Summary:

- The new calendar year will be a major transition year for PayPal, characterized by the company’s new management team seeking to earn street credibility.

- In 2024, I expect management to address a contracting user base while pushing for growth outside the company’s core ecommerce payment business.

- Analysts project an 8.6% YoY increase in PayPal’s sales and a 12.5% YoY jump in earnings per share for 2024, which I see as reasonable.

- I project that 10x EPS should be the lower end of the possible trading spectrum, meaning that the opportunity skew for PYPL should be on the upside.

chameleonseye

2023 was a very disappointing year for PayPal (NASDAQ:PYPL) investors, with PYPL shares down 18% for the year, compared to a gain of 25% for the S&P 500 (SP500), while the tech-heavy Nasdaq 100 (QQQ) returned about 50%.

Following such a grotesque underperformance, equity holders are hopeful that the new year 2024 will bring a shift in fortunes. While I share investor’s frustration on PayPal underperformance in 2023, I try to look with a neutral, commercial lens towards 2024. On that note, I doubt that the new year will bring a major bull run in PYPL shares.

As I see it, 2024 will be a major transition year for PayPal, characterized by the company’s new management team seeking to earn street credibility while turning around negative momentum in growth deceleration and transaction margins. That said, I doubt that market participants will have confidence to push PayPal’s stock price multiple meaningfully beyond 10-12x earnings. At the same time, however, I am also quite confident to project that 10x earnings should be the lower end of the possible trading spectrum, meaning that the opportunity skew should be on the upside rather than the downside. “Buy”.

For context, I have last covered PayPal stock in October, discussing the company’s Q3 outlook and assigning a “Buy” rating. Since my last writing, PYPL shares are up 18%. While my last article was very short-term oriented, in this article I take a more structural view on PayPal’s 2024 outlook.

What I Expect In 2024

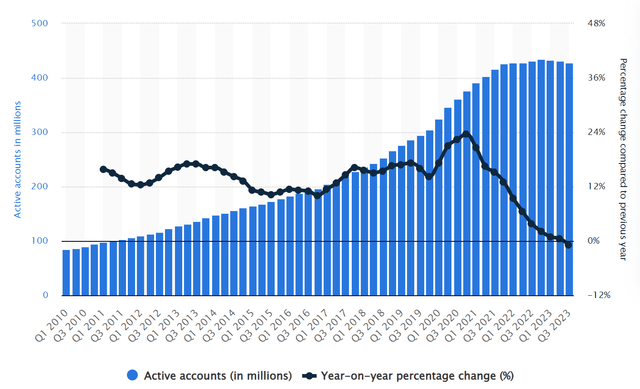

In Q3 2023, PayPal has been taken over by a new management team, specifically a new CEO (Alex Chriss) and a new CFO (Jamie Miller). On that note, there is quite a lot to do for the new leaders heading into 2024: New management is advised to urgently address the root cause of negative momentum in core fundamentals, most notably active users. In fact, I point out that in 2023, PayPal’s active user base consistently decreased QoQ: from late 2022 through Q3 2023, PayPal’s active user base has fallen by 4 million users, to 428 million (Q3 2023). On that note, PayPal’s (old) management team may need to take (partial) ownership for the contracting user base, as the company made headlines on a controversial policy update that reportedly aimed at restricting customers from utilizing its services for activities that promote misinformation. In that context, PayPal reportedly planned fining customers $2,500 for each violation. In my opinion, working to restore customer trust should be the first priority for the new management team in 2024.

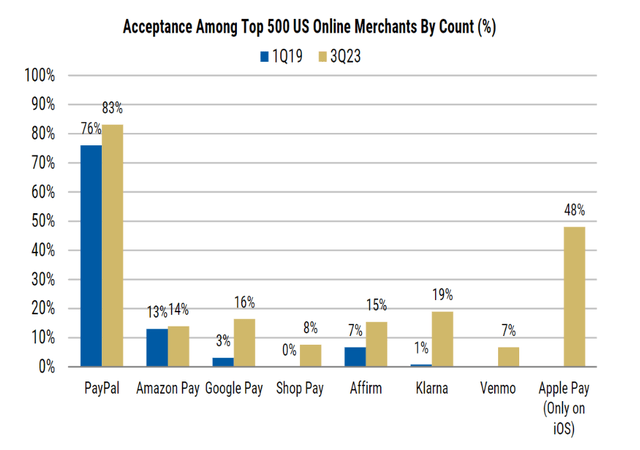

In regions where PayPal has been operating for an extended period, such as the United States and parts of Europe, PayPal’s penetration rates are very high; with 83% among top 500 U.S. online merchants arguably close to full penetration, as modelled by Morgan Stanley research (Source: Morgan Stanley, research note on PayPal, dated 15th December). In fact, many online businesses and consumers already use PayPal as a preferred payment method and there might be only minor pockets for expansion. In addition, I point out that competition in the digital payment landscape is accelerating, and new logo wins would likely be very expensive for PayPal.

