Summary:

- PYPL’s new management has delivered promising performance metrics, while raising its FY2024 guidance, thanks to the growing monetization of its existing fintech offerings.

- This is on top of the new growth initiatives through Fastlane and PayPal Ads, with it likely to continue driving user growth and accelerating top/ bottom-lines.

- With another beat and raise quarter likely in the FQ3’24 earnings call, we believe that PYPL remains a compelling growth stock for opportunistic investors.

- This is significantly aided by the growing bullish support observed in its stock movement and attractively valued PEG ratio compared to its fintech peers.

DNY59

We previously covered PayPal Holdings, Inc. (NASDAQ:PYPL) in May 2024, discussing its growing Active users and expanding operating margins, as the management drove engagement and optimized costs in FQ1’24.

Combined with its inherent undervaluation and robust shareholder returns, we believed that the stock’s bullish support had finally materialized, with it likely to be slowly upgraded nearer to its fintech peers and historical means, offering interested investors with the opportunistic chance of a great upside potential.

Since then, PYPL has further rallied by +12.6%, outperforming the wider market at +7.8%. Even so, we are maintaining our Buy rating here, as the new management team delivers high double-digit adj EPS growth in H1’24 while raising their FY2024 adj EPS guidance.

Combined with Braintree’s improving profitability and the launch of Fastlane in the US, we believe that the fintech continues to offer a compelling growth investment thesis for opportunistic investors.

PYPL’s Reversal Is Here – Behemoth Fintech In The Making

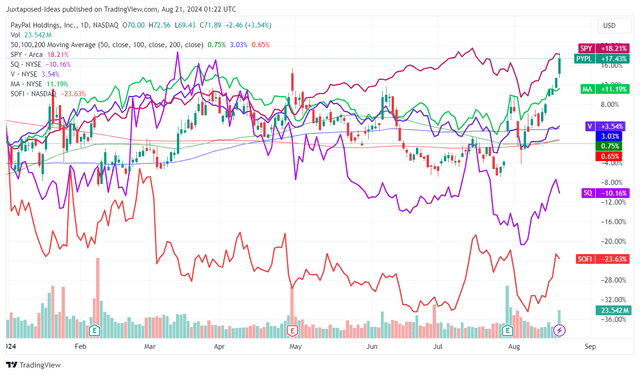

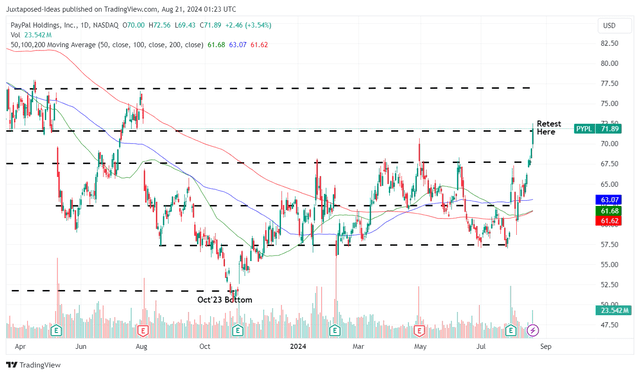

PYPL YTD Stock Price

After losing -82.6%, or the equivalent of -$307.11B of its market cap since the July 2021 peak, PYPL has started to outperform its fintech peers on a YTD basis, including SoFi Technologies, Inc. (SOFI), Block, Inc. (SQ), Visa Inc. (V), and Mastercard Incorporated (MA).

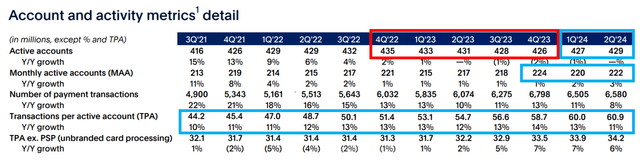

PYPL’s Promising Reversal In Active Account Churn

Perhaps part of the tailwinds may be attributed to PYPL’s promising reversal in the Active Accounts churn observed since FQ4’22, with things seemingly bottoming by FQ4’23 and sequentially improving through FQ2’24.

Its fintech platform appears to be extremely sticky for its existing users as well, based on the consistent expansion in its Total Payment Volume [TPV] and Transactions Per Active Accounts [TPA] over the past few years, with it underscoring why the massive sell-off observed in the stock has been unwarranted.

The stock’s robust YTD performance may also be attributed to PYPL’s double beat FQ2’24 earnings results, with total revenues of $7.88B (+2.4% QoQ/ +8.2% YoY) as the new management team delivers impressive early results.

Moving forward, we believe that it remains well positioned to report robust topline growth through Fastlane, with the management already highlighting that “data from our early adopters shows that returning Fastlane users, convert at nearly 80% versus the industry average guest checkout conversion closer to 50%.”

This is also why PYPL has aimed to integrate Fastlane across its large merchants on Braintree and small-to-medium merchants on PayPal Commerce Platform along with its sales partners, such as Salesforce (CRM), Adobe (ADBE), and BigCommerce (BIGC) by H2’24.

With Fastlane allowing the fintech to tap into the ~60% share of e-commerce purchases made through manual card entry, we believe that it may be able to grow its users along with profit margins, significantly aided by Venmo’s growing monthly actives by +30% YoY.

It is apparent from these developments that PYPL’s well-diversified and vertically integrated platform across retail P2P, small-to-medium merchants, and large enterprises, has been highly strategic in driving user growth, merchant adoption, and top/ bottom-lines.

If anything, the management is already looking to tap into the high margin advertising market through PayPal Ads on its end-to-end fintech platform, with it potentially being a massive growth driver, based on Meta’s (META) $153.28B in FQ2’24 annualized advertising revenues through social media and Google (GOOGL) (GOOG) at $258.44B through its market leading search engine/ streaming.

