Summary:

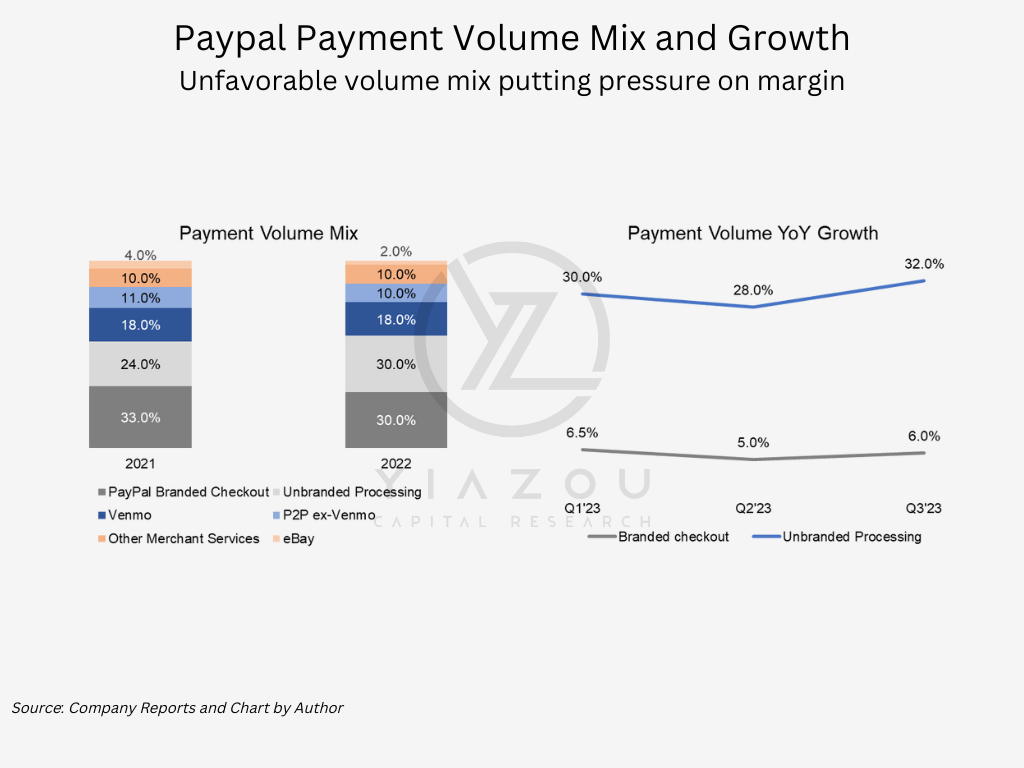

- PayPal faces margin erosion due to an increasing share of lower-margin unbranded processing, which grew to 30% of total payment volume in 2022 and continued to rise in 2023.

- PayPal is addressing margin pressures through key strategies like upgrading Braintree’s services and a major loan sale to KKR, aimed at boosting cash flow and reinforcing share buybacks, reflecting confidence.

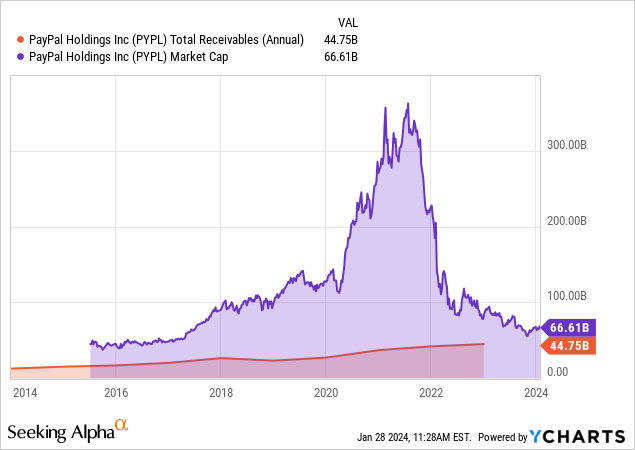

- PayPal’s agreement with KKR to sell up to $44 billion in ‘buy now, pay later’ loan receivables, representing 64% of its current market cap, is a pivotal move.

