Summary:

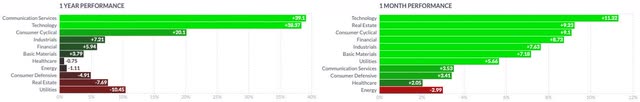

- The financial sector has positive momentum, but performance remains modest on a yearly basis.

- PayPal is a leader in the payment processing industry with a large user base, while Block has faced accusations of overstating its user count.

- The global payment processing solutions market is expected to considerably grow, with retail and e-commerce segments contributing the highest growth rate.

- New leaders will emerge from the actual regionalization and localization of payment systems, while some past leaders may still have enough strength to stay on the frontline.

- This article focuses on long-term investment opportunities based on in-depth fundamental analysis, and I offer two valuation models structured around multiple outcome scenarios.

GOCMEN

The financial sector has reported substantial positive momentum in the past month, while on a yearly retrospective, the performance remains more modest. Companies in the financial sector can benefit from higher rates through increased profit margins, while on the other hand, if the economy cools down, the overall transaction volume handled by the companies in the payment processing industry and the amount of credit tends to drop significantly. Technology companies outperform most other sectors, with software infrastructure firms among the leaders.

The two selected companies are leaders in the transaction and payment processing industry. PayPal Holdings, Inc. (NASDAQ:PYPL) has become a giant in the payments industry, with solutions under brands such as PayPal, Braintree, Venmo, and Xoom, being about double the size as its competitor Block, Inc. (NYSE:SQ) in terms of market capitalization or total assets, with over 430 million active PayPal user accounts among merchants and consumers, and $1.5T total payment volume. Block’s business is segmented under its brand Square, offering an entire toolkit with both hardware and software products for businesses, and its Cash App, oriented mainly towards peer-to-peer money transfer and cryptocurrency services, launched in 2013 to compete against services such as PayPal, Venmo, Apple Pay, or Google Pay. Although the company reported 55 million monthly transactive actives at the end of Q3 2023, Hindenburg Research criticized its declarations earlier this year, accusing the company of massively overstating its user count.

PayPal’s lion’s share of its revenue is generated through transaction fees, especially from e-commerce transactions, while the company also earns money through currency conversion fees and interest rates on certain products like PayPal Credit. Block’s revenue stream is coming increasingly from its Bitcoin business available to its Cash App customers, from transaction fees for its payment processing services, with retail and the food and drink industry accounting for almost 50% of its gross payment volume, hardware sales, and from transaction fees of its Cash App.

Considering the consensus of a broad number of published studies, the global payment processing solutions market is expected to grow on average at 10% Compound Annual Growth Rate [CAGR] through 2032, while some researchers are even estimating the expansion reaching 20.3% CAGR. The market is expected to expand to a total value of $260B, led by the Asia-Pacific region with an actual market share of 19.30%, followed by North America, the region with the most prominent present market share of 47%, and Europe, with 27.30% actual market share. Regarding industry verticals, the retail and e-commerce segments are expected to contribute at the highest growth rate at 18.3% CAGR, followed by the media and entertainment segment, IT and telecom, and the travel and hospitality industry. The global cross-border B2C e-commerce market is anticipated to grow even faster in the forecast period, at 27% CAGR, as some product categories may have higher international than domestic demand.

The COVID-19 pandemic has accelerated the adoption of near-field communication or contactless payment systems worldwide, as the global internet penetration, with the increase of smartphone users, reached about 5.3B people in Q4 2023, the equivalent of 65.7% of the world’s total population. While credit cards are the most used payment method in North America, the increased use of mobile applications such as super apps or mobile payment solutions, especially in developing economies, is accelerating the adoption of eWallets solutions, a segment expected to grow at 24% CAGR through 2023.

