Summary:

- PayPal reported solid second quarter results, but the bearish arguments surrounding PayPal remain.

- However, in my opinion, neither the business model is broken nor the lower growth rates are a problem for PayPal.

- On the other hand, Apple as competitor should be watched closely, and the looming recession could be a problem in the coming quarters.

- Nevertheless, PayPal remains deeply undervalued and clearly is a “Buy”.

olm26250

PayPal Holdings, Inc. (NASDAQ:PYPL) is remaining an interesting company and an interesting stock. In my last article I wrote that I am still waiting for sentiment to improve and since my last article was published the stock did not really move (it improved about 3% at the time of writing). I am personally getting more and more convinced that PayPal found its bottom, but it still seems like the stock can’t really move higher as investor sentiment is still too bearish.

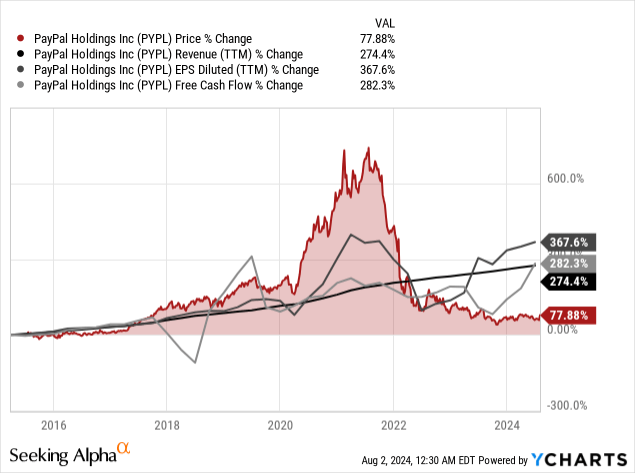

But in case of PayPal, it is getting harder and harder to justify the current stock price from a fundamental point of view. When looking at the chart above, we can see that the stock price probably exaggerated in 2020 and especially in 2021, and a $300 price target for PayPal could not be justified by fundamental numbers. But now the picture is completely reversed, and, in my opinion, it seems almost impossible to justify the current low stock price from a fundamental point of view. Revenue, earnings per share and free cash flow exceeded the stock price performance clearly.

I remain extremely bullish about PayPal (and it remains one of the larger positions in my portfolio), but in the following article I will look especially at the arguments the bears are making, and we will try to find out if these arguments make any sense.

Business Model Broken

One argument we sometimes read, and which would be a strong argument if true, is that PayPal’s business model is broken. In my opinion, the argument is based on the fact that PayPal’s growth rates slowed down in the last few years. And of course, PayPal is not able to report similar growth rates as a few years ago when revenue increased almost 20% annually. Nevertheless, I don’t see signs for a broken business model – only a company which is not growing with a similar high pace as before but is still able to report solid results.

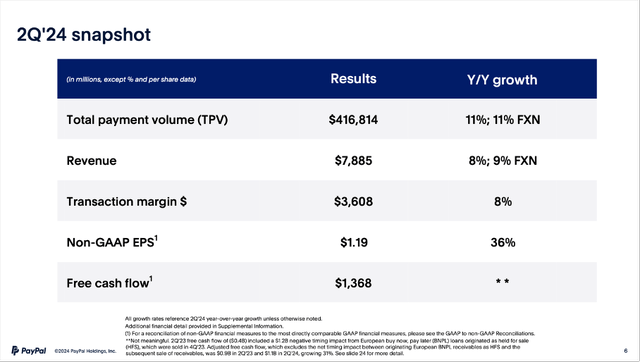

When looking at second quarter results, PayPal not only beat estimates for revenue as well as earnings per share, but the company also increased its top- and bottom-line year over year. Net revenue increased from $7,287 million in Q2/23 to $7,885 million in Q2/24 – resulting in 8.2% year-over-year growth. Operating income increased from $1,133 million in the same quarter last year to $1,325 million in this quarter – resulting in 16.9% year-over-year growth. And finally, diluted net income per share increased 17.4% year-over-year from $0.92 in the same quarter last year to $1.08 in Q2/24. And finally, adjusted free cash flow increased from $869 million in the same quarter last year to $1,140 million this quarter – resulting in 31.2% year-over-year growth.