- Our analysis suggests a fair value of approximately $90/share, considering strategic initiatives and long-term growth potential, even amidst competitive and market challenges.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

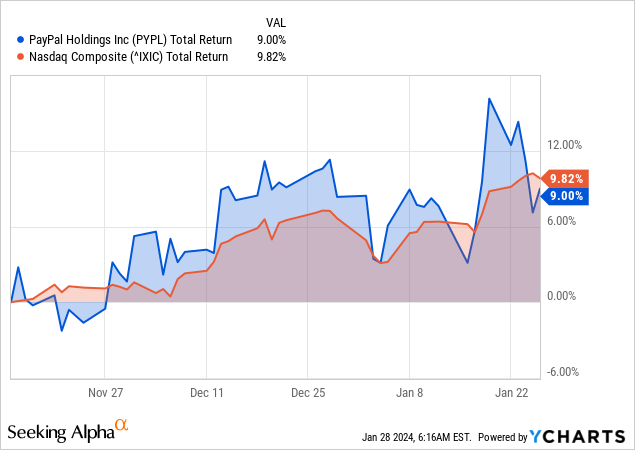

Our earlier analysis indicated that PayPal Holdings, Inc. (NASDAQ:PYPL) has entered an accumulation phase, supporting our thesis on PYPL based on its strong Q3 results, a wider margin of safety, and soaring earnings yield. Lastly, we expected a sideways movement before an uptrend towards ~$64, with a breakthrough at ~$75 necessary to kickstart a bull run.

A few months later, PYPL’s jump to ~$66 was short-lived, setting the stage for another potential bull run. Finally, our valuation analysis indicates a fair value of approximately ~$90 per share for PayPal, reaffirming our strong buy rating.

Margin Challenge: Balancing Branded and Rising Unbranded Processing

PayPal has been experiencing an erosion in margin for some time due to an unfavorable business mix. The unbranded processing segment, which has a lower margin, continues to increase its share in the overall transaction volume.

In 2022, unbranded processing contributed 30.0% to the total payment volume (TPV) mix, compared to 24.0% in 2021, with this trend persisting in 2023 as well. Specifically, during the first three quarters of 2023, unbranded processing grew 30.0% YoY, and branded checkout grew 5.83% YoY on average. Interestingly, unbranded card processing volume has higher expense rates and lower cuts from merchants than other products and services.

The company’s branded segment involves the yellow PayPal button displayed as a payment option. At the same time, the unbranded segment is payment processing completed “behind the scenes” for companies like Uber Technologies (UBER), DoorDash (DASH), or Ticketmaster through Braintree (a subsidiary of PayPal).

Additionally, Paypal’s branded segment’s “take rate” which refers to the percentage of each transaction the company retains as revenue, hovers around 2.5%-3.0% (gross revenue divided by TPV) while Braintree’s (mostly unbranded processing) take rate is in the range of 1.2%-1.5%, gauging from Adyen’s (OTCPK:ADYEY), (a close peer of Braintree) take rate of 1.2% in the last two years. Even though Adyen is more dominant in Europe and the take rate is higher in the US, Braintree’s take rate assumption of 1.2%-1.5% is reasonable.

Undoubtedly, due to increasing competition in the branded payment segment from companies like Apple (AAPL), Google (GOOG), and Affirm (AFRM), coupled with macro headwinds affecting e-commerce sales, this has put pressure on PayPal’s branded segment. Meanwhile, unbranded processing through Braintree assisted PayPal in widening its service beyond the e-commerce segment and branded checkout, including ridesharing, food delivery, online travel, ticketing services, etc., which still have room for expansion, as evident in its growth number. However, the growing contribution from the unbranded segment is causing a dilution in the margin as the segment’s take rate is half that of the branded segment.

Therefore, following the changing volume mix, PayPal’s take rate declined, dropping to 1.91% during Q3’23 from 2.03% in Q3’22. Management foresees a resurgence in the growth of the branded segment, driven by enhancements in the e-commerce sector. Hence, they are actively working towards providing value-added services in Braintree, aiming to elevate fees and enhance the overall take rate.

