Summary:

- PayPal is one of the last remaining value opportunities in the tech sector.

- The company’s growth is being challenged by competition, but its unbranded processing segment continues to grow very rapidly.

- Management continues to show a strong commitment to profitable growth and share repurchases.

- I expect Braintree to be the main catalyst for a meaningful re-rating higher.

Klaus Vedfelt/DigitalVision via Getty Images

PayPal (NASDAQ:PYPL) has offered investors a prolonged buying opportunity, which seems unusual given that tech stocks on the whole have been spiking without abandon. Management has issued conservative expectations for 2024 with hopes for stronger growth in 2025 and thereafter. The company still has a net cash balance sheet and profitable operations, but the lack of near term catalysts may keep some investors away. Yet with the stock trading at a low double-digit multiple of earnings, I cannot ignore the compelling value, as the low valuation and strong balance sheet have priced in a great deal of pessimism. I reiterate my strong buy rating as I expect the rapidly growing Braintree business to eventually earn a premium multiple from the market.

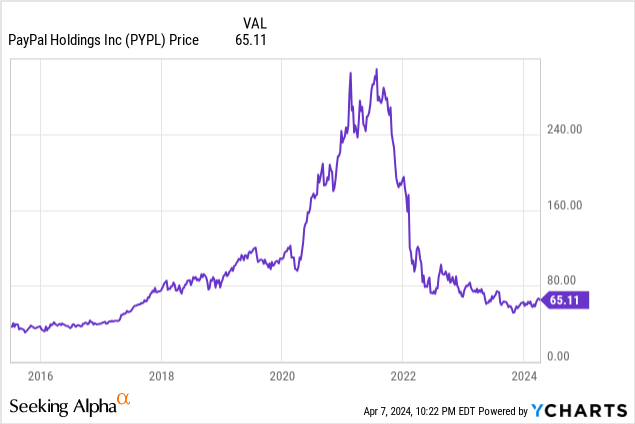

PYPL Stock Price

Nowadays, there aren’t many tech stocks that are trading far from 52-week lows and 2021 highs, but PYPL is one of the few that still trades around 2017 levels.

I last covered PYPL in January where I discussed the company’s disappointing “shock the world” results but rated the stock a strong buy on account of the low valuation. I continue to find shares attractive even if there’s not a lot to be excited about in the near term.

