Summary:

- PayPal Holdings, Inc. stock underperformed the S&P 500 by approximately 35% since our latest rating in June 2022. However, we now hold a bullish outlook.

- The company’s core business shows secular growth with increasing total paying accounts and transactions.

- PayPal’s recent sale of an EU loan book and focus on long-term securities enhance its balance sheet and income mix.

- A drift into the Stablecoin business illustrates that PayPal is staying with the times.

- PayPal Holdings, Inc. stock’s relative valuation multiples communicate a potential GARP opportunity.

Justin Sullivan

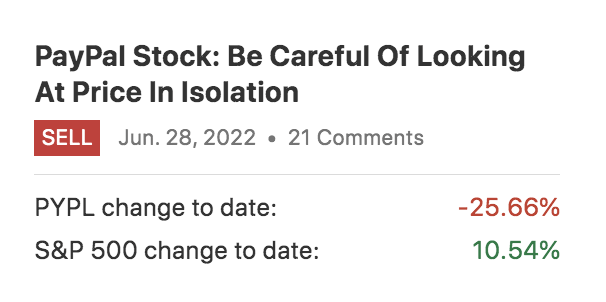

PayPal Holdings, Inc. (NASDAQ:PYPL) is in focus today. We last covered the stock back in June 2022 and received quite a bit of negative feedback on our rating at the time, as most readers believed PayPal stock then was at a cyclical bottom. However, our rating ended up being successful, as PayPal has underperformed the S&P 500 (SP500) by more than 35% ever since.

Pearl Gray’s Historical Ratings (Seeking Alpha)

It is more than a year later, and we have revised the stock’s prospects, establishing a bullish outlook this time.

Let me run you through some of our recent findings on PayPal.

Operational Review

Secular Growth Resumes

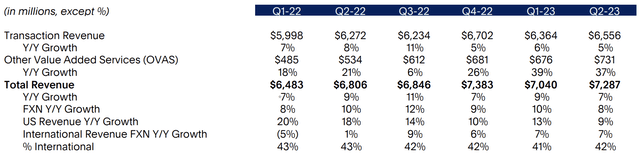

The pandemic’s lockdowns certainly enhanced the scope for digital transactions, which one would naturally say is a tailwind to PayPal. However, significant competition has entered the fray, and a slowdown in consumer confidence during mid-to-late 2022 presented a few stumbling blocks.

Nevertheless, a time-series analysis of PayPal’s payments business illustrates the secular growth embedded in the company’s main segment (other segments covered later in the article).

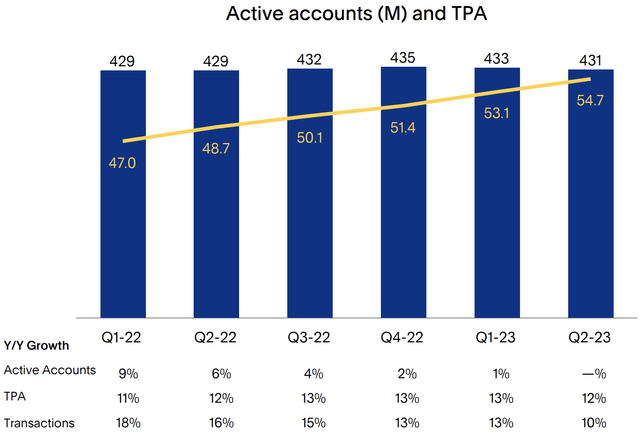

For example, as seen below, total payments per account and transactions drifted up once more in the firm’s latest quarter, adding to a string of double-digital growth quarters. Sure, total accounts experienced negative growth in the last quarter; however, we believe the total accounts line item provides a poor indicator of growth, as ghost accounts and unproductive consumers can cause the item to fluctuate. As such, the total payment by accounts and transactions are what we think are worth noting.

Unmentioned in the analysis above is the contribution that buy now, pay later has on PayPal’s primary revenue and parts of its OVAS revenue. The service allows for enhanced transaction volume as it eases capital requirements on transactions by providing leverage to its customers. Moreover, BNPL generates exorbitant interest on its credit, allowing for secondary income for PayPal. Of course, such interest rates enhance risk; however, PayPal offsets this with long-dated investments in low-risk securities and sales of its receivables (discussed later).

Notice The Growth In Other Services Revenue (PayPal)

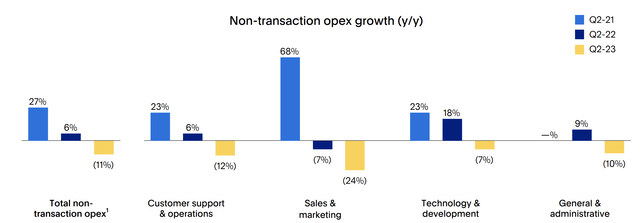

Furthermore, PayPal’s operating expenses have dropped in the past two years. However, there are a few matters to dissect.

Firstly, we think it’s good that general and customer support expenses dropped as it shows that the labor force holds less strength than it did during the pandemic stimulus, naturally reducing the firm’s cost base.

Yet, two straight years of receding spending on R&D and marketing is problematic as it suggests the company is hedging economic risk by cutting back on key business development expenses. Although lower innovation and marketing spending alone may not lead to slower growth, they certainly communicate a passive outlook from PayPal’s management.

Sale of EU Loans Portfolio

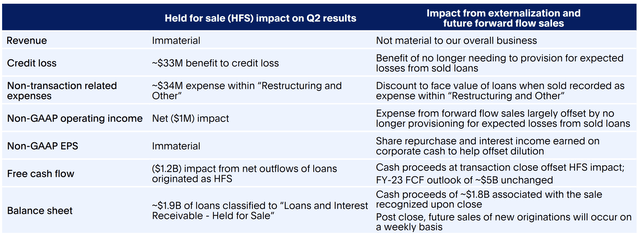

In its second quarter, PayPal decided to offload a $1.9 billion receivables portfolio for $1.8 billion to KKR (KKR). As far as my knowledge extends, PayPal had to record a $100 million loss on the transaction; however, it is considered non-core, and the general transaction has certain benefits.

