Summary:

- PayPal’s stock, currently at $69.35, offers an attractive investment opportunity following strong Q2 results and bullish price action, indicating market recognition of its value.

- The stock has established a strong uptrend, closing above its 200-day SMA for 30 days, confirming the value thesis and signaling a potentially opportune time to invest.

- The upward momentum is justified by the company’s cheap valuation relative to the market as a whole and to its own past.

- As of today, PYPL stock is offering a growing and sustainable buyback yield of 6.4%, significantly beating the 10-year Treasury yield.

spawns/iStock via Getty Images

Introduction

PayPal Holdings (NASDAQ:PYPL) stock has been touted as a good Value story for a while now. While bulls and bears have their share of arguments about the pioneer in the digital payments space, bulls have been joined by a powerful ally in recent weeks, namely momentum. Strong price action following the company’s good Q2 results indicates that Mr. Market may finally be recognizing the stock’s worth as well. As such, at 69 bucks and change, I think PayPal currently offers an attractive set-up to investors, and this article intends to lay out my reasoning behind that.

When a stock declines from a peak of $300, which PayPal reached in July 2021, to a trough of $50, which was hit in late October 2023, inevitably the question arises whether this is not an overreaction and whether the stock is not undervalued. This is especially true for stocks that have been regarded as blue-chip, high-quality companies for years on end, for which such dramatic 80% declines are deemed ultra-rare. In fact, many investors likened PayPal’s situation to that of Meta Platforms (META) in late 2022, a stock with a comparable standing as a previous high performer and a similarly severe decline, followed eventually by a massive recovery of several hundred percent. Of course, every situation is unique, and the comparability is limited, I would argue the PayPal Value thesis is not as strong as it was with META after its decline. Still, I think the story is good, which is corroborated by the fact that courageous bottom buyers are already sitting on profits approaching 40%. However, even for an investor who is only moderately courageous at best and who does not like to buy into falling knives but instead waits for market confirmation, I think there is money to be made in PayPal stock as its re-rating process has further room to run.

Strong Upwards Momentum

Since November 2023, PayPal stock has been stuck oscillating in a sideways movement between roughly $57 on the downside and $68 on the upside, adjusted for a couple of outlier days. It also struggled to establish a new uptrend by closing a meaningful number of days above its 200-day Simple Moving Average (SMA), a powerful trend indicator used by many investors to determine a stock’s underlying sentiment. If you look at the stock chart coupled with this trend line, you can see a certain indecisiveness on the part of the stock. In other words, the eternal battle between bulls and bears produced no clear winner. The stock did eventually go above its 200-day SMA for an extended period from March to June 2024, but it ultimately turned out to be a false breakout as the stock went below its long-term trend again. However, after reporting a beat-and-raise quarter at the end of July, the stock gapped back up into positive trend territory again and has stayed there since, adjusted for a single day’s close, namely that of August 5. This, of course, was a day of great volatility and lows for many kinds of stocks. As a result, without counting this one-off, the stock has closed above trend for 30 days straight now with the stock price currently at $69.35 as of its September 11 close and its 200-day SMA at $62.77, according to TradingView. Although investors may argue about the exact measurement and indicators to use, I think it is fair to say the stock has now firmly broken out of its sideways movement and established a new uptrend. While all this may be of no interest to traditional, pure Value Investors, I think it is an interesting supporting fact that confirms the bull thesis. After all, a stock cannot re-rate significantly without forming an uptrend and in a way, it is safer to buy when the trend is on your side. For a previously well-performing stock to become too cheap, it has to be in a sustained downtrend. Then a sideways consolidation phase follows, possibly accompanied by some false breakouts, as measured by moves above the 200-day SMA. But eventually, if the Value thesis is valid in the first place, the stock should enter an upward movement that is sustained, lifting it to higher and, from a Value perspective, fairer levels. This brings me to the next component of my analysis, since what is true for man also holds up for an investment thesis: It is better to have two legs.

Good Fundamentals & Cheap Valuation

While having trend signals of the stock on your side is a nice confirmation, ultimately you still have to be right on the company’s trajectory in order to expect meaningful upside. In other words, this section explores the question: Is PayPal in good shape? And is it still undervalued? To determine this, I want to look at certain quality metrics, figures and the historical track record of the company.