PYPL Stock Key Metrics

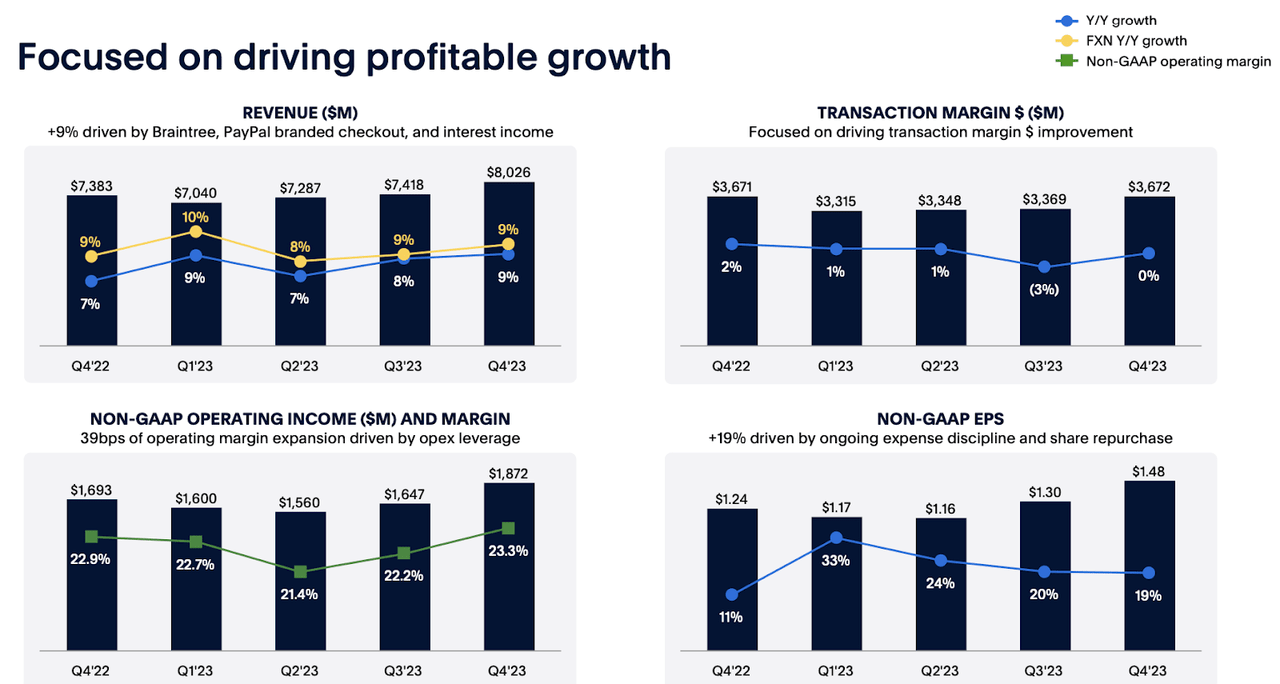

In its most recent quarter, PYPL generated 9% YoY revenue growth to $8.026 billion, exceeding guidance for up to 8% YoY growth. Non-GAAP EPS grew 19% YoY to $1.48, exceeding guidance for $1.36.