PayPal Investor Relations (www.investor.pypl.com)

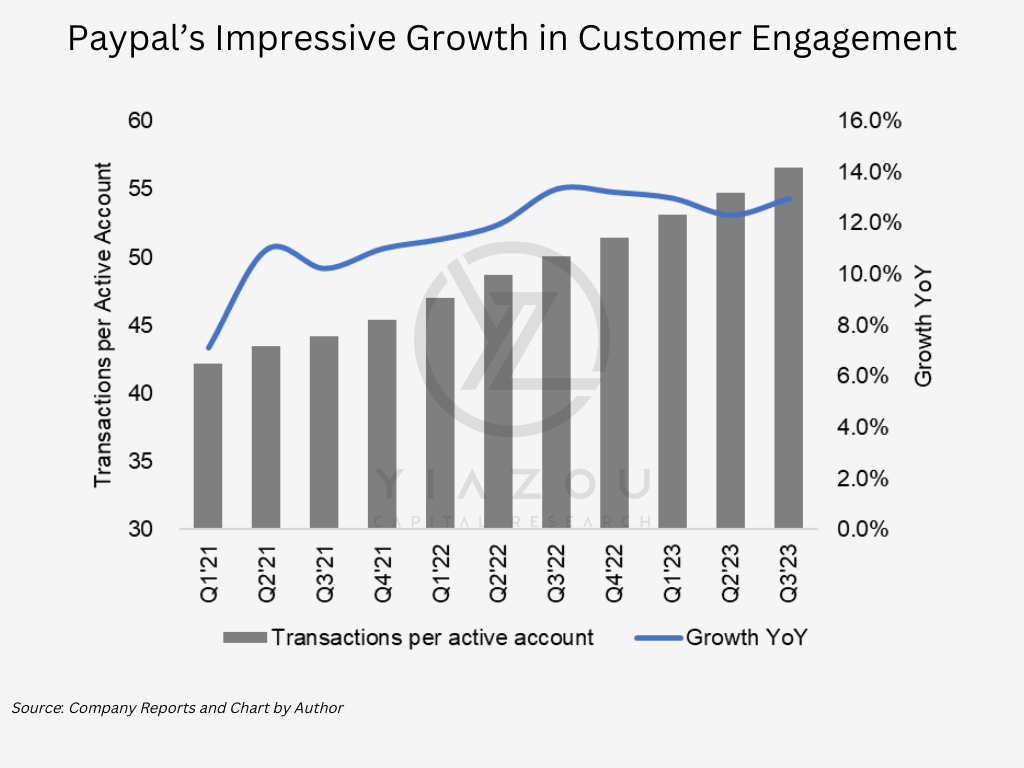

However, honing in exclusively on recent challenges with volume mix and margin decline would neglect the array of promising elements within the business that contribute to the success of this global payment giant. Acknowledging the necessity for consistent, profitable growth, the management team at PayPal has emphasized the cultivation of high-quality active accounts, heightened engagement, and adding features poised for immediate monetization.

Concentrated efforts by management on customer acquisition, expected to be margin-accretive, may yield positive outcomes in the forthcoming quarters. A compelling metric indicating the company’s shift towards margin-accretive revenue growth is the consistent double-digit expansion in transactions per active account. PayPal’s transaction per active account maintained 13.0% YoY growth on average in the last four quarters, reaching 57 during Q3’23 from 50 during Q3’22.

PayPal

Finally, the newly appointed CEO, Alex Chriss, committed to fostering margin-accretive growth and streamlining operations for increased efficiency. In summary, Mr. Chriss outlined three key priorities:

- Launching a revamped consumer experience with an improved checkout process;

- Driving increased adoption of PPCP (PayPal Commerce Platform) in the coming quarters and

- Elevating margin growth in Braintree (a substantial contributor to unbranded processing) through implementing value-added services like payouts, automated fraud management, and optimization of foreign exchange processes.

PayPal Strikes a Game-Changing €40 Billion Deal with KKR

The company’s commitment to streamlining operations and minimizing operational burdens, coupled with a risk reduction strategy, is apparent in its agreement with Kohlberg Kravis Roberts (KKR) to sell up to €40 billion ($44 billion) of ‘buy now, pay later’ (BNPL) loan receivables generated by PayPal in the UK, Spain, Italy, France, and Germany. With the new deal, KKR’s private credit funds and accounts will acquire “substantially” all of PayPal’s existing European buy-now-pay-later loan portfolio and eligible future loans.