An in-depth company comparison

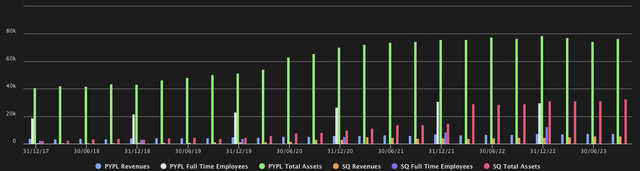

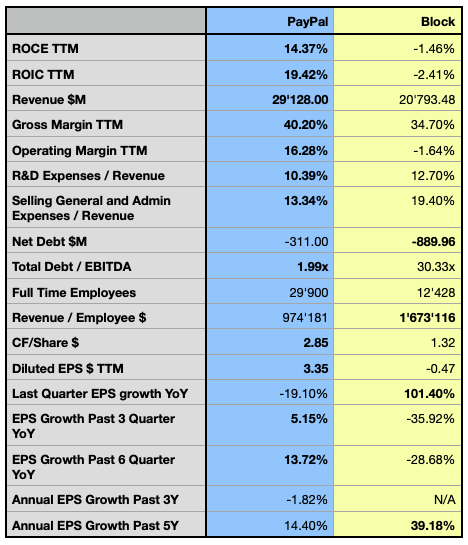

Author, using data from S&P Capital IQ

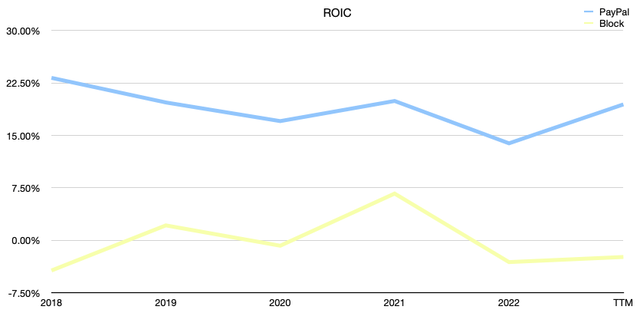

The financial comparison highlights the two competitors’ major relative strengths and weaknesses. In terms of their Return on Invested Capital [ROIC], a critical metric I consider when pondering an investment decision, as a company must be able to create value to be a sustainable investment consistently, PayPal reports a much stronger capital allocation efficiency over the past few years, despite seeing this metric softening during the outbreak of the pandemic. After shortly peaking in 2021, Block’s metric dropped back into negative territory, signaling a likely value destruction for its shareholders. Both companies own a considerable cash position, with PayPal reporting $6.81B and Block $5.11B TTM cash equivalents and unrestricted marketable securities at the end of Q3, and both reported a negative net debt. Despite this, Block’s debt exposure measured by total debt-to-EBITDA has seen a high variance in the past few years, hinting at potentially more financial risks for investors regarding the company’s capacity to repay its debt or sourcing more capital from lenders at suitable conditions.

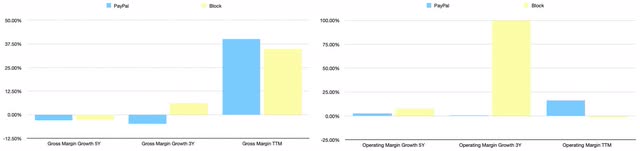

Author, using data from S&P Capital IQ

PayPal’s gross margin growth is seemingly worsening from -2.87% CAGR in the past 5 years to -4.81% CAGR in the past 3 years, while Block’s gross margin growth accelerated from -2.66% CAGR to 6.29% CAGR over the analyzed time, with the management guiding an expansion of 24% for the full year 2023. PayPal’s branded checkout solution, which has a higher gross margin, is growing slower than the unbranded checkout, leading to headwinds in the company’s gross margins anticipation for the remainder of the year.

On the operational side, the companies have an even more divergent profile. Block’s operational profitability has been a red flag for investors, as the company struggled to report positive profitability, averaging at -0.72% in the past 5 years, while PayPal’s operating margin has been significantly higher, averaging at 15.68% during the same time. The latter is guiding 0.75% in non-GAAP operating margin expansion for the current fiscal year, supported by a 12% decrease in non-transaction related expenses in Q3 2023, but down 0.25% from the previous guidance, as the company expects a decline in transaction margin dollars in the fourth quarter.