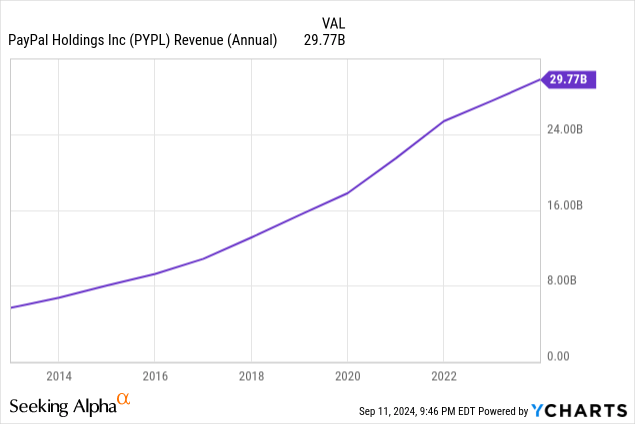

Taking a step back and looking into the past, we can see PayPal has been a steady performer revenue-wise. In fact, PayPal has grown revenue every fiscal year since 2012, and revenue from the 10-year period of 2013-2023 went up by 4.43x, or a 16% CAGR.

The most recent results show that FY 2024 will most likely not be an exception: If we extrapolate the first-half figures, that is, multiply by two, PayPal would generate revenues of $31.2 billion, which is a conservative number I think and is also lower than what analysts expect. Still, even this conservative number would be almost 5% above its FY 2023 predecessor. This is, of course, dramatically lower than its abovementioned heyday growth rates, which speaks to the maturity of the business and a different competitive landscape. But it is positive growth nonetheless and not that bad for a challenging transition year with PayPal’s current CEO only taking over in September 2023. The numbers indicate execution under new leader Alex Chriss has been improving already, especially given the turnaround in transaction-margin dollar growth that has occurred as of Q2, which is a key figure in the digital payments industry.

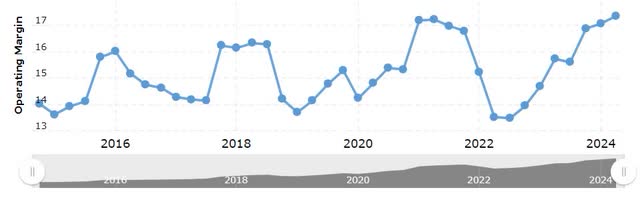

A quick look at data from the past also reveals the business operating margin fluctuated by some amount. It bottomed out repeatedly at roughly 13.5% and went as high as 17%, which is where the business is at currently with 16.8%. Thus, speaking from historical context, the business is at a very good place right now concerning profitability, and you could say there is a certain operating momentum taking place.

PayPal Operating Margin over the years (MacroTrends)

In my estimation, these kinds of margins put you in the good, but not great, kind of business bucket, although its return on tangible equity (equity minus goodwill and intangibles) of 42.6% is rather outstanding. Net Income for the year will probably come in at a little over $4 billion. When you juxtapose that with 1,032 million shares outstanding as of their latest results (which is obviously lagging data) at $69.35, i.e. a market cap of ~$71.5 billion, this results in a 17.87 PE multiple for PayPal stock. This number is significantly below the market average and cheap for a quality company. However, and potentially even more instructive, it is firmly below PayPal’s own historical multiples. According to YCharts, its 5-year average PE ratio is 46. Obviously, one should not assign too much importance to this number. After all, PayPal’s growth today is slower than it was in the past and this figure also takes into account the overinflated prices that were reached during the growth equity bubble of 2021. Still, even if you look back further into the past or make any kind of historical comparison at all, today’s multiples are basically near all-time lows.

A Steady Returner of Capital

While P/E ratios are an important tool, the valuation framework that I am most comfortable with is looking at the company’s net capital return and assigning a fair multiple or a fair yield to it. For the first six months of the year, we had exactly $3 billion of stock repurchases, so call it $6 billion annualized. However, there were also significant Stock-Based Compensation (SBC) expenses of $692 million, so an extrapolated $1.384 billion. So call it $1.4 billion in SBC, since we humans appreciate working with nice round numbers.

That leaves $4.6 billion in net buybacks annualized, which gives PayPal stock a 15.5 buyback multiple or a 6.4% buyback yield. And even though this $4.6 billion figure is currently a little above what the company is earning on a GAAP basis, I would argue that buyback yield is rather safe and sustainable since the company has a pristine, net-liquidity balance sheet it could always fall back on. If the company were to pay off all its debt of $12.2 billion from its existing cash, cash equivalents and investments of $18.3 billion tomorrow, it would still have $6.1 billion left that it could use for any purpose, including share repurchases.