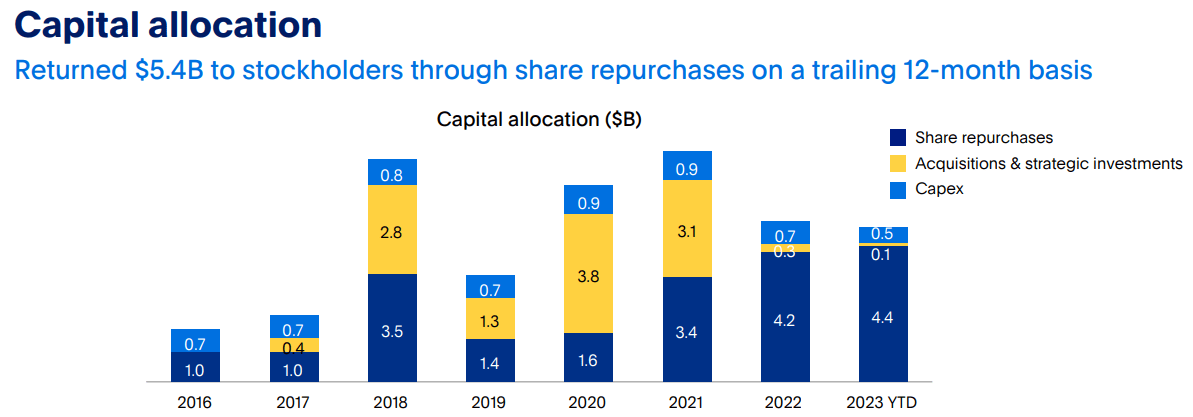

The amount of the loan sale deal is quite substantial, which accounts for 64.0% of PayPal’s current market cap. In Q3’23, PayPal closed the first sale tranche, receiving approximately $1.4 billion in proceeds, and in Q4’23, management expects to close the sale’s second tranche. The company hasn’t yet disclosed the exact timeline for the existing loan book sale; however, it seems that substantial cash flow will follow in the coming quarters, supporting its share buyback programs.

There could be several scenarios where the loan sale deal can boost earnings through a gain on the loan sale when the interest rate drops and through a decline in credit loss, and EPS may grow substantially due to share buybacks through the loan sale proceeds. Therefore, PayPal has strategically opted for a prudent and risk-averse approach, intending to shed a significant portion of its credit risk, alleviate economic uncertainties, and simplify the operational intricacies of managing a sizable loan portfolio.

