Summary:

- PayPal has benefited from e-commerce growth but is facing headwinds due to increased competition in the digital payments industry.

- Despite strong Q2 earnings, user growth is declining, and the company’s product mix is inferior, underpinning cracks.

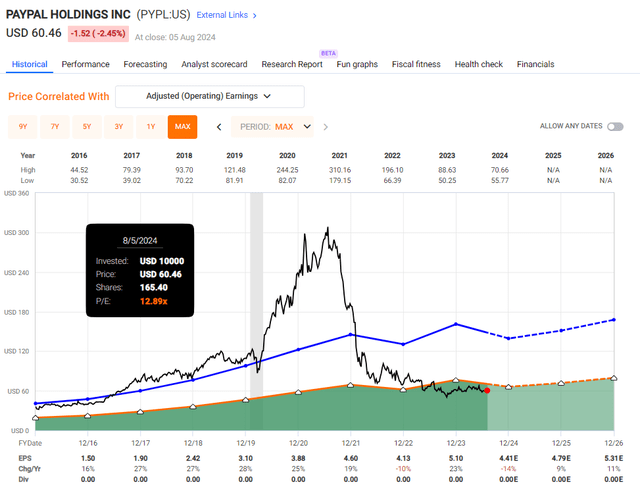

- A blended P/E of 12.9x is cheap in today’s pricey market, yet I see no valuation expansion with negative EPS growth in FY24.

- Analysts expect limited growth potential for PayPal in the midterm, leading me to maintain a “Sell” rating with an outlook of limited returns.

Images By Tang Ming Tung

PayPal Holdings, Inc. (NASDAQ:PYPL) has been one of the first beneficiaries of growing e-commerce transactions. It developed a network early on to wire money between customers and merchants, putting it miles ahead in the race.

The COVID-19 pandemic further accelerated the shift towards digital payments, and the business was thriving, or so it seemed.

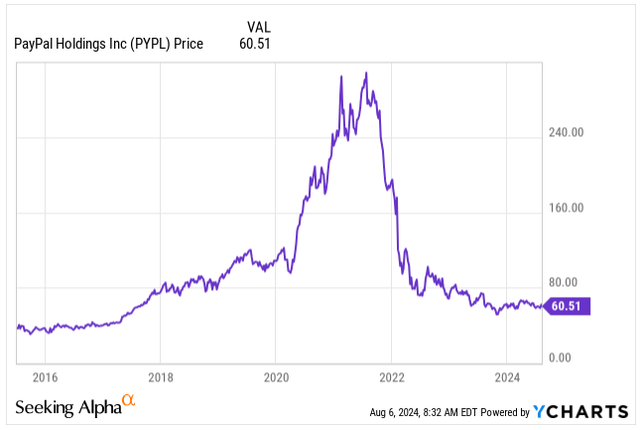

As electronic payments surpassed cash payments worldwide only a few years ago, there is still plenty of growth in the industry to capitalize on. Yet, PayPal has been facing severe headwinds, with user growth slowing and profit margins coming under pressure. This has ultimately hammered the stock price from its all-time high of $310 down to today’s $60.

Price Development (Seeking Alpha)

The reason?

Thanks to the lucrative business of digital payments with somewhat low barriers to entry, other than developing a software/app, other businesses such as Block, Inc. (SQ), Adyen N.V. (OTCPK:ADYEY), and Stripe (STRIP) entered the space, squeezing the profits.

PayPal’s management, led by new CEO Alex Criss, is fighting to revert the slowing top-line growth, focusing on innovation and cost control. However, a turnaround will take time to materialize.

Let me show you why PayPal’s Q2 was strong, yet I am still not convinced, and I still assign the company a “Sell rating”, which has proven to be accurate since my last coverage in April.

