Summary:

- Usually, Wall Street and Main Street do not agree.

- However, in the case of PayPal Holdings under current conditions, both Wall Street and Main Street recommend Buy.

- I will explain why I agree, too.

- In my view, the usual metrics such as Return on Equity underestimate its profitability and can mislead investors about PayPal Holdings’ compounding potential.

BobHemphill

Thesis

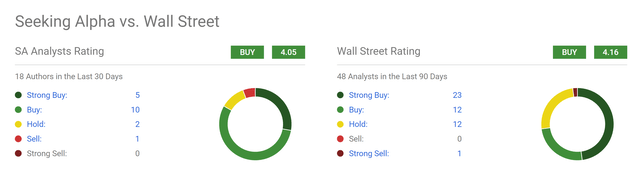

Wall Street’s opinion on stocks often differs from individual investors’ assessment for a range of reasons, including investment objectives, time horizon, and also risk tolerance. PayPal Holdings, Inc. (NASDAQ:PYPL), under current conditions, is an unusual case where Main Street and Wall Street agree, as seen in the chart below. As a popular stock among individual investors, a total of 18 authors on Seeking Alpha have written about PYPL In the last 30 days. And only one of them recommended selling. On the Wall Street side, a total of 44 analysts rated the stock. And only one Wall Street analyst recommended selling.

In the remainder of this article, I will explain why I agree with the above recommendations, too. In particular, I will elaborate on its compounding potential and explain why the usual metrics such as Return on Equity represent a substantial underestimate. As a result, it represents a good example of a high-powered compounder at a reasonable price.

Wall Street holds it at ~14.6x FW P/E

To get a more quantitative assessment of the “streets,” the following chart shows the top super investors who are holding PYPL. I view these large money managers, when viewed as a group, to be a good approximation of the prevailing Wall Street opinion. Of course, a few of them make/made their money by betting against Wall Street. But these are the exceptions, not the rules.

As seen in the following chart provided by Dataroma, several super investors have a significant stake in PYPL. In the past reporting period, 3 of them reduced their PYPL holdings slightly (between 0.58% and 3.91%). While the rest of them added and some additions are substantial. One dramatically increased their exposure by 40 and another super investor (Lee Ainslie) initiated a new position.

All told, PYPL ranks as the 54th highest holding among all the super investors. And quite a few of them are making concentrated bets on the stock. For instance, Both Pat Dorsey and Lindsell Train allocated more than 7% of their portfolio to PYPL.

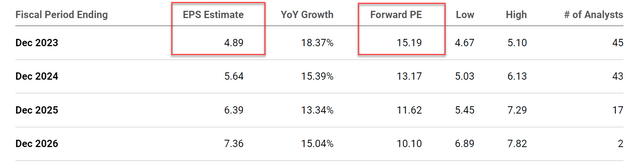

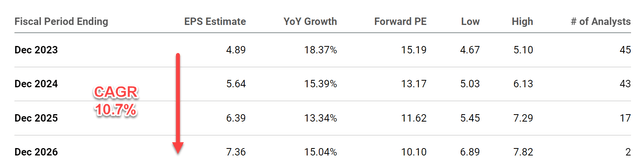

You can also see from the chart below that these super investors are holding PYPL at an average price of $71.6. Analyst forecasts project its FY1 EPS to be in the range of $4.67 to $5.1 (see the next chart below) with a midpoint of $4.89. In other words, based on the company guidance, the super investors are holding the stock at a P/E of ~14.6x.

Next, I will run a simple reality check to show that such a holding P/E provides a skewed return-risk profile.

Skewed return profile

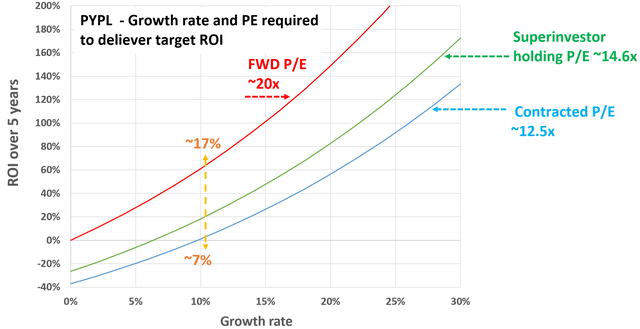

The chart presented next is my simple reality check for any investment decision I make. This chart shows the required growth rate and terminal P/E to achieve a target annualized return on investment (“ROI”) over five years. Two terminal P/E multiples were considered here: 20x (the red line, which is its FWD P/E based on its market price as of this writing) and 12.5x (the blue line, which is about 10x pretax earnings is what I would be willing to pay for a permanently stagnating business). The super investors’ holding P/E 14.6x is shown by the green line.

If a P/E contraction occurs to 12.5x and the growth becomes zero, the total loss in five years would be about 15% at a holding P/E of 14.6x, translating into an annual loss of about 3%. While on the other hand, analyst forecasts project an annual growth rate of 10.7% in the next few years (see the next chart). At this rate, the projected return would be about ~17% per annum in the case of a P/E expansion to 20x and about 7% in the case of a P/E contraction to 12.5x.

This obviously is quite an asymmetric return profile IF the company can grow at a reasonable pace. And next, I will argue there are good reasons to believe that its EPS can indeed grow at double-digits and consensus estimates of 10.7% might be on the conservative side.

