Summary:

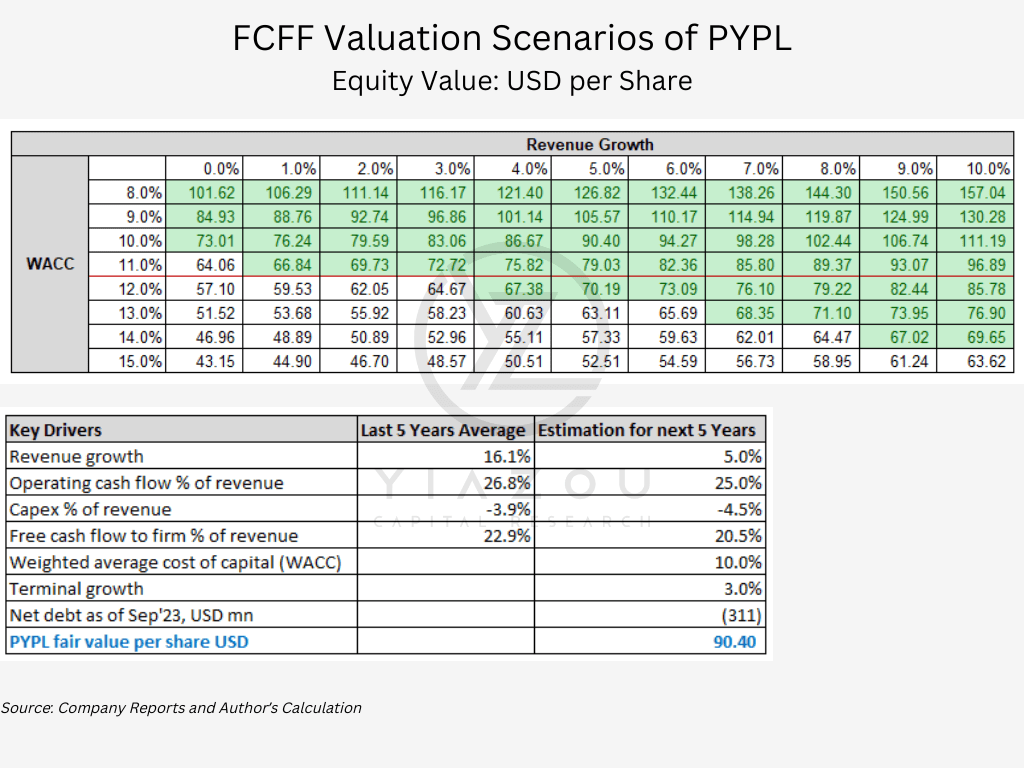

- PayPal’s long-term target price of $90 is supported by robust free cash flow, strategic buybacks, and conservative financial projections from its DCF model.