Q2 Earnings

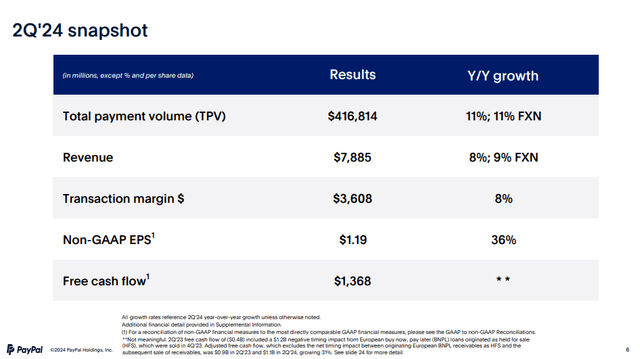

PayPal delivered a strong Q2 with the best transaction margin dollar growth since 2021 while making some progress on the strategic transformation, improving profitability, and focusing on innovation.

The stock jumped by 8.6% on the day of the earnings, yet it retreated since driven by a general market sell-off.

What’s more, management has raised 2024 guidance and increased share repurchases, which might have a meaningful impact on what some may consider a “depressed valuation.”

The company reported 8% sales growth, reaching $7.9B, and 8% transaction margin dollar growth to $3.6B, with Braintree now meaningfully contributing to the development for the first time in over two years.

The total payment volume increased by 11% to $416.8B, and the overall payment transactions grew similarly, increasing by 8% to 6.6B.

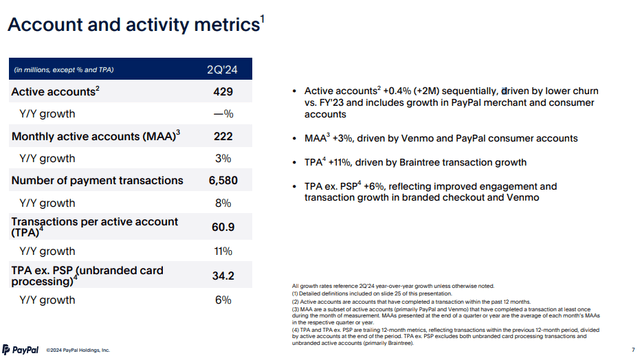

Yet, what worries me and what I will discuss in more depth are the falling active accounts, contracting 0.4% to 429M, a metric that is key for any technology business, particularly FinTech.

On the bright side, the transactions per active account grew by 11% YoY, supported by strong momentum across PayPal and Venmo.

At the end of the period, the company is in a very healthy financial position, with cash and equivalents totaling $18.3B, compared to total debt of only $12.2B. It easily earned PayPal an A- credit rating from S&P Global, implying less than 3% risk of default over the next 30 years.

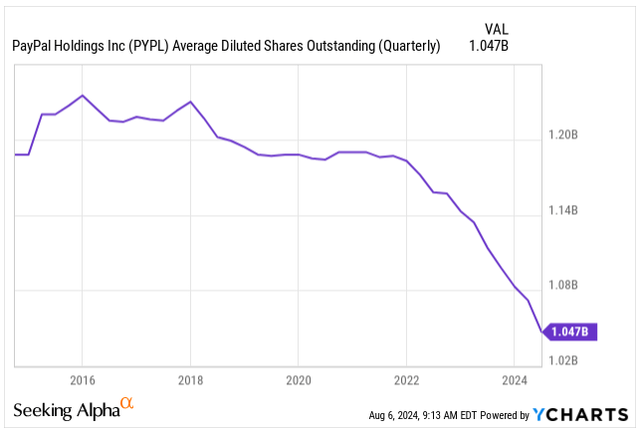

While PayPal is not paying dividends, the company repurchased stock worth $1.5B during the quarter and $5B on a trailing 12-month basis, which is roughly 8.1% of its outstanding float at today’s market cap of $62B.

In theory, shareholders should benefit from the simple supply/demand dynamic, especially as PayPal is repurchasing the shares at a cheap Blended P/E valuation of 12.9. Yet, the stock price has not budged due to investors’ lack of confidence and appetite for digital payment companies.

Shares Outstanding (Seeking Alpha)

Combating the stiff competition in the industry, PayPal, with its sizeable established infrastructure spanning from consumers to merchants, is the only company building an end-to-end platform. This platform will span an entire commerce journey with superior customer experiences and sales conversion from start to finish. It could eventually help to boost the top line and reverse the user decline, yet the impact is to be seen.