In line with my view that there is little growth whitespace in PayPal’s core market, I argue that the new management team in 2024 will likely double-down investments in alternative ventures such as “Buy Now, Pay Later”, as well as Crypto. Unbanded checkout (Braintree) could be another opportunity for growth. Notably, PayPal’s unbranded checkout business, has seen rapid growth in 2023, with revenues increasing about 30% YoY as of Q3 2023. But despite the strong growth, Braintree’s market share in eCommerce is estimated at about 10% only, suggesting that there is still material topline upside for Braintree. Presently, the growth of Braintree is adversely affecting the group’s transaction margins, with unbranded checkout being margin dilutive vs. branded checkout. On that note, it will be interesting to see how management balances the likely trade-off between capturing market share/ growth and increasing Braintree’s take rate on transactions. Although Alex Chriss has previously suggested that increasing take rates for Braintree in 2024 may be possible, I personally would like to see management pushing for growth, rather than profitability–as long as the segment is expanding at >15% YoY.

Analysts’ 2024 Projections Point To Growth

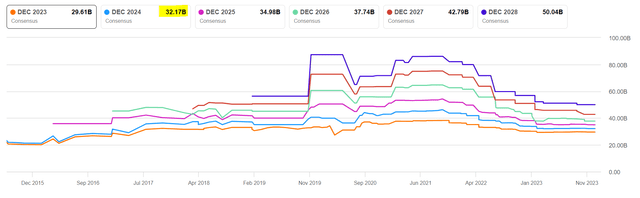

Based on data collected by Seeking Alpha as of December 31st, 48 analysts have provided their projections for PayPal’s FY 2024 fundamentals. The estimates for sales span from $31.3 billion to $33.3 billion, with the consensus at $32.17 billion. Taking the consensus as the reference point, it is suggested that PayPal’s topline in 2024 may expand by 8.6% YoY.

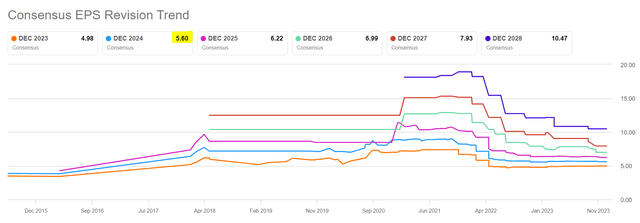

With regard to profitability, the anticipated earnings per share for PayPal fall between $5.26 and $6.13, with consensus at $5.6. Again anchored on consensus, analysts project a 12.5% YoY jump in EPS, which would indicate a 11x based on 2023 closing price.

Examining these revenue and earnings projections, it’s notable that PayPal’s 2024 estimates have shown stability since the close of the June quarter 2022. This shift could signal a broad de-risking of sentiment in the market, which I expect to continue into 2024.

Personally, I think that consensus expectations for PayPal in 2024 may be somewhat optimistic, but still reasonable. In my opinion, quite a significant driver of PayPal’s revenue and earnings growth will anchor on macro, specifically the broader volume of e-commerce activity. On that note, I am encouraged to see economists cutting their inflation estimates, while increasing their GDP projections. Similarly, monetary policy in 2024 may trend to be accommodative for consumption, with the FOMC projecting 3 rate cuts by end of year.

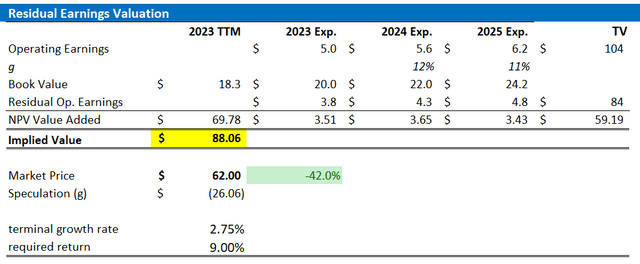

Adjust Target Price To $88

In line with updated analyst consensus EPS estimates for PayPal through 2025, I adjust my residual earnings model for the company’s stock: For 2024, I now estimate that PYPL’s EPS will likely fall within the range of between $5.4 and 5.8 (non-GAAP), in line with consensus. For FY 2025, I set my EPS expectation at $6.2. Lastly, I while I maintain my terminal growth rate input at 2.75%, I reduce my cost of equity assumption by 50 basis points, to 9.0%. The lower cost of equity is mostly a reflection of the 2024 pending rate cuts that reduce the opportunity costs for holding equity assets.

On the backdrop of the adjustments highlighted above, I now calculate a fair implied stock price for PYPL stock equal to $88.06, suggesting about 42% upside based on fundamentals.

Analyst Consensus; Company Financials; Author’s Calculations

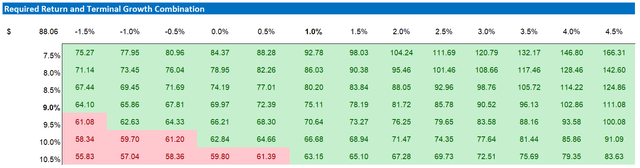

Below also the sensitivity table, which tests different assumptions for cost of equity (row) as well as terminal growth rate (column).

Analyst Consensus; Company Financials; Author’s Calculations

Investor Takeaway

From my perspective, 2024 appears to be a pivotal transition period for PayPal. The company’s new management must rebuild both investor as well as customer confidence, amid challenges in growth deceleration and transaction margins. On fundamentals, I cautiously agree with analyst projections that an 8.6% YoY increase in sales and a 12.5% YoY jump in earnings could be reasonable, if the macro backdrop is supportive. Concluding, I am reasonably confident in projecting that 10x earnings should mark the lower boundary of potential trading, suggesting a more favorable upside opportunity than downside risk. This argument leans towards recommending a “Buy” stance on PYPL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.