Author, using data from S&P Capital IQ

PayPal reportedly has a more cash-rich business than the analyzed peer, while none of them is paying a dividend; PayPal has repeatedly performed stock buybacks, with over $4.4B returned to its shareholders in its current share buyback program targeting $5B during the fiscal year. Block has recently announced a $1B share buyback program, citing its intention to offset the dilution of its shareholders partially. In fact, Block’s share count has increased by 55% over the past 5 years, leading to a substantial dilution of its shareholders, while PayPal’s total outstanding share count has declined by 11%.

Although PayPal’s quarterly EPS growth rate has had a negative development over the most recent quarter, the company reported higher growth over the past few quarters after a more significant slowdown at the end of 2021 and during the first half of 2022. Block’s quarterly EPS has been negative over the past two years, with some signs of growth in the current fiscal year, but the company has yet to prove its capability of being consistently profitable.

The stocks’ performance

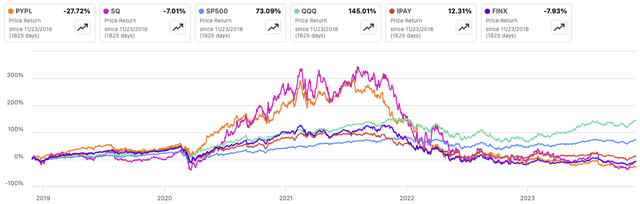

Considering both stocks’ performance in the past 5 years, PYPL underperformed all the analyzed references, reporting a negative performance of -29.44%, while SQ performed less poorly but still reported a loss of -7.59% over the analyzed period. Both major reference indexes, the S&P 500 (SP500) and the Nasdaq technology index, tracked by the Invesco QQQ ETF (QQQ) marked a much more positive performance, while two selected industry references with exposure to both stocks, such as the ETFMG Prime Mobile Payments ETF (IPAY), and the Global X FinTech ETF (FINX), show a mixed performance, hinting at an overall rather flat performance among peers.

Author, using SeekingAlpha.com

While both stocks display periods of relative strength, especially from the pandemic-related market crash in 2020, SQ reported some sporadic periods of resilience after every major drop, while PYPL has been under significant pressure since peaking in 2021. In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer an exciting opportunity while assessing the possible risks in different scenarios.

Valuation

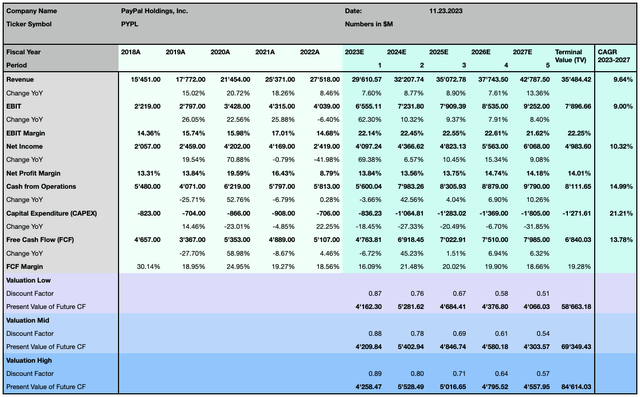

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow [DCF] model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the WACC and the terminal value. As forecasted by the street consensus, PayPal is anticipated to generate 13.78% Free Cash Flow [FCF] CAGR over the coming 5 years, with its operating and net profitability increasing at 9.0% and 10.32% CAGR, while its revenue is projected to expand at solid 9.64%, slightly below the expected growth in the global payment processing solutions industry.