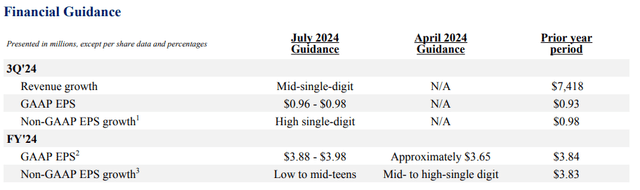

PayPal’s management is quite optimistic heading into H2, even as other payment networks, such as Visa Inc. (V), expect a slowdown in payments. Consumers are showing signs of cracks, especially on the lower end of the income spectrum, so I am somewhat cautious about the increased GAAP EPS guidance to fall anywhere between $3.88 and $3.98, up from $3.65 in April.

Back in 2020, PayPal’s executives were very optimistic about the growth of its users, projected to reach 750M by the end of 2025. We are one and a half years away, and the users currently stand at 429M, or 75% below their initial stretched targets.

Naturally, PayPal is not going to hit its early set goals, but what worries me more is that 50% of PayPal’s user base is made up of users older than 45, with younger generations instead switching to “Buy now, pay later” alternatives without the need for PayPal. This pressure especially applies to higher-margin businesses like the PayPal checkout platform.

As shown below, user growth has been inferior in recent years, even as we see some degree of stabilization. Yet, don’t forget that user growth is a key KPI for technology companies.

| Year | Users in millions | YoY Change % |

| 2013 | 143.0 | 0.0% |

| 2014 | 161.0 | 12.6% |

| 2015 | 179.0 | 11.2% |

| 2016 | 197.0 | 10.1% |

| 2017 | 227.0 | 15.2% |

| 2018 | 267.0 | 17.6% |

| 2019 | 305.0 | 14.2% |

| 2020 | 377.0 | 23.6% |

| 2021 | 426.0 | 13.0% |

| 2022 | 435.0 | 2.1% |

| 2023 | 426.0 | -2.0% |

| Q2 2024 | 429.0 | 0.7% |

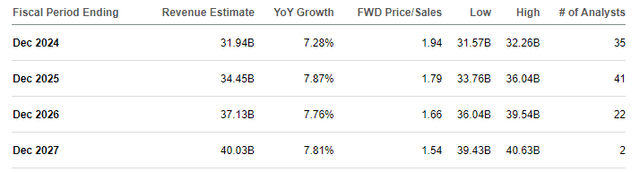

Given the strong correlation between user growth and revenue growth, of course, PayPal’s revenue grew significantly during the last decade from $6.7B back in 2013 to over $29.7B at the end of 2023.

In the last few years, the company delivered an average of 8% top-line expansion, a far departure from the average 20% annual growth between 2014 and 2021.

Analysts do not expect any major top-line growth improvement in the very competitive industry in the midterm, with 7% to 8% annual growth expected.

Revenue Expectations (Seeking Alpha)

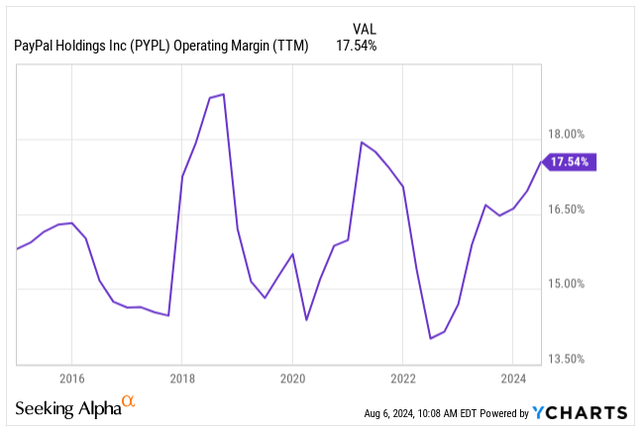

As management has already flagged, instead of focusing on top-line growth, the company prioritizes innovation and cost control to improve profitability in the near term. The operating margin recovered meaningfully to 17.5%, helped by laying off 9% of the company’s workforce.

Operating Margin (Seeking Alpha)

Here comes the problem, though.