PayPal’s Prevailing Competitive Advantage of Strong Network Effect as Leader

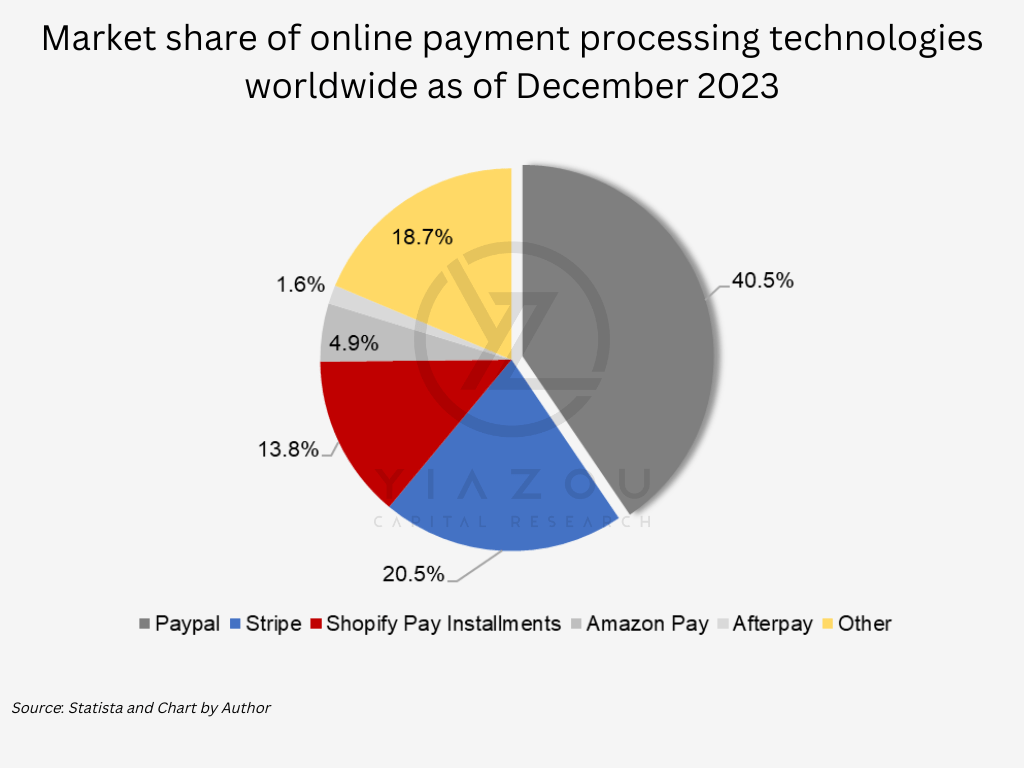

PayPal’s formidable position in the global payment industry still prevails. The company can employ diverse strategies to foster growth and improve margins as opportunities arise.

PayPal’s renowned reputation for user-friendly and secure transactions, combined with its extensive presence in online payments, positions the company favorably to expand its dominance across diverse platforms and channels. The upswing in online shopping amid the pandemic directly favored PayPal’s platform. Simultaneously, the company’s dedication to a modernized tech stack has resulted in heightened integrations, strategic partnerships, and the launch of new products to ensure competitiveness across both mobile and in-store channels.

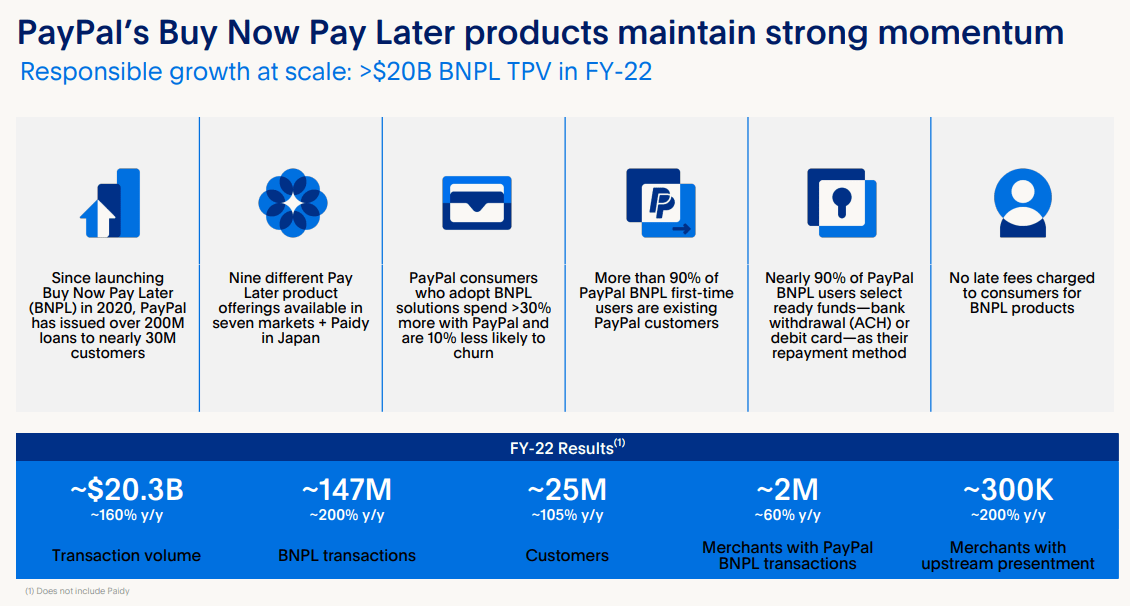

The continuous introduction of new products and expansion across diverse platforms creates significant opportunities for sustained volume growth. This resilience is exemplified in the BNPL sector. Despite entering the market in late 2020, PayPal has rapidly established itself as a global leader, boasting 300,000 merchants, 30 million customers, and a transaction volume of $20.3 billion as of December 2022. This translates to roughly 8.0% of the global market share, as some sources suggest that the global BNPL market was valued at $256 billion in 2022.