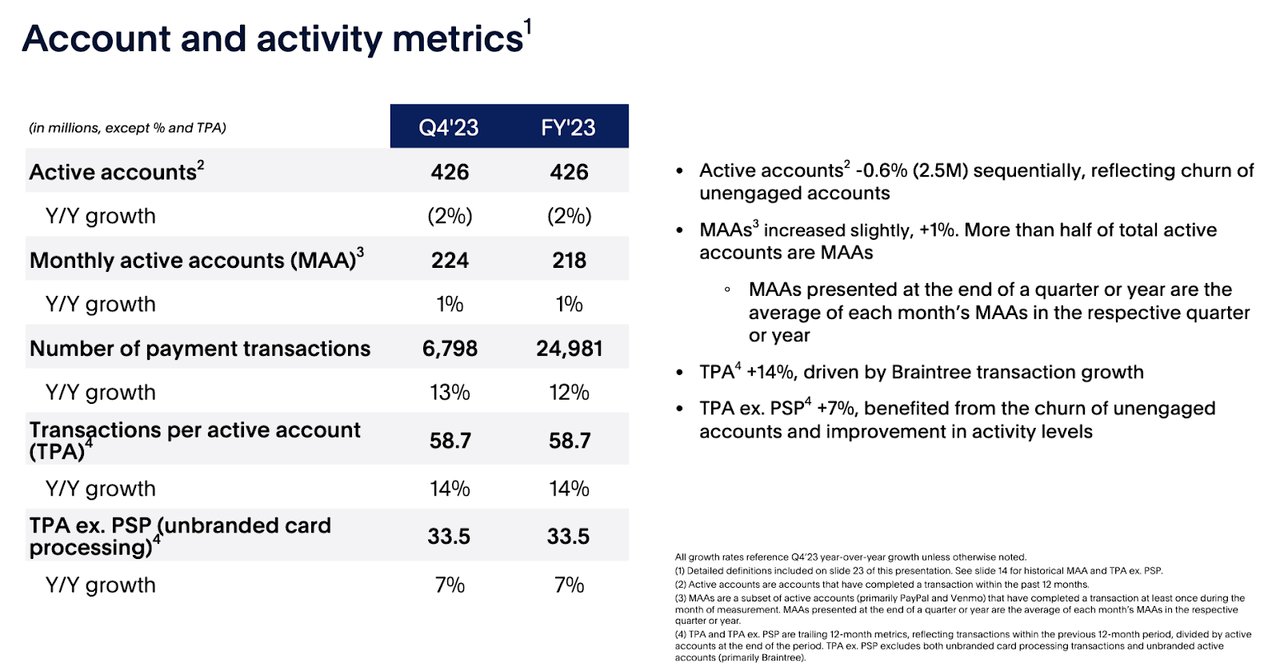

The company has continued to show struggling active accounts growth, with growth coming in at negative 2% YoY. Management blamed the poor growth as being reflective of “churn of unengaged accounts,” but it is hard to dispute the narrative that the company’s first mover advantage in e-commerce checkout is being challenged by formidable competition from the likes of Apple Pay (AAPL) and others.

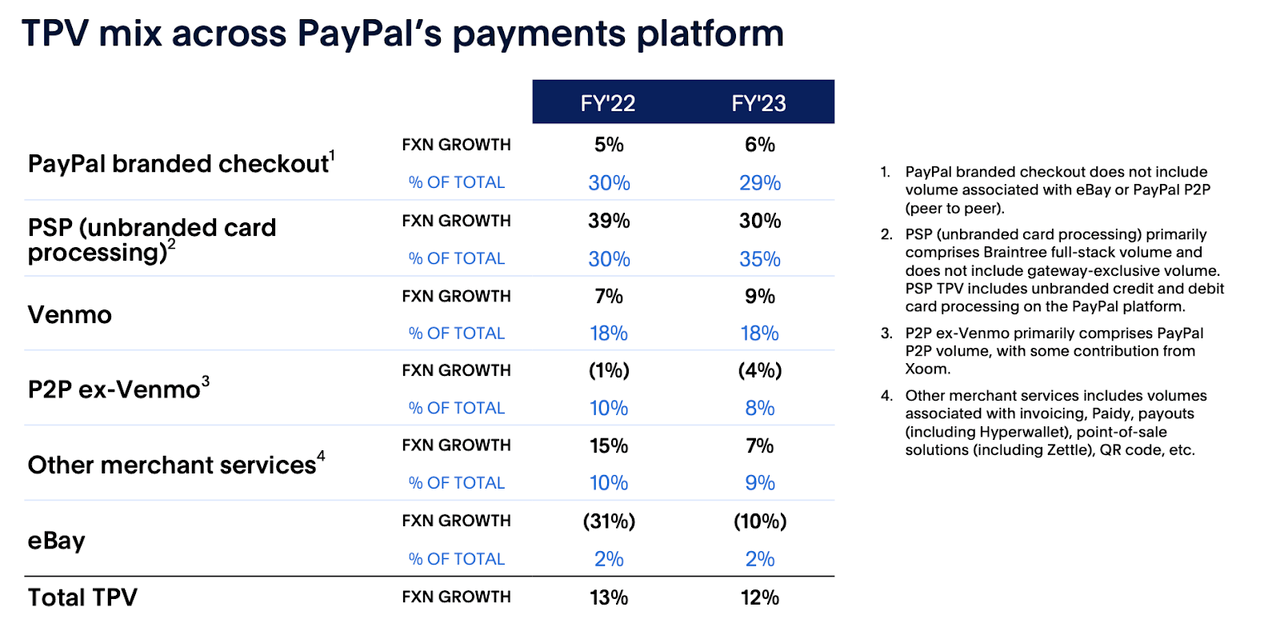

As usual, TPV growth was driven by the company’s unbranded processing segment (known as Braintree), which now makes up 35% of overall TPV.