While PayPal remains the undisputed industry leader in the online payments industry with a market share of around 40%, followed by Stripe’s 21% and Shopify Pay Installments’ 14%, the product mix of the leader is changing and instead of growing in the high-margin PayPal checkout, PayPal’s growth is in Venmo’s payments and Braintree’s payment services, both of which are significantly lower-margin businesses, pressuring the transaction take rate which is vital to PayPal’s top-line growth.

We can understand the take rate as a percentage of how much PayPal retains from the transactions. For example, a transaction of $100 with an average take rate of 1.72% results in $1.72 in revenue for PayPal.

As of Q2 2024, the rate has dropped to 1.72%, hitting its lowest point ever and representing 68% from its all-time high, which has been continuously declining each year.

The 68% drop in nine years showcases PayPal’s deteriorating position in the ever-more-competitive market and the loss of eBay Inc.’s (EBAY) business to Adyen.

Often, I hear investors suggesting PayPal’s growth is in Venmo; while Venmo represents 18% of total volume, it contributes only 4% to total revenue. PayPal’s checkout platform still generates 80% of the company’s revenue, remaining the primary cash cow and asset under attack.

| Year | Transaction Take Rate % | YoY Change % |

| 2015 | 2.89% | – |

| 2016 | 2.71% | -6.2% |

| 2017 | 2.52% | -7.0% |

| 2018 | 2.37% | -6.0% |

| 2019 | 2.26% | -4.6% |

| 2020 | 2.13% | -5.8% |

| 2021 | 1.88% | -11.7% |

| 2022 | 1.83% | -2.7% |

| 2023 | 1.76% | -3.8% |

| Q2 2024 | 1.72% | -2.3% |

Valuation

In today’s expensive market, with SPY trading at 22x its projected CY24 earnings, even after an 8% pullback, PayPal’s valuation stands out from the crowd of pricey names.

Trading at a Blended P/E valuation of 12.9x, the stock is indeed a bargain if one considers its historical valuation range, which hovered between 26x its earnings back in 2016 to over 70x its earnings at the peak of COVID-19-induced trading mania.

Yet, with both top-line and bottom-line growth rates significantly decelerating, this is a flawed way to look at it if you ask me.

The analysts are expecting 7.5% annual top-line growth with the following EPS growth:

- 2024 Expected EPS: $4.41E, growth of -14% YoY.

- 2025 Expected EPS: $4.79E, growth of 9% YoY.

- 2026 Expected EPS: $5.31E, growth of 11%.

In fact, 2024 Non-GAAP EPS has been revised multiple times by analysts, initially expecting single-digit growth, then a transitory year, and now a fall of 14% this year driven by slower-than-expected efficiency improvements and lower monetization of Venmo and Braintree.

With muted bottom-line growth expectations, I do not see any reasonable valuation expansion, especially in the face of stiff industry competition. I expect the stock to keep trading between 12-15x its earnings in the following years, with limited ROR potential.

If we gauge PayPal’s valuation in terms of its competitors, indeed we see that PayPal is among the cheaper digital payment players.

| Company | Ticker | Blended P/E |

| PayPal Holdings, Inc. | (PYPL) | 12.9x |

| Global Payments Inc. | (GPN) | 8.0x |

| Block, Inc. | (SQ) | 20.5x |

| Visa Inc. | (V) | 26.3x |

| Mastercard Incorporated | (MA) | 32.8x |

| Adyen N.V. | (ADYYF) | 40.2x |

| The Western Union Company | (WU) | 6.5x |

Takeaway

Despite some signs of stability in Q2, the user growth situation remains dire. An inferior product mix is causing a steady decline in the transaction take rate, and new product innovation has not yet hit the shelves.

As a result, I maintain my “Sell” rating, as I see no clear path to returns for investors with a fairly wide range of midterm outcomes.

This is supported by PayPal’s repurchase of 8.1% of its float, yet the stock price remained under pressure or, in net terms, actually fell.

PayPal remains a unique player with its customer-to-vendor established network, most likely retaining this strength, yet its position could be challenged over the long term, and opportunities to monetize Venmo might be limited.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.