Author, using data from S&P Capital IQ

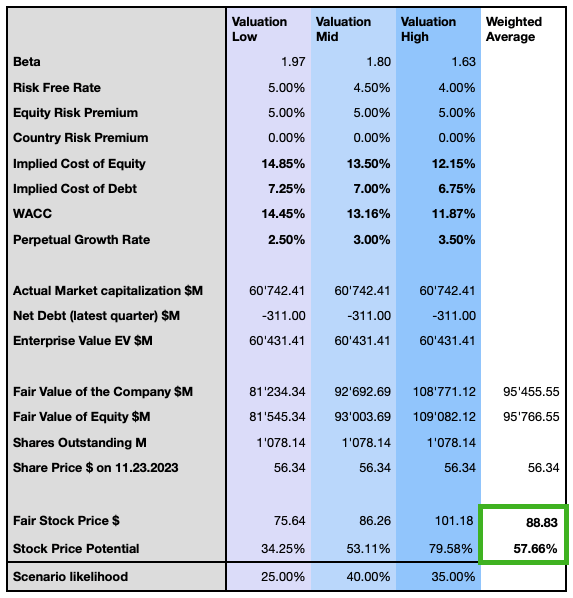

The valuation considers multiple scenarios regarding monetary policy, which will affect the weighted average cost of capital and significantly impact the potential stock price performance.

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be significantly undervalued with a weighted average price target with about 58% upside potential at $89.

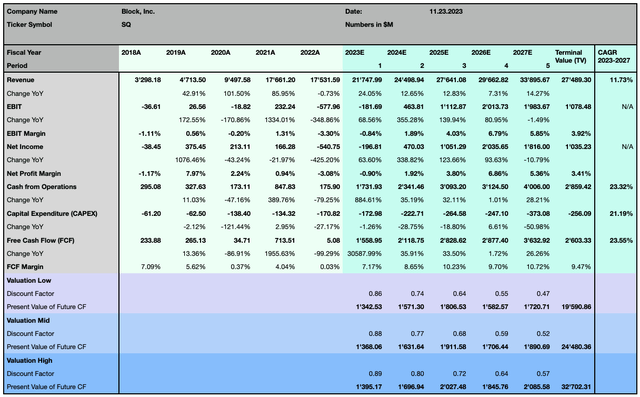

Block is forecasted to expand faster than its peer, with its sales growing at 11.73% CAGR over the next 5 years, faster than the global payment processing solutions industry. Its operating and net profit margins are expected to break even in 2024 and accelerate substantially over three years before slowing down in 2027. The company’s FCF is anticipated to dramatically increase, as it is expected to massively increase its cash from operations by 23.32% CAGR through 2027.

Author, using data from S&P Capital IQ

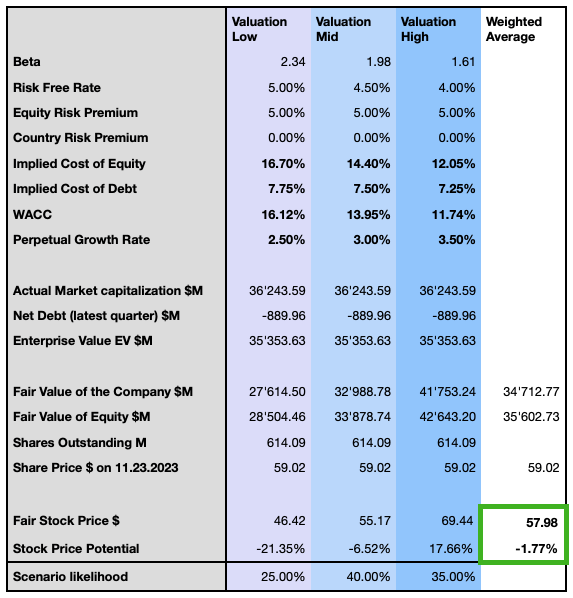

I then consider the same three scenarios affected by the company’s fundamentals and exogenous factors.

Author

Although this is a promising outlook, SQ has a fair value when considering the weighted average price target, offering a relatively small upside potential of 17.66% in the most optimistic scenario. The two modelizations suggest that PYPL may be rated as a buy position, while SQ’s is seen as a hold position. Interestingly, in PYPL’s modelization, all three scenarios forecast a positive return. In contrast, in SQ’s modelization, only the most optimistic scenario hints at some relevant upside potential, with the other two scenarios suggesting even an overvaluation, emphasizing the divergence in the companies’ valuation.

