Summary:

- PayPal has launched a USD-denominated stablecoin called PayPal USD on the Ethereum blockchain.

- Stablecoins are seen as the “killer app” of cryptocurrency networks, allowing for peer-to-peer.

- It’s unclear how PayPal will be monetizing PYUSD, and the token could theoretically cannibalize PayPal’s core business.

Justin Sullivan

After halting development due to regulatory concerns earlier this year, peer to peer payment giant PayPal (NASDAQ:PYPL) has officially launched a USD-denominated stablecoin. This new stablecoin, which is called PayPal USD (PYUSD-USD), will live on the Ethereum (ETH-USD) blockchain network. This is a very interesting move for PayPal as the fiat-backed stablecoin market has been in decline for about 18 months. In this article, we’ll go over what PYUSD is, why stablecoins are such an important part of distributed ledger technology, and what this could ultimately mean for PayPal’s core business in the future.

PayPal USD

PayPal USD is a fiat-backed digital currency that can be utilized in and outside of the PayPal ecosystem. The PYUSD token will be issued by Paxos Trust and will be redeemable on a 1:1 basis for dollars. The collateral for the token will be cash deposits and short-term US treasuries. Functionally, PYUSD appears to be similar to other stablecoin projects that have been issued by Paxos Trust in the past. Those projects include Paxos’ own stablecoin Pax Dollar (USDP-USD) and Binance USD (BUSD-USD). Though PYUSD will be PayPal-branded and usable within the PayPal ecosystem, as an ERC-20 token, PYUSD’s core differentiator from cash held in PayPal’s app is that it can be swapped and held outside of the PayPal ecosystem as well.

Stablecoins Are The “Killer App”

Cryptocurrency networks are designed to be peer-to-peer. Aside from the notion that purely digital assets like Bitcoin (BTC-USD) or Ethereum lack any fundamental backing, one of the major reasons why cryptocurrencies have failed to scale as global payment assets is the volatility of the token prices. Fiat-denominated stablecoins have been seen as sort of the “killer app” of crypto network rails because they allow for peer-to-peer transactions in a familiar unit of account. Put another way, it’s easier for people to comprehend dollar-denominated transactions than it is for people to start pricing goods and services in “sats,” or satoshis, on the Bitcoin ledger.

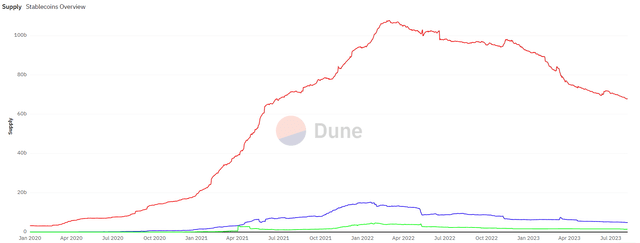

Thus, transitioning from USD in private-ledger ecosystems to something like Circle’s USCoin USD (USDC-USD) in public-ledger ecosystems is seen as a more logical step forward than moving to BTC or ETH as the currencies of P2P payments. The belief in fiat-backed stablecoins helped the stablecoin market explode from a $3 billion capitalization level in early 2020 to over $100 billion just two years later on Ethereum alone.

Ethereum (Dune Analytics/KARTOD)

However, the supply of the stables on Ethereum has declined from a peak of roughly $125 billion in Q1-22 to just over $74 billion today. What’s noteworthy though is most of the reduction in stablecoin supply over the last twelve months has been in over-collateralized crypto-backed stablecoins rather than the fiat-backed stables by percentage:

| Asset Class | Current Capitalization | 12 Month Change |

|---|---|---|

| Fiat-backed Stables | $67.8 billion | -30.0% |

| Crypto-backed Stables | $4.8 billion | -48.8% |

| Algorithmic Stables | $1.4 billion | -39.2% |

Source: Dune Analytics/KARTOD

To this point, the market has put considerably more trust in fiat-backed stablecoins rather than crypto-backed or algorithmic alternatives. What makes these assets so useful is the ability to transact outside of walled-garden ecosystems. As popular as PayPal has become in recent years, the app itself is still a closed ecosystem. Users of PayPal can’t send money to friends or family who would wish to receive those funds through Block, Inc.’s (SQ) Cash App, for example. This is where public blockchain networks offer an advantage.

When a developer integrates with a public blockchain network like Ethereum, a user can send stablecoins peer-to-peer no matter which wallet application the sender and receiver are using. For example, a sender can move Circle’s USDC on Ethereum from MetaMask to Trust Wallet (TWT-USD), Unstoppable Wallet, or Coinbase (COIN) Wallet without any application-level gatekeeping. PayPal’s new stablecoin can theoretically be utilized in the same way.