PayPal Investor Relations

The rapid growth in the BNPL segment underscores PayPal’s formidable network effect. Notably, over 90% of first-time users in PayPal BNPL are existing customers, highlighting that the company leveraged its existing customer base without seeking customers or merchants elsewhere for this new product. Hence, this advantage holds for a company with the largest market share in the online payment industry.

Statista

Additionally, PayPal strategically cultivates partnerships with diverse entities to broaden its customer outreach and enhance engagement while modernizing its technological infrastructure. Leveraging the rapid growth of sharing-economy platforms like Uber and Airbnb (ABNB), as well as widely-used consumer applications such as Spotify (SPOT), GrubHub, Instagram, etc., PayPal serves as both the back-end processor and a branded payment option during customer checkout. Similarly, affiliations with online marketplace giants like Meta (META), Etsy (ETSY), and Pinterest (PINS) contribute to broadening the company’s reach, particularly benefiting small e-commerce sellers.

An extensive roster of banking collaborators allows users to seamlessly link their major credit and debit cards to both PayPal and Venmo wallets. Collaborations with digital wallet platforms like Google Pay further extend PayPal’s reach into physical stores, providing a convenient option for contactless payments. Strategic partnerships with processors such as FIS (FIS) and Paymentus (PAY) help fill gaps in the product suite, while affiliations with MercadoLibre (MELI) and AliExpress enhance the company’s presence in Latin America and Asia

Therefore, strong partnerships with global players yield a large scale for PayPal that is unparalleled and enhances its competitive advantage the more features it adds to its product suite.