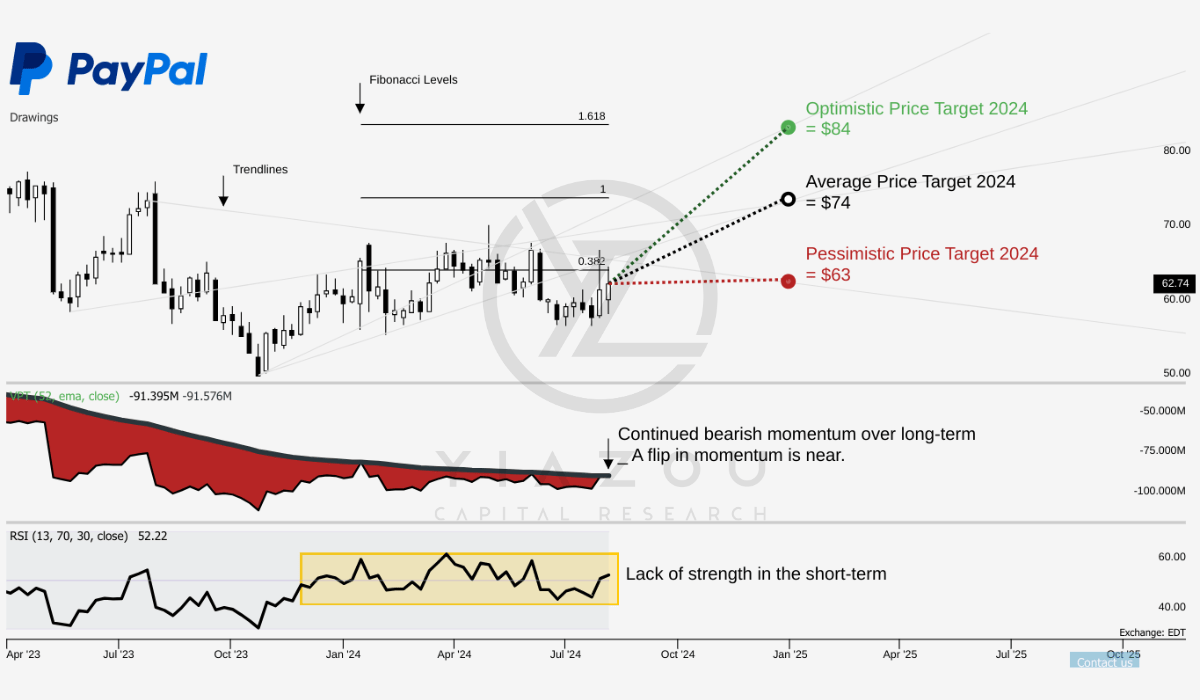

- Based on Fibonacci retracement levels, PayPal’s stock has a moderate target of $74, with an optimistic target of $84, supported by solid technical indicators and bullish momentum.

- PayPal’s RSI of 52.22 and alignment with Fibonacci retracement levels suggest bullish momentum, supporting the case for continued stock recovery.

- PayPal maintains $15.9 billion in cash and investments against $9.8 billion in debt, ensuring liquidity for ongoing buybacks and growth initiatives.

- PayPal generated $1.5 billion in free cash flow during Q2 2024, bringing its total for the first half of 2024 to $3.3 billion.

dem10

Investment Thesis

PayPal’s (NASDAQ:PYPL) recovery narrative is supported by solid fundamentals and technical indicators that align with its long-term growth prospects. The company’s robust free cash flow, strategic buybacks, and consistent revenue growth in Q2 underpin our earlier $90 per share DCF valuation.

Meanwhile, technical signals such as bullish RSI trends and Fibonacci retracement levels confirm this upward momentum, suggesting that a solid technical foundation reinforces the stock’s fundamentals. PayPal appears well-positioned for a sustained rebound in the evolving digital payments landscape.

Despite competitive pressures and market volatility, PayPal’s robust financials, including a solid balance sheet and proven ability to return capital to shareholders, reinforce its value proposition. Continued innovation in its core business and prudent risk management positions PayPal for sustained growth and shareholder value creation in the evolving digital payments landscape.

PayPal Technical Targets Range from $63 to $84

PYPL is trading at $67; the stock’s price targets for 2024 are aligned with Fibonacci retracement levels, suggesting potential positive and stable outcomes. The average price target of $74 aligns with the Fibonacci level 1, indicating a moderate growth expectation. The optimistic target of $84 correlates with the 1.618 Fibonacci level, which could signify a solid bullish trend if achieved. Conversely, the pessimistic target of $63 aligns with the 0.382 Fibonacci level, suggesting a minimal decline if market conditions worsen.

The Relative Strength Index (RSI) stands at 52.22, indicating that the stock is neither overbought nor oversold. The RSI line trend is currently upwards and reverting, which suggests a potential for further gains. No bullish or bearish divergences exist, meaning there is no significant discrepancy between price movements and RSI trends. The RSI setup at 30 may confirm a long-term bottom touchdown to buy, indicating a breakout from the current consolidation of the indicator. The ongoing consolidation is pointing to a weakness in price strength over the short-term.

The Volume Price Trend (VPT) line also shows an upward trend and is reverting, indicating a potential bullish price volume momentum. However, the current VPT line value is -91.40 million, slightly below its moving average of -91.58 million, suggesting a possible buying opportunity as it crosses the moving average. The current month, August 2024, has a 50% probability of positive returns based on historical monthly seasonality data from the past nine years. This suggests that investing now might offer a balanced risk-reward scenario based on historical trends.

Author (trendspider.com)

PayPal’s Q2 2024 Results Reaffirm Our $90 DCF Valuation

The Q2 2024 results further indicate that our $90 per share valuation, derived from a DCF model, remains intact. Underpinned by robust free cash flow generation and strong returns to shareholders through buybacks, combined with financial stability consistent over time, PayPal strengthens the value argument to investors.

In Q2 2024, PayPal generated $1.4 billion of free cash flow, below the Q1 performance of $1.8 billion but still indicative of strong cash generation capabilities. Bringing PayPal’s total FCF for the first half of 2024 to $3.2 billion outlines its ability to generate material cash despite a challenging operating environment.