Who Wins From PYUSD Adoption?

What is unclear at this point is how beneficial this PYUSD stablecoin will ultimately be for PayPal’s bottom line. The big problem that I see with this project is networks that utilize distributed ledger technology are actually insurgents to current global payment infrastructure. If it reaches any kind of real level of adoption, PYUSD usage arguably cannibalizes PayPal’s traditional payments business. A PayPal-branded stablecoin would appear to be somewhat destructive to PayPal’s earnings in two different ways:

- PayPal isn’t the issuer of the token, Paxos Trust is the issuer.

- PayPal doesn’t generate fee revenue either because Ethereum validators earn the transaction fees on the network.

On point number 1, it would be Paxos Trust that holds the collateral of the PYUSD token. Which means interest on treasuries that are backing PYUSD would go to Paxos Trust. It stands to reason that PayPal should have some sort of profit sharing incentive with Paxos to utilize PayPal’s brand, but we don’t know what that looks like yet. That said, interest from treasury holdings isn’t PayPal’s bread and butter anyway. The company makes most of its money through its transaction fees.

On point number 2, PayPal’s current transaction fee business in its closed ecosystem likely doesn’t benefit from PYUSD either. PYUSD is currently being advertised as a feeless currency within PayPal’s walled garden, albeit between friends not businesses. However, sending the PYUSD outside of the PayPal ecosystem doesn’t appear to actually benefit PayPal either as Ethereum network validators take the fees from on-chain transactions. Taking these two points together, it’s unclear how PayPal would actually be monetizing its PYUSD stablecoin.

Summary

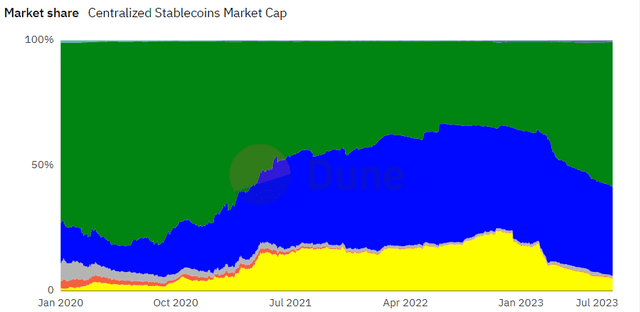

Despite the clear advantage of a fully backed stablecoin asset compared to algorithmic or crypto-backed alternatives, the crypto market has yet to find a stablecoin that has the capitalized staying power of Tether (USDT-USD).

57.8% USDT Share (Dune Analytics/KARTOD)

With nearly 58% share of the entire fiat-backed stablecoin market on Ethereum, Tether is the only leading fiat-backed stable that is still near pre-Terra Classic (LUNC-USD) collapse capitalization levels. USDC is down roughly 50% on Ethereum and BUSD is down 85% from its peak on Ethereum. But the market still values fiat-backed stables.

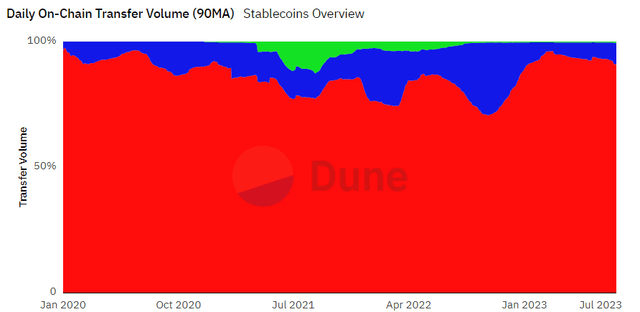

TX Share (Dune Analytics/KARTOD)

The category commands over 90% share of stablecoin transaction volume on Ethereum. Tether is somewhat infamous within crypto circles as there have historically been questions about where that token’s collateral is held. In my view, there is room for another fiat-backed stablecoin from a trusted financial company like PayPal.

However, what I’m less convinced of is how that stablecoin will actually benefit PayPal financially. PayPal’s ability to monetize the token will come down to how much revenue it can generate from the collateral that is backing the stablecoin and/or how much it can take from processing transactions within PayPal’s ecosystem or from sending PYUSD on-chain. It seems to me that PYUSD could actually cannibalize PayPal’s core business. For now, it looks like PYUSD adoption will be better for Ethereum than for PayPal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, ETH-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.