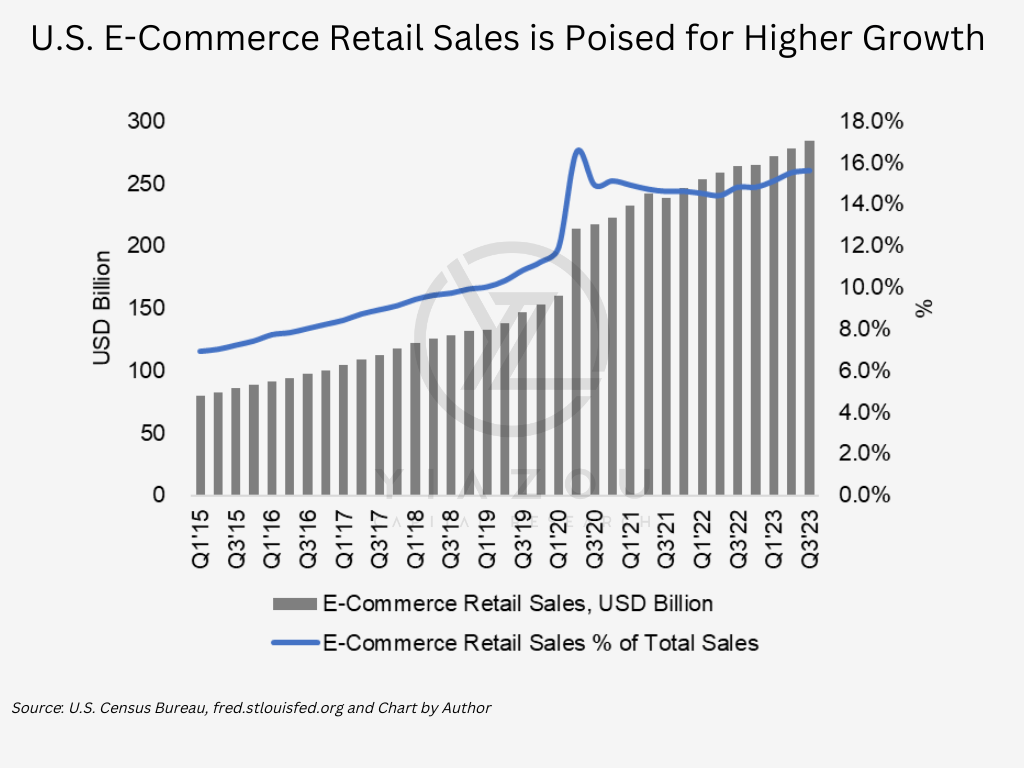

PayPal Rides E-Commerce Surge: US Online Sales Near Record, Fueling Recovery

E-commerce retail sales substantially impact the revenue growth of PayPal, which encountered a slowdown in 2023. However, recent quarterly data show positive trends favoring the company, especially with the potential easing of macroeconomic challenges. During the pandemic, US e-commerce sales as a percentage of total sales surged to 16.5%, but this figure has gradually declined as conditions normalized.

Nevertheless, the rate is nearing that record number, propelled by the lasting impact of the pandemic, which has ushered in enduring shifts in consumer shopping behavior. As of Q3’23, US e-commerce retail sales stood at 15.6% of total US sales. Meanwhile, total US e-commerce retail sales have exhibited a consistent average year-over-year growth rate of 7.5% over the last four quarters. Hence, this trend might experience an upturn in the coming quarters, given the pause on rate hikes by the Fed and the moderation of inflation.

E-Commerce Retail Sales as a Percent of Total Sales

PayPal’s Promising Horizon: A $90 Target Amidst Strategic Buybacks and Undervaluation

PayPal has sharply increased its share buyback program in the last three years, which indicates that management believes the market price of PYPL is much below its fair value. In the nine months of 2023, PYPL returned $4.4 billion through share buyback and expects to increase it to $5.0 billion for the full year, which will put the share buyback yield at 7.35%, an impressive return offered to investors from share buyback alone.

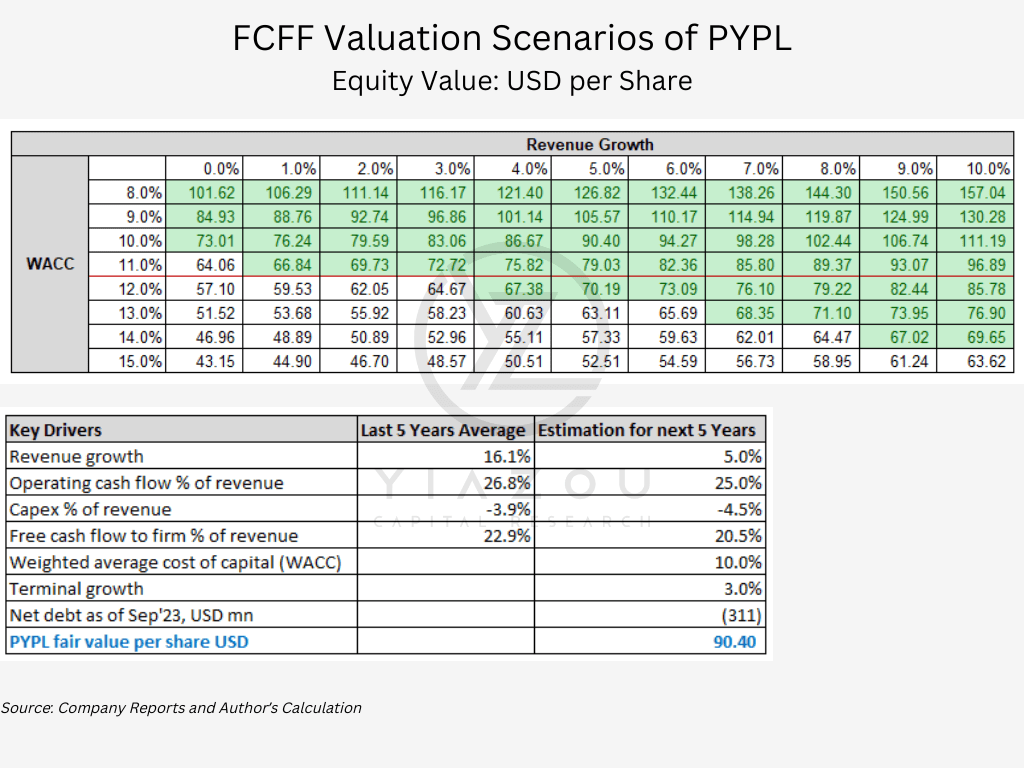

Drawing multiple scenarios for PYPL’s discounted cash flow valuation using free cash flow to the firm, it appears that PYPL is deeply undervalued. Considering a reasonable weighted average cost of capital (WACC) below 12.0% for PYPL, the market is pricing PYPL as if the company will have no revenue growth for the next five years.