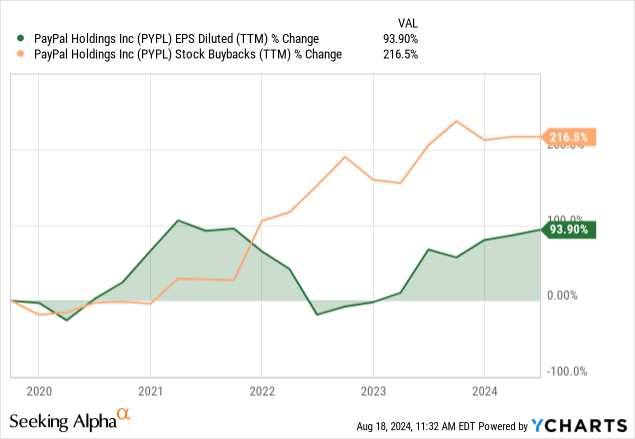

Additionally, the company’s FCF yield remains relatively high at around 9.7%, continuing to support the valuation narrative and showing the strength and resilience of its business model. This strength in free cash flow allows PayPal to maintain an aggressive capital return strategy. In Q2 2024, PayPal bought back 24 million shares, returning $1.5 billion to shareholders, reducing weighted average shares by 6%. Through the trailing twelve months, it has repurchased approximately $5 billion worth of shares.

At the end of Q2 2024, PayPal’s balance sheet remained robust, with $18.3 billion in cash, cash equivalents, and investments—only slightly lower than Q1’s total but still well above its debt load of $9.8 billion. This solid financial stability guarantees that PayPal has ample liquidity to support ongoing share repurchases and invest in growth drivers, thereby underpinning its long-term valuation.

The $90 per share DCF value is based on conservative assumptions that remain intact following Q2 2024 results. These include 5% revenue growth, 25% operating cash flow growth, and a 10% weighted average cost of capital. With PayPal posting $7.9 billion in revenue in Q2 2024, an increase of 8% year over year, these projections still stay within reach. This steady revenue growth and the firm’s ability to generate significant free cash flow underpins these fairly conservative assumptions embedded in the DCF model.

Author

Financial Performance: Early Signs of a Rebound

In this context, PayPal just released financials for Q2 of 2024, indicating the company is still on its way to recovery while facing challenges. Net revenue increased by 8% to almost $7.9 billion on a year-over-year basis, and on a currency-neutral basis, growth was even more robust at 9%. Such performance indicates that, despite the challenging economic climate, PayPal’s core business remains resilient.

The key highlight of this quarter was the increase in transaction margin dollars of 8%, which resulted in $3.6 billion. This metric gauges profitability for every transaction after accounting processing expenses. A part of this expansion was due to interest income on customer balances. Meanwhile, branded checkout, Venmo, and Braintree contributed significantly to the growth. Braintree becoming profitable in two years is a testimonial of the company’s ability to achieve cost efficiencies.

Finally, operating profits increased 24% on a non-GAAP basis to $1.5 billion, as the margin expanded 231 basis points to 18.5%. Hence, PayPal’s powerful free cash flow generation enabled the company to buy back 24 million shares during the quarter, further boosting its earnings per share by 36%.

Harnessing the Power of a Network Effect

PayPal’s core business model enjoys a robust two-sided network connecting millions of consumers and merchants worldwide. The more consumers PayPal uses its services, the greater the value for merchant acceptance. Likewise, the more merchants it can attract, the more perfect the platform is for consumers. These forces reinforce each other, becoming a self-reinforcing condition of PayPal’s market position, but this is a new call to attention to the effort needed to exploit this power.

Recently, PayPal had been sucked into integrating its acquisitions, leading to a fragmented ecosystem that had significantly slowed down the pace of innovation. The CEO, Chriss, now focuses on refocusing efforts toward creating a cohesive platform that enhances customer experience and boosts merchant engagement. The strategy is focused on scaling PayPal Complete Payments for small and medium businesses, refining its branded checkout experience, and increasing investment in improving customer interactions—especially on mobile devices.

Finally, Chriss has indicated that 2024 will be the year of execution, setting the necessary infrastructure for long-term success. For natural solidification, PayPal must continue to take advantage of its network effect, delivering value to consumers and merchants and keeping ahead of the marketplace.

PayPal’s Innovation Push Transforms Checkout Experience and Expands Venmo’s Reach

This is the key to PayPal’s future success; innumerable products and features have been developed that enhance the system’s ease and safety. One extensive development was the implementation of Fastlane, which accelerated guest checkout. The company immediately reported shaving off vast amounts of time customers spent at purchase time.

Early data suggests that Fastlane users convert at a rate of almost 80%—well above the guest checkout industry standard. Other areas have included significant innovations in branded checkout that are better optimized for the mobile-first environment. PayPal’s new vaulted experience has streamlined the purchase path for customers making return visits while unlocking better conversion rates for the merchant. Early testing has delivered conversion lifts to 110 basis points, further solidifying why PayPal is an even more compelling experience on both the merchant and consumer sides.