ROE and ROIC underestimate its compounding power

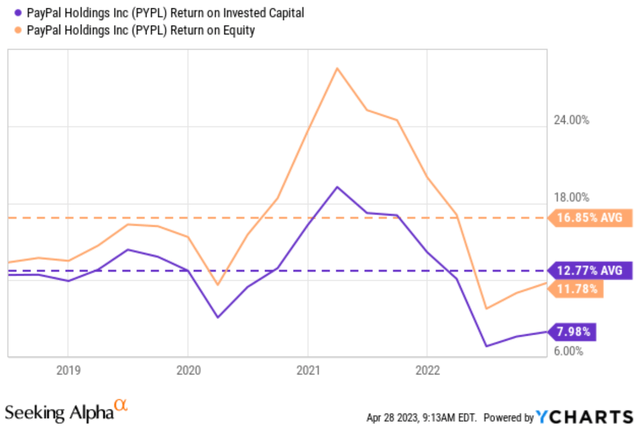

A good reason for its recent price collapse and valuation contraction may be the decline of its return on equity (“ROE”) and returns on capital invested (“ROIC”) as shown below. As seen, its ROE and ROIC peaked at approximately 27% and 19%, respectively, in 2021 (and its stock prices touched $300 at the same time). Then things began to nosedive.

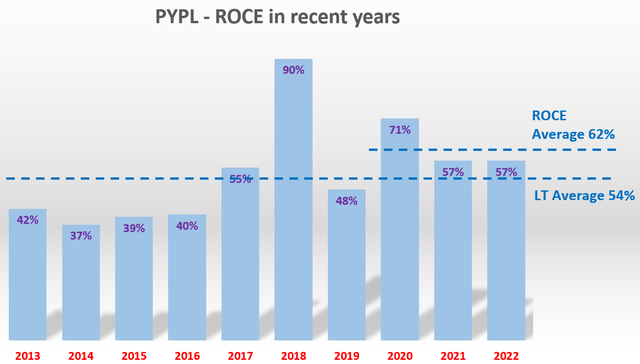

However, in my opinion, ROE and ROIC can be misleading indicators in many cases (see my blog article for more details). And PYPL is such an example. In such instances, ROCE (return on capital employed) is a more insightful indicator. And the second chart below shows that PYPL has maintained a stable and robust ROCE over the years. Its ROCE in recent years is in line with its longer-term average of around 54%.

A ROCE of 54% means that the company only needs to maintain a reinvestment rate (“RR”) of less than 20% to achieve a growth rate of 10% sustainably.

And next, I will explain why I see it as not a problem at all for PYPL to maintain such a RR.

Seeking Alpha Author based on Seeking Alpha data

PayPal Holdings, Inc.’s reinvestment rate

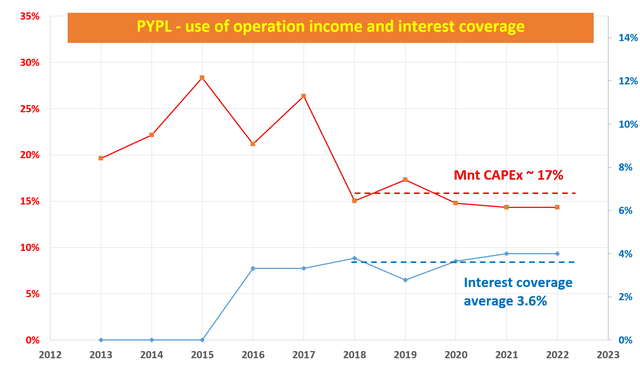

To understand its reinvestment rate, the next chart delves into its capital allocation details in recent years. And my overall conclusion is that PayPal’s management enjoys an enviable degree of flexibility in their capital allocation decisions. The company generates an ample amount of cash from its organic operations, while its business model is very capital-light.

To wit, PYPL is virtually debt-free. It only takes about 3.6% of its EBIT earnings to service its debt on average in recent years. The company only needs an average of 17% of its operating cash flow (“OCF”) to cover its maintenance capital expenditures. PYPL does not pay dividends. As a result, about 80% of its OCF can be utilized at management’s discretion, and thus maintaining a 20% RR is not a problem at all in the way I see it.

Of course, growth requires two key ingredients, and having the money to reinvest is only of them. The other required ingredient is that there need to be high-margin areas to keep expanding into. And I see plenty of opportunities on this front too. PayPal has several promising growth avenues both in the immediate term and long term. Near-term opportunities include the expansion of its Venmo, Tap to Pay functionality, cryptocurrency offerings, and collaborations with Apple to bolster offerings. In the longer term, it is well-positioned to capture additional market share in the global payment processing arena. As consumers increasingly shift to online shopping, PayPal’s payment processing services would only become more valuable. PayPal’s payment services have plenty of potential and space to expand geographically too, particularly in emerging markets in Asia and Latin America.

Author based on Seeking Alpha data

Risks and final thoughts

PayPal Holdings, Inc. faces risks, too, both in terms of macroeconomic risks and also risks specific to its business. The consensus estimates and my model above both assume a stable macroeconomic backdrop, not only in the U.S. but also globally to support its global transaction volume expansion. Within its specific space, increased competition in payment services could prove challenging. PayPal faces challenges from both traditional banks and new digital players in the financial industry. Traditional banks, such as Bank of America and Chase, are beginning to express interest in the digital wallet niche, largely as a means to maintain customer relationships, as well as potentially combat cyber fraud. From new digital players, PayPal faces competition in the areas of mobile payments and peer-to-peer payment services. Digital payment services such as Square Cash have gained popularity, especially among younger generations, and are challenging PayPal’s dominance in the space.

To conclude, I think these risks have already been more than compensated for given PayPal Holdings, Inc.’s current valuation. At an FWD of about 15x (or below like the super investors’ average holding P/E), I see a very asymmetric return profile for PayPal Holdings, Inc., with a large upside but limited downside. No wonder both Wall Street and Main Street love it under these conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.