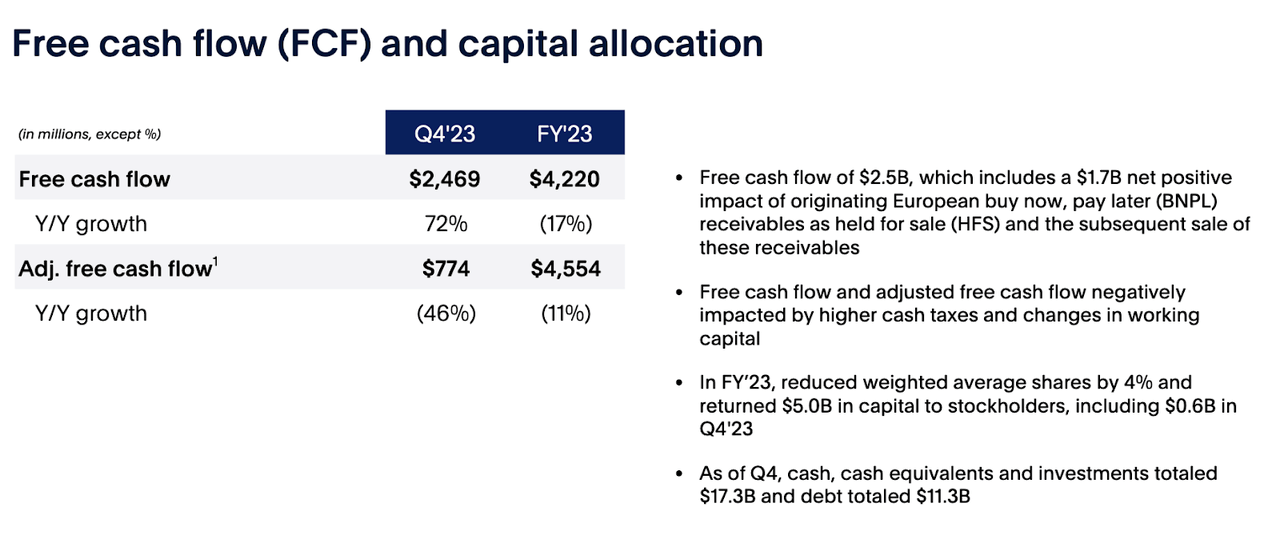

The company generated $2.5 billion in free cash flow in the quarter but that was positively impacted from offloading $1.7 billion of buy now, pay later loan receivables. Adjusted free cash flow was $774 million, a decline of 46% YoY. The company ended the quarter with $6 billion in net cash, representing a bulletproof balance sheet.

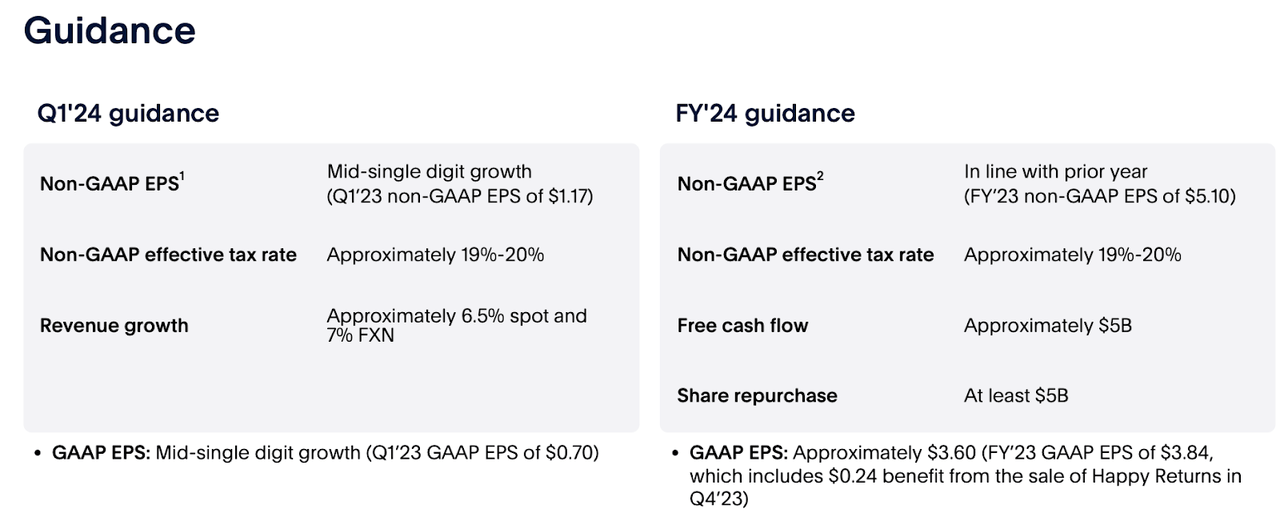

Looking ahead, management has guided for 6.5% YoY revenue growth (versus consensus of 6.8%) and mid-single digit non-GAAP EPS growth (versus 4.3% consensus) in the first quarter. For the full year, management expects non-GAAP EPS to come in at $5.10, or flat year on year.