Moving ahead, PYPL has also executed well on its strategic cost savings plan, as observed in its stabilizing transaction margin of 45.8% (+0.8 points QoQ/ -0.1 YoY/ -8 from FQ4’19 levels of 53.8%), expanding operating margin of 18.5% (+0.3 points QoQ/ +2.3 YoY/ -5.5 from FQ4’19 levels of 24%) and rich adj EPS of $1.19 (+10.1% QoQ/ +36.7% YoY).

Most importantly, Braintree has finally achieved economy of scale thanks to the management’s strategic focus on price-to-value in areas across its large enterprise partners, with it “now meaningfully contributing to transaction margin dollar growth for the first time in over two years,” potentially leading to the fintech’s profit margin recovery nearer to 2019 levels.

Thanks to the robust top/ bottom-line growth, PYPL has been able to retire -6% of its float over the LTM and -11.7% since FY2019 as well, with the management looking to return all of their projected FY2024 Free Cash Flow generation of $6B (+30.4% YoY) to long-term shareholders, based on the raised FY2024 share repurchase target from $5B to $6B.

The lower share count has also aided the growing adj EPS, with the fintech’s balance sheet still extremely healthy at a net cash position of $6.1B (-8.9% QoQ/ +56.4% YoY).

As a result, it is unsurprising that PYPL has raised their FY2024 guidance, with adj EPS growth in the “low-to-mid-teens” at approximately ~$4.32 (+12.5% YoY) compared to the original guidance of “mid-to-high-single-digits” at ~$4.12 (+7.5% YoY) from FY2023 numbers of $3.83 (+23.9% YoY).

With the raised guidance building upon the adj EPS growth at +31.9% YoY observed in H1’24, we believe that the management’s guidance has been on the overly prudent side indeed, with another beat and raise performance very likely in the FQ3’24 earnings call – naturally justifying the stock’s YTD recovery.

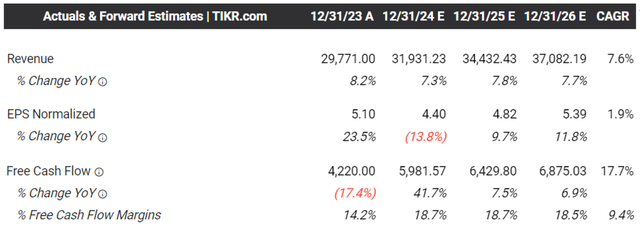

The Consensus Forward Estimates

And this is also why the consensus has already raised their forward estimates, with PYPL expected to generate an accelerated bottom-line growth at a CAGR of +8.94% from the LTM adj EPS of $4.39 to FY2026 numbers of $5.39, along with Free Cash Flow at +17.7%.

Even so, we believe that these estimates are on the low side, given the high double-digit growths observed in H1’24, with another upgrade likely.

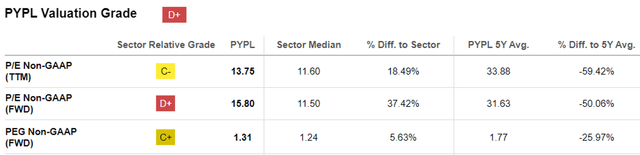

PYPL Valuations

As a result, we believe that PYPL is still trading reasonably at FWD P/E valuations of 15.80x, despite the notable upgrade from its 1Y mean of 12.44x and the sector median of 11.38x.

Even when comparing PYPL’s PEG ratio at 1.31x to its fintech peers, including SOFI at 1.22x, SQ at 0.50x, V at 2.14x, and MA at 2.00x, it is apparent that PYPL is still reasonably valued here – offering interested investors with an excellent margin of safety.

So, Is PYPL Stock A Buy, Sell, or Hold?

PYPL 1Y Stock Price

For now, PYPL has traded sideways since the end of 2023, with the stock now retesting the 2024 resistance levels of $70s while running away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair-value estimates of $60.70 in our last article, based on the FWD P/E of 14.92x and the (new methodology) LTM adj EPS of $4.07 ending FQ1’24.

Based on the market’s recently upgraded FWD P/E valuations of 15.80x and the LTM adj EPS of $4.29 ending FQ2’24, it appears that PYPL is still trading near to our updated base-case estimated fair value of $67.80.

Based on the consensus FY2026 adj EPS estimates of $5.39 and the same P/E valuation, we are looking at a decent upside potential of +18.3% to our long-term price target of $85.10 as well.

This is not forgetting a potential upward re-rating in its FWD P/E valuations to its 5Y mean of ~30x (nearer to its peers based on PYPL’s accelerated bottom-line growth prospects), with it bringing forth a bull-case fair estimate of $128.70 and long-term price target of $161.70, respectively.

As a result of the still attractive risk/ reward ratio at current levels, we are maintaining our Buy rating for the PYPL stock.

Risk Warning

While we may have offered a rather bullish price target, readers must note that PYPL’s stock price reversal is expected to be prolonged since it is uncertain if the churn observed in its Active Accounts since FQ4’22 has ended and whether the sequential growth from FQ1’24 onwards may continue.

At the same time, Fastlane’s widespread adoption/ monetization may be slower than expected, since it is only recently launched in early August 2024, with a likelihood of minimal top/ bottom-line boost in FQ3’24. With the results likely only in by FQ4’24, investors may want to temper their near-term expectations indeed.

This is especially since PYPL has guided higher non-transaction operating expenses, partially attributed to intensified marketing efforts and the normalization in transaction/ credit losses, with it potentially triggering a near-term bottom-line impact on a sequential basis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.