same time seeing a deterioration in operating income and net income.

Despite this deterioration in the income statement, the company was able to generate a strong cash flow from operations remaining flat compared to the previous year at $5.8 billion. This helped the company pay for capital expenditures of $706 and retain 88% of its cash flow from operation. Management opted to use a large portion of this cash to repurchase the company’s stock to the tune of $4.5 billion (More on this at a later stage) while at the same time bolstering its cash position from $9.5 billion in 2021 to $10.9 billion at the end of 2022. It should be mentioned here that PayPal has a strong balance sheet with a small net debt position of $687 million, essentially no net leverage at a meager 0.12x, and a manageable debt-to-equity ratio of 57%. It should also be noted that the Company recorded a significant decline in its return on equity from 19.2% to 11.9%.

Shareholder Returns

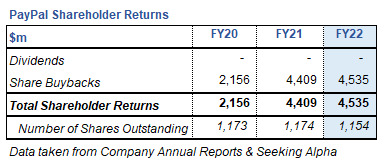

In June 2022, the Board of Directors authorized a stock repurchase program that provides for the repurchase of up to $15 billion of common stock, with no expiration date. Since then, management has bought back shares aggressively. In FYE 2022 the company spent $4.5 billion in share buybacks, however when considering the previous 3 years, we can see this number balloon to $11.1 billion. The number of shares outstanding recorded in this period has only decreased slightly, which can be explained by the high valuation the Company had in previous years. As of the first quarter of 2023, the company has enough cash to repurchase more than 10% of the shares outstanding. This means that should the share price remain at a somewhat similar level we could see this number decrease at a higher rate in the coming quarters.

PayPal Shareholder Returns (PayPal Annual Report & Seeking Alpha)

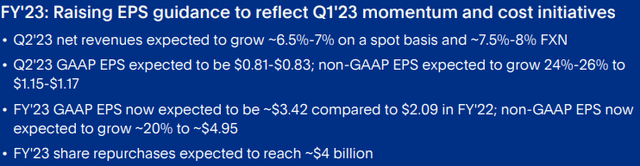

Management has already provided guidance that it plans to spend $4 billion in share repurchase during 2023, which will come essentially from the entire free cash flow the company is projected to generate. Furthermore, after these repurchases, the company will still have around $10 billion authorized to keep repurchasing shares. Please note that the company gives shares as compensation to a high degree, as such there will be somewhat of an offset.

PayPal Guidance (PayPal Quarterly Report)

Valuation

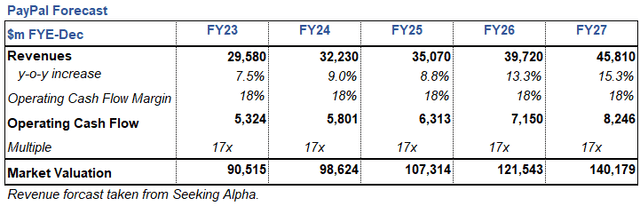

With the current market valuation, the company’s multiples stand at a price-to-cash flow of 14x. For the valuation of the company, I have used the market multiple method, using future forecasted cash flow from operations to a conservative 17x multiple. It should be noted that this is a low multiple compared to what the company has traded historically, as such I believe it is reasonable. I have obtained the analysts’ revenue forecast from Seeking Alpha data and have applied an operating cash flow margin of 18% across the board until 2027. This should be achievable as the company operating cash flow margin has been above 20% during the past 5 years. With these numbers, I arrive at a market valuation by FYE 2027 of $140 billion. It is important to understand that this is based on estimates and assumptions which can change. The company could in fact return back to its highest valuation, however, I always try to be conservative.

PayPal Forecast (Seeking Alpha)

Growth Opportunities

Buy Now Pay Later (BNPL)

BNPL is a payment solution that allows customers to make purchases without having to pay for the complete amount on the spot. This helps customers make purchases that they could not make without this solution.