I believe the transaction is favorable for a few reasons. Firstly, high-yielding consumer debt is risky in the EU at the moment due to the economic turbulence in the region. As such, backing out of the region might be a clever move. Moreover, the capital enhances PayPal’s balance sheet by a capital injection while lowering its provisions requirements to bolster its income statement’s prospects.

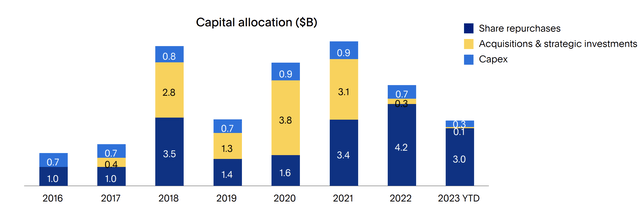

Lastly, most of the proceeds are set to be used for stock repurchases as PayPal continues its trend of shareholder compensation. The diagram below illustrates how PayPal’s shareholder compensation has grown in the last few years, implying increasing residual value is in store.

Balance Sheet Assessment

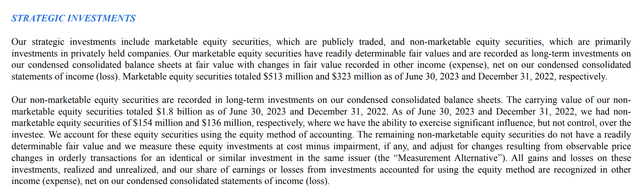

I mentioned earlier that PayPal is offsetting some of its high-yield debt risk from Buy Now, Pay Later (“BNPL”) by investing in long-term held-for-sale and held-to-maturity securities. As illustrated by its most recent management commentary, PayPal’s strategic portfolio has enhanced its focus on such securities, which we believe will act to enhance the firm’s balance sheet and income mix.

Note: For more details on PayPal’s balance sheet composition, visit this link.

PayPal’s Stablecoin – Staying With The Trend

PayPal has decided to enhance its footprint in modernized Fintech with a stablecoin offering named PayPal USD. The aim is to peg the coin to the U.S. Dollar while backing it with deposits, U.S. treasuries, and short-term notes.

In our view, the adoption of the coin is largely due to a generational shift, which could see the phenomenon grow in the coming years. Although the adoption of PayPal’s stablecoin remains uncertain, it does not hurt to stay with the times, especially if you’re a liquid business with the latitude to trial and error concepts.

In essence, we think the outcome of this bet is positively skewed.

Relative Valuation Metrics

A glance at PayPal’s price multiples communicates GARP (growth at a reasonable price).

For starters, most of PayPal’s salient multiples trade at discounts relative to their five-year averages, suggesting that value is in store if mean-reversion pans out.

Two standout metrics are the EV/EBITDA and PEG ratios. The prior is critical to look at when assessing a technology firm as it phases out subjective depreciation and amortization policies, whereas the latter measures for GARP by scaling earnings growth in the P/E ratio. Both metrics are on solid ground, suggesting value is up for grabs.

Lastly, a cash-based price multiple in the P/CF ratio suggests the previously mentioned valuation multiples aren’t misled by accrual accounting and that PayPal’s cash-based valuation is just as sound.

| Metric | Value | 5-y Discount |

| Forward EV/EBITDA | 7.95 | 68.42% |

| Forward PEG | 0.77 | 59.07% |

| Forward Price-to-Cash Flow | 9.74 | 63.06% |

Source: Seeking Alpha.

Risks

I mentioned a few risks throughout the article but wanted to outline additional headwinds in a discreet section to balance the analysis.

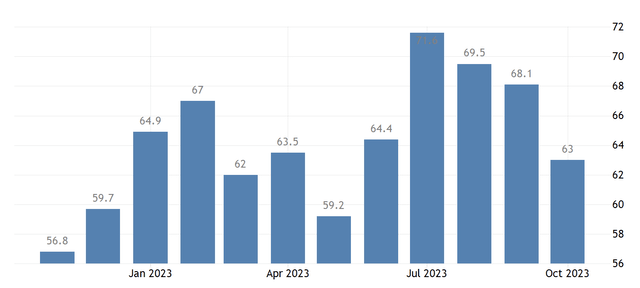

A notable risk to PayPal is the waning consumer sentiment in the U.S., which could come into play soon as transaction volume may take a hit. Moreover, the disinflationary environment could cause nominal transaction value to take a hit, ultimately sending the company’s progress into arrears for the time being.

U.S. Consumer Sentiment (Trading Economics, University of Michigan )

A second risk factor that I would like to point out is very qualitative and subjective, yet I believe it holds validity. The risk factor relates to industry competition, which is heating up by the day as the digital payments industry is gathering momentum.

Sure, PayPal is established in the market, which would naturally lead to earnings growth if intertwined with the industry’s growth. Nevertheless, 17.4% industry CAGR is luring innovation, meaning R&D spending will be high, leading to a rise in competing solutions.

Final Word

Our analysis shows that PayPal’s prolonged selloff has likely opened up a value gap, as the stock’s valuation metrics are met with a company possessing secular growth attributes.

Although a drawdown in stock price doesn’t necessarily translate into a value opportunity, our fundamental overview of PayPal Holdings, Inc. stock and recent market behavior tells us that value is in store.

Consensus: Upgraded to Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Ad copy.