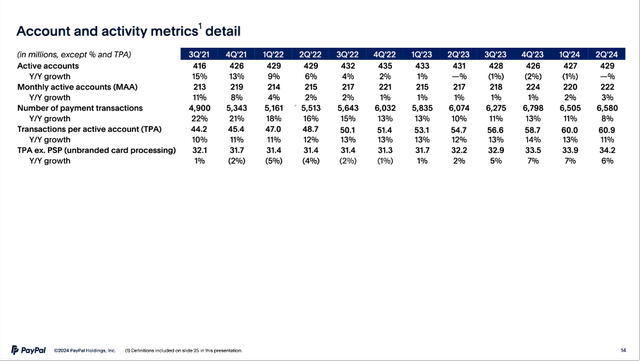

Aside from looking at the income statement, we can look at additional numbers PayPal is reporting. And the picture here is the same: PayPal is reporting solid growth from quarter to quarter. Of course, when looking at additional metrics, we must mention the number of active accounts again. Year-over-year, active accounts declined from 431 million to 429 million, but on the other hand, this is the second quarter in a row with active accounts growing quarter-over-quarter. To put it simple, we can describe the number of active accounts as stagnating in the recent past. But more important are the monthly active accounts (I already mentioned this in previous articles). And here we see the number increasing from 217 million in Q2/23 to 222 million in Q2/24 – resulting in 2.3% year-over-year growth.

While the number of active accounts is still an issue, other metrics are performing well and continue to grow with a solid pace. The number of total payment transactions is continuing to increase from 6,074 million in Q2/23 to 6,580 million in Q2/24 – resulting in 8.3% year-over-year growth. And total payment transactions are increasing as the payment transactions per active account continue to increase 11.3% year-over-year growth from 54.7 in Q2/23 to 60.9 in Q2/24. And finally, TPV (total payment volume) also increased from $376.5 billion in the same quarter last year to $416.8 billion this quarter – resulting in 10.7% year-over-year growth.

In the end, only two arguments against PayPal remain. On the one hand, we have the stagnating number of accounts, which could become a problem over the long run. But in my opinion, PayPal is continuing to grow with a solid pace, and we are actually looking at a stable business. The second argument remaining are growth rates in the high single digits instead of growth rates in the high teens or twenties – but the evolution of growth rates over time deserves a closer look.

Not A Growth Company Anymore

Taking up these arguments, I often read that PayPal is past its growth phase – and that argument might actually be true. We should not expect PayPal to grow 20% or 30% annually in the years to come. On the other hand, growing in the mid-to-high single digits seems achievable for PayPal, however it seems like this is not enough for most investors or analysts to call PayPal a good business or good investment.

When reading statements that PayPal won’t be able to grow in the higher double digits and is therefore not a good investment, I always get the feeling that some people don’t understand the interplay between fundamentals, sentiment and the stock price. It often seems like people are either just focused on growth rates or are only looking at the stock price but don’t understand that the full picture is important to make a good decision if a stock is an investment or not. Knowing that NVIDIA is growing with an extremely high pace or knowing that PayPal is growing with a rather low pace or knowing that Tesla declined 50% from its previous all-time high is not enough to make an investment decision about any of these companies (and stocks).

A company trading for 10 times free cash flow does not have to grow 20% annually to be fairly valued or drive the stock price higher. And it is completely acceptable if growth rates slow down for a company trading for 10 times free cash flow. At a time when PayPal was trading for almost $300, high-growth rates were important and as it turned out, these high stock prices were not justified as growth rates could not hold up. But now the picture is completely different, and we can’t talk about PayPal in the same way in 2024 as we did in 2021. It might be a similar business, but the analysis and resulting investment decision is completely different. Having to pay only one fourth of the price at the peak should make a huge difference in any investment analysis and investment decision.

