Summary:

- PayPal has been underperforming, but has potential for long-term success.

- Braintree and unbranded solutions show growth potential.

- Margin expansion, emerging markets, and strong financial position indicate potential for turnaround.

- I remain invested and believe over the next couple of years, the shareholder value will be unlocked.

JasonDoiy

Introduction

PayPal (NASDAQ:PYPL) has been beaten down for the last few years, and many investors have lost hope and expressed concerns about its growth trajectory. I still believe the company is positioned very well for long-term success. These are the reasons that are keeping me invested in the company that I believe will unlock significant value for shareholders over the next few years if the management succeeds, which may be a big if, but I am willing to wait it out.

Since the last time I covered the company, its share price continued to underperform the broader market. However, it is not surprising to me because investors are waiting for proof that the company can turn itself around, and we all know 2024 is a transition year, which means I am not expecting any huge improvements yet, but at least plans of improvements to be set.

Reason 1: Braintree Growth and Other Unbranded Solutions

I believe Braintree along with the rest of the unbranded solutions will continue to perform very well over the next while. In the most recent quarter, the unbranded solutions segment saw a 26% growth, thanks mostly to Braintree, which has been on a tear recently. The management is making all the right moves when it comes to these products. PYPL is undercutting the competition in order to drive growth and take market share, at a real cost of reduced margins of course, but I think this is going to be a “short-term pain for long-term gain” type of situation. The new CEO Alex Chriss back in March told us that it was necessary to price Braintree aggressively so that it could gain customers, which seems to be working when we look at the growth it has exhibited over the last while. Now, the market share is nowhere near that of companies that are well-established like Stripe, but that only means there is a lot more opportunity to win if the product is of value, which it is, in my opinion. In the following quarters, I would like to hear more ways that the company can accelerate the growth of these unbranded solutions, or at least the growth we are seeing right now to persist.

Reason 2: Margin Expansion is on the Horizon

I briefly mentioned in the first reason, that in order to gain market share, the company had to underprice the competition, which led to lower margins overall. I believe once the company starts to increase prices when they are satisfied with the numbers, I expect margin improvements to follow. This is still quite a ways away, but in the long run, margin expansion is almost certain. The new CEO took the helm very recently, and he said many times that 2024 is a transition year, a turnaround year, so I am expecting nothing too exciting to change right now, but I wouldn’t be surprised to hear of more operational efficiencies to pop up. Streamlining operations is of priority to Alex Chriss, and I am all for it. While the company’s core business, or the branded side of business, brings it the highest profitability, I believe the unbranded solutions will play the largest role in increasing operational efficiency over the years. The company is slowly but surely starting to shift from pricing to win to pricing to value, which essentially means the company has a product that is of a high value to customers, and now that there are many customers on platforms like Braintree, or the tested Fastlane product, the company is looking to increase pricing because it is offering a superior product. Fastlane has been a success at converting customers and reducing times during checkout, which is a high-value proposition. Therefore, once the company strategically increases pricing, margins will see an improvement too.

Reason 3: Emerging Markets Present a Huge Opportunity

Countries like Mexico, Brazil, Argentina, and Colombia traditionally have been using cash more than any other form of payment. In recent years, this has started to shift now, which could present a large opportunity for PYPL and could revive what I would call a stagnant total active user pool, which saw just a 2% growth recently. The share of cash in total transaction value has been steadily falling in the LatAm region, and given that SMEs are the backbone of Latin America (90% to 95% of all business in the region), and Alex Chriss’ deep experience within this area, should be no-brainer to put some more effort in expanding and improving access to what PayPal can offer these entrepreneurs. The more countries encourage their citizens to transition to more digital payment solutions, the higher the account base PYPL will be able to attain, as long as it can adapt these solutions to this specific region. Governments like Mexico are encouraging their youth to use less cash and more digital payments. Gen Zs are more tech-savvy and with such a population growing up, cash usage should be going down considerably over the next decade.

Reason 4: Financial Position is Great

As of Q1 ’24, which was filed on April 30th, the company had around $14.3B in cash and short-term investments, against around $9B in long-term debt. Many investors don’t like when companies take on leverage, but if it’s manageable, it’s a great way of improving operations overall. Is the debt pile worrisome in PYPL’s case? It is not. For the quarter, the company paid $86m in interest expense, while receiving $166m in interest income from ST investments, which means that alone covers the annual interest expense on debt. PYPL’s EBIT covers interest expense 13 times, which means the debt is not an issue, coupled with the massive cash pile, PYPL has plenty of dry powder to continue its way to a successful turnaround.