Management did note that they will begin including stock-based compensation in the calculation of non-GAAP EPS, addressing a typical bearish complaint, but I note that this adjustment is not reflected in the $5.10 2024 guidance nor the $1.17 2024 Q1 guidance as it will only be reflected beginning in the next quarter (I have seen some investment analysis suggest otherwise). Make no mistake – management is guiding for earnings to remain flat on a YoY basis, which implies considerable margin deterioration given the ongoing revenue growth and share repurchase program.

On the conference call, management explained that the decision to begin including equity-based compensation in non-GAAP EPS is aimed to “introduce more accountability and discipline.” Management emphasized that they are “committed to maintaining an investment-grade credit rating” and aim to spend “approximately 70% to 80% of our free cash flow to share buybacks.” That might imply around $3.5 billion to $4 billion in 2024 share repurchases, but management notes that due to their strong cash position, they intend to repurchase at least $5 billion. All things considered, management appears to be saying all the right things, and this is a playbook that has worked for other companies heading into this tech rally – Meta Platforms (META) comes to mind. But when will investors reward PYPL with similar treatment, if ever?

Is PYPL Stock A Buy, Sell, or Hold?

It can be easy to forget, but PYPL is one of the pioneers of enabling e-commerce transactions. While the company is most well-known for its branded checkout and Venmo app, I am instead drawn to the company’s unbranded Braintree product which has been rapidly taking market share.

The company’s rapid growth comes in part due to its aggressive pricing strategies, which may also be pulling down overall profit margins. However, the pessimism appears overblown. PYPL stock traded at just under 13x earnings as of recent trading.

Consensus estimates call for the company to sustain high single-digit top-line growth over the coming years.

While one can make an argument that Adyen (OTCPK:ADYEY) may be a higher quality business due to its stronger overall growth rates, it is really worth 39x 2024e EBITDA when PYPL trades at 9x 2024e EBITDA? That is pricing in nearly 6 years of 30% growth just to narrow the gap, and that is also assuming no growth from PYPL (which seems unlikely).

I continue to see PYPL eventually trading up to 15x to 18x earnings, but the catalyst to drive this re-rating may be elusive. Yes, the company’s commitment to profitable growth and share repurchases may help over the long term, but these are unlikely to spur a near term reaction. Instead, I expect continued growth from unbranded processing to end up being the catalyst. As Braintree becomes a bigger and bigger portion of the business, I expect Wall Street to reward PYPL stock with a higher multiple as it realizes that profitability can continue to improve alongside that growth.

What are the key risks? The company’s branded checkout processing is under heavy competitive pressure, or at least that is what the sentiment dictates. It bears noting that PayPal branded processing TPV grew by 5% YoY, though that might not be as important as the fear of ongoing disruption. The company may need to show stabilizing results in its branded processing and an acceleration in overall top-line growth rates (as a result of continued stellar results from unbranded processing) before a re-rating occurs. That is no easy task, and investors might need to be patient. It is possible that the macro environment worsens, or that branded processing volume growth deteriorates further simply due to competition. It is also possible that unbranded processing growth slows down and the company’s strong growth over the past few years proves transitory. I can see the stock trading between 8x and 12x earnings until the re-rating thesis takes place. I personally am not concerned with volatility given the strong balance sheet and confidence in the long term thesis, but investors hoping for a quick trade might be disappointed.

I reiterate my strong buy rating for the stock as the valuation looks particularly compelling when compared against lofty valuations for tech stocks on the whole.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!