PayPal

In our conservative scenario, with estimated revenue growth of 5.0%, operating cash flow of 25.0% of revenue, CapEx of 4.5% of revenue, WACC of 10.0%, and terminal growth of 3.0%, PYPL’s fair value stands at ~$90 per share considering the current number of shares outstanding.

However, we believe loan sales to KKR in tranches will improve free cash flow in the coming quarters through reduced receivables and improved operating cash flow. In the best case scenario, if we estimate revenue growth to be 10.0%, operating cash flow of 30.0% (partial impact from loan sale) for the next five years, and keeping all other assumptions the same as above, the fair value is ~$138 per share.

In the worst-case scenario, if we estimate revenue growth to be 0.0%, operating cash flow of 20.0% (partial impact from loan sale) for the next five years, and keeping all other assumptions the same as the first one, the fair value is ~$55 per share.

Author

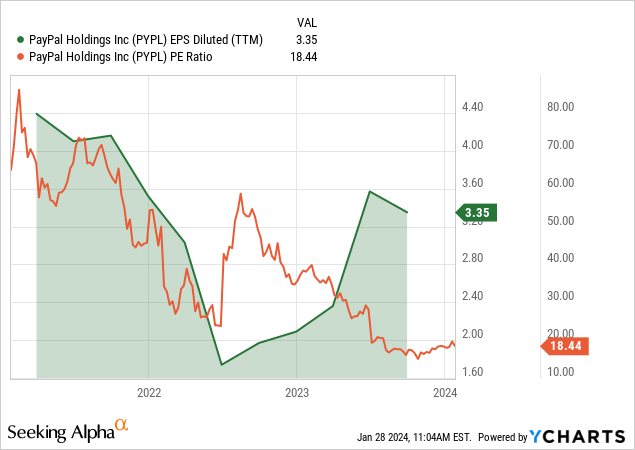

Examining PYPL’s relative valuation metrics reveals the market remains concerned over the company’s recent decline in margin and active accounts growth. However, this focus overlooks the long-term fundamental aspects that hold substantial potential for driving profitable growth. Thus, management’s intensified focus on operational efficiency and margin accretive growth will be value-additive for the company.

|

PYPL Valuation Metrics |

PYPL |

Sector Median |

PYPL 5Y Avg. |

|

P/E GAAP (TTM) |

13.09 |

10.19 |

37.57 |

|

EV / Sales (TTM) |

2.35 |

3.11 |

7.39 |

|

EV / EBITDA (TTM) |

12.55 |

11.47 |

37.98 |

|

Price / Sales (TTM) |

2.45 |

2.70 |

7.54 |

|

Price / Book (TTM) |

3.49 |

1.19 |

8.51 |

|

Price / Cash Flow (TTM) |

17.99 |

7.68 |

27.76 |

Finally, in anticipation of PayPal’s upcoming earnings call on February 7, analysts hold a cautiously optimistic view, expecting conservative results. According to the finance expert Enoch Omololu, steady growth is projected for PayPal, with EPS potentially reaching the $5 range and annual revenue growth in the high single digits. Therefore, despite facing competitive challenges, PayPal’s strong network effect and brand dominance can protect its moat, and delivering EPS of $5 along with a conservative P/E multiple of 20x leads to a target price of ~$100/share.

Takeaway

PayPal is adeptly managing its portfolio, focusing on margin growth amid challenges in its unbranded processing segment. The company demonstrates confidence in its value and growth potential with a substantial share buyback program and a targeted fair share price of $90. Strategic moves, including operational streamlining and loan sales to KKR, aim to strengthen financials. Despite short-term pressures, PayPal’s robust network and e-commerce partnerships underpin its long-term prospects in the digital payment landscape.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.