Investors should consider that those forecasts are based on a relatively conservative assumption regarding perpetual growth rates, higher discount rates, and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and risk discussion

The traditional trend towards globalization is challenged by increased geopolitical tensions, national polarization, and international trade agreements, leading to the emergence of regionalization and localization in payment systems, supported by the rise of locally controlled networks and infrastructure. More countries want to gain control over local instances of payment and critical infrastructure, resulting in a more diversified, demanding, and overall complex regulatory framework. Until compliance and security requirements are more standardized, companies offering simplified cross-border transactions and payment processing services will have many opportunities to position themselves and gain market shares in this reshoring trend. Ultimately, this will offer internationally established companies and new entrants to acquire market shares. PayPal is available in over 200 countries and supports 25 currencies, while Square is available only in the US, Canada, Australia, Japan, the United Kingdom, the Republic of Ireland, France and Spain. Block’s Cash App is even more restrictive in cross-border payments, accepting only US and UK transactions.

While the company reported massive revenue growth from its cryptocurrency business, Block’s Bitcoin dependency is increasingly a risk factor that exposes its income to substantial volatility in the cryptocurrency market. In August 2023, the company launched its USD stablecoin, which it claims to be fully backed by USD deposits, short-term US treasuries, and similar cash equivalents, to seamlessly connect fiat and digital currencies. The company has already allowed customers in the US to transact with cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. For both competitors, the blockchain might offer significant growth opportunities, with additional cryptocurrencies that could be added to their offer and a large-scale adoption of cryptocurrency payments globally. Despite the potential, the industry is increasingly targeted by heavy regulatory clampdowns and is particularly exposed to fraud and cybercriminals. Security concerns are other important risk factors that affect both competitors. Cybercrimes are increasing quickly, with global cybercrime damage costs estimated to grow by 15% YoY, reaching $10.5T annually by 2025, up from $3T in 2015.

PayPal also has a much more consistent portfolio of products and services under its multiple brands, much broader brand awareness, and the dominant market share of 40.52% in the global online payment processing market, with Stripe following with 20.52% and Block holding a small market share of 1.58% through its acquisition of Afterpay in 2021. The latter might pose risks of restructuring charges, unanticipated costs with the ongoing integration, and write-offs due to potential unknown liabilities and the significantly increased amount of Block’s goodwill by over $11.7B.

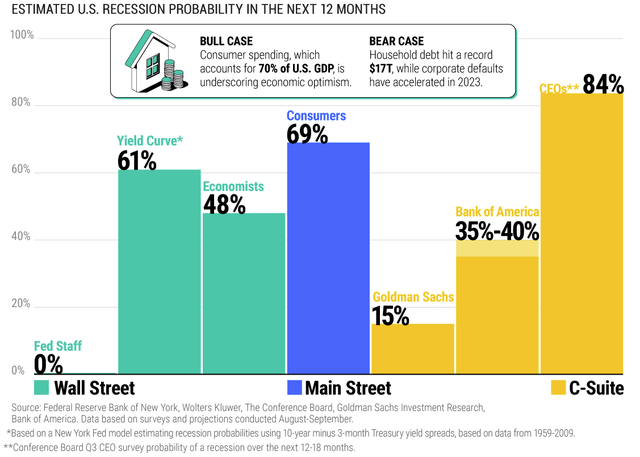

Ultimately, the major threat for the whole industry is a possible significant economic downturn in the foreseeable future. Although the overall projected monthly probability of a US recession in the coming 12 months has fallen to 46% in October, from a peak level above 70% estimated in May, only the staff of the Federal Reserve is convinced that a recession will be avoided, while based on other metrics the odds are still significant and represent a threat that has to be considered by investors.

Reserve Bank of New York, Wolters Kluwer, The Conference Board, Goldman Sachs Investment Research, Bank of America

Although consumer spending has been surprisingly resilient, the consumer is increasingly relying on borrowing for spending, with consumer credit at historically high levels in the past two years, the private savings rate at levels seen in 2008, and credit card interest rates skyrocketing to a peak of 28.9%, and averaging at 21.19%. As a comparison, in 2018 and 2019, the savings rate was more than double the actual reading, credit card interest rates averaged between 14.22% and 15.05%, and the consumer credit was flat over the two years. Credit card delinquency is also increasing, doubling in the past two years.