So what is all that worth? Well, it is tough to come up with an exact number, but in my eyes, in a world where the 10-year Treasury rate is 3.67%, a sustainable 6.4% buyback yield paid from a quality company that is growing earnings is too good of a deal to be fair. Especially if you take into consideration that the US government’s balance sheet is not nearly as pristine and that the rate received from the 10-year can never grow once you make the investment. Add to the list the rate cut cycle that is clearly emerging on the horizon, which should make any above-average yield even more attractive in the coming months and years.

So with all of that in mind, maybe you would agree with me that anything between 4.5% and 5.5% makes more sense for PayPal’s capital return yield. This would put PayPal’s fair market cap anywhere between $84 billion and $102 billion, suggesting an upside potential between 17.5% and 42.7% from current prices, or roughly 30% at mid-point. This would translate to a stock price of $90.15. In my eyes, such a target would be a conservative fair value estimate; but of course, the stock price could go even higher than that on good sentiment. Also, fair value is a moving target, and it stands to reason that PayPal exhibited good momentum in its operating metrics recently, which might continue and deliver incremental upside.

Risks

There are several risks worth mentioning in the investment case here. First of all, while recent execution has been good and operating metrics have been improving, there is always the risk that things take a turn for the worse again. If transaction-margin dollars or other metrics do not live up to expectations in the next quarter, obviously, the market might become disillusioned with the recovery story. You also have marketing and public communication risks; certain User Agreement policies of the past come to mind, as well as misguided CEO appearances on financial networks that did not quite shock the world. However, I think the company may have learned from its past missteps and if recent performance is a guide, I do not think execution risk is significantly higher here than at other companies.

While momentum is powerful and self-reinforcing to some extent, the flip side of the coin, of course, is the danger of disappointments. Skeptics may point to PayPal’s historically high operating margins and see the potential for a mean reversion to something like 15% again.

Also, there are well-documented competitive risks in the case of PayPal. While PayPal operates a huge network and enjoys certain economies of scale, which may be one of the reasons famous Value fund manager Pat Dorsey owns the stock as an 8% position, I think it is fair to say PayPal does not possess a deep moat. Both startups and big tech behemoths are trying to take market share in the fintech space, and especially in mobile payments, Apple (AAPL) Pay has been a real challenger. However, I would say that all of this has been going on for a while now and yet people are still using PayPal just the way they did before, by and large. PayPal is far from irrelevant in this space. The company is growing and operating with solid profitability, and so far, it has been able to more or less meet any challenge that has arisen. It is true that PayPal may no longer be the growth stock it once was, but it is definitely no longer priced as one either.

Finally, a ubiquitous risk is the state of the American and global consumer. I think it is really tough to predict anything in that regard, but there have been signs that the macro is getting cloudier, with a record number of Americans maxing out their credit cards and a job market that is showing signs of weakening. A slowing of the economy obviously has a negative impact on PayPal’s business, but I, personally, believe that this kind of risk is the same for the market as a whole, especially given its stretched valuation relative to a discounted stock like PayPal.

Risk-averse investors who do not mind getting in and out of positions based on price action may also consider using Stop-Loss Orders in the low $60s in order to limit the risk taken with PayPal stock in case the thesis does not pan out. Several important moving averages such as the 50, the 100 and the 200-day SMA are at $64.86, $64.01 and $62.77, respectively. A sustained move below those levels would indicate that the momentum portion of the investment thesis has failed and is over, which would signal that this is not the uptrend to lift PayPal to its fair value or beyond. This choice, of course, depends on individual risk management practices and how much wiggle room one wants to give the bull thesis. Some investors may choose to employ an even tighter Stop, while other long-term Buy & Hold investors may not use Stop-Losses at all.

Final Thoughts

To conclude, I think PayPal is a good bet at this moment due to a combination of sound business developments and its stock price finally showing signs of turning as measured by certain momentum indicators. Even after an almost 40% move from its $50 lows, its valuation remains undemanding and leaves room for worthwhile upside potential. Cautious investors might think about securing their positions with a Stop-Loss in order to establish a good Risk-Reward bet. In my opinion, the upside case is the more likely one, and I think the re-rating process that is currently going on with PayPal still has legs. As such, I rate its stock a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.