Of course, growth rates are important, but when deciding whether a stock can be a good investment or not, we always must look at the interplay between growth, the fundamental business and the stock price. And arguing that a stock trading almost for single digit valuation multiples must grow 10% or 20% to be a good investment is just nonsense. On the other hand, just trading for 10 times free cash flow does not make a stock automatically a good investment, either. Like I said, it is always the interplay between fundamentals and stock price. We will get back to this in the last section (the intrinsic value calculation).

Making Mistakes

Another argument I read quite often is that management missed several opportunities and does not deploy its capital well. The argument made here is often that PayPal could actually grow with a much higher pace if management did not make constant strategic mistakes. First, it is interesting as this argument contradicts in some ways the argument made above that the business model is broken. Second, it is really difficult to assess if PayPal has missed opportunities and which opportunities it missed. It is always easy to see opportunities in retrospect and take about the steps management should have taken and what management should have seen beforehand.

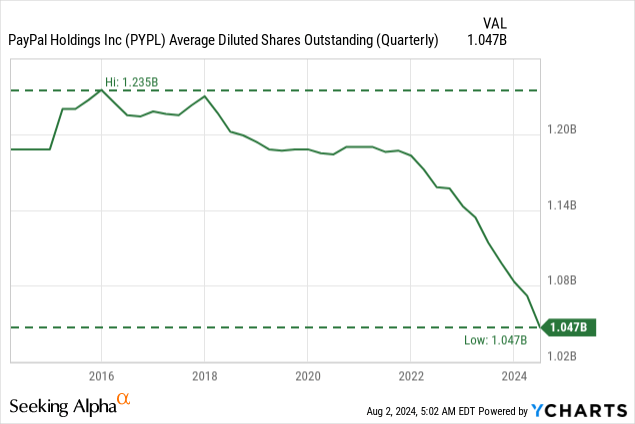

And I won’t call PayPal’s management perfect, as I believe management certainly made mistakes in the past. But, at least in my personal opinion, management also made several right calls – especially about capital allocation and how the business used its free cash flow in the past. The decision to use almost the entire free cash flow for share buybacks at a point where the stock price completely collapsed is, in my opinion, a smart move. Since about 2018, the company decreased the number of outstanding shares constantly. Back then, the number of outstanding shares was about 1,230 million and the last reported number of shares outstanding was 1,047 million. This is resulting in a CAGR of 2.5% with which the company reduced the number of outstanding shares.

PayPal is also not paying any dividend, which also seems to be the right decision considering the extremely low share price (we will get to this). Aggressively buying back shares at this point is the smartest move management can make.

In fiscal 2024, the company will spend about $6 billion on share buybacks. With a market cap of $67 billion at the time of writing, the amount is enough to repurchase almost 9% of all outstanding shares in a single year. And as long as the stock remains somewhere between $50 and $70, management should continue to use as much free cash flow as possible for share buybacks.

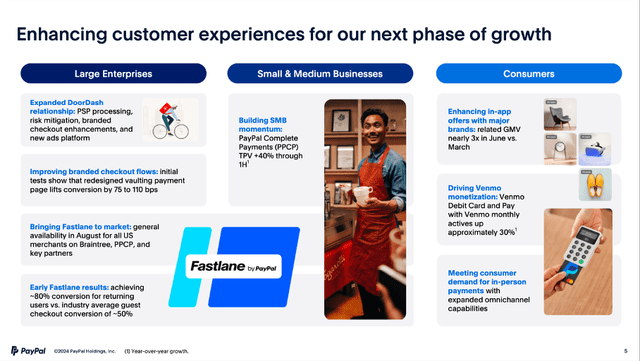

PayPal Not Being Innovative

And hand in hand with the argument of management making mistakes is the argument that PayPal is not innovative anymore. But in my opinion, the argument has to be different: If a business must (!) constantly be innovative to thrive (or maybe even survive) we might rather face a problem. While it sounds great for a business to constantly be innovative, it seems rather impossible to actually achieve constant innovation. And if a business constantly has to innovate all the time to stay ahead, the risk of one misstep or one failed innovation threatening the existence of the entire business is rather high.

