Summary:

- PayPal is set to release its Q3 earnings on November 1st with consensus quarterly earnings expected to be around $1.23/share and revenues growing 8% YoY.

- Recent Q3 GDP data revealed strong consumer spending, driven by factors such as low unemployment, wage growth, government stimulus, and online shopping, which bodes well for PayPal in my view.

- However, PayPal is facing increasing competition in the online payment industry, eroding its market share and presents challenges for its future.

- Despite this, I am bullish on PayPal as it appears there is currently a disconnect between the strong macroeconomic backdrop and its heavily beaten down stock.

chameleonseye

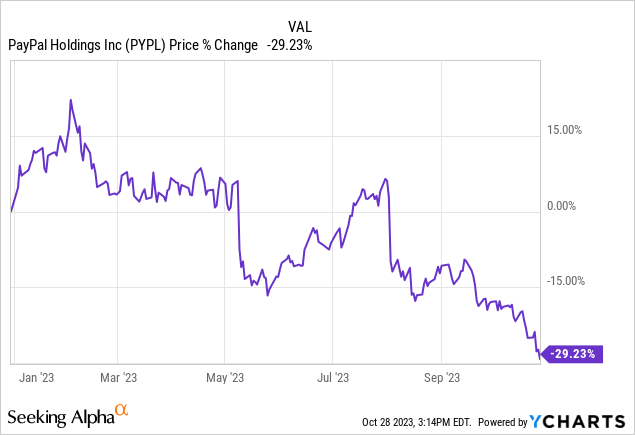

PayPal Holdings, Inc. (NASDAQ:PYPL) is set to report Q3 earnings on Wednesday, November 1st, after the market close. Consensus quarterly earnings according to Seeking Alpha are expected to be around $1.23/share with revenues growing 8% YoY to $7.4 billion. On an annualized basis, PayPal trades at a forward price-to-earnings ratio of 10x, which is well below the S&P 500 historical trailing average. Unfortunately for PayPal investors, this already low multiple has continued to go lower as of late, with the stock now down 29% YTD at the time of writing.

There’s been a ton of negative sentiment this year, primarily around increased competition and decelerating revenue growth. However, in my view, it’s gotten to a point where PayPal’s valuation has become attractive based on numerous financial metrics, including price-to-earnings and free cash flow yield. Add in the company’s planned share buybacks and strong consumer spending data released a few days ago and you have a potential turnaround if the next earnings report is strong.

High Consumer Spending Bodes Well For PayPal

On October 26th, the Bureau of Economic Analysis (BEA) released its Advanced Estimate for Q3 real GDP, which exceeded expectations at +4.9%. The increase was driven by robust consumer spending, buoyed by various economic factors. Strong consumer spending data for the year indicated a healthy economy and optimistic consumer sentiment. Several key factors contributed to this trend.

-

Low Unemployment: The job market continued to strengthen, resulting in low unemployment rates. This created a more confident consumer base with greater job security and disposable income.

-

Wage Growth: Wages saw steady growth, with many industries increasing pay to attract and retain talent. Higher incomes enabled consumers to increase their spending.

-

Government Stimulus: Various government stimulus packages and financial aid programs provided direct assistance to individuals and families, injecting additional funds into the economy and stimulating consumer spending.

-

Economic Recovery: As the world recovered from the COVID-19 pandemic, businesses reopened, travel resumed, and in-person events returned. This led to increased consumer spending on travel, entertainment, and dining out.

-

Online Shopping: E-commerce continued to thrive, with consumers increasingly embracing online shopping. Retailers adapted to this trend, offering convenience and a wide range of choices for consumers.

-

Consumer Confidence: Surveys consistently showed high levels of consumer confidence, with people feeling optimistic about the economy’s future.

These factors collectively drove strong consumer spending in the United States in 2023, benefiting various industries and contributing to the nation’s economic growth. However, it’s essential to monitor economic conditions and fiscal policies to assess the sustainability of this trend.

PayPal is well-positioned to thrive amidst strong consumer spending, as it acts as a pivotal intermediary for online transactions, benefiting from increased e-commerce activity. Additionally, the company’s reputation for secure and convenient digital payment solutions makes it a trusted choice for consumers during periods of elevated spending.

Risks

PayPal, once a dominant player in the online payment industry, is facing increasing competition that’s eroding its market share. Companies like Square, Stripe, and Adyen have entered the market with innovative solutions that cater to businesses of all sizes. Square’s point-of-sale and payment processing services, Stripe’s developer-friendly platform, and Adyen’s global reach have drawn merchants away from PayPal. Other tech behemoths including Apple and Google are also involved in this industry, presenting more challenges for PayPal. Additionally, the rise of decentralized finance and cryptocurrencies presents alternative methods for online transactions, threatening PayPal’s position. These competitors offer faster, more flexible, and often more cost-effective services, which have contributed to PayPal’s gradual market share decline. PayPal’s moat is being challenged and investors are demanding a higher equity premium for investing in its stock. Shares are now trading below pre-pandemic levels.

Conclusion

Wednesday’s Q3 earnings are going to be extremely important for PayPal’s future outlook. Shares have been decimated this year without any real negative headlines crossing the tape. PayPal has met earnings and revenue targets but Wall Street is still not sold. If revenues & earnings are not in line with expectations despite the strong macroeconomic backdrop, problems are likely related to losing market share. I am optimistic PayPal can hit its estimates, easing concerns for investors. This could be the ultimate “buy the dip moment” at $50/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.