Summary:

- I believe the PayPal buy thesis is centered around the growth of their Venmo Credit Card, which aims to monetize its extensive Venmo user base.

- The card’s unique features and integration with the Venmo app cater well to the preferences of younger consumers, especially Gen Z.

- PayPal’s current stock valuation is significantly lower than its competitors, suggesting room for share price growth based on earnings expansion alone.

Justin Sullivan

Investment Thesis

I believe the buy thesis for PayPal (NASDAQ:PYPL) is centered around the growth of their Venmo Credit Card. In my opinion, this is a strategic move to capitalize on and monetize its extensive Venmo user base, alleviating one of the street’s biggest concerns around the stock.

Venmo’s credit card, with its attractive cash-back offerings and the backing of Visa (V), enhances both its acceptance and appeal, aligning well with PayPal’s existing reputation among international merchants. I believe the card’s unique features, such as their adaptive cash-back rewards tailored to user spending habits and integration with the Venmo app, cater well to the preferences of younger consumers, especially Gen Z.

With PayPal’s current stock valuation, standing at just 12.25x forward earnings estimated, this is significantly lower than its competitors like Square (SQ), Mastercard (MA), or Visa, suggesting room for share price growth just on earnings expansion alone.

On top of this, I believe PayPal’s continued robust payment volumes and its share buyback program strengthens the investment case – the overall firm is on solid ground. Despite facing challenges in 2022 and 2023, such as increased competition in the digital payments market and the need for strategic refocusing, PayPal’s user base and these strong transaction volumes remain key pillars. Overall, I think the stock is a buy in 2024, with the credit card as the catalyst to monetize their strong Venmo franchise and bring confidence back into the stock.

Background and Challenges

2022 and 2023 brought a series of execution challenges for the payments giant. With increasing competition in the digital payments sector and changes in the market and consumer behavior, PayPal shares are down over 80% after peaking at $310.16 on July 26th, 2021.

One of the biggest issues has been the intensifying competition in the digital payments market. PayPal, despite being a popular choice among users, has faced growing competition from rivals like Apple Pay, Cash App, Zelle, and Google Pay. Higher competition put a strain on PayPal’s margins, making it more difficult for the company to sustain its previous growth levels. Although the company has remained the most popular digital wallet, with 69% of Americans using it, their growth rate has slowed down, reverting to pre-pandemic levels.

With this, PayPal has undergone significant leadership changes. The new CEO (Alex Chriss) has recognized that the company has lost its focus (they contemplated buying Pinterest at one point). Chriss’s acknowledgment was part of a broader strategy to reorient PayPal towards innovation and growth.

Why Venmo is Popular Among Gen Z

Venmo is popular among Gen-Z and Millennials because of its unique blend of financial utility and social media-like features. Venmo taps into the social behaviors of younger generations by allowing them to engage in financial transactions that are visible to their network, fostering a sense of community and openness about money matters (as someone who is Gen-Z myself, I think it’s fun to see what your friends are up to).

With this, Venmo encourages users to add a social element to their transactions through the use of emojis and notes. These memos can be liked and commented on, adding an interactive dimension that is typically found in social media apps.

Given Venmo is a large portion of many Gen-Z and Millennials social networks, it’s become the go-to app for peer-to-peer payments. This widespread adoption among peers, especially in college and young professional settings, has led to Venmo becoming not just an app but a verb in itself, indicating its deep integration into the daily lives of younger generations (much like how people say they want a Kleenex vs. a tissue).

Venmo Credit Card is the Key to Success

Wall Street analysts, including James Faucette at Morgan Stanley, have expressed concerns that Venmo will be hard to monetize and recently cited slow progress as part of the bank’s downgrade of the stock.

I think the Venmo Credit Card is the key piece. One of the most distinctive features of the Venmo Credit Card is its customized cash-back rewards. Unlike many traditional credit cards, the credit card offers between 1-3% cash back on your top spend category. This is great for Gen-Z which values experiences (like going out for drinks and eating food) and often will concentrate spending on travel and leisure. This card is perfect for this and could offer 3% back on this category.

In addition, the Venmo Credit Card is deeply integrated with the Venmo app, adding to its appeal for a demographic that is already comfortable with digital wallets and online financial management. The card is directly connected to the user’s Venmo account, allowing for seamless management of card activity, including tracking purchases, payments, and rewards. Another modern feature is the ability to split card purchases via Venmo, making it easy to manage shared expenses with friends and family.

If just 5% of the 90 million Venmo users were to convert to a Venmo credit card, this would represent over 4.5 million Venmo credit card users.

Last year, research showed that Synchrony Bank (the bank that Venmo works with) made $259.81 per average credit card account. Assuming they split this with PayPal 50/50 this would imply about $129.90 in annual revenue per Venmo Credit Card, unlocking $584.55 million in annual revenue.

For reference, Venmo as a whole made $935 million in 2022 through processing/transaction fees. Full 2023 data is not out yet, but the opportunity with credit cards could be meaningful in accelerating the Venmo revenue profile.

Valuation

For reference, PayPal did $29.128 billion in revenue in the trailing 4 quarters. So while $584 million in additional revenue would only represent approx. 2% of annual revenue, it’s the monetization of Venmo that counts.