Demanding that business must be revolutionary all the time to grow and thrive is nonsense in my opinion. The most successful businesses that last over a long time are those with the ability to adapt to a changing environment (and in the process of adapting, these businesses sometimes must be innovative). Many great companies that were built to last managed to create a service or product that is so essential and one of the basic services and products people need every day and don’t need to change. Coca-Cola (KO) does not have to invent its core products new every year – actually, the one time they did, it went horribly wrong.

Visa (V) or Mastercard (MA) must adapt and make the process more secure or easier for customers – but the core product and services more or less stay the same. And people are just continuing to use it for payment processes. And I think PayPal also has a product that is built to last, and the company does not have to be innovative or revolutionary all the time. The company must adapt its core product to a changing environment, but the fact that the core product does not need to change is part of the reason for the company’s wide economic moat and what makes PayPal a good investment.

And sometimes it is enough to make small changes that are far from revolutionary. But as long as the business is adapting to a changing environment, it will be enough for the business to perform well. However, if a business constantly must be innovative just to survive, we are probably facing a problem more than a great investment.

Growing Competition

Another risk mentioned quite frequently is the growing competition from other major tech companies – including Apple Inc. (AAPL). Apple should not be underestimated as a competitor, as it has one major advantage: Apple already has a huge ecosystem and a huge number of users which already have an iPhone and can start paying by using Apple Pay quite easily. It seems like Apple Pay has about 510 million users worldwide, with about 45 million American using it monthly.

Apple certainly is a strong competitor, and that risk should not be underestimated. But, in my opinion, several payment options can co-exist in the same way as Visa and Mastercard could co-exist over decades and grow almost hand-in-hand. The payment volume will continue to rise, and digital payments will continue to increase and take market shares from other forms of payment. And in such an environment, PayPal will continue to perform well – alongside with other companies offering payment solutions like Apple Pay.

Upcoming Recession

To be honest, I am reading several arguments why PayPal is not a great investment right now and should be rather avoided. And while many of the arguments don’t make much sense in my opinion, there is one argument I hardly read in the last few months and quarters – the risk of an upcoming recession and what impact this might have on PayPal in the short-to-midterm.

However, the last few weeks might have been a game changer here and now panic suddenly seems to return and sentiment might be changing a bit. The markets will probably recover in the next few weeks and this first shock will probably be forgotten soon, but in the coming quarters the risk of recession and a bear market is very real.

A recession will certainly have an impact on PayPal’s business as people will most likely spend less in times of a recession and when people are purchasing less, it will have an impact on the total payment volume and revenue PayPal is generating.

Usually, stocks decline rather steep during bear markets and recessions – and when the business is affected in a negative way, the stock is in most cases reacting as well. But in the case of PayPal, I actually see the downside risk rather limited. And here we come to the final section of every analysis – calculating an intrinsic value.