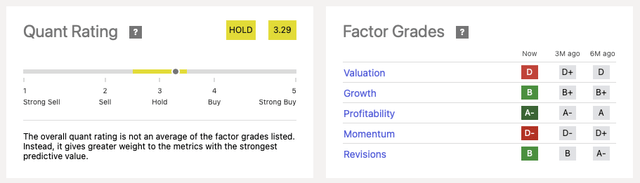

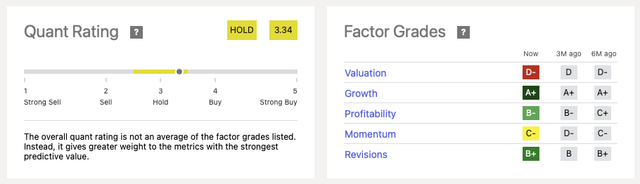

PayPal has been rated with a Hold rating from Seeking Alpha’s Quant Rating since July 2022 with only sporadic short periods of buy signals and holds the 12th position out of 44 in the transaction and payment processing services industry.

Block has also been rated as a hold position since July 2022 but has instead been upgraded to a buy position over the end of 2022 until March of the current year and is ranked in the 9th position in the relevant industry. Both companies are, with some surprise concerning PayPal, ranked low in terms of valuation; while growth and profitability are seen as the more positive factors for both peers, the actual momentum seems less favorable for PayPal, while Block is profiting from some positive revisions.

The verdict: Which stock is the better buy?

From an investor’s point of view, it’s essential to consider the company’s ability to create value for its shareholders while minimizing the risks. Past performance is not a guarantee for future results, and despite both analyzed companies experiencing a substantial spike in their past valuations, their shares are now deep into stage four, and the biggest issue in this kind of situation is the massive technical but also psychological, overhead resistance that the stock has to overcome before possibly setting up a new uptrend.

This comparative analysis emphasizes the two stocks’ different risk/reward profiles. While both companies are positioned in a market with massive growth potential, ultimately, it comes down to how capable the company is of capturing the potential in the long term. In these terms, an important aspect to consider is the network effects built in the company’s ecosystem, which translates into a more substantial moat and better customer retention. Block’s growth has lately been driven by recent partnerships with DoorDash (DASH), Adyen (OTCPK:ADYEY)(OTCPK:ADYYF), Stripe, and other large Afterpay merchants. Still, the company has also made dubious steps out of its core business, with a significant stake of 86.23% in the music platform Tidal, bought for $237.3M, which led to controversy among shareholders and even a lawsuit. Tidal’s revenue is reported under the Corporate and Other segment, which reported a decrease of 10% YoY in the nine months ended in September 2023. PayPal’s product portfolio offers a more consistent ecosystem, and the company is much better positioned to capture growth on an international level. Regarding financial strength, PayPal reports an overall more robust profile with a significant positive ROIC and higher actual and projected profitability, while Block is destroying value for its shareholders, confirmed by a negligible and even negative ROIC.

Even though I consider both companies as being attractive in terms of their technologies and potential and will continue to monitor their developments, at this point, I recognize only PYPL as a buy position, categorizing SQ as a relatively higher-risk hold position, as the stock seems to be reasonably priced, but faces essential headwinds and is highly dependent on a positive development in the cryptocurrency market, as well as the successful integration of Afterpay. All elements considered, PayPal offers better opportunities with a lower risk profile while offering great potential in its stock performance when considering all three forecasted scenarios, suggesting it is a great stock pick for long-term-oriented investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned company or underlying, as of the date of publication. Any opinions or estimates are subject to change without notice, and I am under no circumstance obliged to update or correct any information presented in my analyses. I am not acting in an investment adviser capacity, and this article is not financial advice. This article contains independent commentary to be used for informational and educational purposes only. I invite every investor to do their research and due diligence before making an independent investment decision based on their particular investment objectives, financial situation, and risk tolerance. I take no responsibility for your investment decisions but wish you great success.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.