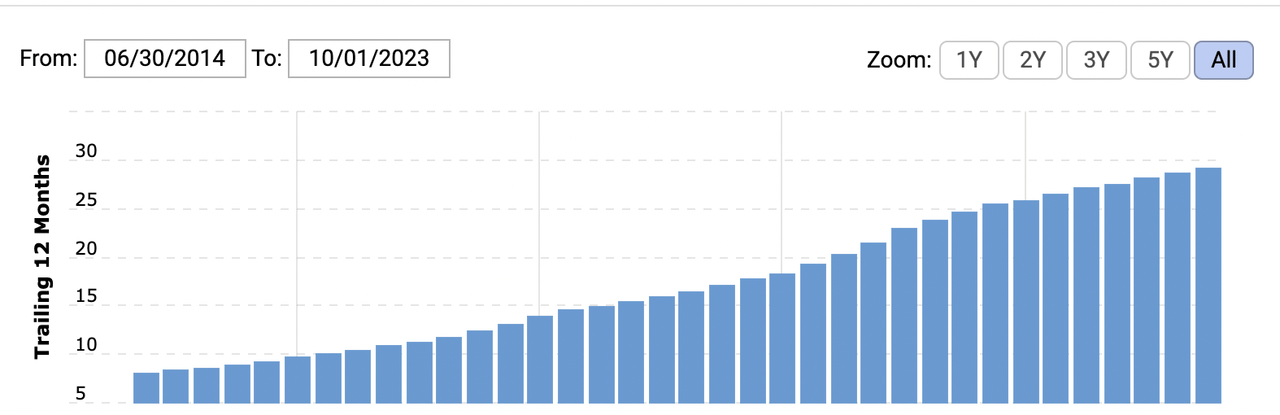

PayPal (despite being beat up by the market), has not had a declining trailing 12-month revenue. Sure, revenue growth has been slower, but it’s not shrinking.

PayPal Trailing 12 Months Revenue (Macrotrends)

In my opinion, what the market needs to see here is that the company will continue to grow, so Venmo needs to show strong monetization, and then the earnings (P/E) multiple will expand. For reference, their forward P/E is 12.25. This is meaningfully lower than other payment processors like Visa, Mastercard, or Square/Block.

|

Company |

(V) |

(MA) |

(SQ) |

(PYPL) |

|

Forward P/E (Non-GAAP) |

12.25 |

If the company could even see their forward P/E multiple expand to 20 times forward earnings (still below its 3 peer average), this could represent a 63% upside from the current stock price. In fact, this 20x forward P/E ratio is still significantly below the average PE the stock has had for most of the last 10 years.

Keep in mind, the company also has a $5 billion buyback program available after a deal with KKR to buy some of its receivables. This on its own could represent 7.7% of the company’s common stock being retired (at current market prices).

Why I Think 2024 is the Year for Change

PayPal’s new CEO (recruited September 2023) is putting a strong emphasis on innovation. I think this will be key, as the new CEO has been quoted saying he hopes to “…relaunch a brand new, end-to-end consumer experience with checkout at the center that will bring value to consumers with every single purchase.”

A big piece of this (of course) will have to be the Venmo Credit card. I think emphasizing by management will allow them to raise awareness of it and increase consumer adoption.

Risks to the Thesis

The recent decision by Amazon (AMZN) to end its payment partnership with Venmo presents challenges to PayPal’s growth strategy. Introduced in just late 2022, the collaboration between Amazon and Venmo was seen as a critical step in monetizing the Venmo platform, which PayPal had been emphasizing as a key component of its expansion plans. This partnership allowed Venmo users to use the service for purchases on Amazon, thereby integrating Venmo more deeply into the e-commerce ecosystem.

Amazon nor PayPal detailed the specific reasons for this decision, but it has led to some concerns about the underlying factors, including potential concerns over fraud and chargebacks associated with Venmo transactions. Venmo, being a peer-to-peer payment service, has been susceptible to various scams and fraud, which could have contributed to Amazon’s decision in my view, considering Amazon’s efforts to clamp down on fraudulent activities on their own platform.

However, the partnership ending doesn’t concern me a lot. PayPal’s strength has not been payment processing on Amazon, in my opinion. It’s been smaller, peer-to-peer transactions, or smaller merchant transactions.

With this, PayPal has a JavaScript SDK code package that integrates the Venmo button on product and checkout webpages, enabling Venmo as a funding source, and ensuring a smooth integration process for smaller merchants. I think this allows them to take the lessons they have learned from integrating with Amazon and apply them to smaller merchant operations.

Bottom Line

The Venmo Credit Card, with its unique and adaptive cash-back rewards program, presents a promising avenue for PayPal to expand and monetize its user base and convince investors to reward the company with a higher earnings multiple. The card caters to the changing spending habits of consumers, offering a dynamic rewards system without the complexity of rotating categories. Its deep integration with the Venmo app (along with Venmo SDK checkout package) enhances user/merchant convenience and appeals to a demographic already comfortable with digital wallets.

The card’s success will likely depend on PayPal’s ability to grow its Venmo user base and convert these users. However, Venmo growth has been strong, up to 90 million users in 2023 (from 40 million in 2019 pre-COVID). In this case, I think the market has become too pessimistic on the stock. I think it’s a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noahs' Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.