On the other hand, one of PayPal’s brands, Venmo, is also working on extending its functionality beyond P2P payments. It announced that the Venmo debit card would now be added to Apple (AAPL) and Google (GOOG) (GOOGL) Wallets, and Pay with Venmo would be expanded to more merchants, enabling users to spend their Venmo balance directly. These efforts are keeping funds within the Venmo ecosystem longer, driving engagement higher, and making the platform more essential in everyday life.

Finally, for small and medium businesses, the PayPal Commerce Platform is an emerging one-stop solution that offers functionalities ranging from smart receipts to push notifications. It is architected to enable merchants to manage and grow their businesses online.

Maintains Checkout Dominance Amid Fierce Competition

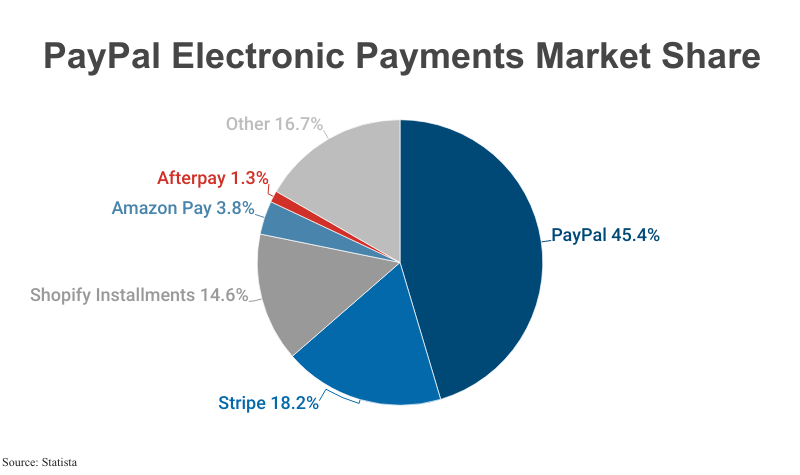

The digital payments landscape has never been more fiercely competitive, with Stripe, Square, and Apple Pay, among others, jostling for position and market share. Despite all this competition, PayPal still dominates as a branded checkout solution provider.

As of 2024, PayPal remained the leading branded checkout provider across all platforms and devices. On the desktop web, still 40–50% of all checkout activity, PayPal has held its share for the last four years—a credit card to its brand and product offerings.

The competition, however, stays razor-sharp, and PayPal needs to keep innovating. Its two-sided network remains one of the key differentiators. What created value for consumers also created value for merchants. How well PayPal can leverage its vast data insights to deliver tailored experiences and optimize risk management will be important in sustaining competitive advantages.

At the same time, however, the opportunities and threats a regulation shift poses are widespread. For instance, the EU has forced Apple to open its NFC technology to third-party payment providers, such as PayPal. This will allow a digital wallet provider like PayPal to supply its digital wallet for in-store payments in physical shops across Europe, perhaps another reason for business success.

fintech.global

PayPal’sPath to Recovery: Navigating Risks Amid Fierce Competition

While PayPal’sturnaround strategy shows some early signs of success, significant risks remain, including intensifying competition from entrenched providers of Stripe and Square and new entrants to the digital payment space.

To maintain its market position for consumers and merchants, PayPal must continue innovating and delivering competitively offered products and services. Another critical risk relates to cybersecurity. As a digital payment leader, PayPal has become one of the most alluring targets of any cyber-attack. Any breaches can cause enormous reputational damage and considerable financial losses. Ensuring the security of its platform is how the business preserves customer trust and compliance with regulatory requirements.

The other primary concern of a company like PayPal is the regulatory risks that are a function of its global footprint. The company has to face challenging, dynamic regulatory environments in different regions, each with its own set of legal frameworks. For example, the European Union’s ruling, asking Apple to open its NFC technology, may have significant implications regarding opportunities and challenges for PayPal as it builds out its strategy in Europe.

Finally, macroeconomic factors such as inflation and rising interest rates could impact consumer spending and merchant activity, affecting PayPal’s revenues and transaction volumes. The company’s ability to negotiate through these external pressures will be the key to its long-term success.

Takeaway

PayPal Q2 2024 results underscore its leading position, driven by strong free cash flow generation, aggressive share buybacks, and a solid financial foundation. The company has continued showing strength in a challenging market environment and is delivering value to shareholders.

Overall, stable revenue growth, successful execution of the capital return strategy, and rather conservative financial projections all support PayPal’s valuation at $90 per share quite well. However, continued innovation and careful management of competition and regulatory risks will be crucial for sustaining long-term growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.