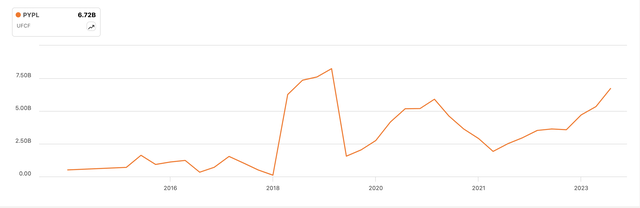

Furthermore, the company’s unlevered free cash flow has been on a tear since 2021 and isn’t showing any signs of stopping.

In short, the company has many ways it can turn itself around, like the ones mentioned above, the company’s financial position is very strong, and it has been known that 2024 will be a transition year, so I am curious to see how well the strategy of turning around will play out over the next couple of years, but I remain hopeful.

Valuation

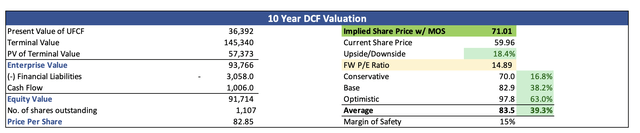

So, with what I think are high potential reasons for the company to see overall improvements in profitability, I went ahead and updated my valuation model to reflect some margin improvements over the next decade, which I still think are on the more conservative end.

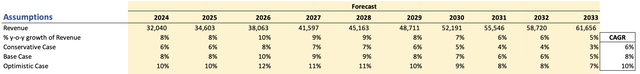

For revenues, the company managed to grow at around 14% in the last 5 years, and around 8% in the last 3. I think the company will easily continue to grow at around 8% and will see its top line doubling by FY33. Analysts seem to agree with that sentiment too, although my end number is slightly on the more conservative end than analysts’, which only bodes well for my conservatism.

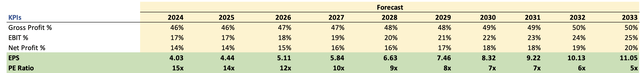

For margins, given the possibilities of operational improvements continuing since the new CEO is prioritizing streamlining of operations, the company’s products will shift towards value rather than winning more customers in the long run, I can see the company’s gross and EBIT margins improving around 400bps over the next decade, which I also think is on a conservative end. Analysts are much more aggressive on improvements, while my model achieves around 11% EPS growth on average.

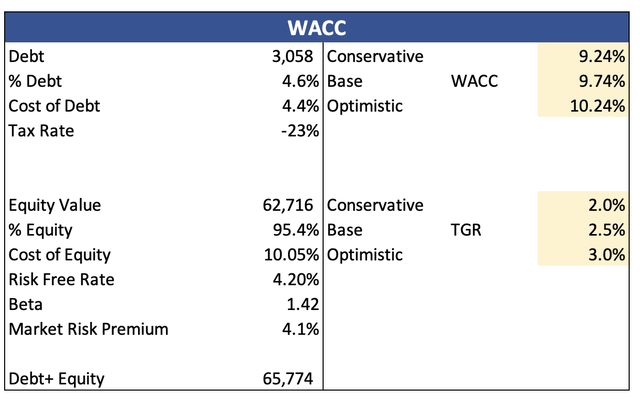

For the DCF model, I went with the company’s WACC of around 9.7% as my discount rate, and 2.5% as my terminal growth rate because I would like it to at least match the US long-term inflation goal.

Additionally, I added another 15% discount to the final intrinsic value, to give myself more room for error in the estimates above. With that said, PYPL’s intrinsic value is around $71 a share, which means it is trading below its fair value.

Risks And Investor Takeaway

So, the model depends on the company achieving higher profitability and maintaining decent top-line growth. I think the model isn’t very aggressive in those assumptions, but if the reasons above do not improve operational efficiency over the next couple of years, then PYPL will not see a share price surge any time soon.

The new CEO is working hard at trying to improve the company, but that may come with costly errors that may end up wasting its resources, which will continue to provide a negative sentiment that already surrounds the company, and share price tumbles further.

A substantial decrease in the growth of its unbranded products while stagnating the performance of its branded ones will not be enough to propel the company further, and the turnaround will be much harder to achieve, at least delayed by many years, thus adding more negative sentiment. If the value proposition is not good enough to attract more customers, I expect further share price declines in the next while.

Nevertheless, I think even with these challenges ahead for the company, focus on unbranded solutions, margin improvement strategies, and expansion in emerging markets does paint a very positive picture of where the company may end up over the next couple of years. The company’s strong financial position provides it with a solid foundation for growth, while the updated DCF valuation shows the company’s undervaluation currently, I believe the potential outweighs the risks. The next year or two will be crucial for PYPL, which needs to prove to a lot of investors that it can turn around. The newly appointed CEO has his work cut out for him.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.