Intrinsic Value Calculation

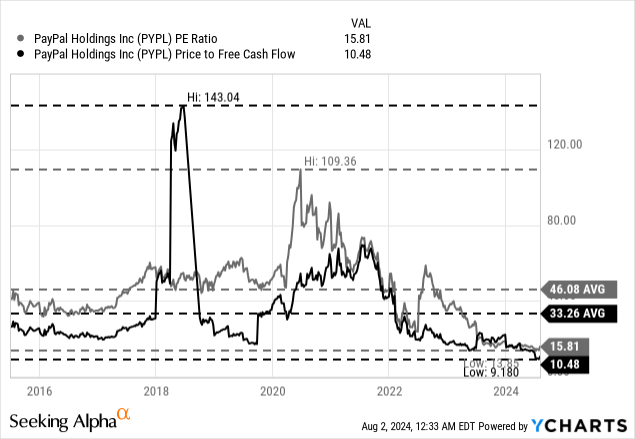

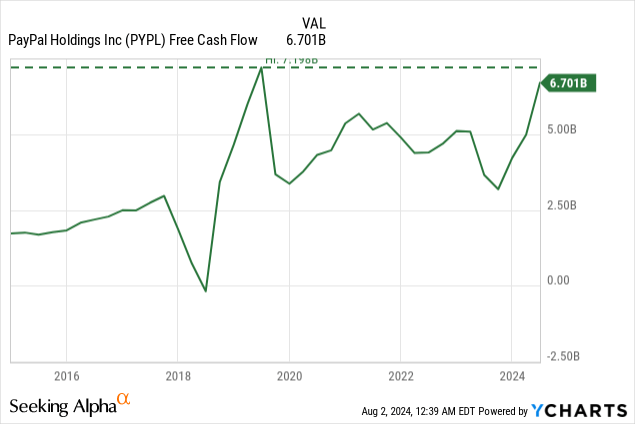

When talking about the risk of PayPal declining during a bear market or trying to assess if it is a problem when PayPal suddenly can grow only in the high single digits anymore, calculating an intrinsic value is extremely important. And as we saw in the chart above, PayPal is continuing to trade at a lower and lower P/FCF ratio. This is mostly due to the stock price remaining at a very depressed level while the underlying fundamental business is continuing to improve.

In my opinion, PayPal trading for 10.5 times free cash flow is absurd and in no way justified for a business like PayPal that is still able to grow with a rather high pace (at least high single digits) and has a wide economic moat around the business.

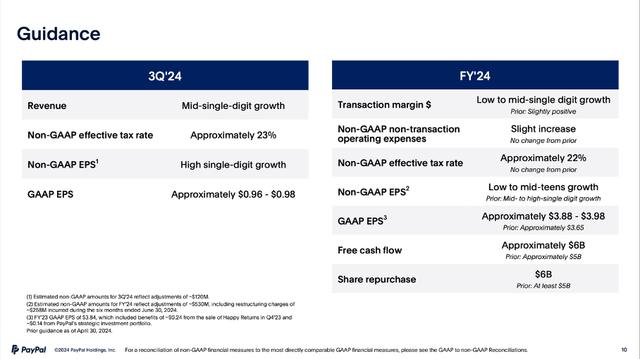

We can also calculate an intrinsic value once again by using a discount cash flow calculation. In the last four quarters, PayPal generated a free cash flow of $6.7 billion, but let’s be more cautious and take the $6 billion in free cash flow for fiscal 2024 according to the company’s guidance. Additionally, we are calculating with a 10% discount rate and 1,047 million diluted shares outstanding.

And let’s be optimistic for the next few years and follow analysts’ growth assumptions, which are expecting earnings per share to grow with a CAGR of 12.13% till fiscal 2033. We can also argue for 12% annual growth being in line with past growth rates. In the last five years, operating income increased with a CAGR of 14.58% and earnings per share increased with a CAGR of 17.56%. So, let’s calculate with 12% growth for the next ten years, followed by 3% growth until perpetuity. When calculating with these assumptions, we get an intrinsic value of $146.73 making PayPal deeply undervalued.

And of course, we can argue that this is an unrealistic calculation and a completely unrealistic intrinsic value. And I get the argument of 12% growth being rather optimistic, but even when calculating with much lower growth rates, PayPal is still deeply undervalued. Even when assuming that PayPal is not growing in the next five years (for example due to a severe recession), the intrinsic value would still be $97.80 (all other assumptions being the same).

Conclusion

All in all, I don’t get many of the arguments made against PayPal. I neither think the business model is broken nor are lower growth rates a problem. And PayPal must deal with rising competition, but the wide economic moat will keep most competitors at bay and in an overall growing market, we can be confident that PayPal will grow as well.

Only a potential upcoming recession will have an impact on PayPal in the next few years, in my opinion. However, considering the low stock price, such a scenario is more than priced in at this point. Overall, I still see PayPal as a clear “Buy” (and only the looming recession is preventing a “Strong Buy” rating at this point).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.