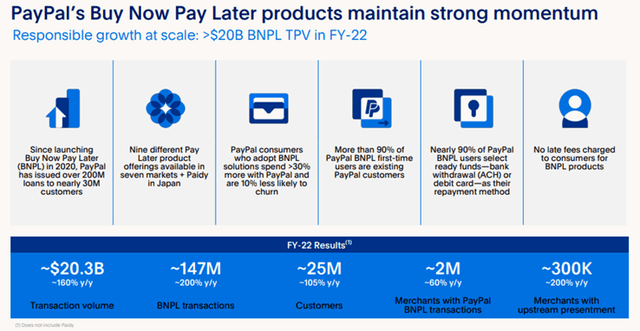

As shown in the picture below, since its launch PayPal has issued over 200 million for about 30 million customers with more than 90% of PayPal BNPL first-time users being existing customers. During 2022 the company saw an outstanding increase of 160% to 20.3 billion in transaction volume and a 105% increase in customers to 25 million. These are indeed great numbers for the company.

According to Precedence Research, the market size for BNPL stood at $753 billion during 2022 with the market expected to balloon to $9.2 trillion by 2032. Given PayPal is growing handsomely in this market, this could mean a great opportunity for PayPal to set another revenue stream.

PayPal Buy Now Pay Later Metrics (PayPal Investor Presentation)

Venmo

Venmo was almost a gift as it was acquitted by Braintree one year before Braintree was acquired by PayPal for a purchase price of $800 million. Venmo allows users to easily send and receive money from peers, with a social touch that allows users to share what they are spending on or receiving money from. Venmo generates revenues when users pay for purchases, receiving a fee for each transfer, interchange, or withdrawal.

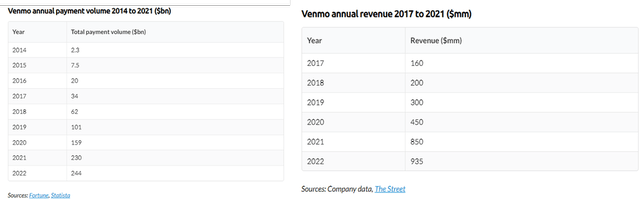

Since 2015 Venmo has seen its total payment volume increase by 106 times to an outstanding $244 billion in 2022, further to this, it has increased its revenues from $160 million to $935 million in 2022 (Please refer to the tables below). These are truly explosive numbers that will be difficult to emulate in the future, however, Venmo remains on its growth path, and we could continue seeing growth for several years.

According to eMarketer, the US Peer-to-Peer mobile Payment users are expected to continue to increase during the next years reaching 180 million users by 2026. As such Venmo should be a beneficiary of this growth.

Venmo Financial Highlights (Business of Apps)

Risks

Strong Competition

One of PayPal’s risks is the strong competition faced in the global payments industry which has major players of the likes of Visa (V), Block (SQ), American Express (AXP), Master Card (MA), Apple (AAPL), Google (GOOGL), Stripe, Adyen (OTCPK:ADYEY), etc. As any investor can see these are huge and established companies all vying for a piece of the market. Further to this, the competition comes from different directions, extending in all forms of payments including, cash and checks, credit and debit card, contactless payments, cryptocurrencies, etc. As such the company needs to continually innovate and develop products in order to offer the best payment solutions and experience to merchants and consumers.

Management Changes

Dan Schulman the current CEO of PayPal has announced his plan to retire at the end of 2023 as such the leadership of the company will change which can entail changes across the board. Saying this Schulman has plans to remain on the company’s board of directors so we investors could expect the company to at least remain on a somewhat stable path. Further to the CEO change, the CFO position also recently saw a change from Black Jorgensen to Gabrielle Rabinovitch. It is essentially unclear how the leadership will look in a couple of quarters, if there will be an internal candidate taking the CEO position, or if it will be someone from the outside. This uncertainty is clearly a risk for the company.

Conclusion

In conclusion, PayPal has strong fundamentals with a strong presence in the digital payments industry. The company generates significant revenues from TPV which continues to increase, and which has the possibility to continue to increase in coming years with opportunities in the buy now pay later segment or through Venmo which has experienced explosive growth during the past 5 years. The company also has a strong balance sheet and generates a robust cash flow from operations of $5 billion, this allows the company to fund its operations while at the same time pursuing an aggressive share buyback policy which should decrease the number of shares outstanding significantly.

With a nice runway for growth ahead and a market valuation that has plummeted approx. 80% from its peak, the company offers an attractive long-term investment opportunity, as such I rate PayPal as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.